Market Overview

The Europe Military Aircraft market is projected to reach USD ~, driven by increased defense spending and the continuous development of advanced military aircraft systems. Rising geopolitical tensions and modernization programs in military forces across Europe are key contributors to this market growth. Governments are investing heavily in upgrading their fleets, focusing on advanced, versatile, and highly efficient military aircraft, particularly for surveillance, reconnaissance, and combat missions. Moreover, technological advancements in avionics, weapon systems, and propulsion technologies are expected to further boost the market.

Dominant countries in the Europe Military Aircraft market include the United Kingdom, France, and Germany. The United Kingdom’s longstanding defense initiatives, coupled with a strategic focus on aircraft modernization, position it as a leader in the region. France’s military aircraft industry benefits from extensive government contracts and collaborations with European defense agencies. Germany is a prominent player due to its strong defense budgets and the integration of advanced systems into its air force and NATO operations. Additionally, the presence of leading aircraft manufacturers in these countries solidifies their dominance.

Market Segmentation

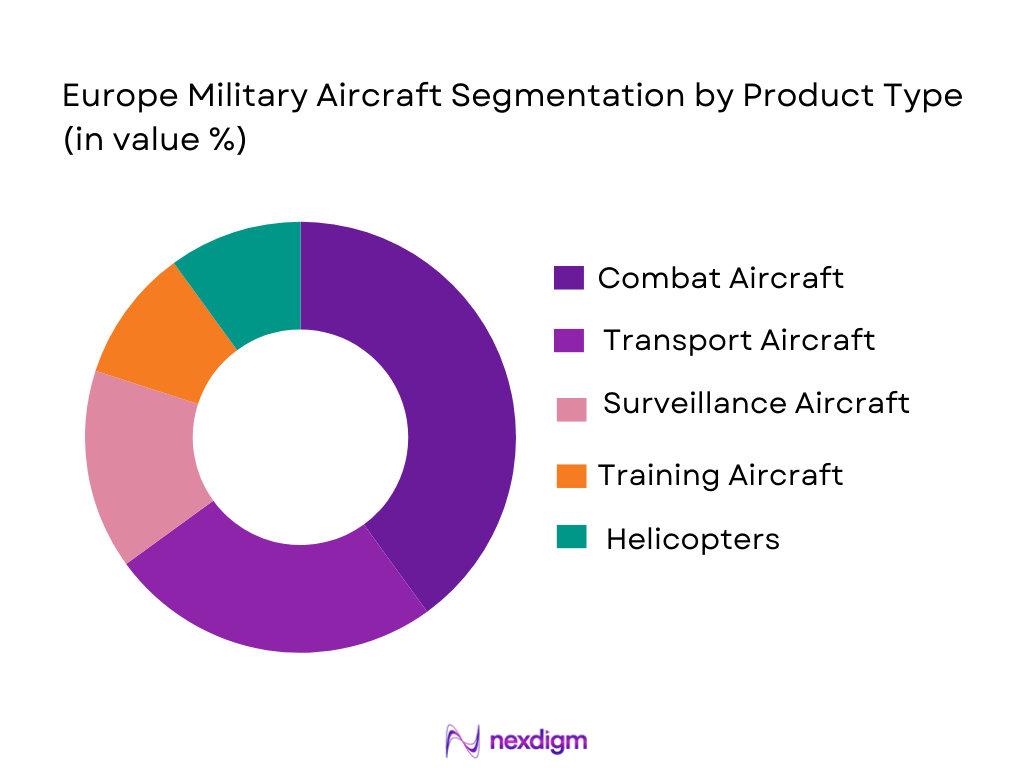

By Product Type

The Europe Military Aircraft market is segmented by product type into combat aircraft, transport aircraft, surveillance aircraft, training aircraft, and helicopters. Recently, combat aircraft have a dominant market share due to the growing defense budgets and increased geopolitical tensions in the region. The demand for advanced fighter jets, multi-role combat aircraft, and unmanned aerial vehicles (UAVs) is rising, driven by the necessity for enhanced air superiority and defense capabilities. Furthermore, the continuous upgrades to existing fleets and the procurement of new generation stealth aircraft contribute to the dominance of this sub-segment.

By Platform Type

The Europe Military Aircraft market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Airborne platforms have the largest market share, driven by demand for versatile, multi-role aircraft that can perform various functions, from reconnaissance to combat operations. The increasing importance of air superiority and surveillance across European borders has led to an expansion in airborne platform investments, particularly in stealth, drone, and fighter aircraft. The advanced capabilities of these platforms to meet modern warfare requirements continue to reinforce their dominance.

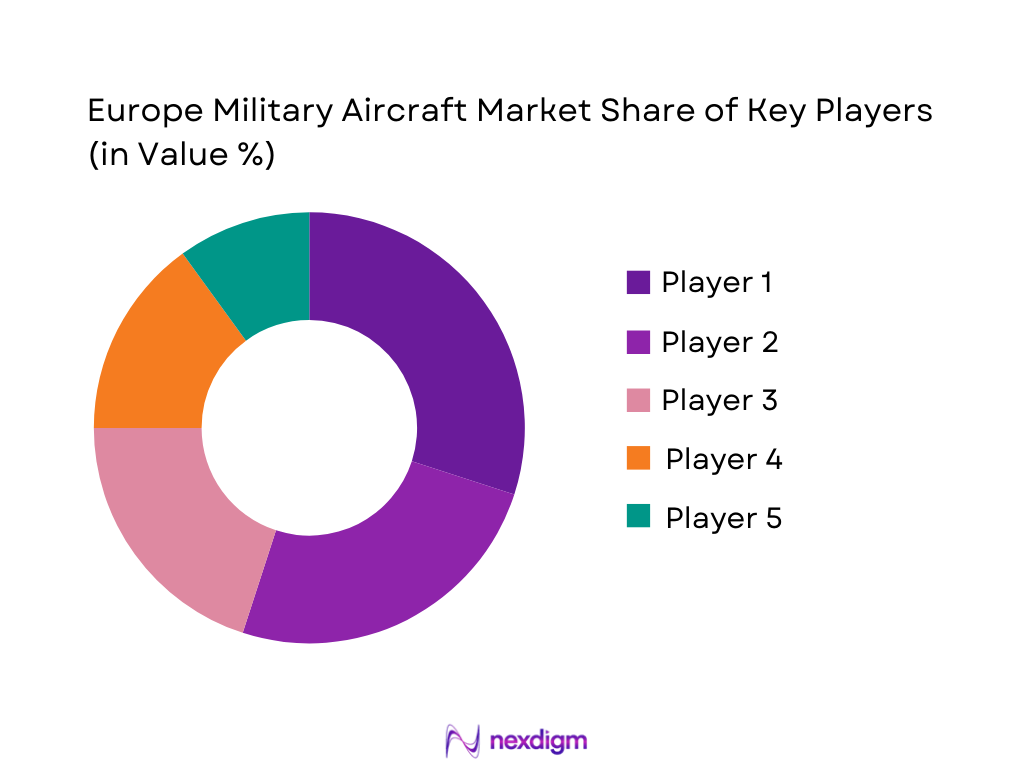

Competitive Landscape

The competitive landscape of the Europe Military Aircraft market is marked by significant consolidation, with major players dominating the landscape due to technological leadership, large defense contracts, and strategic partnerships. The influence of top-tier manufacturers such as Airbus, Boeing, and Lockheed Martin plays a critical role in shaping market dynamics. These companies are focusing on expanding their product portfolios to cater to the growing demand for advanced military aircraft systems and are also forging collaborations to gain competitive advantages in the highly regulated and competitive defense sector.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Government Contracts |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Saab | 1937 | Stockholm, Sweden | ~ | ~ | ~ | ~ | ~ |

Europe Military Aircraft Market Analysis

Growth Drivers

Increased Military Budgets

Increased defense spending in European countries has significantly boosted the demand for military aircraft. Governments are prioritizing military modernization as part of their defense strategies, with air forces receiving substantial budget allocations to upgrade existing fleets and procure new systems. The need for advanced aircraft systems capable of handling a wide range of operations—from intelligence, surveillance, reconnaissance (ISR) to air-to-air combat—has driven the demand for multi-role and stealth aircraft. This increase in defense budgets is particularly evident in countries like the UK, France, and Germany, which are home to some of the largest defense industries in Europe. High-tech military aircraft such as fighter jets and UAVs are being developed to meet evolving defense needs, with manufacturers offering cutting-edge solutions to cater to these growing requirements. These developments are projected to continue driving the growth of the Europe Military Aircraft market, with budgets expected to increase further to address emerging threats.

Technological Advancements in Aircraft Systems

The rise of new technologies in avionics, propulsion systems, and materials science has been a significant growth driver for the military aircraft market in Europe. Advances in stealth technology, multi-role capabilities, and artificial intelligence (AI) integration are revolutionizing military aircraft designs. The development of next-generation fighter jets and drones with enhanced surveillance, targeting, and defense systems is pushing the market forward. Furthermore, new propulsion technologies that increase fuel efficiency and reduce the aircraft’s radar signature are gaining traction. These innovations have improved the overall performance of military aircraft, allowing them to operate in complex and high-risk environments. As European nations increasingly invest in technological upgrades to maintain a competitive edge, technological advancements in military aircraft systems are expected to continue fueling market growth.

Market Challenges

High Operational and Maintenance Costs

The cost of operating and maintaining advanced military aircraft presents a significant challenge to the Europe Military Aircraft market. Modern military aircraft require high levels of expertise for maintenance and servicing, and the cost of spare parts and ongoing upgrades can be substantial. Additionally, aircraft fleets must be regularly overhauled to meet the demands of modern warfare, which leads to considerable financial outlays. Smaller countries or those with tighter defense budgets face particular challenges in maintaining fleets of advanced fighter jets and transport aircraft. These operational costs can limit the expansion of aircraft fleets or hinder the adoption of newer technologies, particularly in regions facing economic difficulties. The need to balance modernization with fiscal responsibility presents a challenge for defense planners who must allocate resources across various priorities while ensuring the long-term viability of military aircraft fleets.

Technological Integration Issues

Integrating new technologies into existing military aircraft poses a challenge for many European defense forces. The rapid pace of technological advancement has led to difficulties in ensuring that legacy aircraft can integrate seamlessly with cutting-edge systems such as AI, cybersecurity measures, and advanced weaponry. The need for interoperability between old and new systems, as well as integration with allied forces, presents significant technical hurdles. This challenge is particularly pronounced in multinational defense programs where different countries may have varying requirements for their military aircraft systems. Additionally, the time and cost required to retrofit existing aircraft fleets with new technologies can delay the deployment of advanced systems. These integration issues represent a key barrier to the growth of the Europe Military Aircraft market and must be addressed to fully capitalize on technological innovations.

Opportunities

Expansion of UAV and Drone Technologies

The growing use of unmanned aerial vehicles (UAVs) and drones presents a significant opportunity in the Europe Military Aircraft market. UAVs are increasingly being used for a wide range of military applications, including surveillance, reconnaissance, combat support, and even logistics. The demand for drones is expected to grow as military forces look for ways to enhance operational efficiency while reducing risks to personnel. UAVs can provide real-time intelligence on battlefield conditions and perform precision strikes with minimal risk. With advancements in drone technology, including longer endurance, higher payload capacities, and improved AI capabilities, UAVs are poised to play a central role in modern European military operations. Manufacturers who invest in drone and UAV technologies stand to benefit from increased demand in the coming years, presenting a lucrative opportunity in the European defense sector.

Partnerships with Private Sector for Innovation

One of the most promising opportunities in the Europe Military Aircraft market is the growing trend of partnerships between defense contractors and private technology firms. Collaborations between defense contractors and private sector companies allow for the integration of cutting-edge commercial technologies such as AI, big data analytics, and cybersecurity into military aircraft systems. These partnerships enable defense companies to access innovative technologies that can enhance aircraft performance and combat capabilities while reducing development costs. Additionally, private sector involvement in the defense market fosters innovation, particularly in the areas of autonomous flight, advanced avionics, and advanced materials. As governments seek to modernize their military forces, collaboration with private firms provides an avenue for driving technological advancement and securing a competitive edge in military operations.

Future Outlook

Over the next five years, the Europe Military Aircraft market is expected to experience steady growth, driven by increasing defense budgets and the continuous advancement of military technologies. With technological developments in stealth, UAVs, and multi-role aircraft, the region is set to enhance its defense capabilities. Regulatory support, such as EU defense collaboration programs, will also contribute to the market’s growth. As demand for next-generation aircraft systems rises, European nations will continue to modernize their fleets and strengthen military operations in response to evolving security challenges.

Major Players

- Airbus

- Lockheed Martin

- Boeing

- BAE Systems

- Saab

- Northrop Grumman

- Dassault Aviation

- Thales Group

- Leonardo

- General Dynamics

- Raytheon Technologies

- L3 Technologies

- Rockwell Collins

- Sikorsky Aircraft

- Embraer

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- Aerospace manufacturers

- Air force procurement departments

- Defense technology firms

- Research and development departments

- Military policy makers

Research Methodology

Step 1: Identification of Key Variables

Key variables such as market drivers, challenges, and opportunities are identified through industry reports, interviews, and secondary data sources.

Step 2: Market Analysis and Construction

The market is analyzed based on geographical segmentation, market size, and trends to construct the overall market structure.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses formed based on initial analysis are validated through expert consultations with industry leaders and market participants.

Step 4: Research Synthesis and Final Output

The synthesized research findings are compiled into a final report, incorporating both qualitative and quantitative data for comprehensive analysis.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Military Spending

Technological Advancements in Aircraft Systems

Rising Demand for Advanced Military Aircraft - Market Challenges

High Operational and Maintenance Costs

Technological Integration Issues

Geopolitical Instability - Market Opportunities

Expansion of Advanced Aircraft Technologies

Partnerships with Private Sector for Innovation

Increase in Defense Budgets - Trends

Increase in Adoption of Unmanned Aircraft Systems

Advancements in Aircraft Propulsion Technologies - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Combat Aircraft

Transport Aircraft

Surveillance Aircraft

Training Aircraft

Helicopters - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions - By End User Segment (In Value%)

Military Forces

Government Agencies

Defense Contractors

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus

Lockheed Martin

Northrop Grumman

Boeing

Dassault Aviation

BAE Systems

Saab

Leonardo

General Dynamics

Raytheon Technologies

Thales Group

L3 Technologies

Rockwell Collins

Sikorsky Aircraft

Embraer

- Increasing Government Investments in Military Aircraft

- Private Sector’s Role in Innovation and Aircraft Development

- Defense Contractors’ Shift Towards Advanced Aircraft

- Military Forces’ Need for High-Performance Aircraft

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035