Market Overview

The Europe Military Satellite Market is projected to be driven by the growing demand for advanced satellite communication and intelligence-gathering systems, as well as increasing defense budgets across European nations. The market is expected to experience significant growth, fueled by developments in satellite technology, with both governmental and private organizations increasing investments in the sector. As of the latest market assessments, the value of the market is expected to exceed USD ~, with demand mainly concentrated on military communications, Earth observation, and surveillance satellites.

In Europe, countries like the United Kingdom, France, and Germany dominate the market due to their advanced defense infrastructure, technological capabilities, and high levels of military expenditure. The UK and France have a strong presence in satellite manufacturing and deployment, with numerous defense programs aimed at enhancing national security through satellite technologies. Furthermore, their strategic geographical locations and participation in NATO-led missions increase the need for robust satellite communication and surveillance systems in military operations.

Market Segmentation

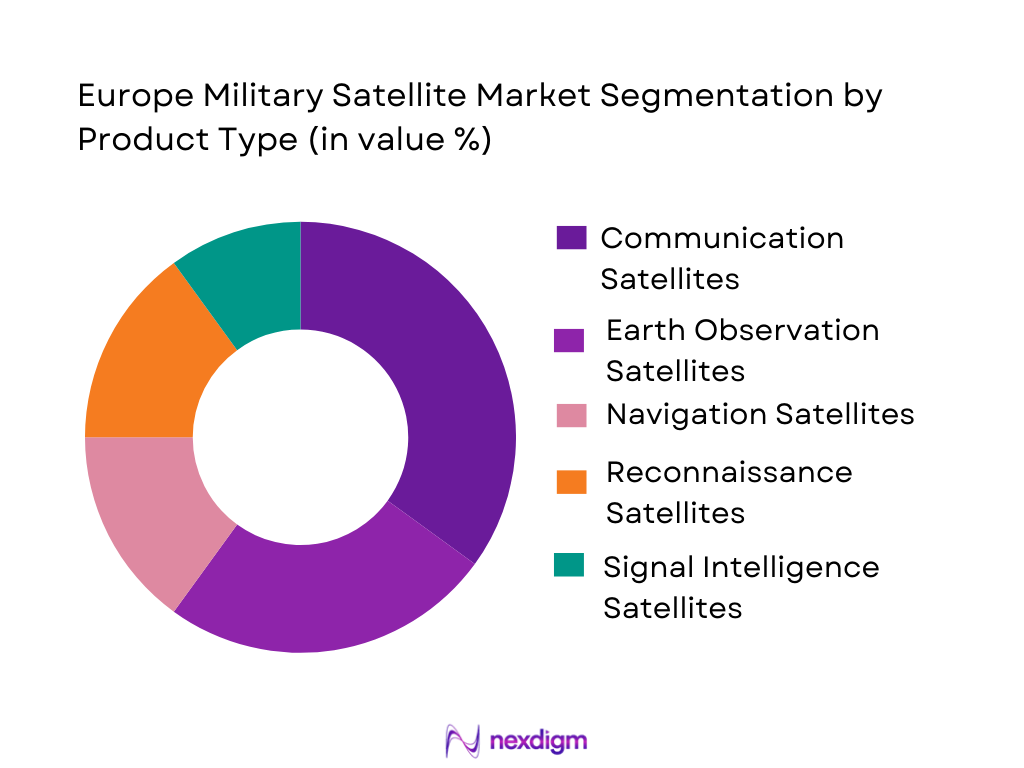

By Product Type

The Europe Military Satellite Market is segmented by product type into communication satellites, Earth observation satellites, navigation satellites, reconnaissance satellites, and signal intelligence satellites. The communication satellites sub-segment has a dominant market share due to the increasing demand for secure and reliable communication channels for military forces. As European nations enhance their defense strategies, the requirement for advanced communication systems that can offer global reach, secure encrypted transmissions, and rapid data relay has grown substantially. These satellites ensure effective and secure communication during combat situations, disaster relief, and peacekeeping missions.

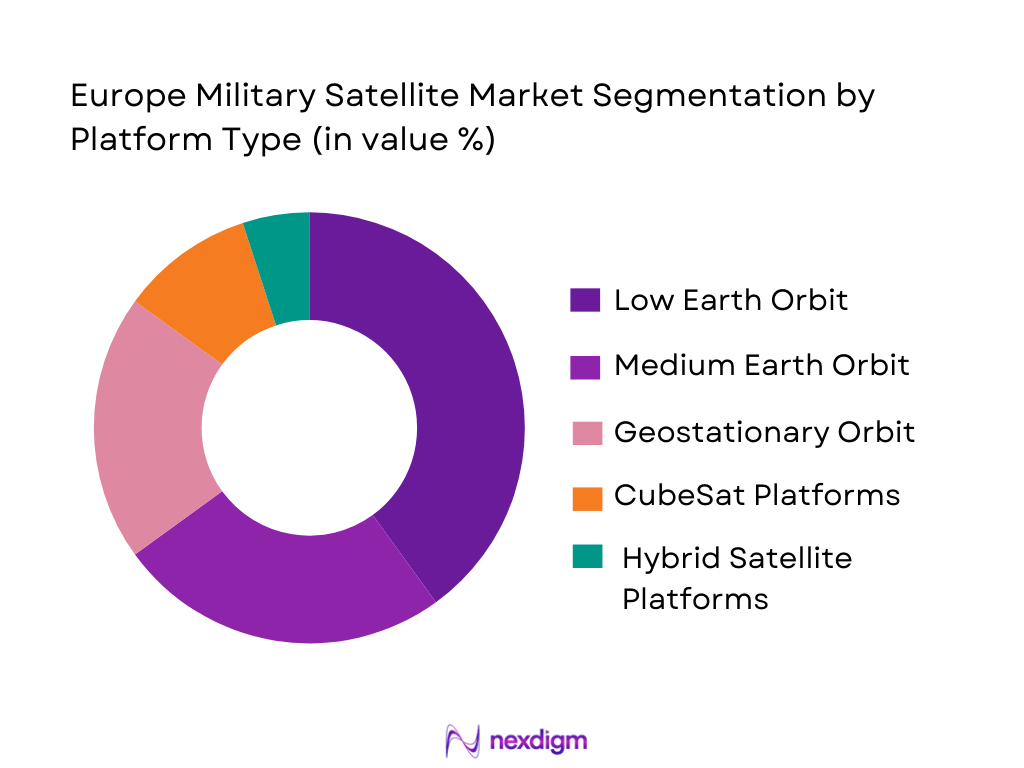

By Platform Type

The market is segmented by platform type into Low Earth Orbit (LEO) satellites, Medium Earth Orbit (MEO) satellites, Geostationary Orbit (GEO) satellites, CubeSat platforms, and hybrid satellite platforms. The LEO satellites sub-segment holds a dominant share, driven by their growing use in real-time communications, Earth observation, and intelligence gathering. Their ability to provide rapid data transmission, lower latency, and high-resolution imaging makes them particularly valuable for military operations. Moreover, the reduced cost of launching LEO satellites and advancements in miniaturization technologies contribute to their increasing adoption in defense systems.

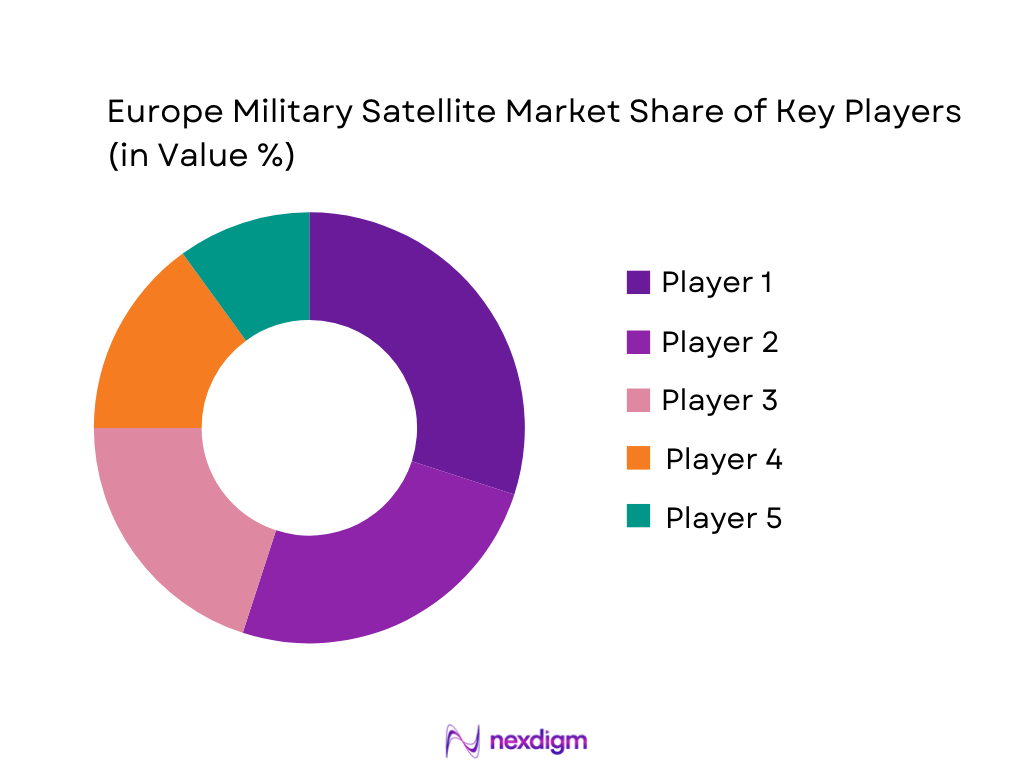

Competitive Landscape

The competitive landscape in the Europe Military Satellite Market is marked by significant consolidation, with both established players and new entrants competing for a larger share of the growing defense sector. Key players continue to innovate by integrating advanced technologies into their products, contributing to their strong market positions. In addition, defense contractors and governments are forming partnerships to develop next-generation satellite systems that meet the evolving requirements of military operations.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Billion) | Specialized Capability |

| Airbus Defence and Space | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

Europe Military Satellite Market Analysis

Growth Drivers

Government Investments in Defense and Security

The Europe Military Satellite Market is experiencing significant growth due to increasing government investments in defense and national security. European governments are allocating a large portion of their budgets to advanced defense technologies, including military satellite systems, to enhance their capabilities in communication, surveillance, and reconnaissance. This growth is primarily driven by the growing threat of cyber-attacks, regional conflicts, and the need for enhanced national security. As the geopolitical landscape shifts, defense budgets across the region are expected to rise, fueling demand for more sophisticated satellite systems to ensure strategic and tactical advantages in military operations. Furthermore, European nations are increasingly investing in autonomous defense systems, which include satellite communication and surveillance technologies, to enhance their military readiness. Governments are collaborating with private companies and defense contractors to develop and deploy cutting-edge satellite systems that can deliver real-time data and intelligence for better decision-making in critical situations.

Technological Advancements in Satellite Systems

Another key driver of growth in the European military satellite market is the continuous technological advancements in satellite systems. The development of more advanced satellites capable of providing better communication, higher resolution imagery, and faster data transmission is meeting the growing demand for real-time information and intelligence. The increasing reliance on military satellites for secure communication, surveillance, reconnaissance, and geospatial intelligence is driving the need for more powerful satellite systems. Moreover, the development of miniaturized satellites, such as CubeSats, is reducing the cost of deployment while improving the performance of military satellite systems. Innovations in propulsion systems, satellite materials, and artificial intelligence are further improving satellite capabilities, making them more efficient, reliable, and capable of performing complex tasks.

Market Challenges

High Cost of Development and Deployment

One of the major challenges faced by the Europe Military Satellite Market is the high cost of satellite development and deployment. Designing and manufacturing military satellites require significant capital investment, particularly as the demand for more advanced and sophisticated systems increases. These systems often involve cutting-edge technologies, which can be expensive to develop and manufacture. Furthermore, launching military satellites into orbit requires considerable investment in space infrastructure, launch vehicles, and ground-based facilities, contributing to the overall cost. This can be a major barrier to entry for smaller defense contractors and countries with limited budgets. Additionally, the long lead times involved in satellite development and deployment mean that defense budgets need to be allocated years in advance, making it challenging for governments to remain flexible in response to rapidly evolving security threats.

Geopolitical Tensions and Regulatory Barriers

Another significant challenge for the Europe Military Satellite Market is the geopolitical tensions and regulatory barriers that often arise when developing and deploying military satellite systems. In recent years, the increasing tensions between European countries and other global powers, particularly in relation to defense capabilities, have led to challenges in collaboration and information sharing. The geopolitical landscape plays a critical role in the development and distribution of military satellites, as countries must navigate complex international regulations, trade restrictions, and arms control agreements that limit the types of satellite technologies that can be developed and shared. This geopolitical uncertainty can lead to delays in satellite programs and hinder the ability of European nations to collaborate effectively on joint defense projects.

Opportunities

Growth of Commercial Partnerships for Military Satellite Deployment

The rise of commercial partnerships for military satellite deployment presents a significant opportunity for the Europe Military Satellite Market. In recent years, European governments and defense contractors have increasingly turned to private companies for satellite manufacturing, launching, and operations. Commercial satellite operators, such as SES and OneWeb, are entering the defense market by providing cost-effective, flexible, and scalable satellite systems for military use. This trend is expected to continue as private sector involvement in military satellite systems grows, offering new opportunities for collaboration, technology sharing, and cost savings. By leveraging commercial satellite technologies and services, governments can reduce the cost of defense spending while still gaining access to the latest satellite systems for secure communication, surveillance, and reconnaissance.

Adoption of Small Satellites and CubeSats in Defense Applications

The increasing adoption of small satellites and CubeSats for defense applications is another opportunity for growth in the Europe Military Satellite Market. These small-scale satellites offer a more cost-effective and flexible solution for military operations, as they can be quickly deployed and can provide similar capabilities as larger satellites at a fraction of the cost. The development of CubeSats, in particular, has been a game-changer in the defense sector, as they can be customized for various applications, including communications, reconnaissance, and Earth observation. Small satellites are also more versatile, allowing for rapid deployment and operational flexibility in remote or contested regions. This growing trend toward small satellite adoption is expected to open new markets for defense contractors and satellite manufacturers, particularly as European governments seek to enhance their defense capabilities while managing budgets efficiently.

Future Outlook

The future of the Europe Military Satellite Market is promising, with expected growth driven by continued advancements in satellite technology, government investments in defense, and the increasing reliance on space-based assets for national security. Over the next five years, the market is expected to see continued innovation in satellite systems, including the development of smaller, more affordable satellites that offer greater flexibility and performance. This technological progression, combined with increasing demand for secure military communication, intelligence gathering, and surveillance capabilities, will fuel market expansion. The adoption of public-private partnerships, along with government initiatives to modernize defense infrastructure, will further contribute to market growth.

Major Players

- Airbus Defence and Space

- Thales Alenia Space

- Lockheed Martin

- Northrop Grumman

- Boeing

- SES S.A.

- Inmarsat

- SSL (Space Systems Loral)

- Leonardo

- Orbital Sciences Corporation

- Raytheon Technologies

- Arianespace

- Ball Aerospace

- Intelsat

- OneWeb

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military and defense technology firms

- Satellite operators

- Aerospace and aviation companies

- Telecommunications firms

- National security agencies

Research Methodology

Step 1: Identification of Key Variables

In this step, the key market variables such as satellite technology, government investments, and defense needs are identified to understand their impact on market trends.

Step 2: Market Analysis and Construction

A detailed analysis of market size, segmentation, and growth drivers is performed to construct a comprehensive market model for the region.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts and key stakeholders in the defense and satellite sectors.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into actionable insights, providing a complete market report with forecasts, trends, and strategic recommendations.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Defense Budgets in Europe

Demand for Advanced Communication Capabilities

Rising Geopolitical Tensions - Market Challenges

High Capital Expenditure in Satellite Development

Regulatory and Compliance Barriers

Technological Limitations in Satellite Manufacturing - Market Opportunities

Rise of Small Satellites and CubeSats

Partnerships with Commercial Satellite Providers

Growing Demand for Advanced Earth Observation Satellites - Trends

Integration of Artificial Intelligence in Satellite Operations

Increase in Commercialization of Military Satellites - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Communication Satellites

Earth Observation Satellites

Navigation Satellites

Reconnaissance Satellites

Signal Intelligence Satellites - By Platform Type (In Value%)

Low Earth Orbit (LEO) Satellites

Medium Earth Orbit (MEO) Satellites

Geostationary Orbit (GEO) Satellites

CubeSat Platforms

Hybrid Satellite Platforms - By Fitment Type (In Value%)

Space-based Solutions

Ground-based Solutions

Integrated Space and Ground Solutions

Mobile Satellite Solutions - By End User Segment (In Value%)

Military Forces

Government and Defense Agencies

Private Contractors

Satellite Manufacturers - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus Defence and Space

Thales Alenia Space

Lockheed Martin

Northrop Grumman

Boeing

SES S.A.

Inmarsat

SSL (Space Systems Loral)

Leonardo

Orbital Sciences Corporation

Raytheon Technologies

Arianespace

Ball Aerospace

Intelsat

OneWeb

- Military Forces’ Increasing Demand for Secure Communication Satellites

- Government Agencies Seeking Real-time Intelligence

- Private Contractors Focusing on Satellite Manufacturing

- Satellite Operators Enhancing Global Coverage

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035