Market Overview

The Europe Freighter Aircraft market is projected to reach USD ~ billion in 2024, driven by the increase in air cargo demand due to growing e-commerce, global trade, and the need for efficient logistics solutions. Advancements in aircraft technology and the conversion of passenger planes into freighters further fuel the market growth. Additionally, the growing importance of time-sensitive goods has spurred the need for air freight, particularly in the pharmaceutical and perishable goods sectors.

Countries such as Germany, the United Kingdom, and the Netherlands are leading the Europe Freighter Aircraft market due to their strong logistics infrastructure, central geographical locations, and major international airports serving as hubs for air cargo. These countries’ key role in global trade and their strategic proximity to key European and international markets further enhance their dominance. Their significant investment in expanding and modernizing their freighter fleets has cemented their leadership in the market.

Market Segmentation

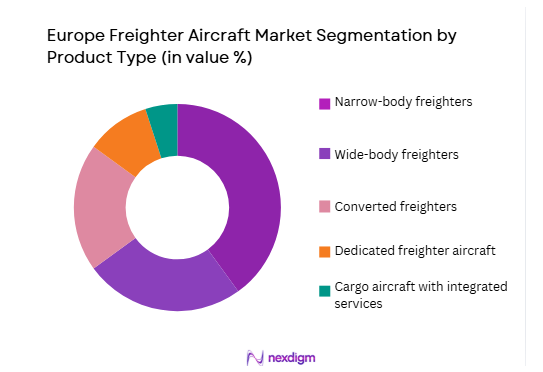

By Product Type:

The Europe Freighter Aircraft market is segmented by product type into narrow-body freighters, wide-body freighters, converted freighters, dedicated freighter aircraft, and cargo aircraft with integrated services. Recently, narrow-body freighters have gained a dominant market share due to their cost-effectiveness and high efficiency in delivering smaller payloads over medium-to-short distances. These aircraft are especially popular among cargo operators for regional routes and are highly favored for their fuel efficiency, lower operating costs, and ease of maintenance. The rising demand for regional air cargo services further reinforces the dominant position of narrow-body freighters in the market.

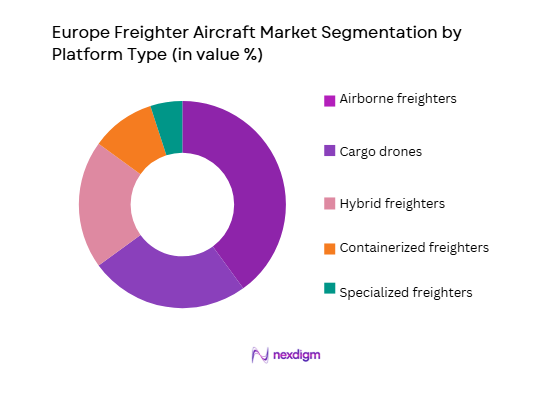

By Platform Type:

The market is segmented by platform type into airborne freighters, cargo drones, hybrid freighters, containerized freighters, and specialized freighters. Airborne freighters dominate the market due to their versatility in transporting various types of goods over long distances. They are ideal for time-sensitive deliveries and high-volume cargo operations, providing essential services for both global supply chains and e-commerce. The flexibility of airborne freighters, including the ability to operate on long-range routes, positions them as the preferred choice for major logistics providers.

Competitive Landscape

The Europe Freighter Aircraft market is highly competitive, with several key players driving innovation in aircraft design, technology, and services. Major players, including aircraft manufacturers, conversion companies, and logistics service providers, are competing to meet the growing demand for faster and more efficient air cargo solutions. Additionally, there is increasing consolidation in the market as companies collaborate to expand their fleet and operational capabilities, ensuring they can offer comprehensive services in the face of rising competition.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Market-Specific Parameter |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ |

| FedEx Express | 1971 | USA | ~ | ~ | ~ | ~ | ~ |

| UPS Airlines | 1981 | USA | ~ | ~ | ~ | ~ | ~ |

| Cargolux Airlines | 1970 | Luxembourg | ~ | ~ | ~ | ~ | ~ |

Europe Freighter Aircraft Market Analysis

Growth Drivers

Increased demand for e-commerce and logistics:

One of the primary growth drivers in the Europe Freighter Aircraft market is the rapid growth of e-commerce and global logistics. As online retail continues to expand, the demand for quick and reliable delivery solutions has surged, pushing the need for efficient air cargo services. E-commerce giants like Amazon and Alibaba, alongside smaller logistics providers, require fast and flexible shipping methods to meet consumer expectations for quick deliveries. Freighter aircraft play a critical role in this, offering a flexible solution that accommodates different types of goods, including time-sensitive products, electronics, and perishables. As e-commerce continues to grow and global trade expands, the demand for dedicated air freighters to transport goods quickly and efficiently will only increase. Additionally, the integration of next-generation logistics technologies, such as real-time tracking and automated handling systems, will enhance the demand for airfreight solutions, positioning the market for continued expansion.

Technological advancements in cargo aircraft design:

Technological advancements in freighter aircraft design, including improvements in fuel efficiency, cargo capacity, and automation, are driving growth in the market. Innovations such as lightweight materials, more efficient engines, and aerodynamic enhancements have made freighter aircraft more cost-effective and environmentally friendly. These improvements help reduce operating costs, which is critical for logistics companies looking to optimize their profitability. Additionally, the integration of automated cargo handling systems within freighter aircraft has significantly improved loading times, making operations more efficient. The use of AI-driven flight management systems has also enhanced operational safety and precision, making air cargo services more reliable. As technology continues to evolve, the development of even more efficient and flexible freighter aircraft will fuel market growth.

Market Challenges

High operational costs and fuel efficiency concerns:

Despite technological advancements, the high operational costs of freighter aircraft remain a significant challenge. Fuel expenses are one of the largest operating costs for freighter aircraft operators, and fluctuations in fuel prices can have a substantial impact on profitability. As governments around the world continue to push for environmental sustainability, the aviation industry is also under increasing pressure to reduce emissions, which may further increase operational costs. The development and adoption of more fuel-efficient aircraft designs, including the use of alternative fuels and hybrid propulsion systems, are critical for addressing these challenges. However, these innovations require significant upfront investments, making it a costly transition for many players in the industry.

Regulatory barriers and international restrictions:

Regulatory barriers are another challenge facing the Europe Freighter Aircraft market. International air cargo operations are subject to strict regulations, including those related to security, environmental standards, and airspace management. These regulations vary between countries, and navigating different regulatory environments can be complex and time-consuming. Additionally, environmental regulations aimed at reducing carbon emissions from the aviation sector may increase compliance costs, especially for older, less fuel-efficient freighter aircraft. These challenges may hinder the ability of companies to expand their fleets or introduce new aircraft models, impacting the overall growth of the market.

Opportunities

Growth in dedicated freighter aircraft fleets:

One of the most significant opportunities in the Europe Freighter Aircraft market is the expansion of dedicated freighter aircraft fleets. As global trade and e-commerce continue to grow, there is an increasing need for dedicated air cargo solutions that can handle large volumes of goods, including high-value or time-sensitive shipments. The shift toward dedicated freighter aircraft, rather than relying on passenger aircraft for cargo, allows for better capacity utilization and greater flexibility in scheduling and routing. This shift will drive demand for both new freighter aircraft and the conversion of passenger aircraft into freighters, opening new opportunities for aircraft manufacturers and conversion specialists.

Technological innovation in cargo drones and hybrid freighters:

The rise of cargo drones and hybrid freighters presents a major opportunity for the market. With advancements in unmanned aerial vehicle (UAV) technology, cargo drones are becoming an increasingly viable solution for last-mile deliveries and smaller freight operations. These drones offer the ability to transport goods quickly and efficiently over short distances, reducing costs and environmental impact. Hybrid freighters, which combine traditional aircraft technology with electric or alternative fuel systems, are also gaining traction as they provide a more sustainable solution for air cargo. As these technologies continue to develop, they offer exciting new opportunities for companies operating in the Europe Freighter Aircraft market.

Future Outlook

The Europe Freighter Aircraft market is poised for growth over the next five years, driven by increasing demand for air cargo services, advancements in aircraft technology, and growing trade volumes. Technological innovations such as AI-driven cargo management systems, hybrid propulsion technologies, and the rise of cargo drones will shape the future of the market. Regulatory support for greener and more efficient airfreight solutions will further enhance market opportunities. As global supply chains continue to evolve, the demand for faster and more reliable air cargo services will continue to drive the growth of dedicated freighter aircraft fleets.

Major Players

- Boeing

- Airbus

- FedEx

- UPS Airlines

- Cargolux Airlines

- Emirates SkyCargo

- Ryanair

- Volga-Dnepr Group

- Lufthansa Cargo

- Atlas Air

- AirBridgeCargo

- Qatar Airways Cargo

- Air France-KLM Cargo

- IAG Cargo

- Royal Air Maroc Cargo

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Cargo airlines

- E-commerce and logistics companies

- Aerospace and defense manufacturers

- Freight forwarding companies

- National aviation authorities

- Global trade organizations

Research Methodology

Step 1: Identification of Key Variables

Identifying critical factors that influence the market, including demand for air cargo, regulatory developments, and technological advancements in freighter aircraft.

Step 2: Market Analysis and Construction

Analyzing market trends, including fleet expansion, technological adoption, and the role of air cargo in global trade, to develop accurate market projections.

Step 3: Hypothesis Validation and Expert Consultation

Consulting industry experts, government officials, and key stakeholders to validate assumptions and refine market forecasts.

Step 4: Research Synthesis and Final Output

Compiling research findings into a comprehensive report with actionable insights, future forecasts, and recommendations for market participants.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Growth in e-commerce and logistics

Technological advancements in cargo aircraft

Increase in air cargo demand due to global trade - Market Challenges

High operational costs of freighter aircraft

Regulatory barriers in international air freight

Cargo capacity and logistics inefficiencies - Market Opportunities

Rising demand for low-cost cargo solutions

Expansion of dedicated air cargo fleets

Technological innovation in cargo drones - Trends

Increased automation in cargo handling

Adoption of eco-friendly aircraft technologies

Integration of drones in air cargo logistics - Government regulations

Regulation of air cargo and logistics operations

Environmental regulations for aviation emissions

Certification standards for cargo aircraft - SWOT analysis

- Porters 5 forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Narrow-body freighters

Wide-body freighters

Converted freighters

Dedicated freighter aircraft

Cargo aircraft with integrated services - By Platform Type (In Value%)

Airborne freighters

Cargo drones

Hybrid freighters

Containerized freighters

Specialized freighters - By Fitment Type (In Value%)

Custom-built freighters

Modular solutions

Integrated systems

Fixed-fit solutions

Portable solutions - By EndUser Segment (In Value%)

Cargo airlines

Logistics providers

Freight forwarding companies

E-commerce and retail

Government agencies - By Procurement Channel (In Value%)

Direct procurement

Private sector procurement

Government tenders

Online procurement platforms

Distributors and resellers

- Market Share Analysis

Cross Comparison Parameters (Cargo Capacity, Fuel Efficiency, Operational Costs, Technological Integration, Maintenance Requirements, Payload Flexibility, Range, Environmental Compliance, Reliability, Turnaround Time) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Boeing

Airbus

Lockheed Martin

Antonov Airlines

FedEx

DHL Aviation

UPS Airlines

IAG Cargo

Lufthansa Cargo

Cargolux Airlines

Emirates SkyCargo

Royal Air Maroc Cargo

AirBridgeCargo Airlines

Ryanair

Volga-Dnepr Group

- Increasing demand for e-commerce delivery solutions

- Cargo airlines investing in specialized freighter aircraft

- Logistics providers seeking more efficient air cargo systems

- Government agencies expanding air cargo fleets for strategic needs

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035