Market Overview

The Europe Intelligence, Surveillance, and Reconnaissance market is valued at approximately USD ~ billion, driven by increasing defense budgets, advancements in sensor technologies, and a rise in geopolitical tensions that demand enhanced surveillance capabilities. The demand for ISR systems is growing rapidly as both government and military agencies seek more efficient ways to monitor and respond to emerging security threats. Technological innovations in satellite systems, drones, and real-time data analytics are key contributors to market growth.

Countries like the United Kingdom, France, and Germany dominate the European ISR market due to their established military capabilities, strategic geopolitical positions, and significant investments in defense infrastructure. These nations lead in the development and deployment of advanced ISR technologies, supported by robust defense policies and cooperation within NATO frameworks. Their strong defense budgets further support the integration of cutting-edge ISR solutions to safeguard national security.

Market Segmentation

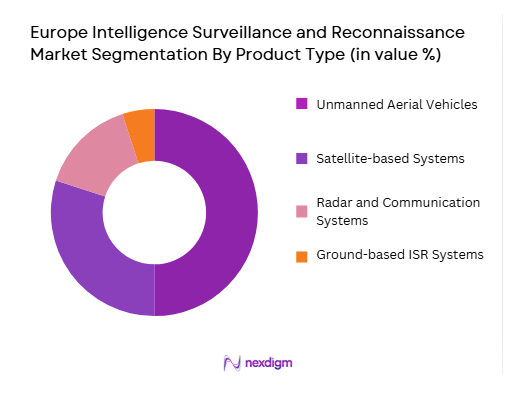

By Product Type

The Europe Intelligence, Surveillance, and Reconnaissance market is segmented by product type into satellite-based systems, unmanned aerial vehicles (UAVs), radar and communication systems, and ground-based ISR systems. Recently, UAVs have emerged as the dominant sub-segment, with UAV-based surveillance solutions gaining significant traction. UAVs provide enhanced flexibility, cost-effectiveness, and real-time data collection, making them ideal for a wide range of surveillance and reconnaissance missions. Their ability to access hard-to-reach areas and collect high-resolution imagery has made them indispensable for both military and intelligence operations. Additionally, advancements in UAV technology, such as extended flight times, improved data transmission, and autonomous operations, continue to drive their market share growth.

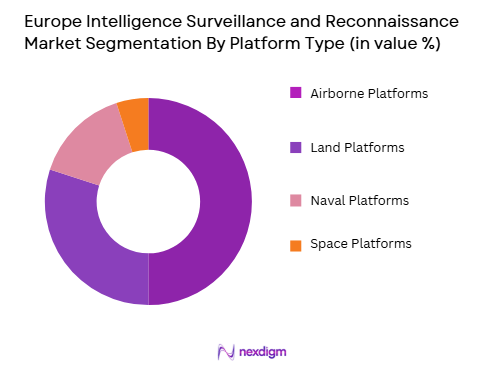

By Platform Type

The market is also segmented by platform type into airborne platforms, land platforms, naval platforms, and space platforms. Airborne platforms dominate the market share due to their rapid deployment capabilities and versatility in surveillance operations. These platforms are widely used for reconnaissance and intelligence gathering by military forces, offering significant advantages in terms of coverage, speed, and flexibility. Airborne ISR platforms, such as drones and manned aircraft, can be deployed over large geographical areas, providing real-time intelligence and high-resolution imaging. Additionally, technological advancements in radar and sensor systems enhance the capability of airborne platforms to perform complex surveillance tasks, thereby further driving their demand in the market.

Competitive Landscape

The competitive landscape of the Europe Intelligence, Surveillance, and Reconnaissance market is marked by high consolidation, with several key players dominating the development and deployment of ISR systems. These major players focus on integrating advanced technologies such as AI, big data analytics, and machine learning into their ISR solutions to provide more accurate and actionable intelligence. Leading companies also engage in strategic partnerships with defense agencies and technology firms to stay ahead of the competition. As the market continues to evolve, innovation in ISR technologies is central to gaining a competitive edge.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Leonardo | 1948 | Rome, Italy | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2000 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1970 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

Europe Intelligence Surveillance and Reconnaissance Market Analysis

Growth Drivers

Geopolitical Instability and Defense Modernization:

The increasing geopolitical tensions and evolving security threats in Europe have significantly boosted the demand for intelligence, surveillance, and reconnaissance systems. As the need for effective border control, surveillance of critical infrastructure, and threat detection rises, countries are investing heavily in ISR technologies to enhance national and regional security. In addition, defense modernization programs in Europe, focused on improving intelligence-gathering capabilities, are driving this market. ISR systems offer critical capabilities to monitor and respond to potential threats from state and non-state actors, particularly in sensitive regions. Countries are increasingly relying on ISR technologies to strengthen their military capabilities, improve situational awareness, and support strategic decision-making. As such, the demand for sophisticated ISR systems is expected to continue growing, as nations seek to safeguard their borders and protect national interests from various forms of instability.

Technological Advancements in ISR Systems:

Technological innovations in sensors, data analytics, and AI have propelled the growth of ISR systems. The development of advanced radar systems, high-definition imaging, and real-time data transmission technologies have made ISR platforms more capable and efficient. Additionally, the use of artificial intelligence in ISR systems enhances their ability to process vast amounts of data quickly, identifying critical patterns and providing actionable intelligence. The integration of machine learning allows ISR platforms to adapt to various environments and improve over time, ensuring more precise and reliable surveillance capabilities. UAVs, drones, and satellite technologies have seen remarkable advancements in terms of flight endurance, data resolution, and operational flexibility. These innovations are pushing the market forward, enabling military and defense agencies to carry out more complex and extensive surveillance operations in real time. As technology continues to evolve, ISR systems will become even more advanced, further driving their adoption across Europe.

Market Challenges

High Development and Operational Costs:

One of the major challenges facing the Europe Intelligence, Surveillance, and Reconnaissance market is the high cost associated with the development, deployment, and maintenance of ISR systems. These systems often require significant investment in cutting-edge technology, such as advanced sensors, satellite systems, and UAVs, which can be prohibitively expensive. Additionally, the operational costs, including personnel training, data management, and system maintenance, are substantial. For defense agencies and private companies, this represents a significant financial burden, particularly when trying to deploy large-scale ISR networks. Despite the increasing demand for ISR systems, the high costs associated with their lifecycle can limit their widespread adoption, particularly for smaller defense agencies or those with limited budgets. The complexity of integrating new ISR systems with existing military infrastructure further increases the cost, making cost optimization a critical factor for market players.

Regulatory and Compliance Challenges:

The market also faces challenges related to the regulatory and compliance landscape, particularly when it comes to the use of drones and UAVs in ISR operations. The deployment of UAVs for surveillance purposes is subject to strict regulations, especially concerning airspace control, privacy, and data protection. In Europe, these regulations can vary across countries, creating complexities for companies and defense agencies seeking to operate UAVs across borders. The need for compliance with international treaties, airspace regulations, and privacy laws often delays the deployment of ISR technologies. Additionally, military ISR systems must meet stringent requirements for accuracy, reliability, and performance, which adds complexity to both the design and certification processes. These regulatory challenges can slow the pace of innovation and expansion in the ISR market, particularly as new technologies emerge that require regulatory adjustments.

Opportunities

Advancements in Autonomous Systems for ISR:

One of the key opportunities for growth in the Europe Intelligence, Surveillance, and Reconnaissance market is the continued development of autonomous systems, particularly UAVs and drones. These platforms are increasingly being designed with autonomous capabilities that enable them to operate without human intervention over extended periods, reducing the cost and risk associated with traditional manned systems. Autonomous ISR systems can be deployed in remote and hostile environments, where human operators would face significant risks. These systems can provide real-time data collection, including high-resolution imaging and video, across vast geographical areas. The growth of autonomous systems in ISR operations presents opportunities for companies to innovate and offer more efficient and scalable solutions. This trend aligns with the increasing demand for cost-effective and persistent surveillance capabilities across a wide range of applications, from border patrol to battlefield reconnaissance.

Integration of AI and Big Data Analytics for Enhanced ISR:

Another key opportunity in the market lies in the integration of artificial intelligence (AI) and big data analytics with ISR systems. AI can process and analyze vast amounts of surveillance data much faster than human analysts, identifying key patterns and actionable intelligence that would otherwise be missed. This capability is especially useful in complex and time-sensitive operations where decision-making speed is critical. Big data analytics can further enhance the effectiveness of ISR systems by enabling the collection, integration, and analysis of data from multiple sources, including satellites, drones, and ground-based sensors. By incorporating these technologies into ISR systems, defense agencies can improve the accuracy and timeliness of their intelligence operations. As AI and big data technologies continue to mature, they offer the potential to revolutionize the ISR market by providing more intelligent, autonomous, and predictive systems.

Future Outlook

The Europe Intelligence, Surveillance, and Reconnaissance market is poised for continued growth, driven by advancements in technology and increasing defense expenditures. Over the next five years, the integration of AI, big data analytics, and autonomous platforms will significantly enhance the capabilities of ISR systems, providing more efficient, scalable, and cost-effective solutions. Geopolitical tensions and evolving security threats will continue to drive demand for enhanced surveillance capabilities, ensuring a steady market expansion. The adoption of 5G and autonomous systems will further shape the future of ISR operations, while regulatory challenges may slow the pace of adoption in certain regions.

Major Players

- Leonardo

- Thales Group

- Northrop Grumman

- BAE Systems

- Airbus Defence and Space

- Lockheed Martin

- General Dynamics

- Saab Group

- Raytheon Technologies

- Rheinmetall

- Elbit Systems

- L3Harris Technologies

- FLIR Systems

- Textron Systems

- Israel Aerospace Industries

Key Target Audience

- Government Defense Agencies

- Military Forces

- Aerospace and Defense Contractors

- UAV Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Security and Surveillance Providers

- Technology Integration Companies

Research Methodology

Step 1: Identification of Key Variables

This step involves defining the critical market variables, such as demand drivers, technology advancements, and defense budgets, to ensure accurate market insights.

Step 2: Market Analysis and Construction

Data from primary and secondary sources are used to analyze market trends, consumer behavior, and competitor dynamics, resulting in the construction of an actionable market model.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses derived from the analysis are tested through consultations with industry experts, military personnel, and technology providers to refine insights.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into a comprehensive report, offering strategic insights, forecasts, and actionable recommendations for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing defense budgets and national security concerns

Advancements in drone and satellite technologies

Rise in demand for real-time intelligence in military operations - Market Challenges

High cost of ISR system development and integration

Regulatory barriers and export restrictions

Interoperability issues among different ISR platforms - Market Opportunities

Development of autonomous and AI-powered ISR systems

Growing demand for hybrid ISR solutions

Emerging markets investing in ISR capabilities - Trends

Rise in unmanned ISR platforms

Advancements in data analytics and AI for intelligence processing

Shift towards integrated ISR systems for multi-domain operations - Government regulations

Export control regulations for ISR technology

National security-related certification standards

Environmental regulations related to ISR system operations - SWOT analysis

- Porters 5 forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Airborne ISR Systems

Land-based ISR Systems

Naval ISR Systems

Satellite ISR Systems

Unmanned ISR Systems - By Platform Type (In Value%)

Military Aircraft

Drones

Satellite Platforms

Naval Platforms

Ground Vehicles - By Fitment Type (In Value%)

OEM Fitment

Retrofit Fitment

Hybrid Fitment

Modular Fitment

Integrated Fitment - By End-User Segment (In Value%)

Government & Defense Agencies

Private Military Contractors

Aerospace & Defense Manufacturers

Intelligence Agencies

Commercial Sector - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Vendors

Leasing

Contract Bidding

Public-Private Partnerships

- Market Share Analysis

Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End-User Segment, Fitment Type, Data Security Standards, Integration Complexity, Operational Costs, Technological Innovation, Interoperability with Existing Systems, Government Policy Impact, Vendor Relationships) - SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Northrop Grumman

General Dynamics

BAE Systems

Raytheon Technologies

L3Harris Technologies

Leonardo

Elbit Systems

Thales Group

Airbus

Israel Aerospace Industries

Harris Corporation

Leonardo DRS

SAAB

Indra Sistemas

- Europe Intelligence Surveillance and Reconnaissance End-user Analysis

- Defense agencies seeking advanced ISR capabilities for national security

- Private military contractors focused on high-end surveillance systems

- Aerospace and defense manufacturers developing innovative ISR technologies

Intelligence agencies leveraging ISR systems for global surveillance and counterterrorism

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035