Market Overview

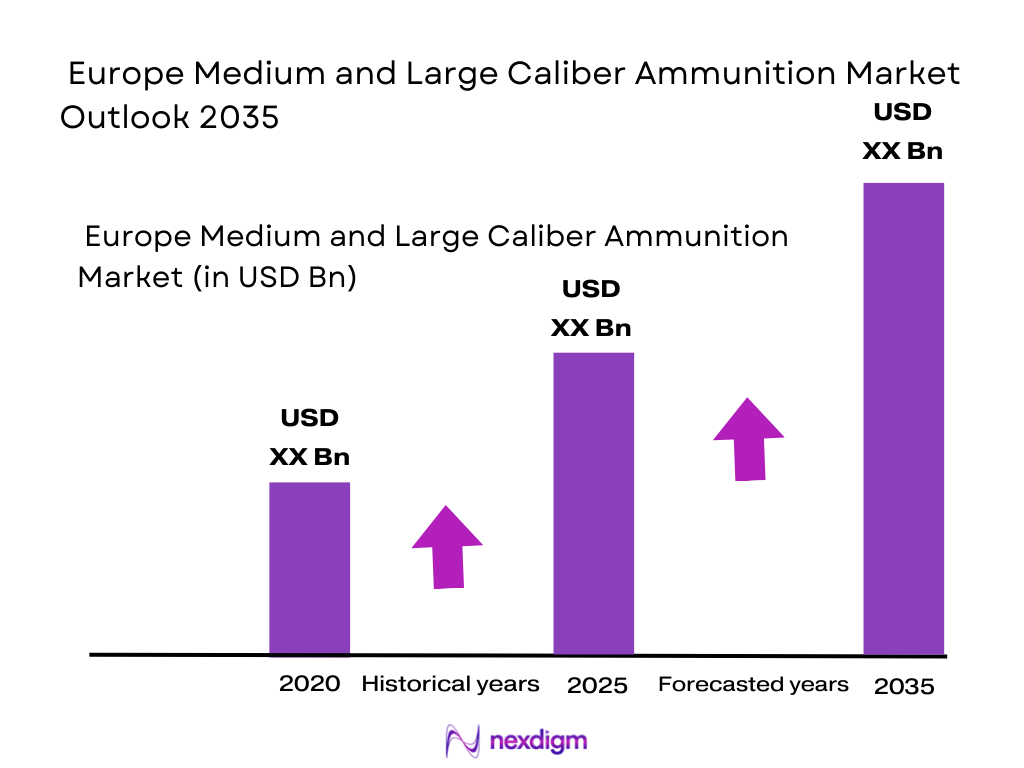

The Europe Medium and Large Caliber Ammunition Market is valued in the ~ of USD, driven by the increasing defense spending across European nations. The demand for advanced ammunition types continues to rise due to geopolitical tensions and the modernization of military forces. The market is also influenced by technological advancements in ammunition systems, which have led to a shift towards more precise and efficient munitions, enabling enhanced operational capabilities for defense forces. This growth is further accelerated by the need for consistent supplies in military operations and international defense partnerships, highlighting a significant demand in the market.

The market dominance is largely attributed to key defense hubs such as the United Kingdom, France, and Germany, where defense budgets are robust and defense innovation thrives. These countries have strategically positioned themselves at the forefront of military technology advancements, driven by both governmental and private sector initiatives. Additionally, the proximity to various defense manufacturers and strong ties with NATO nations contribute to the steady demand for medium and large-caliber ammunition in the region. Their central role in defense alliances further ensures their continuous market leadership in this sector.

Market Segmentation

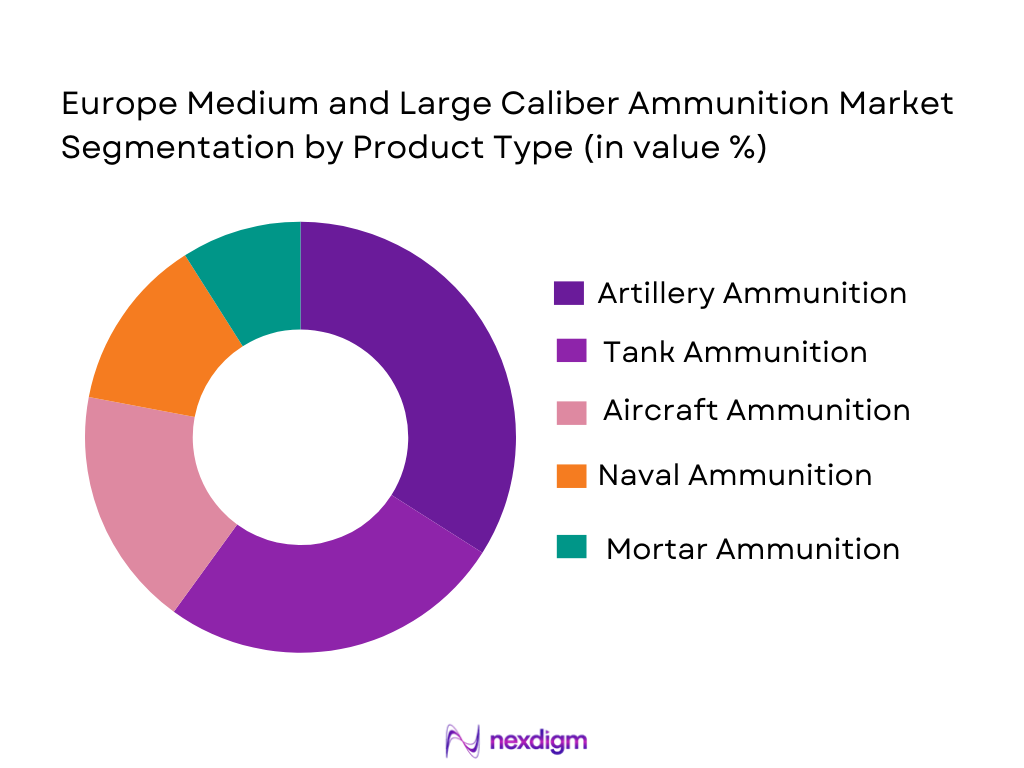

By Product Type

The Europe Medium and Large Caliber Ammunition market is segmented by product type into various categories, including artillery, tank, and aircraft ammunition. Recently, artillery ammunition has emerged as a dominant segment due to its increased demand in military conflicts and its enhanced capabilities for long-range precision targeting. The demand for artillery ammunition is driven by the modernization of military forces and the integration of advanced targeting systems, which are increasingly required for efficient battlefield operations. The growing geopolitical instability in regions surrounding Europe has also played a crucial role in sustaining the demand for artillery systems across various European nations. The long-range effectiveness and cost-efficiency of artillery ammunition continue to boost its position in the market, which is expected to grow steadily in the coming years.

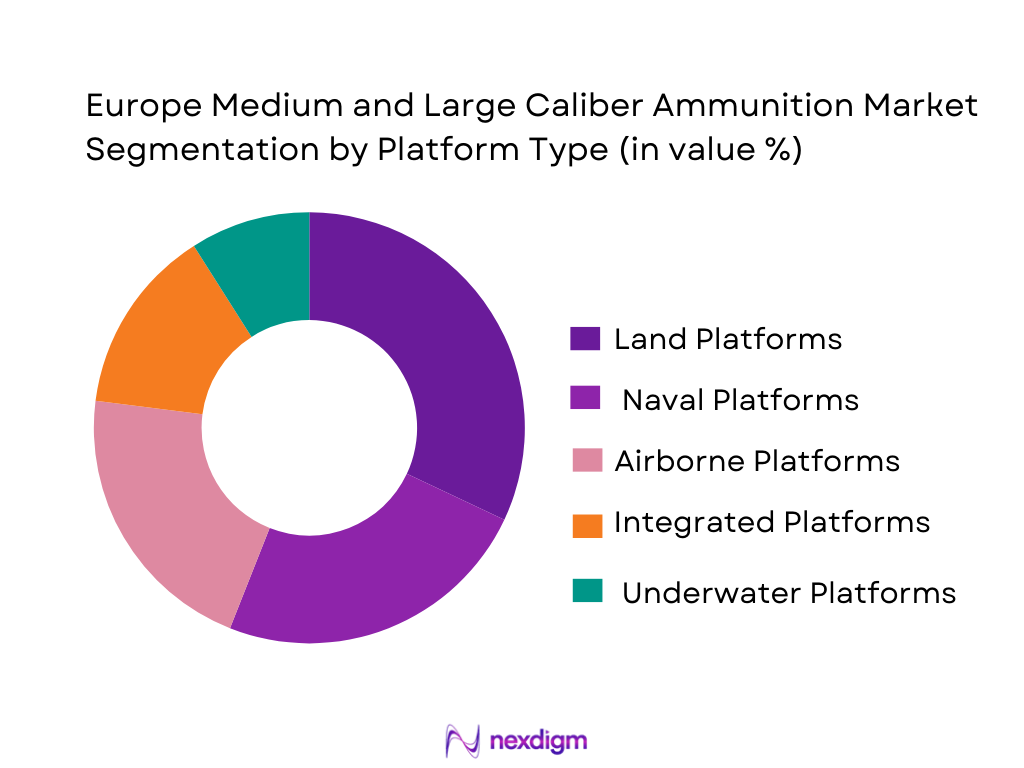

By Platform Type

The Europe Medium and Large Caliber Ammunition market is segmented by platform type into land, naval, and airborne platforms. Among these, land platforms have the largest market share, primarily due to the extensive use of ground-based artillery and tanks in both defensive and offensive military operations. Land platforms are critical in regional security strategies, and their use in military exercises and active conflict zones continues to rise. Countries in Europe with significant ground forces, including Germany and the United Kingdom, are driving the demand for ammunition suited to land-based weaponry. The need for advanced, long-range systems that improve accuracy and reduce collateral damage further fuels the growth of land-based ammunition systems, ensuring their dominance within the market.

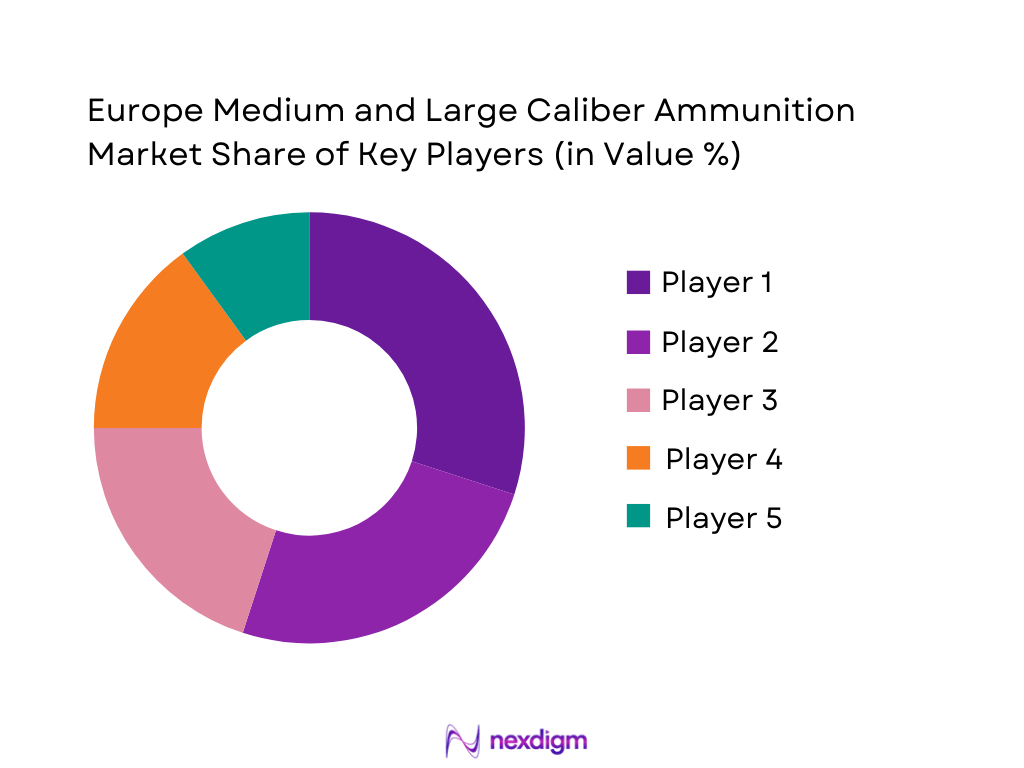

Competitive Landscape

The competitive landscape in the Europe Medium and Large Caliber Ammunition market is shaped by a mix of established global defense manufacturers and regional players. Consolidation in the industry has led to a few large companies dominating the market, often through strategic mergers and acquisitions. Major players, such as BAE Systems and Rheinmetall, continue to innovate and expand their product portfolios, contributing to market growth and technological advancement. The influence of these players is particularly strong in key European markets, where defense contracts and government tenders play a pivotal role in shaping the competitive dynamics.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD billion) | R&D Investment (USD million) |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Germany | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ |

Europe Medium and Large Caliber Ammunition Market Analysis

Growth Drivers

Increased Military Expenditure

The growing defense budgets across European countries are significantly fueling the demand for medium and large-caliber ammunition. As nations like Germany, France, and the UK allocate larger portions of their GDP towards national security, the procurement of advanced ammunition systems is prioritizing. This trend has been accelerated by the need to modernize military forces and enhance readiness in light of evolving geopolitical tensions. European defense contractors are increasingly receiving large government contracts to supply ammunition, with many of these countries also investing in research and development to improve the precision, efficiency, and effectiveness of their ammunition. This investment in military expenditure ensures a steady market for medium and large-caliber ammunition and creates opportunities for technological advancements.

Technological Advancements in Ammunition

The rapid advancements in ammunition technology are also driving market growth. The demand for precision-guided munitions, smart artillery, and specialized ammunition systems is on the rise, particularly as European military forces prioritize enhanced accuracy and minimized collateral damage. Innovations such as longer-range and more effective artillery systems have expanded the applications of ammunition, thereby supporting their increased usage in both defensive and offensive operations. Furthermore, the integration of smart technologies, such as autonomous targeting systems, into ammunition types ensures that the European military remains at the forefront of global defense capabilities. These technological developments improve the operational efficiency of defense systems, thereby enhancing the overall market demand for advanced medium and large-caliber ammunition.

Market Challenges

High Manufacturing and Development Costs

One of the primary challenges facing the Europe Medium and Large Caliber Ammunition market is the high cost associated with the development and manufacturing of advanced ammunition systems. While technological advancements offer improved performance and precision, they also lead to increased production costs, particularly in the development of smart munitions and precision-guided systems. As defense contractors face pressure to deliver cutting-edge ammunition solutions, the cost of raw materials, advanced technology integration, and skilled labor continues to rise. These rising costs place strain on defense budgets, forcing governments to make tough decisions on resource allocation. For many nations, balancing technological advancement with cost-effectiveness remains a difficult challenge, especially as military budgets face fluctuations due to broader economic conditions.

Regulatory Barriers and Compliance

Another significant challenge is the complex regulatory environment surrounding the production and distribution of ammunition. Stringent compliance requirements imposed by governments and international bodies can delay the approval processes for new products and increase the burden on manufacturers. Additionally, the need for certification of new ammunition types and compliance with environmental and safety regulations can slow down the development cycle. With the European Union’s increasing focus on regulating arms exports and controlling the flow of military-grade materials, manufacturers must navigate complex legal frameworks to remain operational. This regulatory pressure not only affects time-to-market but also adds significant operational costs, challenging companies to balance compliance with profitability.

Opportunities

Rising Demand for Modernized Ammunition Systems

One of the most promising opportunities in the Europe Medium and Large Caliber Ammunition market is the growing demand for modernized ammunition systems. As countries continue to focus on modernizing their armed forces, the need for advanced, high-performance ammunition systems is critical. This includes the development of new types of ammunition capable of meeting the demands of modern warfare, including greater range, accuracy, and targeting precision. The European defense sector’s shift towards upgrading legacy systems provides an opportunity for ammunition suppliers to capitalize on contracts for replacement ammunition systems. Additionally, increasing investments in smart technology and precision-guided munitions present a growing avenue for future market development, offering ammunition manufacturers the chance to expand their product portfolios and meet the evolving needs of defense forces.

Partnerships with Private Tech Firms for Ammunition Innovations

Another significant opportunity for growth lies in partnerships between defense contractors and private technology firms. With the ongoing integration of AI, machine learning, and autonomous technologies into defense systems, there is ample scope for collaboration to develop next-generation ammunition. Private tech companies specializing in AI and cybersecurity are particularly well-positioned to work alongside ammunition manufacturers to create smart, autonomous munitions capable of real-time data processing and improved battlefield effectiveness. These collaborations allow for innovative breakthroughs in ammunition systems, potentially revolutionizing the market with advanced features such as adaptive targeting and enhanced efficiency. By leveraging expertise from both defense and tech industries, ammunition companies can offer more effective solutions to meet the increasing demand for precision and automation in modern warfare.

Future Outlook

Over the next five years, the Europe Medium and Large Caliber Ammunition market is expected to witness steady growth driven by both technological advancements and increased defense expenditure. Key trends include the integration of smart munitions, advancements in precision targeting, and enhanced operational efficiency of ammunition systems. Furthermore, regulatory support for defense innovation and collaboration between governments and private defense contractors will contribute to the market’s growth. As geopolitical tensions continue to shape military priorities, demand for advanced ammunition will remain strong, ensuring a stable trajectory for the market.

Major Players

- BAE Systems

- Rheinmetall AG

- Lockheed Martin

- Thales Group

- Leonardo

- General Dynamics

- Northrop Grumman

- Raytheon Technologies

- L3 Technologies

- Saab Group

- Elbit Systems

- Harris Corporation

- Boeing

- Sikorsky Aircraft

- Nexter Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military defense contractors

- Aerospace and defense technology firms

- Private security companies

- Law enforcement agencies

- Military equipment suppliers

- Defense manufacturers

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying critical market variables such as product types, technological advancements, regional regulations, and economic factors affecting the Europe Medium and Large Caliber Ammunition market.

Step 2: Market Analysis and Construction

The market analysis focuses on gathering primary and secondary data, examining industry trends, market segmentation, and evaluating the impact of macroeconomic factors.

Step 3: Hypothesis Validation and Expert Consultation

Consultations with industry experts and stakeholders are conducted to validate the hypotheses regarding market trends and growth projections.

Step 4: Research Synthesis and Final Output

The final step synthesizes the gathered data, refining it into actionable insights and forecasts for the Europe Medium and Large Caliber Ammunition market.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Military Expenditure

Technological Advancements in Ammunition

Rising Geopolitical Tensions - Market Challenges

High Manufacturing Costs

Regulatory Constraints

Logistical Complexities in Distribution - Market Opportunities

Emerging Defense Partnerships

Innovation in Ammunition Technology

Rising Demand for Advanced Military Systems - Trends

Increased Use of Precision-Guided Munitions

Integration of AI in Ammunition Systems - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Artillery Ammunition

Tank Ammunition

Aircraft Ammunition

Naval Ammunition

Mortar Ammunition - By Platform Type (In Value%)

Land Platforms

Naval Platforms

Airborne Platforms

Integrated Platforms

Underwater Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Security Firms

Law Enforcement Agencies - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

Thales Group

Rheinmetall AG

Leonardo

Saab Group

Harris Corporation

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

L3 Technologies

- Military Forces’ Increasing Demand for Ammunition

- Government Agencies’ Role in Regulation and Procurement

- Private Security Firms’ Shift Towards Advanced Systems

- Law Enforcement Agencies’ Increasing Procurement

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035