Market Overview

The Europe Drone Services market is expected to reach USD ~ billion in 2024, driven by technological advancements and increasing demand for drone-based solutions across various sectors. Key growth drivers include the expansion of commercial drone applications in industries such as agriculture, logistics, and surveillance. The widespread adoption of drones for data collection, mapping, and infrastructure inspection further fuels market growth. Additionally, governments’ support for drone regulations and safety standards has been instrumental in ensuring the market’s expansion.

Countries such as the United Kingdom, Germany, and France lead the Europe Drone Services market, driven by strong regulatory frameworks, technological innovations, and established industries that are quick to adopt drone technologies. These nations have advanced research and development facilities and robust drone regulations, which promote safe drone operations. As a result, they have become major hubs for drone service providers and innovation. Their strategic geographic locations also contribute to their dominance in the market, making them key players in the global drone services industry.

Market Segmentation

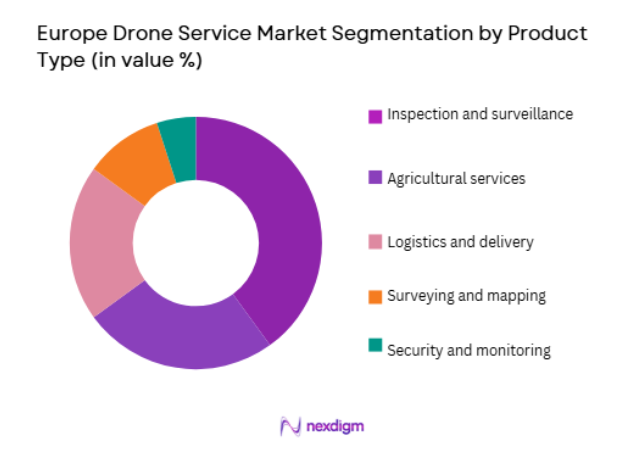

By Product Type:

The Europe Drone Services market is segmented by product type into inspection and surveillance services, agricultural services, logistics and delivery services, surveying and mapping services, and security and monitoring services. Recently, inspection and surveillance services have gained a dominant market share due to the increasing need for real-time monitoring in sectors like infrastructure, energy, and telecommunications. The ability of drones to perform inspections efficiently, safely, and at a lower cost compared to traditional methods has led to their widespread adoption. These services are especially crucial for high-risk industries, where drone-based solutions can reduce human exposure to hazardous environments, while also providing more accurate data.

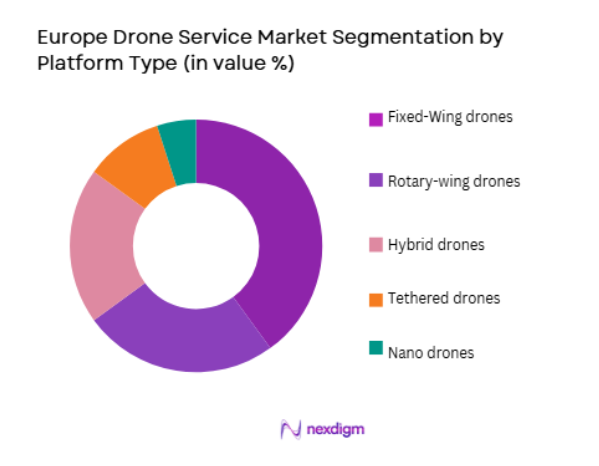

By Platform Type:

The market is segmented by platform type into fixed-wing drones, rotary-wing drones, hybrid drones, tethered drones, and nano drones. Rotary-wing drones dominate the market due to their versatility and widespread use in commercial drone services. These drones are particularly favored for their ability to hover, making them ideal for tasks like aerial surveillance, inspections, and precise data collection. Their ability to take off and land vertically without requiring large spaces is a major advantage in urban and confined environments, which boosts their demand in sectors such as agriculture, construction, and energy.

Competitive Landscape

The Europe Drone Services market is highly competitive, with several key players driving innovation and market expansion. The competition is particularly intense among drone manufacturers and service providers, with both established and new companies entering the market. The influence of major players is significant as they continue to expand their service offerings, particularly in areas like infrastructure inspection, logistics, and agriculture. Collaborations between private companies, government agencies, and research institutions further consolidate the market, ensuring the development of standardized, scalable solutions for diverse industries.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| DJI | 2006 | China | ~ | ~ | ~ | ~ | ~ |

| Parrot SA | 1994 | France | ~ | ~ | ~ | ~ | ~ |

| AeroVironment | 1971 | USA | ~ | ~ | ~ | ~ | ~ |

| Skydio | 2014 | USA | ~ | ~ | ~ | ~ | ~ |

| PrecisionHawk | 2010 | USA | ~ | ~ | ~ | ~ | ~ |

Europe Drone Services Market Analysis

Growth Drivers

Technological advancements in drone capabilities:

Technological advancements in drone capabilities are a major growth driver for the Europe Drone Services market. The continuous evolution of drone technologies, including improved battery life, better sensors, and advanced AI algorithms, has significantly expanded the applications of drones. These innovations have enhanced the performance of drones in key areas such as inspection, monitoring, and surveying, making them indispensable tools for various industries. Furthermore, the integration of autonomous features in drones has allowed for more efficient operations, particularly in applications that require precise data collection and real-time decision-making. As these technologies become more advanced, drone services are increasingly being adopted for applications beyond traditional use cases, further fueling the market’s growth.

Government regulations and support for commercial drone services:

The role of government regulations in enabling drone services is another key growth driver. European governments are increasingly recognizing the value of drones for commercial applications, leading to the establishment of supportive regulatory frameworks that promote safe operations. The European Union Aviation Safety Agency (EASA) has set up guidelines to ensure that drones can operate safely in shared airspace, which is essential for the growth of commercial drone services. These regulations provide the necessary legal clarity for businesses to operate drones for a wide range of services, including infrastructure inspections, agricultural monitoring, and emergency response. Additionally, government initiatives to support drone innovation, through funding programs and public-private partnerships, are further boosting the market’s growth.

Market Challenges

Privacy and security concerns in drone operations:

Privacy and security concerns represent significant challenges for the Europe Drone Services market. As drones collect data for various applications, there is growing apprehension regarding the privacy of individuals and sensitive information. In particular, drones used for surveillance or agricultural monitoring may inadvertently capture private data or cause security breaches if not properly secured. These concerns are compounded by the potential for drones to be hacked or used for malicious purposes. Governments are introducing stricter privacy and security regulations to mitigate these risks, but ensuring that drone operations comply with these rules while still providing valuable services remains a challenge for the industry.

Regulatory compliance complexities:

Regulatory compliance complexities also pose a challenge for drone service providers in Europe. Each country within the European Union has its own set of rules and regulations governing drone operations, creating a fragmented landscape for drone services. This makes it difficult for companies to expand their operations across multiple regions without navigating a complex web of regulations. In addition, the regulatory environment for drone operations is still evolving, which adds uncertainty to long-term business strategies. Service providers must ensure they adhere to both local and international regulations, which can be resource-intensive and time-consuming. This challenge is particularly significant for small and medium-sized enterprises (SMEs) in the drone services market, which may struggle to keep up with constantly changing rules.

Opportunities

Expansion of drone-based logistics and deliveries:

One of the most significant opportunities in the Europe Drone Services market is the expansion of drone-based logistics and deliveries. As e-commerce continues to grow and consumer expectations shift toward faster deliveries, drones offer a viable solution for last-mile delivery challenges. Several European companies are already testing drone delivery services, particularly in urban and rural areas, where traditional delivery methods may be inefficient or costly. The regulatory frameworks being put in place for drone operations are opening up new opportunities for drone logistics providers to scale their services and reach new customers. As the technology matures and becomes more cost-effective, drone deliveries are expected to become a mainstream solution for logistics companies, creating a significant opportunity in the market.

Growing demand for agricultural drone services:

The increasing demand for precision agriculture presents another opportunity for the Europe Drone Services market. Drones are becoming essential tools for farmers to monitor crops, assess field health, and gather data to make more informed decisions. By utilizing drones for tasks such as crop spraying, mapping, and yield estimation, farmers can improve productivity and reduce costs. The growth of organic farming and the rising need for sustainable agricultural practices are also driving the demand for drones, as these technologies allow for more efficient and targeted interventions. Governments in Europe are also encouraging the use of drones in agriculture through subsidies and grants, further boosting the adoption of these technologies.

Future Outlook

The Europe Drone Services market is expected to experience robust growth over the next five years, fueled by advances in drone technology, regulatory support, and growing demand across multiple industries. The increasing adoption of drones in logistics, agriculture, and infrastructure inspections will contribute significantly to market expansion. As regulatory frameworks become more standardized and drone technology continues to improve, service providers will have greater opportunities to scale operations. Furthermore, the integration of AI and autonomous systems into drones will continue to drive innovation and operational efficiency, ensuring sustained market growth.

Major Players

- DJI

- Parrot SA

- AeroVironment

- Skydio

- PrecisionHawk

- SenseFly

- Delair

- Quantum Systems

- Insitu

- AgEagle

- Hoverfly Technologies

- Flyability

- Ascend UAV

- Robolox

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military procurement agencies

- Aerospace and defense manufacturers

- Technology development firms

- National security agencies

- Defense research organizations

Research Methodology

Step 1: Identification of Key Variables

Identification of the primary factors influencing the market, such as technological advancements, drone adoption across industries, and regulatory concerns.

Step 2: Market Analysis and Construction

Analyzing current market trends, creating models based on market dynamics, and projecting growth opportunities across different drone service sectors.

Step 3: Hypothesis Validation and Expert Consultation

Validating market assumptions and projections through consultations with industry experts, stakeholders, and market participants.

Step 4: Research Synthesis and Final Output

Compiling findings into a comprehensive report, with actionable insights and growth forecasts for the Europe Drone Services market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in drone technology

Increased demand for data-driven solutions

Government regulations supporting drone services - Market Challenges

Privacy and security concerns

Regulatory compliance complexities

High cost of advanced drone systems - Market Opportunities

Expansion of drone-based logistics and deliveries

Growing demand for agricultural drone services

Increased applications in infrastructure inspections - Trends

Integration of AI in drone operations

Rise of drone-based data analytics

Development of BVLOS (Beyond Visual Line of Sight) regulations - Government regulations

Drone certification standards

Airspace management regulations

Data privacy laws for drone operations - SWOT analysis

- Porters 5 forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Inspection and surveillance services

Agricultural services

Logistics and delivery services

Surveying and mapping services

Security and monitoring services - By Platform Type (In Value%)

Fixed-wing drones

Rotary-wing drones

Hybrid drones

Tethered drones

Nano drones - By Fitment Type (In Value%)

Custom-fit solutions

Modular solutions

Integrated systems

Fixed-fit solutions

Portable solutions - By EndUser Segment (In Value%)

Agriculture

Logistics and transportation

Construction

Public safety and emergency response

Environmental monitoring - By Procurement Channel (In Value%)

Direct procurement

Private sector procurement

Government tenders

Online procurement platforms

Distributors and resellers

- Market Share Analysis

Cross Comparison Parameters (Cost Efficiency, Technological Innovation, Product Reliability, Scalability, Geographic Reach, Regulatory Compliance, Market Penetration, Brand Recognition, Customer Support, Customization Options) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

DJI

Parrot SA

AeroVironment

Yuneec International

Skydio

PrecisionHawk

SenseFly

Delair

Quantum Systems

Insitu

AgEagle

Hoverfly Technologies

Flyability

Ascend UAV

Robolox

- Agriculture benefiting from autonomous drone farming

- Logistics companies leveraging drones for last-mile delivery

- Construction industry using drones for site surveys

- Public safety organizations utilizing drones for monitoring and emergency response

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035