Market Overview

The general aviation market in Europe has seen consistent growth due to an increasing demand for private and business aviation services. In recent assessments, the market size was valued at USD ~ billion, driven by factors such as a robust economy, high net worth individuals, and expanding private aviation fleets. Technological advancements, including more efficient engines and advanced avionics, also contribute to market expansion. The continued rise in business aviation is expected to maintain this upward trajectory, with more businesses opting for private aircraft to enhance efficiency and reduce travel times.

Europe’s major hubs like the United Kingdom, France, and Germany continue to dominate the general aviation market due to strong infrastructure and a high concentration of corporate clients. The United Kingdom remains a leader in private jet services, while France has a growing demand for leisure aviation, reflecting the country’s emphasis on tourism and luxury travel. Germany, with its advanced aerospace industry, plays a significant role in aviation technology development and the maintenance sector, further enhancing the region’s market prominence. These countries have well-established regulatory frameworks and robust infrastructure that support general aviation activities.

Market Segmentation

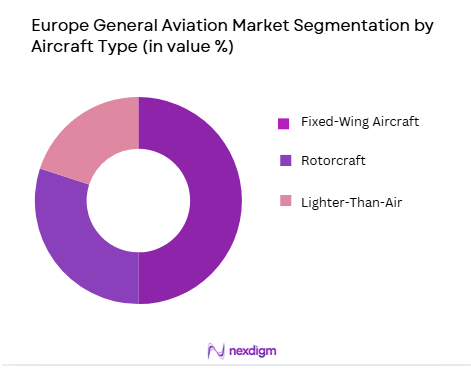

By Aircraft Type

The general aviation market is segmented by aircraft type into fixed-wing aircraft, rotorcraft, and lighter-than-air vehicles. Fixed-wing aircraft dominate the market due to their greater range, efficiency, and versatility. This sub-segment holds the highest market share, primarily driven by the demand for business jets and small commercial aircraft. A growing preference for faster travel and increasing disposable income are key factors driving this trend. Additionally, the introduction of more fuel-efficient aircraft models has further contributed to fixed-wing aircraft’s market dominance.

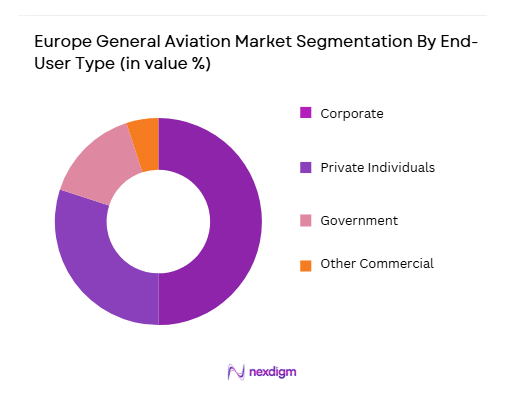

By End-User

The market is segmented by end-user into corporate, private individuals, government, and other commercial entities. The corporate segment holds the largest market share, driven by businesses investing in aviation services to ensure quick, reliable travel for executives and clients. The demand for private aircraft by high-net-worth individuals (HNWI) also contributes significantly to this sub-segment, where luxury, comfort, and time efficiency are prioritized. Government contracts, especially for surveillance and emergency operations, further strengthen this segment.

Competitive Landscape

The competitive landscape of the European general aviation market is shaped by consolidation and the growing influence of major players like Bombardier, Dassault Aviation, and Gulfstream. These players dominate the market through their innovative products, global service networks, and strategic partnerships with governmental and private sectors. Smaller players focus on niche markets, offering specialized services such as maintenance or regional aircraft solutions. The competitive intensity remains moderate, with a few large firms driving technological advancements and setting market trends, while smaller firms cater to specific demand areas.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| Bombardier | 1942 | Canada | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | France | ~ | ~ | ~ | ~ |

| Gulfstream | 1958 | USA | ~ | ~ | ~ | ~ |

| Pilatus Aircraft | 1939 | Switzerland | ~ | ~ | ~ | ~ |

| Cessna | 1927 | USA | ~ | ~ | ~ | ~ |

Europe General Aviation Market Analysis

Growth Drivers

Technological Advancements in Aircraft:

The general aviation market is increasingly driven by technological innovations, which enhance aircraft performance, fuel efficiency, and passenger comfort. The integration of advanced avionics, lightweight composite materials, and more efficient propulsion systems has led to aircraft becoming safer, more cost-effective, and environmentally friendly. These developments make flying more accessible to both business and private users, driving demand for general aviation aircraft. Additionally, manufacturers are focusing on reducing operational costs and increasing flight range, which appeals to both corporate users and high-net-worth individuals. This technological evolution, alongside the introduction of electric aircraft, provides significant growth potential for the market, especially for eco-conscious consumers and organizations. As governments incentivize green technologies and sustainability, aircraft that meet environmental standards will gain a competitive edge, stimulating further growth in the general aviation sector.

Increasing Demand for Private and Corporate Air Travel:

A key growth driver in the European general aviation market is the rising demand for private and corporate air travel. Businesses, especially multinational corporations, are increasingly using private jets for faster and more efficient travel, saving valuable time and reducing the hassle of commercial air travel. This demand is fueled by the need for flexibility, privacy, and accessibility to remote or less-served destinations. As corporate leaders prioritize productivity and time efficiency, private aviation is seen as a valuable tool. Furthermore, the growing number of high-net-worth individuals in Europe is contributing to the rise in demand for luxury private jets. The market is also benefiting from the expansion of smaller airports and airstrips, making general aviation more accessible to a broader customer base.

Market Challenges

High Operational and Acquisition Costs:

One of the primary challenges hindering the growth of the general aviation market in Europe is the high operational and acquisition costs associated with aircraft. Purchasing and maintaining aircraft are capital-intensive activities, often requiring substantial financial resources. Additionally, ongoing expenses such as fuel costs, maintenance, insurance, and crew salaries can be burdensome for private owners and corporate clients. Smaller companies and private individuals with limited budgets may find it difficult to justify the investment in general aviation. Although advancements in technology have helped to make operations more efficient, the overall financial barrier remains a significant challenge. The cost disparity between general aviation and commercial flights also restricts the broader adoption of private air travel, limiting market expansion in certain segments.

Regulatory Challenges and Airspace Restrictions:

Another significant challenge facing the European general aviation market is the complex regulatory environment and increasing airspace restrictions. European airspace is heavily regulated, with stringent policies and regulations governing aircraft certification, air traffic control, and flight operations. These regulations can create barriers to entry for new companies and restrict the operational flexibility of general aviation aircraft. Additionally, airspace congestion in major metropolitan areas further limits access for smaller aircraft, which can result in delays and increased operational costs. Although authorities have been working to streamline regulations, the evolving nature of aviation laws and airspace usage continues to pose challenges for market players. As the demand for general aviation grows, policymakers will need to find a balance between safety, security, and efficient airspace management.

Opportunities

Expansion of Electric and Hybrid Aircraft:

The introduction of electric and hybrid aircraft presents a significant opportunity for growth in the European general aviation market. These aircraft offer lower emissions and reduced operating costs compared to traditional jet-powered aircraft. With increasing environmental concerns and stricter emissions regulations, the demand for green aviation solutions is on the rise. Several manufacturers are actively developing electric aircraft with the potential to revolutionize the market, providing a sustainable alternative for short regional flights. Government incentives and funding for electric aircraft development further enhance the attractiveness of this opportunity. As the technology matures and becomes more commercially viable, the adoption of electric aircraft will drive growth in both the private and commercial aviation sectors.

Increasing Focus on Air Mobility and Regional Aircraft:

The general aviation market is seeing a shift towards air mobility solutions and the demand for regional aircraft. These solutions are designed to reduce congestion in major cities by providing fast, efficient, and affordable travel over short distances. Regional aircraft are becoming more popular in Europe as they offer an alternative to traditional modes of transport such as trains or cars, which can be slow and inefficient for medium-distance travel. This trend is supported by advancements in urban air mobility (UAM), with aircraft manufacturers working on developing vertical take-off and landing (VTOL) aircraft and drones for passenger transport. The European Union’s push for sustainable transport solutions and the integration of these technologies into urban environments present substantial opportunities for the general aviation market.

Future Outlook

Over the next five years, the European general aviation market is expected to experience steady growth, driven by technological advancements, increasing demand for private air travel, and the adoption of eco-friendly solutions like electric aircraft. Regulatory support, especially in the form of incentives for sustainable aviation, is expected to provide a boost to innovation and market expansion. Demand for business aviation and regional aircraft will remain strong, with ongoing infrastructure development and airspace improvements further supporting growth. The market will also benefit from the continued presence of high-net-worth individuals and the increasing popularity of air mobility solutions.

Major Players

- Bombardier

- Dassault Aviation

- Gulfstream

- Pilatus Aircraft

- Cessna

- Embraer

- Textron Aviation

- Lockheed Martin

- Piper Aircraft

- Beechcraft

- Honda Aircraft Company

- Cirrus Aircraft

- Mooney International

- Diamond Aircraft Industries

- Quest Aircraft

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aircraft manufacturers

- Aviation service providers

- Airlines

- Aircraft operators

- Corporate jet owners

- High-net-worth individuals

Research Methodology

Step 1: Identification of Key Variables

This involves understanding the primary factors influencing the market, including demand patterns, regulatory constraints, and technological advancements.

Step 2: Market Analysis and Construction

The next step is analyzing the market through primary and secondary research, identifying market size, growth trends, and competitive dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Validation of findings through expert consultations, including discussions with industry specialists and stakeholders, ensures the accuracy of the market data.

Step 4: Research Synthesis and Final Output

Finally, synthesizing all collected data into a coherent report, highlighting the key insights and offering actionable recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for private and business aviation

Technological advancements in aircraft design

Growing adoption of UAVs and AAM technologies - Market Challenges

High operational and maintenance costs of aircraft

Stringent regulations and certification requirements

Infrastructure limitations for general aviation - Market Opportunities

Expansion of advanced air mobility (AAM) solutions

Growth in the private aviation sector

Rising demand for UAVs in commercial applications - Trends

Rising interest in electric aircraft

Increased investment in drone technologies

Growing demand for sustainable aviation solutions - Government regulations

Regulation of air traffic for general aviation

Environmental regulations for aviation emissions

Certification standards for new aviation technologies - SWOT analysis

- Porters 5 forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Fixed-wing aircraft

Rotorcraft

Hybrid aircraft

Balloon aircraft

Airships - By Platform Type (In Value%)

Light aircraft

Business jets

Helicopters

UAVs (Unmanned Aerial Vehicles)

Advanced air mobility (AAM) - By Fitment Type (In Value%)

Custom-built aircraft

Modular systems

Integrated fitments

Ready-to-fly solutions

Experimental aircraft - By EndUser Segment (In Value%)

Private aviation

Business and corporate aviation

Charter services

Government and military agencies

Training and flight schools - By Procurement Channel (In Value%)

Direct procurement

Private sector procurement

Government tenders

Online platforms

Dealership and resellers

- Market Share Analysis

CrossComparison Parameters (Flight Range, Fuel Efficiency, Safety Features, Technology Integration, Maintenance Costs, Environmental Impact, Payload Capacity, Customer Support, Upgradability, Compliance with Certification Standards) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Gulfstream Aerospace

Cessna Aircraft Company

Bombardier

Airbus

Boeing

Cirrus Aircraft

Textron Aviation

Embraer

Piaggio Aerospace

Sikorsky Aircraft

Piper Aircraft

Dassault Aviation

Bell Helicopter

Thales Group

Lilium

- Private aviation growing in demand for leisure and business travel

- Government agencies expanding fleet for surveillance and law enforcement

- Charter services increasing due to demand for flexible and on-demand flights

- Flight schools seeing greater demand for pilot training and certification

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035