Market Overview

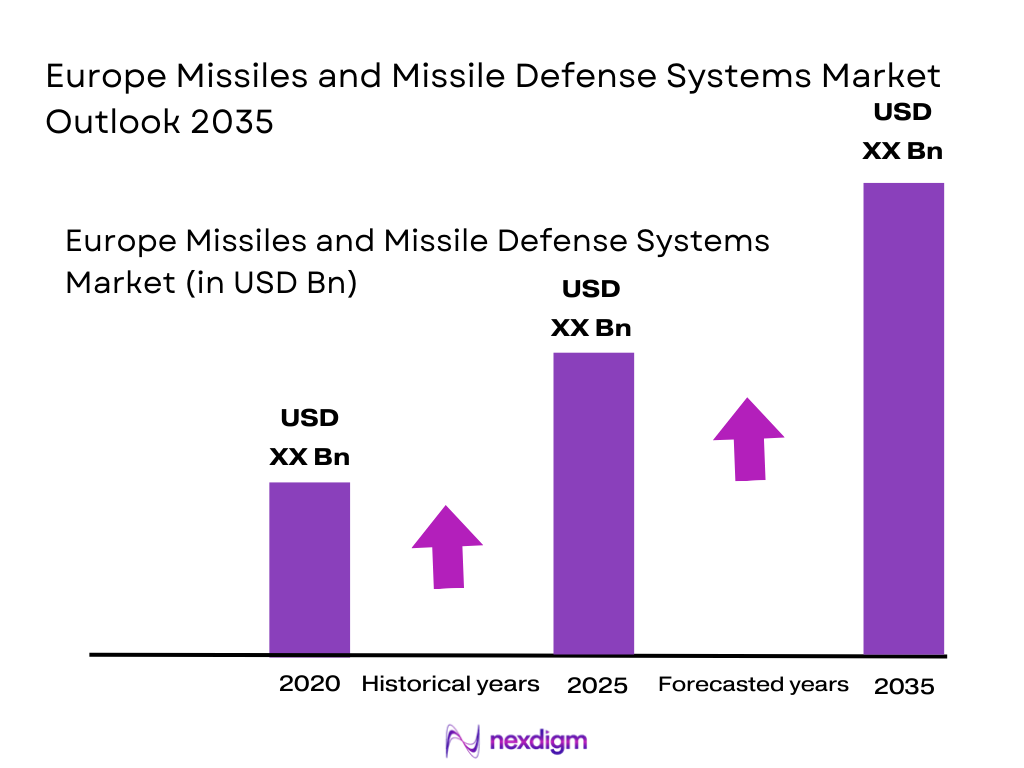

The Europe Missiles and Missile Defense Systems market is valued in the ~, with significant investments directed toward enhancing national security through advanced defense technologies. The market has been driven by factors such as increasing geopolitical tensions, rising defense budgets, and the growing need for advanced missile defense systems across Europe. With countries prioritizing modernization of their defense infrastructure, Europe continues to see substantial demand for missile defense technologies, leading to a rapidly expanding market.

Countries like the United Kingdom, France, and Germany play a crucial role in the dominance of the European missile defense systems market. These nations are major defense contractors and have substantial investments in defense technologies, including missile defense. The prominence of these countries is primarily driven by their robust defense budgets, technological innovations, and their strategic position in the European security framework. Their involvement in international defense alliances further solidifies their leadership in this market.

Market Segmentation

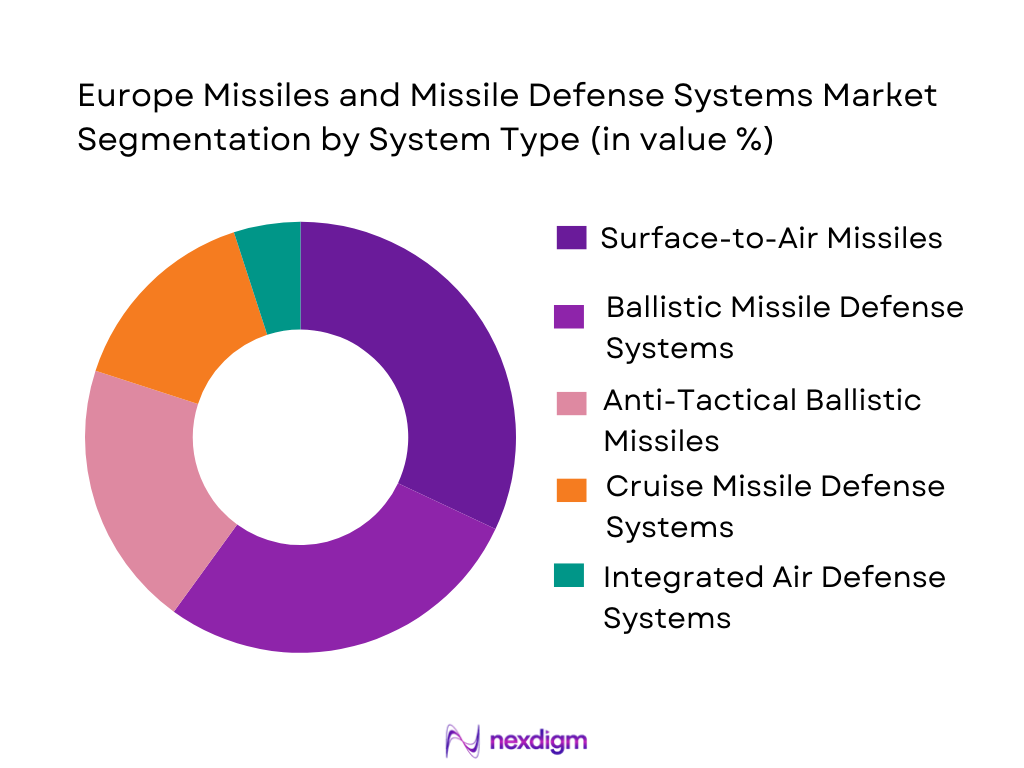

By System Type

Europe Missiles and Missile Defense Systems market is segmented by system type into Surface-to-Air Missiles, Ballistic Missile Defense Systems, Anti-Tactical Ballistic Missiles, Cruise Missile Defense Systems, and Integrated Air Defense Systems. Recently, the Surface-to-Air Missiles sub-segment has a dominant market share due to factors such as rising threats of missile attacks, increased government spending on defense technologies, and the widespread deployment of air defense systems in various European countries. The growing need for air defense in highly populated and strategic regions has further strengthened the demand for surface-to-air missiles, making it the leading sub-segment in this market.

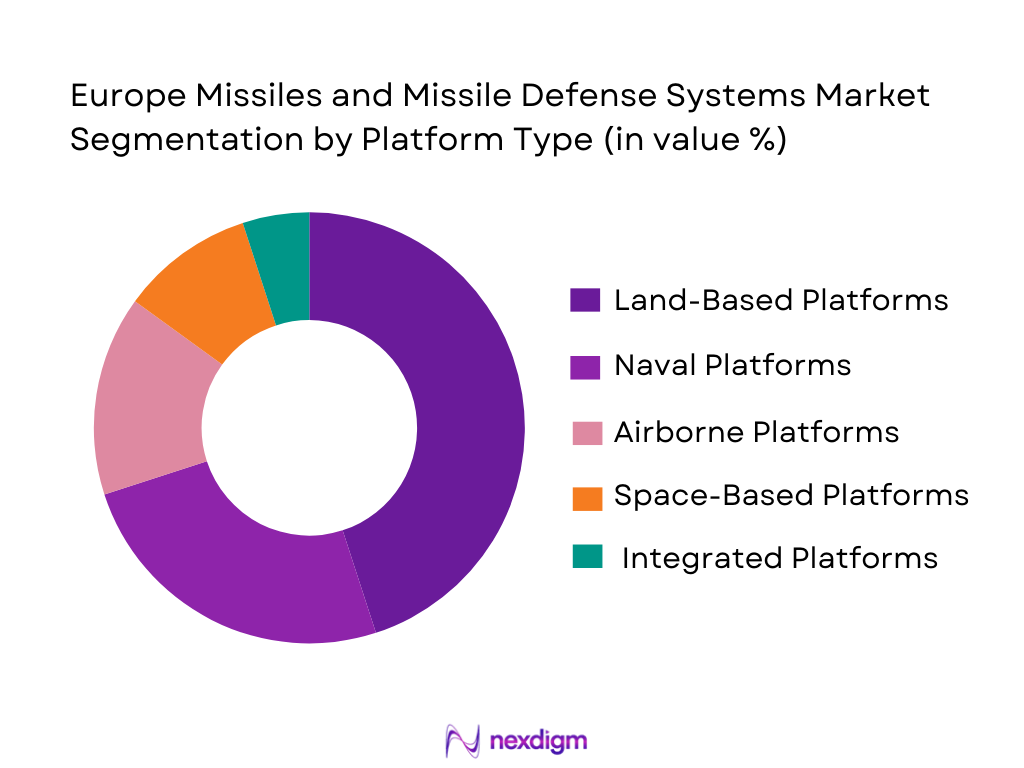

By Platform Type

Europe Missiles and Missile Defense Systems market is segmented by platform type into Land-Based Platforms, Naval Platforms, Airborne Platforms, Space-Based Platforms, and Integrated Platforms. The Land-Based Platforms sub-segment has the largest market share, driven by the increasing defense expenditure in land defense systems and the rapid adoption of land-based missile defense systems. Furthermore, these platforms offer greater flexibility, easier deployment, and are generally more cost-effective, making them a preferred option for many European nations seeking to bolster their defense capabilities.

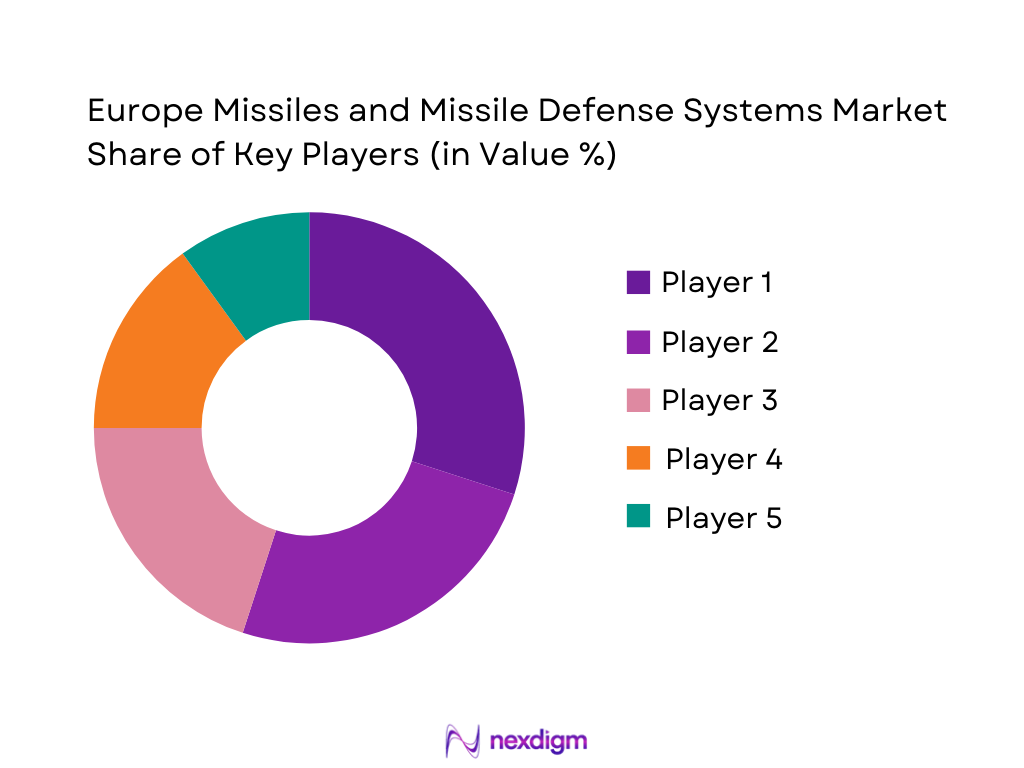

Competitive Landscape

The Europe Missiles and Missile Defense Systems market is highly competitive, characterized by the presence of well-established players who lead in innovation, technological advancement, and market share. Consolidation is visible in the form of collaborations, mergers, and acquisitions, which enable these companies to strengthen their market positions and enhance product offerings. Major players continue to influence the market through strategic initiatives, new product launches, and technological developments.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Strategic Alliances |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ | ~ |

| MBDA | 2001 | France/UK | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

Europe Missiles and Missile Defense Systems Market Analysis

Growth Drivers

Increased Geopolitical Tensions

The heightened geopolitical instability across Europe has escalated the demand for advanced missile defense systems. As nations face external threats, the need for robust defense infrastructure has increased significantly, driving governments to allocate higher budgets for missile defense systems. This growth driver is further fueled by the threat of ballistic missile attacks and the growing arms race between global powers, particularly in Eastern Europe. The situation has forced many European nations to expedite their defense modernization programs, leading to substantial investments in missile defense technologies.

Technological Advancements in Missile Defense Systems

Advancements in missile defense technology, such as the development of hypersonic missile defense systems, AI-powered radar systems, and more efficient interception technologies, have led to the rapid growth of the Europe Missiles and Missile Defense Systems market. With ongoing research and development programs, the European defense industry has made significant strides in improving the reliability, accuracy, and range of missile defense systems. These technological advancements enable better protection against new and emerging threats, which has made defense modernization a priority for many countries in the region.

Market Challenges

High Capital Investment Requirements

One of the most significant challenges for the European missile defense systems market is the high capital investment required for the procurement and deployment of advanced missile defense systems. Governments and defense contractors are often faced with budgetary constraints, which makes securing funding for missile defense projects a complex process. The long-term financial commitment required to maintain and upgrade missile defense systems further adds to the challenge, particularly for smaller European nations with limited defense budgets.

Regulatory and Compliance Barriers

Another challenge affecting the Europe Missiles and Missile Defense Systems market is the complex regulatory environment governing defense technologies. Compliance with both national and international regulations, export controls, and certification standards can delay the development and procurement of new missile defense systems. Additionally, various security and data protection laws restrict the exchange of sensitive defense technologies, hindering cross-border collaborations and partnerships. Navigating through these regulations requires time, expertise, and resources, which can be a barrier for new players entering the market.

Opportunities

Expansion in Autonomous Defense Systems

One significant opportunity in the Europe Missiles and Missile Defense Systems market lies in the growing demand for autonomous and unmanned defense systems. As countries look to reduce human risk in missile defense operations, the demand for autonomous systems has risen. This market trend is driven by the rapid development of AI and machine learning, which can be used to enhance decision-making processes in missile defense operations. These systems can detect, intercept, and neutralize threats with minimal human intervention, providing greater efficiency and effectiveness in defense operations.

Public-Private Partnerships for Enhanced Cybersecurity

The increasing reliance on advanced technologies has also heightened the vulnerability of missile defense systems to cyber threats. As a result, there is a growing opportunity for public-private partnerships aimed at enhancing the cybersecurity of missile defense systems. Collaboration between government bodies and private defense technology firms can help develop advanced cybersecurity measures that protect defense systems from hacking, malware, and other cyber risks. This partnership presents a lucrative opportunity for companies specializing in cybersecurity technologies to expand their offerings to missile defense systems.

Future Outlook

The future of the Europe Missiles and Missile Defense Systems market is projected to experience continued growth over the next five years, driven by advancements in defense technologies, increased geopolitical threats, and rising defense budgets across European nations. Technological innovations, particularly in the areas of AI and hypersonic missile defense, are expected to shape the market landscape. Regulatory support and international defense collaborations will also contribute to the market’s expansion, as countries work together to strengthen missile defense capabilities.

Major Players

- Lockheed Martin

- Raytheon Technologies

- MBDA

- Northrop Grumman

- Thales Group

- BAE Systems

- Leonardo

- Kongsberg Defence & Aerospace

- Rafael Advanced Defense Systems

- Rheinmetall AG

- General Dynamics

- Saab Group

- Elbit Systems

- L3 Technologies

- Hanwha Defense

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military contractors

- National defense ministries

- Private defense technology companies

- Aerospace companies

- Security service providers

- Armed forces procurement agencies

Research Methodology

Step 1: Identification of Key Variables

In this step, key market variables such as market size, growth drivers, challenges, opportunities, and major players are identified and defined through a comprehensive literature review and expert consultations.

Step 2: Market Analysis and Construction

Data gathered from various sources is analyzed to construct the market overview, segmentation, and dynamics, ensuring a clear understanding of the market structure and competitive landscape.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses about market trends, growth drivers, and challenges are validated through consultations with industry experts, including government officials, defense contractors, and market analysts.

Step 4: Research Synthesis and Final Output

The final output synthesizes all the data and findings into a coherent market report, which includes market forecasts, competitive analysis, and actionable insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in Geopolitical Tensions

Government Investments in National Security

Technological Advancements in Defense Systems - Market Challenges

High Capital Investment Requirements

Interoperability Issues

Complex Regulatory Compliance - Market Opportunities

Emerging Demand for Autonomous Defense Systems

Growth in Cross-Border Defense Collaborations

Integration of Artificial Intelligence in Missile Defense - Trends

Integration of AI and Machine Learning in Missile Defense

Development of Hypersonic Missile Defense Systems - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surface-to-Air Missiles

Ballistic Missile Defense Systems

Anti-Tactical Ballistic Missiles

Cruise Missile Defense Systems

Integrated Air Defense Systems - By Platform Type (In Value%)

Land-Based Platforms

Naval Platforms

Airborne Platforms

Space-Based Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-Based Solutions

Hybrid Solutions

Modular Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

Raytheon Technologies

MBDA

Northrop Grumman

Thales Group

BAE Systems

Saab Group

Rheinmetall AG

Kongsberg Defence & Aerospace

Elbit Systems

Leonardo

General Dynamics

L3 Technologies

Hanwha Defense

Diehl Defence

- Increasing Demand from Military Forces for Advanced Missile Defense

- Growth in Government Agencies’ Investments

- Rising Adoption by Defense Contractors

- Expansion of Security Services in Missile Defense

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035