Market Overview

The Europe Defense market is projected to reach USD ~ billion in 2024, driven by increasing defense budgets and the demand for advanced military technologies. Governments across Europe are modernizing their defense infrastructures, focusing on new missile systems, cybersecurity solutions, and military intelligence capabilities. Strategic investments in defense manufacturing, particularly in naval and air defense systems, are key drivers of market growth, as nations seek to bolster their security in response to rising geopolitical tensions and defense needs.

Countries like the United Kingdom, France, and Germany dominate the Europe Defense market due to their strong defense industries and significant military expenditure. These countries have robust defense policies in place and invest heavily in research and development, particularly in missile technology and cybersecurity solutions. Their position as key players in global defense alliances, such as NATO, further solidifies their dominance. Additionally, the increasing collaboration between European nations on defense projects helps foster regional growth in this sector.

Market Segmentation

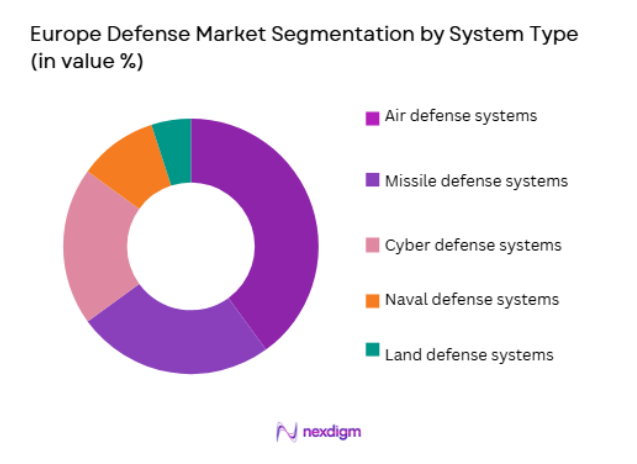

By System Type:

The Europe Defense market is segmented by system type into air defense systems, missile defense systems, cyber defense systems, naval defense systems, and land defense systems. Recently, the air defense systems sub-segment has a dominant market share due to the rising need for advanced aerial defense capabilities. The growing threat of airspace incursions and the increasing sophistication of unmanned aerial vehicles (UAVs) have pushed many European nations to invest heavily in air defense technologies. These systems offer rapid reaction times, precision, and the ability to protect vital assets such as airbases and critical infrastructure. As air threats become more complex, the air defense sector’s growth continues to outpace other defense systems.

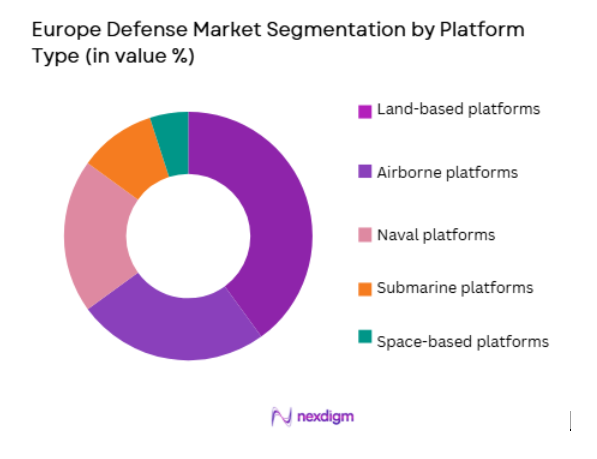

By Platform Type:

The market is segmented by platform type into land-based platforms, airborne platforms, naval platforms, submarine platforms, and space-based platforms. Among these, airborne platforms have the largest market share. Airborne platforms, such as fighter jets and drones, are essential for many European defense strategies due to their ability to rapidly respond to threats, both in combat and intelligence gathering. They are equipped with advanced technologies like radar systems, stealth features, and high-performance weaponry, making them versatile and valuable assets for air superiority. Additionally, the integration of unmanned aerial vehicles (UAVs) into European air forces enhances surveillance and combat capabilities, driving the dominance of airborne platforms.

Competitive Landscape

The Europe Defense market is highly competitive, with several key players leading the way in defense technology innovations and strategic defense partnerships. Major defense contractors play a central role in shaping the market by developing new products and systems. Additionally, consolidation in the market is driven by mergers and acquisitions between defense firms, allowing for more integrated and cost-effective solutions. Major companies focus on technological advancements in areas such as air defense, cyber defense, and autonomous systems, all of which are critical to meeting the evolving demands of European governments.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

Europe Defense Market Analysis

Growth Drivers

Increasing defense budgets across Europe:

The rising defense budgets in Europe are one of the most important growth drivers for the defense market. As geopolitical tensions grow, many European countries are dedicating larger portions of their budgets to defense, especially in response to perceived threats from neighboring regions and non-state actors. The continuous modernization of defense technologies, from air defense to naval systems, is supported by increased funding, allowing defense contractors to invest in research and development. Additionally, the European Union has been facilitating joint defense projects, making it easier for member states to share costs and improve technological capabilities. European countries’ efforts to maintain a credible deterrent and defense capability are fueling this demand. This increased investment in defense also results in long-term contracts for defense manufacturers, further stimulating the market.

Technological advancements in defense systems:

Another critical driver for the Europe Defense market is the ongoing technological advancements in defense systems. Innovations in missile defense, radar systems, artificial intelligence, and cybersecurity technologies have been at the forefront of military modernization efforts. With the increasing sophistication of weapons, including hypersonic missiles and autonomous drones, European nations are focusing on enhancing their defense capabilities to counter these emerging threats. The development and integration of these technologies into existing systems allow European defense contractors to offer more effective and adaptive defense solutions. These advancements are also making defense systems more affordable and efficient, ensuring the continued growth of the market.

Market Challenges

High capital investment and operational costs:

One of the most significant challenges facing the Europe Defense market is the high capital investment and operational costs associated with modern defense technologies. Developing and maintaining cutting-edge systems such as missile defense systems, naval vessels, and advanced fighter jets requires substantial funding from governments. Many European nations are facing fiscal constraints that make it difficult to allocate sufficient funds to defense, which limits the pace of technological advancements and procurement. This challenge is further exacerbated by the long development timelines for new defense systems, which means that significant investments may take years to bear fruit. Governments and defense contractors are working to overcome this hurdle by adopting cost-effective solutions, but high costs remain a significant barrier to market growth.

Regulatory hurdles in defense procurement:

Another challenge is the complex and often stringent regulatory environment surrounding defense procurement. Defense projects in Europe are subject to numerous regulations regarding procurement processes, arms control, export restrictions, and international compliance standards. While these regulations are necessary for ensuring the ethical use of defense technologies, they also create delays in product development and procurement, increasing costs for defense contractors and governments. Additionally, the regulatory landscape can vary significantly across countries, creating a fragmented market where defense contractors must navigate complex legal frameworks to secure contracts. This complexity can make it difficult for new players to enter the market and for existing companies to quickly adapt to changing requirements.

Opportunities

Emerging demand for autonomous defense systems:

One of the most significant opportunities in the Europe Defense market is the growing demand for autonomous defense systems. As military operations become increasingly complex, European nations are looking for more efficient and effective ways to address security challenges. Autonomous systems, including drones and unmanned ground vehicles, are capable of performing tasks such as surveillance, reconnaissance, and targeted strikes with minimal human intervention. The increasing use of artificial intelligence (AI) and machine learning in these systems is enhancing their decision-making capabilities and enabling them to operate in complex and dangerous environments. These autonomous systems are expected to become a key component of European defense strategies, driving growth in the market.

Growth of cyber defense capabilities:

The rise of cyber threats is creating a significant opportunity for the Europe Defense market, particularly in the area of cybersecurity defense. As the digital landscape expands, so too do the risks associated with cyber-attacks targeting critical infrastructure, government systems, and military networks. European nations are prioritizing the development of cyber defense capabilities to protect sensitive data and maintain national security. Investments in cybersecurity solutions, such as secure communications systems and cyber warfare technologies, are expected to grow, presenting a substantial opportunity for defense contractors. Governments are increasingly integrating cyber defense into their overall defense strategies, further supporting this market opportunity.

Future Outlook

Over the next five years, the Europe Defense market is expected to experience steady growth, driven by technological innovations, increased defense spending, and rising geopolitical tensions. Key trends such as the expansion of AI-driven military systems and the development of hypersonic weapons will play a significant role in shaping the market’s evolution. Moreover, collaboration between European countries on defense projects is likely to increase, fostering a more integrated defense industry. The continuous modernization of defense infrastructure, particularly in cybersecurity and autonomous systems, will ensure that European nations are better prepared to address future security challenges.

Major Players

- BAE Systems

- Lockheed Martin

- Thales Group

- Raytheon Technologies

- Northrop Grumman

- General Dynamics

- Leonardo

- L3 Technologies

- Saab Group

- Kongsberg Gruppen

- Rheinmetall AG

- Elbit Systems

- Israel Aerospace Industries

- Hensoldt

- MBDA

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military procurement agencies

- Aerospace and defense manufacturers

- Technology development firms

- National security agencies

- Defense research organizations

Research Methodology

Step 1: Identification of Key Variables

Identification of the primary factors influencing the market, such as technological advancements, defense budgets, and geopolitical concerns.

Step 2: Market Analysis and Construction

Analyzing current market trends and constructing models based on historical data, market dynamics, and technological progress.

Step 3: Hypothesis Validation and Expert Consultation

Validating assumptions through interviews with industry experts and consulting defense professionals to ensure accurate market insights.

Step 4: Research Synthesis and Final Output

Compiling the findings into a comprehensive market report, including forecasts and recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased defense budgets in Europe

Technological advancements in defense systems

Rising geopolitical tensions - Market Challenges

High capital investment and operational costs

Regulatory hurdles in defense procurement

Technological integration and interoperability issues - Market Opportunities

Emerging demand for autonomous defense systems

Collaborations with private technology firms

Growing focus on cybersecurity defense systems - Trends

Rise in AI-driven military systems

Expansion of cyber defense capabilities

Advancement in hypersonic weapons - Government regulations

Export control regulations

Defense spending and procurement policies

National security compliance - SWOT analysis

- Porters 5 forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Land-based defense systems

Air defense systems

Naval defense systems

Cyber defense systems

Missile defense systems - By Platform Type (In Value%)

Land-based platforms

Naval platforms

Airborne platforms

Submarine platforms

Space-based platforms - By Fitment Type (In Value%)

Fixed solutions

Modular solutions

Upgrade kits

Integrated systems

Custom-fit solutions - By EndUser Segment (In Value%)

Military forces

Government agencies

Defense contractors

Private sector technology firms

Security services - By Procurement Channel (In Value%)

Government procurement

Private procurement

Direct contracts

Third-party distributors

Online procurement

- Market Share Analysis

- Cross Comparison Parameters (Cost Efficiency, Technological Innovation, Market Share, Product Reliability, Integration Capability, Customer Support, Regulatory Compliance, Production Capacity, Geographic Reach, Speed of Development)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

BAE Systems

Lockheed Martin

Thales Group

Raytheon Technologies

Northrop Grumman

General Dynamics

Leonardo

L3 Technologies

Saab Group

Kongsberg Gruppen

Rheinmetall AG

Elbit Systems

Israel Aerospace Industries

Hensoldt

MBDA

- Increased defense spending by European governments

- Growth in cybersecurity defense requirements

- Emerging interest from private sector technology firms

- Government agencies focusing on strategic defense procurement

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035