Market Overview

The Europe light and very light jets market is closely tied to the regional business aviation sector, which was valued at approximately USD ~ based on a recent historical assessment, according to Mordor Intelligence. Strong corporate travel demand, cross-border commercial activity, and the need for flexible point-to-point connectivity continue to drive aircraft procurement. Additionally, operators increasingly favor light-class jets due to lower operating costs and short-runway capability, reinforcing their position within private aviation fleets serving executive mobility and specialized missions.

The United Kingdom, France, Germany, and Switzerland emerge as dominant aviation hubs due to dense financial ecosystems, mature charter infrastructure, and high concentrations of multinational headquarters. Major airports in London and Paris support significant business jet movements, while Switzerland benefits from private wealth and cross-border commerce. Spain is gaining traction through airport upgrades and Mediterranean connectivity, strengthening its operational relevance. Extensive access to more than 1,400 airports further supports regional dominance by enabling direct connections unavailable through commercial airline networks.

Market Segmentation

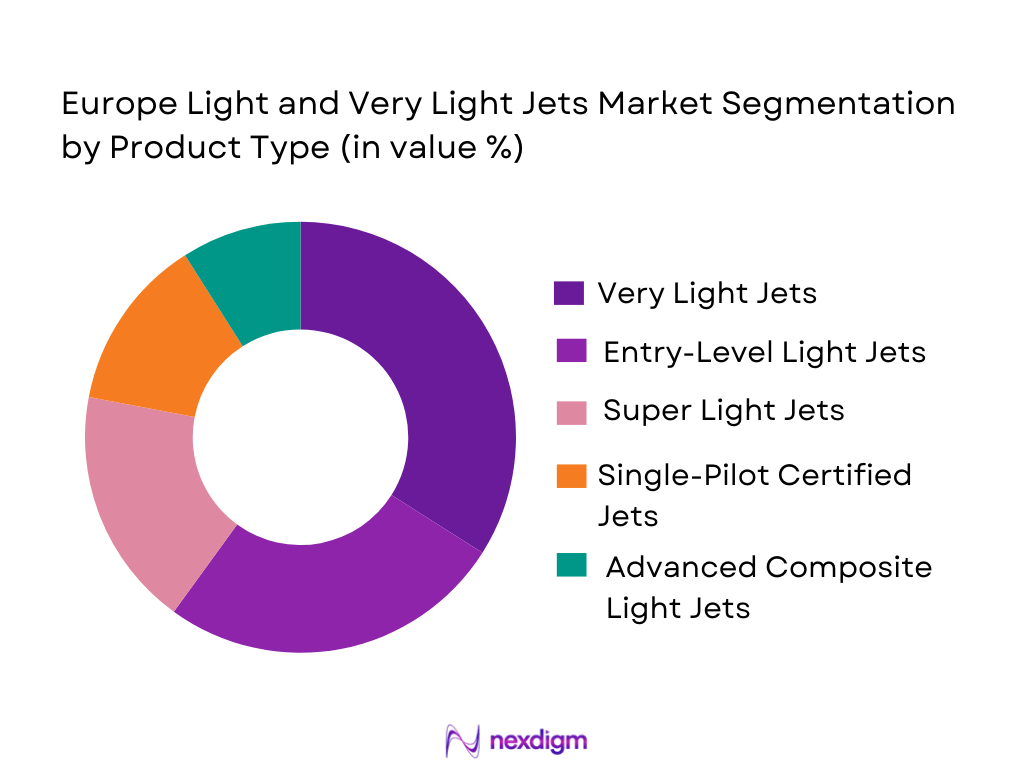

By Product Type

Europe Light and Very Light Jets market is segmented by product type into Very Light Jets, Entry-Level Light Jets, Super Light Jets, Single-Pilot Certified Jets, and Advanced Composite Light Jets. Recently, Very Light Jets have a dominant market share due to their lower acquisition cost, simplified pilot requirements, and suitability for short regional routes across Europe. Operators increasingly deploy these aircraft for charter services and corporate shuttle missions because they can access smaller airports while maintaining operational efficiency. Growing demand from high-net-worth individuals seeking privacy and schedule flexibility further strengthens adoption. Manufacturers continue integrating modern avionics and fuel-efficient engines, improving lifecycle economics and encouraging fleet renewal across business aviation operators.

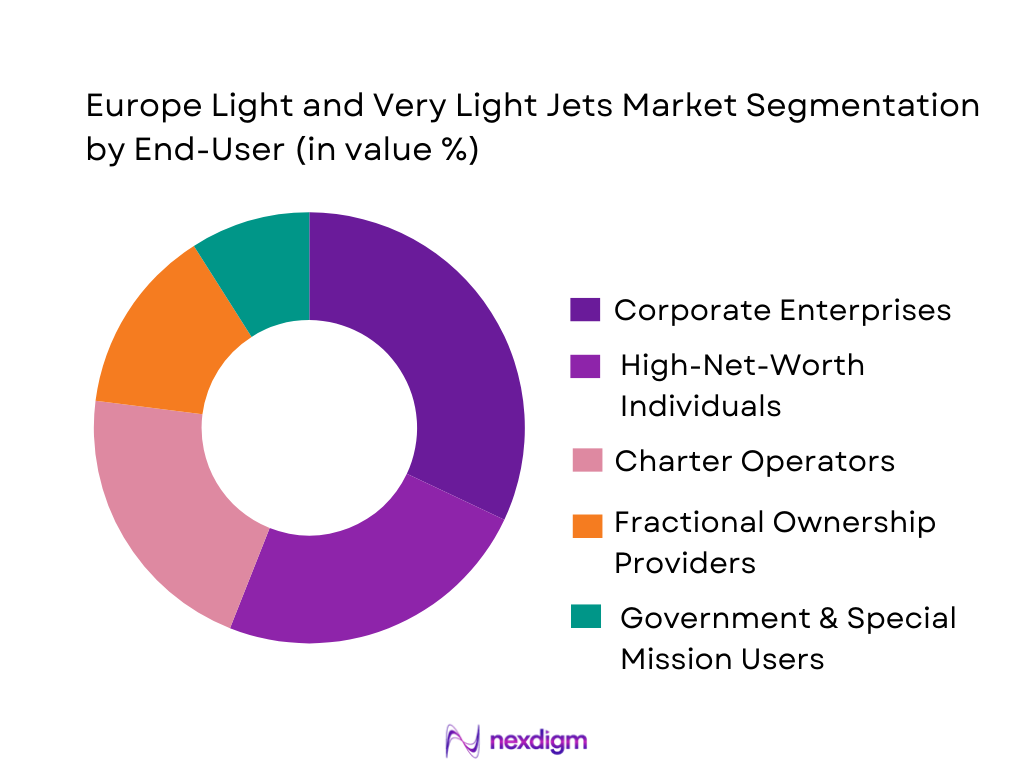

By End User

Europe Light and Very Light Jets market is segmented by end user into Corporate Enterprises, High-Net-Worth Individuals, Charter Operators, Fractional Ownership Providers, and Government & Special Mission Users. Recently, Corporate Enterprises have a dominant market share as organizations prioritize executive travel efficiency and secure transportation across multiple European cities. Time-sensitive dealmaking, site visits, and decentralized corporate operations sustain consistent utilization rates. Businesses also favor ownership or managed aircraft models to ensure availability during congested commercial travel periods. Furthermore, regulatory disclosure requirements surrounding emissions are prompting companies to modernize fleets, indirectly supporting demand for newer light-class aircraft with improved environmental performance.

Competitive Landscape

The Europe light and very light jets market exhibits moderate consolidation, with established aircraft manufacturers maintaining technological leadership while specialized operators expand service footprints. Major players compete through cabin innovation, avionics integration, fuel efficiency, and lifecycle cost optimization. Strategic partnerships with charter providers and leasing firms enhance distribution channels, while aftermarket services create recurring revenue streams. Entry barriers remain high due to certification requirements and capital intensity, allowing incumbent manufacturers to preserve competitive positioning across the regional business aviation ecosystem.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Fleet Support Network |

| Textron Aviation | 2014 | United States | ~ | ~ | ~ | ~ | ~ |

| Embraer | 1969 | Brazil | ~ | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | France | ~ | ~ | ~ | ~ | ~ |

| Pilatus Aircraft | 1939 | Switzerland | ~ | ~ | ~ | ~ | ~ |

| Honda Aircraft Company | 2006 | United States | ~ | ~ | ~ | ~ | ~ |

Europe Light and Very Light Jets Market Analysis

Growth Drivers

Rising Corporate Demand for Time-Efficient Regional Mobility

Corporate travel patterns across Europe increasingly favor private aviation as executives seek predictable scheduling, reduced transit times, and enhanced productivity while traveling between financial centers. Light and very light jets are particularly well suited to this requirement because they enable direct access to secondary airports that commercial airlines do not serve, minimizing ground transfers and logistical delays. The European Business Aviation Association highlights that business aviation connects more than 1,400 airports, many of which lack scheduled airline service, underscoring its structural advantage in regional connectivity. As multinational enterprises expand geographically, the need for rapid intercity travel has intensified, encouraging companies to invest in dedicated aircraft capacity or long-term charter agreements. The operational flexibility offered by smaller jets also aligns with modern corporate strategies emphasizing agility and decentralized decision-making. Furthermore, the ability to conduct multiple site visits within a single day enhances managerial efficiency and supports faster execution of commercial transactions. Increasing cross-border mergers, foreign direct investment activity, and pan-European supply chains further reinforce reliance on private aviation infrastructure.

Expansion of Charter and Fractional Ownership Models

Access-based aviation models are reshaping how customers engage with private flight, significantly broadening the addressable market for light and very light jets. Fractional ownership programs allow multiple clients to share aircraft usage without assuming full capital expenditure, making private aviation financially accessible to mid-sized companies and emerging wealth segments. Charter platforms, meanwhile, provide on-demand availability that appeals to travelers prioritizing flexibility over ownership commitments. Industry data indicates that pre-owned aircraft and fractional models account for substantial transaction activity, reflecting a structural shift toward asset-light consumption. Operators benefit from higher fleet utilization as shared access increases flight frequency, improving return on investment for aircraft acquisitions. Digital booking platforms and transparent pricing tools are also reducing traditional friction in private aviation procurement, attracting younger executives and first-time users.

Market Challenges

Stringent Environmental and Emissions Compliance Requirements

Environmental scrutiny across Europe presents a persistent structural challenge for the light and very light jets market as policymakers intensify efforts to decarbonize aviation. Regulatory frameworks tied to climate commitments increasingly require operators to disclose emissions footprints, encouraging corporate customers to reassess travel policies and prioritize sustainability metrics. While business aviation contributes less than 0.04% of total EU emissions, public perception often magnifies its environmental impact, generating reputational risks for users. Carbon taxation proposals, sustainable aviation fuel mandates, and noise compliance standards collectively elevate operating costs, placing financial pressure on smaller operators. Manufacturers must therefore accelerate research into fuel-efficient engines, hybrid propulsion concepts, and lightweight materials, all of which demand substantial capital investment. Certification timelines for environmentally advanced technologies remain lengthy, delaying commercialization and complicating fleet planning decisions. Additionally, corporate sustainability reporting directives are prompting companies to renew aircraft earlier than historically typical, creating transitional cost burdens even as they support long-term efficiency gains. Airport-level restrictions on older, noisier aircraft further limit operational flexibility in metropolitan hubs.

High Acquisition Costs and Supply Chain Vulnerabilities

Capital intensity remains a defining barrier within the European light jet ecosystem, where procurement involves substantial upfront expenditure alongside long-term maintenance obligations. Aircraft pricing is sensitive to fluctuations in raw material costs, advanced avionics components, and propulsion systems, making manufacturers vulnerable to industrial supply disruptions. Recent aerospace production cycles have been affected by engine shortages and delayed parts deliveries, slowing output and extending lead times for customers awaiting new aircraft. For operators, these delays can hinder capacity planning and restrict the ability to capitalize on favorable demand conditions. Financing conditions also influence purchasing behavior, as higher interest rates increase borrowing costs and can discourage speculative fleet expansion. Smaller charter providers are particularly exposed because they rely on predictable utilization rates to justify investment.

Opportunities

Integration of Sustainable Aviation Fuel and Next-Generation Propulsion Technologies

The transition toward lower-carbon aviation creates a substantial innovation runway for manufacturers specializing in light aircraft, particularly as sustainable aviation fuel becomes more widely available across European airports. Smaller jets often require lower fuel volumes, making them practical early adopters of alternative energy pathways relative to larger aircraft categories. Manufacturers investing in aerodynamic efficiency, advanced composites, and optimized flight management systems can deliver measurable emission reductions without compromising performance. This technological evolution aligns with corporate environmental commitments, potentially unlocking new procurement cycles among companies seeking to balance mobility with sustainability objectives. Governments and aviation bodies are also supporting research initiatives aimed at accelerating green propulsion development, fostering collaboration between OEMs and technology providers. Operators that demonstrate environmental leadership may gain preferential access to airports implementing stricter sustainability thresholds, creating a competitive differentiator. Furthermore, sustainable technologies can enhance brand perception among high-net-worth travelers increasingly attentive to responsible consumption.

Emergence of Advanced Air Mobility and Regional Connectivity Ecosystems

The broader evolution of advanced air mobility is beginning to influence conventional jet programs, particularly through innovations such as electric taxiing and battery-assisted systems that reduce ground emissions and noise. These technological spillovers enhance the operational attractiveness of light jets at slot-constrained airports, where environmental performance increasingly affects access decisions. Europe’s fragmented geography, characterized by numerous mid-sized cities and industrial clusters, naturally supports point-to-point aviation networks that complement commercial airline routes. Infrastructure upgrades in emerging aviation hubs further expand the operational envelope for smaller aircraft capable of operating from shorter runways. As customer expectations shift toward faster, more personalized travel experiences, integration with digital mobility platforms could enable seamless multimodal journeys linking private flights with ground transport solutions.

Future Outlook

The Europe light and very light jets market is expected to demonstrate stable expansion supported by sustained corporate mobility needs and the normalization of private travel demand. Technological improvements in fuel efficiency, avionics, and lightweight materials are likely to enhance operational economics while aligning with tightening environmental standards. Regulatory clarity around sustainable aviation fuel may further accelerate fleet modernization. Additionally, the growth of fractional ownership and charter ecosystems is projected to widen customer participation, reinforcing procurement pipelines and supporting long-term industry resilience.

Major Players

- Embraer

- Dassault Aviation

- Pilatus Aircraft

- Honda Aircraft Company

- Gulfstream Aerospace

- Bombardier

- Leonardo S.p.A.

- Airbus Corporate Jets

- Daher

- Diamond Aircraft Industries

- Aura Aero

- Cirrus Aircraft

- Flight Design

- Eviation Aircraft

Key Target Audience

- Charter service providers

- Fractional ownership companies

- Government and regulatory bodies

- Airport infrastructure developers

- Aviation leasing firms

- Investments and venture capitalist firms

- Private wealth management firms

Research Methodology

Step 1: Identification of Key Variables

Key demand and supply variables were mapped through secondary sources including aviation associations, manufacturer disclosures, and regulatory publications. Economic indicators, fleet activity, and procurement patterns were evaluated to determine structural drivers. The process ensured that only validated metrics informed market interpretation.

Step 2: Market Analysis and Construction

Data points were synthesized to construct a cohesive view of the regional ecosystem, integrating fleet statistics, operator activity, and infrastructure coverage. Comparative benchmarking across aircraft classes helped define the positioning of light and very light jets. Analytical frameworks were applied to maintain consistency and reliability.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary findings were cross-verified through expert commentary, industry whitepapers, and aviation databases. Contradictory signals were reconciled using triangulation techniques to strengthen analytical confidence. This validation phase ensured alignment between qualitative insights and quantitative indicators.

Step 4: Research Synthesis and Final Output

All validated inputs were consolidated into a structured narrative emphasizing actionable intelligence. Editorial controls ensured factual integrity, logical flow, and methodological transparency. The final output reflects a balanced assessment of current dynamics and forward-looking considerations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for Time-Efficient Regional Travel

Expansion of Business Aviation Infrastructure Across European Economies

Increasing Adoption of Cost-Optimized Private Jet Solutions - Market Challenges

Stringent Environmental and Emission Regulations

High Lifecycle and Maintenance Costs

Airspace Congestion Across Major European Hubs - Market Opportunities

Integration of Sustainable Aviation Fuel-Compatible Aircraft

Growing Air Taxi Ecosystem Across Tier-II Cities

Technological Advancements in Lightweight Composite Airframes - Trends

Shift Toward Digitally Integrated Glass Cockpits

Rising Development of Low-Noise Aircraft Designs - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Very Light Jets (VLJs)

Entry-Level Light Jets

Super Light Jets

Single-Pilot Certified Jets

Next-Generation Fuel-Efficient Light Jets - By Platform Type (In Value%)

Corporate Aviation Platforms

Private Ownership Platforms

Air Taxi and On-Demand Mobility Platforms

Charter Fleet Platforms

Special Mission Aviation Platforms - By Fitment Type (In Value%)

OEM Factory-Fitted Aircraft

Cabin Interior Customization Installations

Advanced Avionics Integration

Connectivity and Satellite Communication Systems

Safety Enhancement Retrofits - By End User Segment (In Value%)

Corporate Enterprises

High-Net-Worth Individuals

Charter Service Providers

Fractional Ownership Companies

Government and Emergency Service Operators - By Procurement Channel (In Value%)

Direct OEM Procurement

Authorized Aircraft Dealers

Leasing Providers

- Market Share Analysis

- Cross Comparison Parameters (Aircraft Range, Passenger Capacity, Operating Economics, Cabin Configuration, Avionics Technology)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Textron Aviation

Embraer S.A.

Dassault Aviation

Pilatus Aircraft Ltd

Honda Aircraft Company

Cirrus Aircraft

Gulfstream Aerospace Corporation

Bombardier Inc.

Leonardo S.p.A.

Airbus Corporate Jets

Daher Aerospace

Aura Aero

Diamond Aircraft Industries

Eviation Aircraft

Flight Design General Aviation

- Corporate Demand Driven by Executive Mobility Requirements

- Charter Operators Expanding Premium Short-Haul Offerings

- Fractional Ownership Models Attracting New Customer Segments

- Public Sector Utilization Increasing for Medical and Surveillance Operations

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035