Market Overview

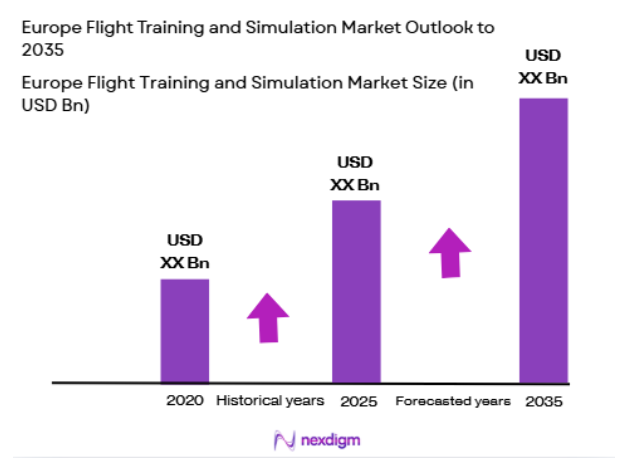

The Europe Flight Training and Simulation market is estimated to reach USD ~ billion based on recent historical assessments. Growth in this sector is driven by the increasing demand for advanced flight training solutions across civil aviation and military sectors. As air traffic continues to rise, there is a growing need for both pilot and crew training programs that incorporate the latest technologies such as virtual reality, full-motion simulators, and artificial intelligence. Furthermore, the increasing adoption of flight simulators in both commercial and private aviation sectors further fuels the market’s growth.

Countries such as the United Kingdom, Germany, and France dominate the Europe Flight Training and Simulation market, driven by their robust aviation sectors and significant defense budgets. These countries have established advanced flight training infrastructures, including numerous flight schools and military training facilities. Additionally, their strategic partnerships with major aviation manufacturers and research institutions further enhance their dominance in the market. The large number of international aviation conferences and the high demand for pilot training in these nations also contribute to their strong market presence.

Market Segmentation

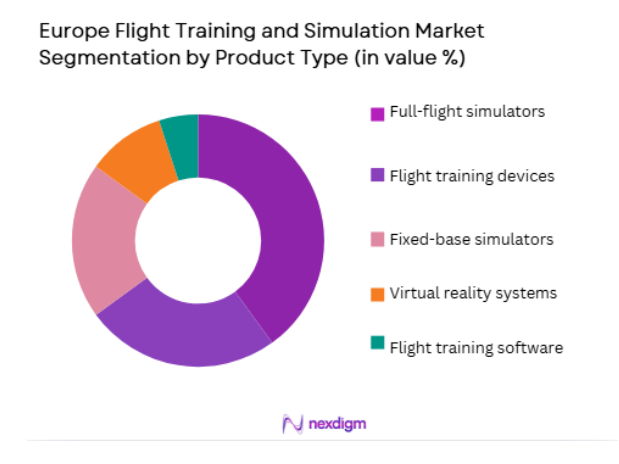

By Product Type:

The Europe Flight Training and Simulation market is segmented by product type into full-flight simulators, flight training devices, fixed-base simulators, virtual reality systems, and flight training software. Recently, full-flight simulators have gained a dominant market share due to their ability to replicate a wide range of real-world flight scenarios, providing pilots with a comprehensive and immersive training experience. Full-flight simulators are particularly preferred for commercial aviation and military training as they closely mimic actual flight conditions, offering high levels of realism and safety. Their large-scale adoption in aviation training institutions and by airlines further cements their dominant position in the market.

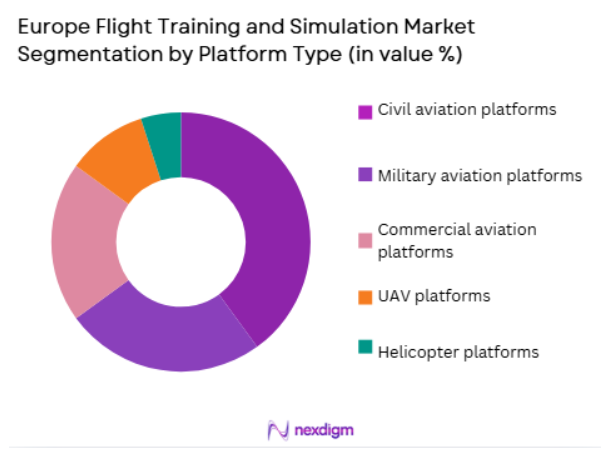

By Platform Type:

The market is segmented by platform type into civil aviation platforms, military aviation platforms, commercial aviation platforms, unmanned aerial vehicles (UAVs), and helicopter platforms. Civil aviation platforms dominate the market, as airlines and flight schools continue to invest heavily in flight training simulators to ensure the safety and proficiency of their pilots. With the increasing demand for commercial pilots driven by expanding air travel, training solutions for civil aviation platforms are seeing widespread adoption. These platforms provide comprehensive training for various flight scenarios, including takeoff, in-flight navigation, and emergency procedures, driving their market dominance.

Competitive Landscape

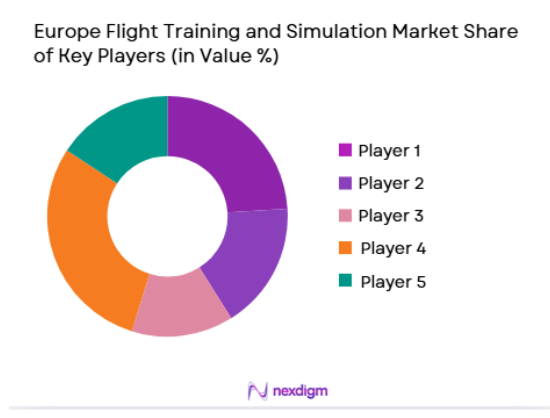

The Europe Flight Training and Simulation market is highly competitive, with several key players driving technological innovations and market expansion. Large aviation training companies and manufacturers dominate the market, focusing on developing high-fidelity simulators, integrating advanced technologies such as AI and VR, and offering tailored training solutions for both civilian and military sectors. The market also sees strategic collaborations and partnerships between industry leaders and aviation regulatory bodies to ensure compliance with international standards.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| CAE | 1947 | Canada | ~ | ~ | ~ | ~ | ~ |

| FlightSafety International | 1975 | USA | ~ | ~ | ~ | ~ | ~ |

| L3 Harris Technologies | 2000 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Rockwell Collins | 1933 | USA | ~ | ~ | ~ | ~ | ~ |

Europe Flight Training and Simulation Market Analysis

Growth Drivers

Advancements in simulation technology:

One of the major growth drivers for the Europe Flight Training and Simulation market is the rapid advancements in simulation technology. Flight training has become increasingly sophisticated with the introduction of new technologies, including virtual reality, augmented reality, and artificial intelligence. These technologies allow for more immersive and realistic training environments, significantly enhancing the learning experience for pilots. Additionally, the incorporation of AI and machine learning into flight simulators is enabling more personalized and adaptive training experiences, where simulators can analyze pilot performance in real-time and offer tailored feedback. These technological advancements not only improve training effectiveness but also reduce costs by minimizing the need for actual flight hours. As these technologies continue to evolve, the demand for cutting-edge flight training simulators will drive market growth.

Increasing demand for pilot training:

The growing demand for pilots due to the expansion of global air travel is another major driver for the Europe Flight Training and Simulation market. Airlines, flight schools, and military organizations are all investing in flight training programs to meet the increasing need for skilled pilots. With the rise in passenger numbers and the expansion of commercial aviation, particularly in emerging markets, there is a pressing need to train more pilots in a shorter time frame. Flight training simulators play a crucial role in meeting this demand by offering cost-effective, high-quality training solutions. Additionally, the aging workforce of pilots and the ongoing retirement of senior pilots further contribute to the need for new talent, driving the demand for flight training solutions across Europe.

Market Challenges

High cost of simulation systems:

The high upfront and maintenance costs associated with advanced flight simulators represent a significant challenge for the Europe Flight Training and Simulation market. Full-motion simulators, which are essential for providing high-quality pilot training, can cost millions of dollars to purchase and maintain. For smaller flight schools and training organizations, the financial burden of acquiring and maintaining these systems may be prohibitive. Although simulators offer significant long-term cost savings by reducing the need for actual flight hours, the initial investment can still be a major barrier to entry, particularly for emerging players in the market. Additionally, continuous technological upgrades and regular maintenance further add to operational costs. This financial challenge limits the widespread adoption of flight training simulators, especially in developing regions.

Integration challenges with existing systems:

Another challenge faced by the market is the integration of new training simulators with existing training systems. Many aviation schools, especially those that have been in operation for several years, rely on legacy systems that may not be compatible with newer simulation technologies. Integrating new simulators with older systems can be both time-consuming and costly, and may require significant overhauls of existing infrastructure. This presents a barrier to adopting the latest simulation technologies and may delay the deployment of cutting-edge systems. Additionally, ensuring that the new simulators comply with international aviation regulations while maintaining compatibility with various aircraft types can be a complex process.

Opportunities

Growth in unmanned aerial vehicle (UAV) simulation:

One of the major opportunities for the Europe Flight Training and Simulation market lies in the growth of unmanned aerial vehicle (UAV) simulation. The increasing use of UAVs in both military and civilian applications has created a demand for specialized UAV training simulators. As UAVs become more integrated into military operations, surveillance missions, and commercial industries such as agriculture and delivery, the need for specialized training systems for UAV operators is growing. These simulators help operators develop the skills needed to control UAVs in complex environments while adhering to regulatory requirements. The rising demand for UAV simulation presents an exciting opportunity for manufacturers to develop new products and services tailored to this growing market.

Increase in virtual and augmented reality adoption:

The increasing adoption of virtual and augmented reality (VR/AR) in the aviation sector presents another significant opportunity for the market. VR/AR technologies offer highly immersive, interactive experiences that can simulate a wide range of flight scenarios, making them ideal for pilot training. These systems provide a more cost-effective solution than traditional full-flight simulators, as they require less physical infrastructure and can be used on a wider variety of devices. VR/AR-based flight training solutions are particularly attractive to flight schools and airlines looking to reduce costs while maintaining high-quality training programs. As VR/AR technologies continue to improve, they are expected to play an increasingly important role in the market, offering new opportunities for innovation and market expansion.

Future Outlook

The Europe Flight Training and Simulation market is expected to continue its growth trajectory over the next five years, driven by advances in simulation technology, increasing demand for pilot training, and the growing use of UAVs. As flight training programs become more sophisticated, integrating AI, VR, and AR, the demand for high-fidelity simulators is set to rise. Additionally, regulatory support for flight safety and emerging trends such as the use of drone-based training systems are expected to further shape the future of the market.

Major Players

- CAE

- FlightSafety International

- L3 Harris Technologies

- Thales Group

- Rockwell Collins

- Honeywell Aerospace

- Saab AB

- AeroVironment

- Simloc

- Alsim Simulation

- Indra Sistemas

- Meggitt

- Esterline Technologies

- Textron Systems

- Elbit Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aviation training providers

- Aerospace and defense manufacturers

- Airlines and aviation schools

- Technology development firms

- National aviation authorities

- Defense research organizations

Research Methodology

Step 1: Identification of Key Variables

Identification of the primary market drivers such as technological advancements, aviation regulations, and emerging trends in flight training.

Step 2: Market Analysis and Construction

Analyzing market trends, data on training systems adoption, and constructing forecasts for growth based on current market dynamics and technological advancements.

Step 3: Hypothesis Validation and Expert Consultation

Validating assumptions through consultations with industry experts, aviation authorities, and technology providers.

Step 4: Research Synthesis and Final Output

Compiling findings into a comprehensive report, providing actionable insights, market forecasts, and recommendations for key stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Advancements in simulation technology

Increasing demand for pilot training

Government regulations supporting flight safety - Market Challenges

High cost of simulation systems

Integration challenges with existing systems

Technological limitations of current simulators - Market Opportunities

Growth in unmanned aerial vehicle (UAV) simulation

Increase in virtual and augmented reality adoption

Rising demand for cost-effective training solutions - Trends

Integration of AI in flight simulators

Development of mixed-reality simulation systems

Increase in cloud-based training solutions - Government regulations

Certification of flight simulators

Pilot training regulations

Government funding for aviation safety - SWOT analysis

- Porters 5 forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Full-flight simulators

Flight training devices

Fixed-base simulators

Virtual reality systems

Flight training software - By Platform Type (In Value%)

Civil aviation platforms

Military aviation platforms

Commercial aviation platforms

Unmanned aerial vehicles (UAVs)

Helicopter platforms - By Fitment Type (In Value%)

Custom-built solutions

Modular solutions

Portable solutions

Fixed systems

Integrated solutions - By EndUser Segment (In Value%)

Commercial airlines

Military forces

Private aviation companies

Flight training schools

Aerospace manufacturers - By Procurement Channel (In Value%)

Direct procurement

Government tenders

Private sector procurement

Online procurement platforms

Distributors and resellers

- Market Share Analysis

- Cross Comparison Parameters (System Complexity, Market Penetration, Technological Integration, Customer Loyalty, Cost of Ownership, After-Sales Support, Performance Efficiency, Customization Potential, Operational Scalability, Regulatory Compliance)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

CAE

FlightSafety International

L3 Harris Technologies

Thales Group

Rockwell Collins

Honeywell Aerospace

Saab AB

AeroVironment

Simloc

Alsim Simulation

Indra Sistemas

Meggitt

Esterline Technologies

Textron Systems

Elbit Systems

- Rising demand for military training simulators

- Increasing adoption of virtual reality in civil aviation training

- Growing number of private aviation companies investing in training systems

- Flight schools incorporating advanced training solutions

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035