Market Overview

The Europe Drones market is projected to reach USD ~ billion based on recent historical assessments, driven by increasing demand across sectors like agriculture, logistics, and defense. The growing adoption of drones for commercial and industrial purposes, along with advancements in drone technology such as automation, AI, and battery life, is significantly contributing to the market’s growth. The integration of drones in sectors like agriculture and e-commerce has also accelerated their uptake.

Countries such as the United Kingdom, France, and Germany dominate the Europe Drones market due to their strong technological infrastructure, regulatory frameworks, and early adoption of drone technology. These nations are home to several major drone manufacturers, and their favorable regulatory environments facilitate the growth of drone applications. Their leadership is further reinforced by strategic investments in research, development, and the increasing use of drones in military, logistics, and environmental monitoring.

Market Segmentation

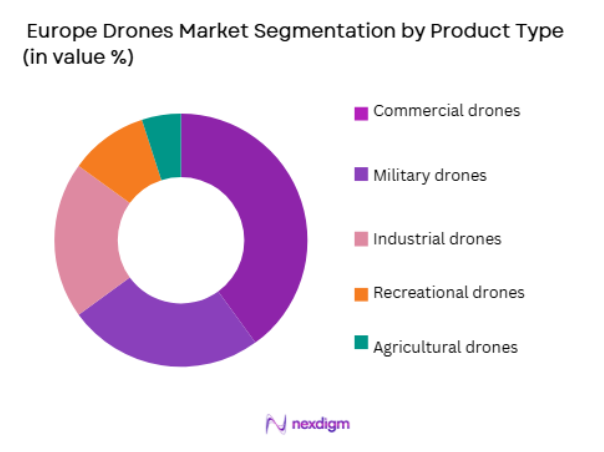

By Product Type:

The Europe Drones market is segmented by product type into commercial drones, military drones, industrial drones, recreational drones, and agricultural drones. Recently, commercial drones have gained a dominant market share due to their diverse applications across multiple industries such as delivery, surveillance, infrastructure inspection, and photography. The demand for drones in commercial sectors continues to increase as businesses seek efficient, cost-effective, and innovative ways to collect data and manage operations. This broad applicability and continued technological advancements ensure the continued dominance of commercial drones in the market.

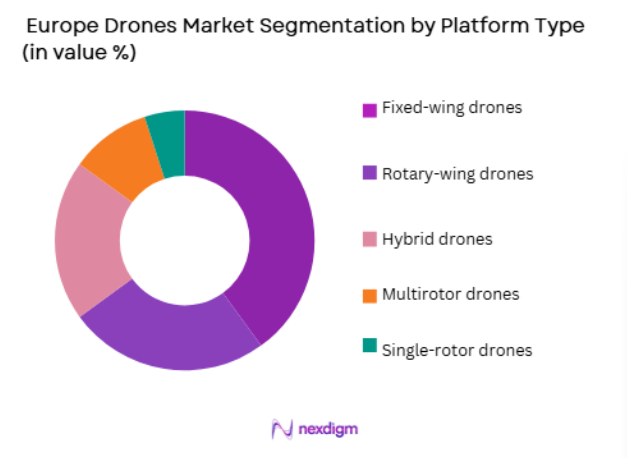

By Platform Type:

The market is segmented by platform type into fixed-wing drones, rotary-wing drones, hybrid drones, multirotor drones, and single-rotor drones. Fixed-wing drones dominate the market due to their longer flight times, greater range, and efficiency for surveillance, mapping, and other commercial applications. These drones are highly favored for large-scale applications, such as agriculture, infrastructure inspections, and aerial photography, where long-duration flights are essential. The growing use of fixed-wing drones for long-range operations, coupled with their ability to cover larger areas more efficiently, continues to solidify their dominance in the market.

Competitive Landscape

The Europe Drones market is highly competitive, with several key players driving technological advancements and innovations. Major drone manufacturers, including both established companies and startups, are focusing on developing drones with improved flight capabilities, longer battery life, and advanced AI and automation features. The market also sees a growing number of collaborations between drone manufacturers and industries such as logistics, defense, and agriculture, aiming to integrate drones into various operations efficiently. This competitive landscape is also shaped by regulatory advancements and ongoing partnerships with government and military organizations.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| DJI | 2006 | China | ~ | ~ | ~ | ~ | ~ |

| Parrot SA | 1994 | France | ~ | ~ | ~ | ~ | ~ |

| AeroVironment | 1978 | USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | UK | ~ | ~ | ~ | ~ | ~ |

| EHang | 2014 | China | ~ | ~ | ~ | ~ | ~ |

Europe Drones Market Analysis

Growth Drivers

Technological advancements in drone capabilities:

One of the primary growth drivers in the Europe Drones market is the rapid technological advancements in drone capabilities. The continuous development of drones equipped with advanced sensors, artificial intelligence, and automation technologies has expanded their use in various industries. Drones are now capable of autonomous operations, real-time data processing, and advanced image recognition, which has significantly enhanced their value for industries such as logistics, agriculture, defense, and environmental monitoring. These advancements are reducing the operational costs of drone use and increasing their efficiency, making them more attractive to businesses and governments alike. As drone technology continues to evolve, the demand for more sophisticated, capable drones is expected to drive the growth of the Europe Drones market further.

Rising demand for drones in commercial and industrial applications:

The increasing demand for drones in commercial and industrial applications is another key growth driver for the Europe Drones market. Drones are now used in a wide range of applications such as infrastructure inspection, aerial photography, delivery services, and environmental monitoring. The growing adoption of drones by industries such as logistics, agriculture, and construction is fueled by their ability to collect data quickly and efficiently, offering a significant advantage over traditional methods. As the market for industrial and commercial drones continues to expand, the need for advanced drone systems will further drive market growth, particularly in regions with strong manufacturing and technological infrastructure.

Market Challenges

Regulatory barriers and airspace restrictions:

Regulatory barriers and airspace restrictions represent a significant challenge for the Europe Drones market. Although drones offer numerous benefits, they are subject to strict regulations that vary across countries and regions. Issues such as restricted airspace for drones, concerns over privacy, and safety regulations limit the scope of drone operations. Additionally, the integration of drones into air traffic management systems is a complex process that requires significant regulatory collaboration across national borders. The lack of uniform regulations and the slow pace of regulatory adaptation to accommodate new drone technologies could hinder the market’s growth, particularly in industries that require more freedom of operation.

High operational costs and maintenance requirements:

Another challenge faced by the Europe Drones market is the high operational costs and maintenance requirements associated with drones. While drones have become increasingly affordable for consumers, professional-grade drones, particularly those used for commercial and industrial purposes, come with high upfront costs. Additionally, drones require regular maintenance to ensure optimal performance, including battery replacements, software updates, and repair of wear-and-tear components. These maintenance and operational costs can add up quickly, especially for companies deploying drones at scale. For many small and medium-sized enterprises (SMEs), the financial investment required to maintain a drone fleet may be prohibitive, limiting market participation and growth.

Opportunities

Growth in drone delivery services:

One of the most promising opportunities in the Europe Drones market is the growing adoption of drone delivery services. E-commerce companies, logistics providers, and retail companies are increasingly exploring the use of drones for last-mile deliveries, especially for time-sensitive products. Drones provide an efficient, cost-effective solution for delivering goods over short distances, bypassing traffic and reducing delivery times. The demand for fast delivery, particularly in urban areas, is driving the growth of drone delivery services. As companies work to overcome regulatory hurdles and develop infrastructure for drone-based delivery networks, this segment is expected to see significant growth, creating a substantial opportunity for manufacturers and service providers in the market.

Expanding use of drones in agriculture:

The expanding use of drones in agriculture presents another significant opportunity for the Europe Drones market. Drones are increasingly being used in precision agriculture for tasks such as crop monitoring, spraying, and field mapping. Equipped with advanced sensors and cameras, drones can provide farmers with real-time data on crop health, soil conditions, and irrigation needs, allowing for more efficient and sustainable farming practices. As the agricultural sector embraces digital technologies, the adoption of drones is expected to increase, driving demand for agricultural drones and supporting the growth of the Europe Drones market.

Future Outlook

The Europe Drones market is expected to experience continued growth over the next five years, driven by advancements in drone technology, increasing demand for commercial and industrial applications, and the expansion of drone delivery services. The regulatory landscape will evolve to accommodate the growing presence of drones, allowing for greater operational flexibility. Technological advancements in AI, machine learning, and automation will further enhance drone capabilities, enabling them to perform more complex tasks across various industries. As the market matures, there will be a shift toward more sustainable drone solutions and widespread adoption of drones in sectors such as logistics, agriculture, and environmental monitoring.

Major Players

- DJI

- Parrot SA

- AeroVironment

- BAE Systems

- EHang

- Yuneec International

- Intel Corporation

- Northrop Grumman

- Thales Group

- Leonardo

- L3 Technologies

- Lockheed Martin

- Quantum Systems

- Delair

- Aerialtronics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Drone manufacturers

- Logistics companies

- Agricultural enterprises

- Environmental monitoring agencies

- Technology development firms

- Drone service providers

Research Methodology

Step 1: Identification of Key Variables

Identifying market drivers, regulatory considerations, technological advancements, and key trends shaping the Europe Drones market.

Step 2: Market Analysis and Construction

Analyzing market trends, data on drone adoption across industries, and constructing growth models based on technological advancements and regulatory changes.

Step 3: Hypothesis Validation and Expert Consultation

Validating assumptions with consultations with industry experts, drone manufacturers, and key stakeholders in the logistics and agricultural sectors.

Step 4: Research Synthesis and Final Output

Compiling data, synthesizing insights, and providing a comprehensive market report, including forecasts, growth strategies, and actionable recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological advancements in drone capabilities

Government support for commercial drone use

Expansion of drone applications across industries - Market Challenges

Regulatory complexities

High operational and development costs

Privacy and security concerns - Market Opportunities

Drone-based logistics and deliveries

Use of drones for environmental monitoring

Rising demand for agricultural drone services - Trends

Integration of AI into drone operations

Growth of autonomous drone systems

Emerging drone service applications - Government regulations

Regulations for drone safety and certification

Airspace management policies

Data privacy and protection laws - SWOT analysis

- Porters 5 forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Surveying drones

Inspection drones

Agricultural drones

Delivery drones

Security drones - By Platform Type (In Value%)

Fixed-wing drones

Rotary-wing drones

Hybrid drones

Nano drones

Tethered drones - By Fitment Type (In Value%)

Custom-fit solutions

Integrated systems

Modular solutions

Portable systems

Fixed-fit solutions - By EndUser Segment (In Value%)

Agriculture

Logistics

Security services

Construction

Government sectors - By Procurement Channel (In Value%)

Direct procurement

Online procurement platforms

Government tenders

Private sector procurement

Distributors

- Market Share Analysis

Cross Comparison Parameters (Cost Efficiency, Technological Innovation, Regulatory Compliance, Operational Range, Payload Capacity, After‑Sales Support, Integration Capability, Reliability, Scalability, Market Penetration) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

DJI

Parrot SA

AeroVironment

Skydio

PrecisionHawk

SenseFly

Delair

Quantum Systems

Insitu

AgEagle

Hoverfly Technologies

Flyability

Ascend UAV

Robolox

- Growing adoption of drones in agriculture

- Government sectors focusing on drones for surveillance

- Security services leveraging drones for monitoring

- Logistics companies investing in drone-based deliveries

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035