Market Overview

The Europe Military Unmanned Vehicles market is valued based on recent historical assessments, demonstrating a robust growth trajectory due to increasing defense budgets and technological innovations. The market is primarily driven by advancements in autonomous systems and the increasing demand for unmanned vehicles in military operations. Based on a recent historical assessment, the market size is projected to reach USD ~, reflecting a heightened focus on defense modernization and technological sophistication in unmanned systems.

Countries such as the United Kingdom, France, and Germany dominate the Europe Military Unmanned Vehicles market due to their strong defense infrastructure, technological advancements, and significant defense expenditure. The United Kingdom, in particular, is a leader in unmanned aerial vehicles (UAVs), driven by strategic investments in defense technology. Similarly, France and Germany focus on developing autonomous land and sea systems, ensuring their leadership in unmanned systems for defense purposes.

Market Segmentation

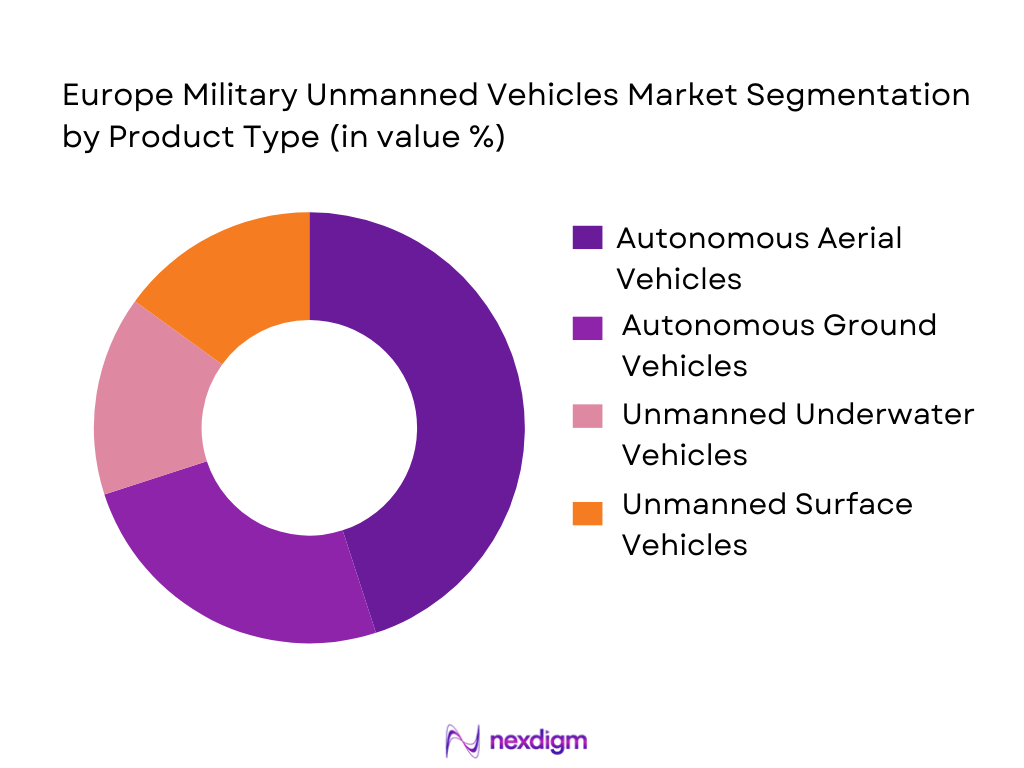

By Product Type

The Europe Military Unmanned Vehicles market is segmented by product type into autonomous aerial vehicles, autonomous ground vehicles, unmanned underwater vehicles, and unmanned surface vehicles. The unmanned aerial vehicles (UAVs) sub-segment holds a dominant market share due to their increasing adoption for surveillance, reconnaissance, and precision strike missions. UAVs are preferred for their flexibility, ease of deployment, and ability to cover large areas in a short time. The demand for UAVs is driven by technological advancements, cost-effectiveness, and the strategic advantage they offer in modern warfare operations.

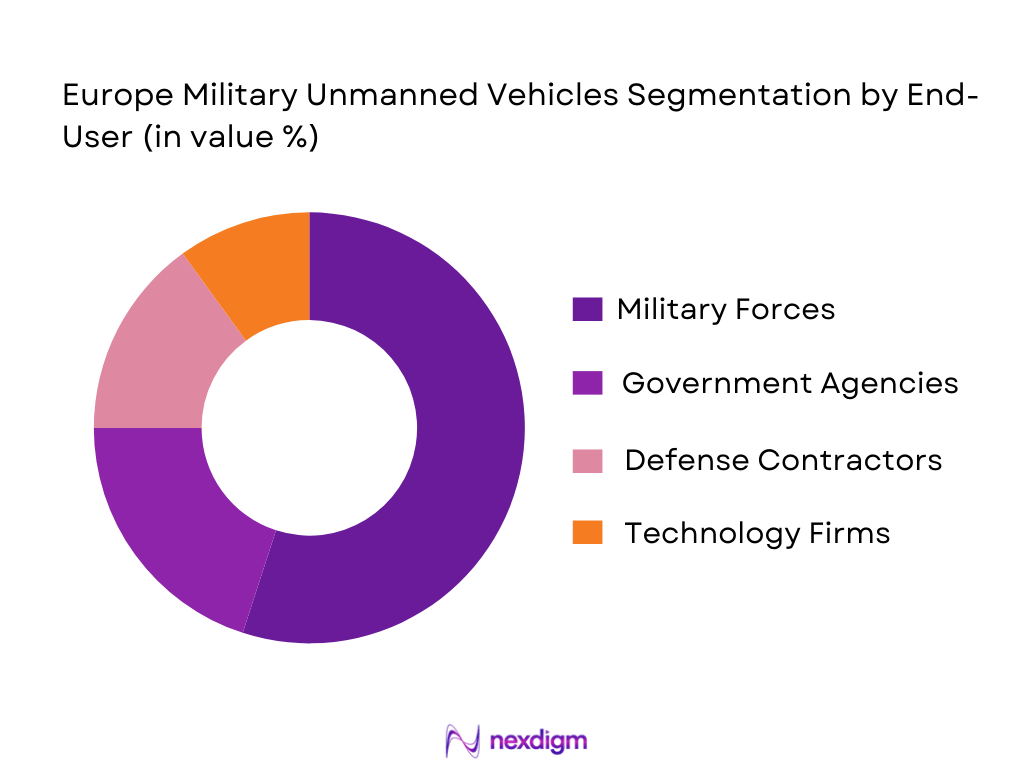

By End User Segment

The Europe Military Unmanned Vehicles market is segmented by end user into military forces, government agencies, defense contractors, and private sector/technology firms. Military forces dominate the market due to the increasing adoption of unmanned systems for defense operations. The rising threat from geopolitical tensions and the necessity for modernized defense mechanisms fuel the demand from military forces, with unmanned vehicles playing a critical role in reconnaissance, logistics, and tactical operations. Their increasing reliance on automation and autonomous vehicles is driving growth in the market.

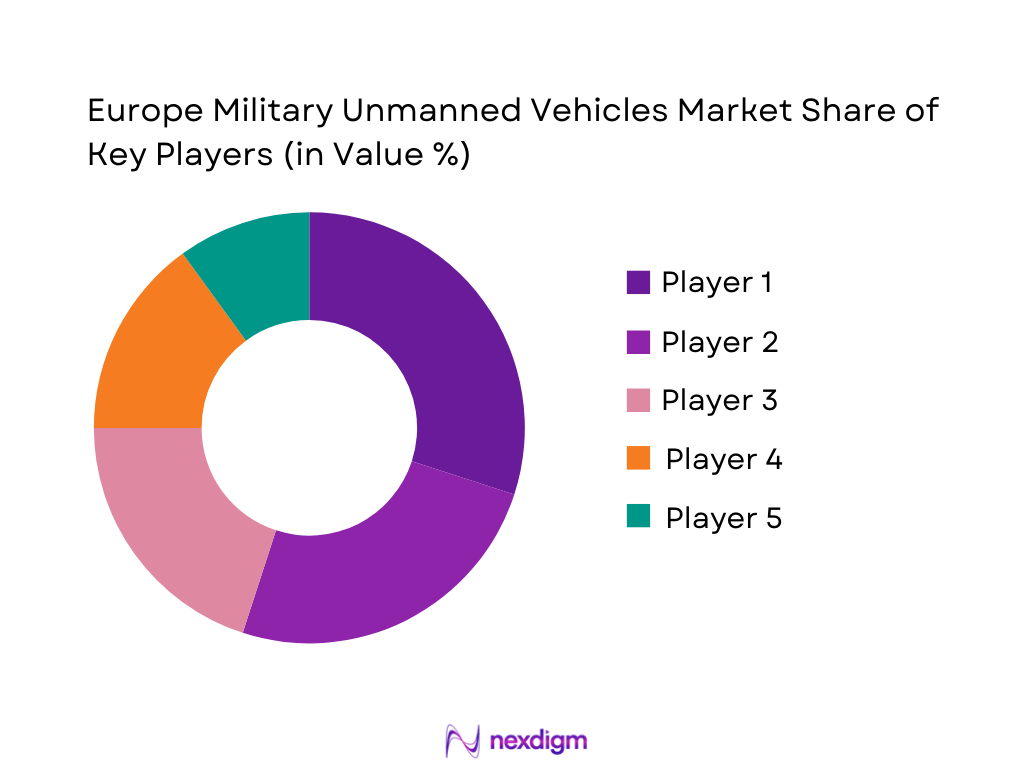

Competitive Landscape

The Europe Military Unmanned Vehicles market is highly competitive, with a blend of established players and emerging innovators. The market sees consolidation driven by collaborations and acquisitions between defense contractors and tech companies focusing on autonomous systems. Major players influence market dynamics by offering advanced unmanned vehicle systems and driving technological developments, particularly in AI, sensor technology, and autonomy. The market continues to witness increasing investments, with leading defense contractors and tech giants entering strategic partnerships to bolster their market presence.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | United States | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1995 | United States | ~ | ~ | ~ | ~ |

| Airbus | 2000 | France | ~ | ~ | ~ | ~ |

Europe Military Unmanned Vehicles Market Analysis

Growth Drivers

Technological Advancements in Unmanned Systems

The growing demand for advanced unmanned vehicles in Europe is driven by rapid technological advancements in AI, machine learning, and robotics. The need for automation in defense operations is intensifying as military forces seek to reduce human involvement in high-risk operations while enhancing operational efficiency. These advancements facilitate the development of highly sophisticated UAVs, UGVs, and other unmanned platforms capable of autonomous decision-making, precise targeting, and real-time data collection. Additionally, the integration of cutting-edge sensor technologies, such as thermal and infrared imaging, further enhances the functionality and versatility of unmanned systems. Governments and defense agencies in Europe continue to heavily invest in research and development to improve the autonomy and capabilities of unmanned vehicles.

Rising Geopolitical Tensions in Europe

The escalating geopolitical tensions in Europe have significantly influenced the demand for military unmanned vehicles. With increasing threats from neighboring countries and regional conflicts, defense agencies are investing in unmanned systems for strategic surveillance, reconnaissance, and intelligence gathering. These vehicles provide a safer and more efficient means of monitoring volatile areas without putting human soldiers at risk. As the geopolitical landscape becomes more complex, the reliance on unmanned vehicles for border security, maritime patrol, and combat missions is expected to grow. Moreover, the need for rapid deployment in crisis zones further enhances the role of unmanned systems, leading to accelerated demand. European countries, particularly in Eastern Europe, are focusing on strengthening their defense capabilities, which includes increasing their fleets of unmanned military vehicles.

Market Challenges

High Initial Investment and Development Costs

One of the significant challenges facing the Europe Military Unmanned Vehicles market is the high cost associated with the research, development, and deployment of unmanned systems. These vehicles require substantial upfront investment in advanced technology, including AI, sensors, and autonomous navigation systems. Additionally, the infrastructure required to support unmanned vehicles, such as communication networks and maintenance facilities, adds to the overall cost. This high financial barrier can be a limiting factor for smaller defense contractors or countries with constrained budgets. Despite the long-term benefits of unmanned systems, including cost savings in personnel and operational efficiency, the initial capital requirements pose a significant challenge for many defense organizations. Balancing the high costs of development with the growing need for these systems remains a crucial issue for the market.

Regulatory and Compliance Barriers

The regulatory and compliance framework for military unmanned vehicles in Europe presents a challenge, especially with varying regulations across different countries. Strict military and aviation laws govern the operation of unmanned vehicles, which can significantly delay the deployment of these systems. The approval process for new unmanned systems requires thorough testing, certification, and compliance with international treaties and defense protocols. This lengthy process can be particularly challenging for manufacturers and defense contractors who aim to bring their products to market swiftly. The lack of a unified regulatory approach across the European Union further complicates the situation, as each country has its own set of rules and standards.

Opportunities

Integration of AI and Autonomous Technologies

One of the primary opportunities in the Europe Military Unmanned Vehicles market lies in the continued integration of artificial intelligence (AI) and autonomous technologies. These advancements are enhancing the operational capabilities of unmanned systems, allowing for greater autonomy, precision, and decision-making abilities in the field. AI-powered unmanned vehicles are capable of analyzing large amounts of data in real-time, identifying threats, and making autonomous decisions that improve mission success rates. The increasing use of AI in navigation systems, targeting, and even maintenance is opening new doors for defense agencies to improve the efficiency and effectiveness of unmanned vehicles. With continued advancements in AI and machine learning, unmanned vehicles will become increasingly intelligent, enabling them to handle more complex tasks and scenarios with minimal human intervention.

Demand for Hybrid Unmanned Systems

Another significant opportunity in the Europe Military Unmanned Vehicles market is the rising demand for hybrid unmanned systems. Hybrid vehicles, which combine the benefits of aerial, ground, and marine platforms, are gaining traction due to their versatility and ability to perform multi-domain operations. These hybrid systems can seamlessly transition between different operational environments, providing military forces with a broader range of capabilities. As defense agencies seek to increase their operational reach and enhance mission flexibility, hybrid unmanned systems are becoming a valuable asset. Moreover, hybrid systems can offer cost savings by eliminating the need for separate vehicles for different types of missions, making them an attractive option for military budgets. The development of hybrid systems that integrate multiple technologies, such as UAVs and UGVs, is expected to drive growth in the market over the coming years.

Future Outlook

Over the next five years, the Europe Military Unmanned Vehicles market is expected to experience significant growth driven by technological innovations, increasing defense budgets, and rising demand for autonomous military systems. Technological advancements in AI, robotics, and sensor technologies will continue to play a pivotal role in enhancing the capabilities of unmanned vehicles, making them an essential component of modern military operations. The integration of hybrid unmanned systems will further drive market growth, offering military forces greater flexibility in mission execution. Additionally, supportive government policies and rising geopolitical tensions will boost the demand for unmanned vehicles in surveillance, reconnaissance, and combat missions. With these developments, the market is expected to expand rapidly, offering lucrative opportunities for both established and emerging players in the defense sector.

Major Players

- BAE Systems

- Thales Group

- Northrop Grumman

- Lockheed Martin

- Airbus

- Leonardo

- General Dynamics

- Saab Group

- Rheinmetall AG

- Elbit Systems

- Harris Corporation

- Boeing

- L3 Technologies

- Roketsan

- Hanwha Defense

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military defense contractors

- Aerospace and defense manufacturers

- Military technology providers

- Armed forces and defense organizations

- National security agencies

- Defense research institutions

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the critical variables affecting the market, such as technological advancements, geopolitical factors, and regulatory impacts, based on extensive market research.

Step 2: Market Analysis and Construction

In this phase, comprehensive data on market trends, growth drivers, and consumer demand patterns is collected, followed by detailed market construction based on quantitative and qualitative analysis.

Step 3: Hypothesis Validation and Expert Consultation

This step involves validating initial market hypotheses through expert consultations, industry surveys, and discussions with key stakeholders to ensure the accuracy of the market model.

Step 4: Research Synthesis and Final Output

The final phase synthesizes all research data, integrating expert insights, and producing a comprehensive market report that addresses key findings, trends, and forecasts.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Technological Advancements in Automation

Increased Defense Budgets

Rising Geopolitical Tensions - Market Challenges

High R&D Costs

Regulatory and Compliance Issues

Technological Integration and Interoperability - Market Opportunities

Increased Adoption of AI in Unmanned Vehicles

Emerging Demand for Autonomous Systems in Military

Public-Private Partnerships in Defense Technology - Trends

Rise in Multi-Domain Unmanned Systems

Increased Military Investment in Autonomous Vehicles - Government Regulations

- SWOT Analysis

Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Autonomous Ground Vehicles

Unmanned Aerial Vehicles (UAVs)

Unmanned Underwater Vehicles (UUVs)

Unmanned Surface Vehicles (USVs)

Hybrid Vehicles - By Platform Type (In Value%)

Land-Based Platforms

Airborne Platforms

Naval Platforms

Integrated Platforms

Subsea Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

BAE Systems

Thales Group

Northrop Grumman

Lockheed Martin

General Dynamics

Airbus

Leonardo

Saab Group

Rheinmetall AG

Elbit Systems

Harris Corporation

Boeing

L3 Technologies

Roketsan

Hanwha Defense

- Military Forces’ Increasing Demand for Autonomous Vehicles

- Government Agencies’ Role in Regulating and Procuring Defense Systems

- Defense Contractors’ Focus on Innovation

- Private Sector’s Growing Interest in Autonomous Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035