Market Overview

The Europe Naval Vessels Market is projected to experience strong growth, driven by factors such as rising defense budgets, increasing maritime security concerns, and advancements in naval technologies. The market size is expected to reach significant figures, backed by both governmental investments and technological innovations. Various defense programs and contracts have spurred the demand for modern naval vessels across different European countries. This development is further supported by strategic geopolitical shifts that necessitate robust naval capabilities to ensure national security and defense preparedness.

Several European nations, including the United Kingdom, France, and Germany, are leading the market in terms of naval vessel procurement and technological advancements. These countries dominate due to their robust naval defense sectors and the strategic importance of maintaining a strong maritime presence. Key regions are also home to several naval defense contractors, fostering local production and supply chain capabilities, which further contribute to their leadership in the market. The presence of established shipyards and defense companies in these countries reinforces their dominant position in the global naval vessel market.

Market Segmentation

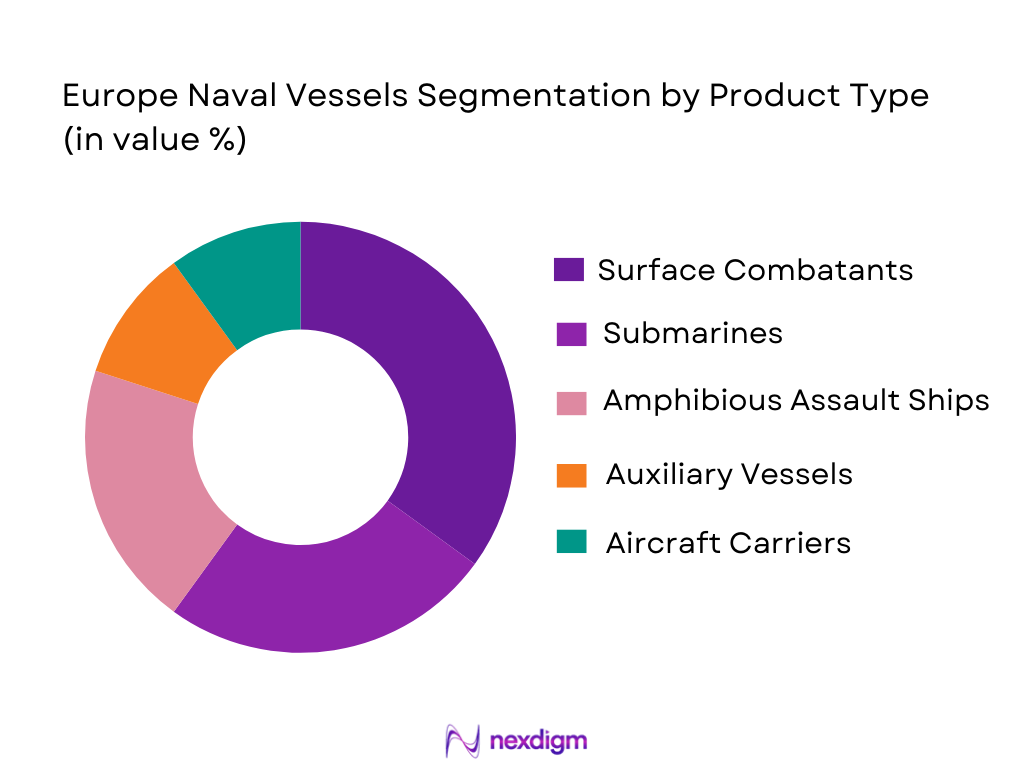

By Product Type

The Europe Naval Vessels Market is segmented by product type into surface combatants, submarines, amphibious assault ships, auxiliary vessels, and aircraft carriers. Recently, surface combatants have held a dominant market share due to their versatility and critical role in defense operations. The demand for surface combatants has surged as these vessels are integral to naval defense strategies, with countries increasing their focus on high-tech vessels capable of defending national waters and supporting international maritime missions. Surface combatants are preferred due to their multi-role capabilities, such as anti-air, anti-submarine, and anti-surface warfare operations. They are central to naval force structure, enabling flexibility and mobility in a wide range of defense scenarios.

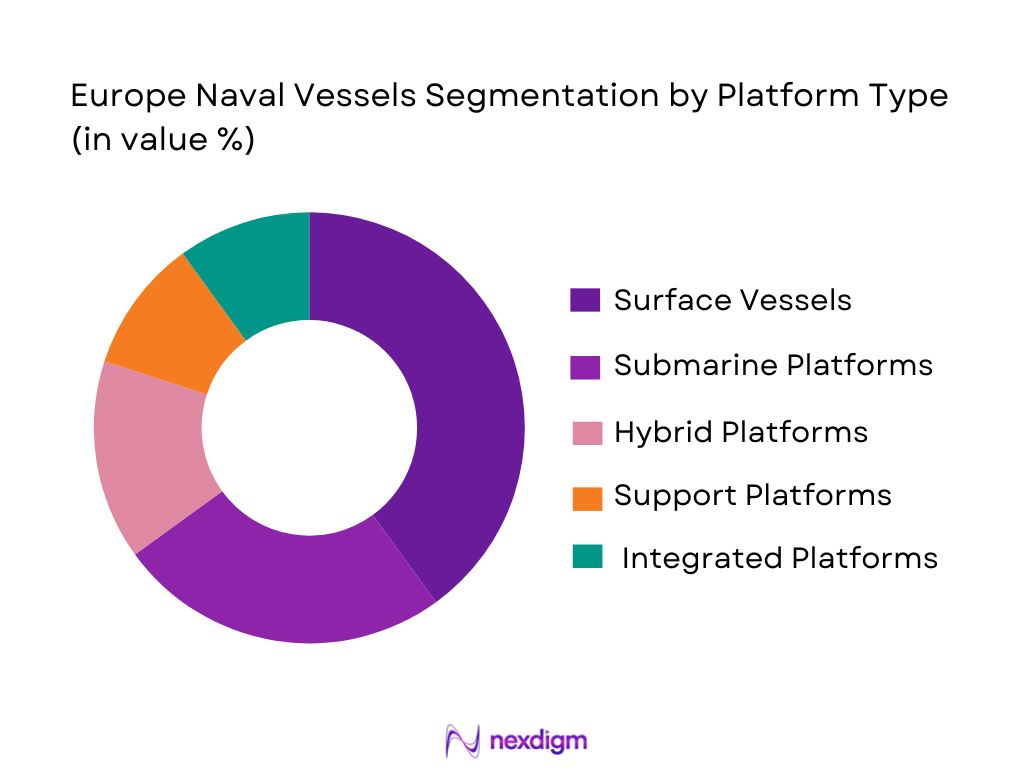

By Platform Type

The Europe Naval Vessels Market is also segmented by platform type into surface vessels, submarine platforms, hybrid platforms, support platforms, and integrated platforms. Among these, surface vessels are leading the market due to their wide array of functionalities in modern naval defense. Surface vessels are crucial for maintaining a robust presence in both territorial waters and international maritime zones, with capabilities ranging from offensive and defensive operations to surveillance and reconnaissance missions. They are equipped with advanced technologies, including radar and sonar systems, to combat evolving threats such as submarines and surface combatants.

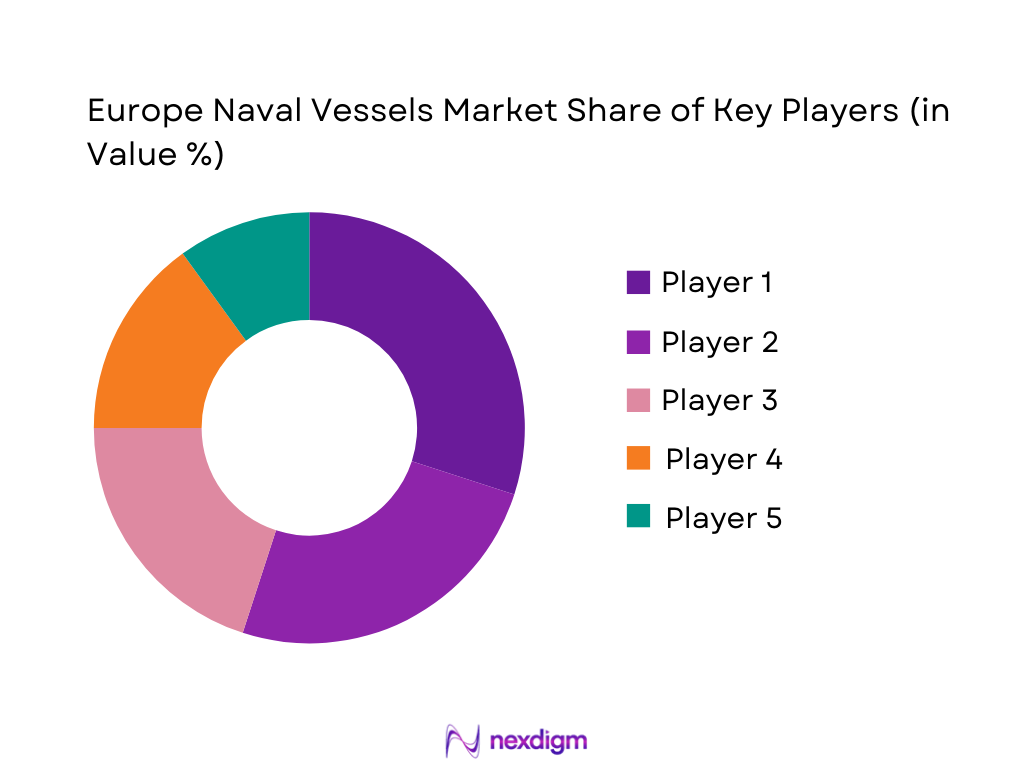

Competitive Landscape

The Europe Naval Vessels Market is highly competitive, characterized by the presence of several key players and strategic consolidation efforts. The industry is dominated by a few large defense contractors who shape the market landscape. These companies focus on enhancing their technological capabilities, forming partnerships, and expanding their product portfolios to maintain their competitive edge. Additionally, there is a growing trend of international collaboration between countries to share resources and expertise, which further strengthens the competitive environment.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Billion) | Additional Parameter |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Naval Group | 2006 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Fincantieri | 1959 | Trieste, Italy | ~ | ~ | ~ | ~ | ~ |

| Thyssenkrupp Marine Systems | 1999 | Kiel, Germany | ~ | ~ | ~ | ~ | ~ |

Europe Naval Vessels Market Analysis

Growth Drivers

Increased Government Spending

One of the key growth drivers for the Europe Naval Vessels Market is the significant increase in government defense budgets across European nations. Many countries are prioritizing the modernization and expansion of their naval forces, prompted by rising security concerns in regional waters and beyond. Increased investment in naval defense systems reflects the need to strengthen maritime security, particularly in response to escalating tensions in global geopolitics. Governments are also seeking to enhance their naval fleet’s technological capabilities, such as advanced radar systems, stealth technology, and enhanced missile defense systems. These expenditures are contributing to the overall growth of the naval vessels market, as countries look to upgrade their fleets to meet modern warfare demands. As European countries continue to increase their defense budgets, demand for new naval vessels, including advanced surface combatants and submarines, is expected to grow significantly, thus driving the market forward.

Technological Advancements in Naval Vessels

Another important growth driver for the Europe Naval Vessels Market is the continuous advancement in naval vessel technologies. Innovations in automation, propulsion systems, and weaponry have enhanced the operational efficiency and effectiveness of naval vessels. The integration of cutting-edge technologies such as artificial intelligence, advanced radar systems, and high-performance missile defense systems is shaping the future of naval warfare. These technological advancements have made modern naval vessels more versatile, enabling them to operate in a wider range of environments, from anti-submarine warfare to counter-terrorism operations. Furthermore, the increased focus on energy-efficient vessels and green technologies in naval shipbuilding is driving demand for more environmentally friendly and cost-effective solutions. As the naval defense industry continues to innovate, the demand for technologically advanced naval vessels is expected to continue growing, significantly influencing the market.

Market Challenges

High Cost of Production

The Europe Naval Vessels Market faces a significant challenge in the form of the high cost of production associated with advanced naval vessels. The construction of modern naval vessels involves substantial financial investments, especially when incorporating advanced technologies, materials, and systems. This results in expensive ships and submarines, making procurement costly for governments and defense contractors. The high cost of production is a major barrier for smaller countries with limited defense budgets, which may struggle to maintain or expand their naval forces. While large European nations such as the UK, France, and Germany can afford to invest in high-tech vessels, the financial strain can limit the purchasing power of smaller countries. This challenge requires effective budget management, international partnerships, and innovative financing models to ensure that naval defense capabilities are accessible across the region.

Technological Integration Issues

Another challenge faced by the Europe Naval Vessels Market is the complexity involved in integrating new technologies into existing naval platforms. As defense forces strive to modernize their fleets, integrating advanced technologies such as AI, automation, and new propulsion systems into older vessels presents a significant hurdle. This technological integration is often hindered by compatibility issues between new and existing systems, making it difficult to upgrade older ships. Moreover, the complexity of incorporating multiple new technologies into a single vessel increases the risk of delays, cost overruns, and performance issues. The long development cycles associated with naval vessel upgrades further complicate this issue, and the lack of skilled workforce in certain regions can also hinder progress. Overcoming these integration challenges will be crucial for ensuring the success of future naval defense strategies across Europe.

Opportunities

Growing Demand for Autonomous Naval Vessels

The increasing demand for autonomous naval vessels presents a significant opportunity for growth in the European market. Autonomous systems are becoming a key focus area in the naval defense sector, with the potential to reduce operational costs and enhance the effectiveness of naval fleets. Autonomous vessels can carry out a wide range of missions, including surveillance, reconnaissance, and supply operations, without the need for a human crew on board. These vessels can also operate in dangerous or high-risk environments, such as mine-sweeping missions or anti-submarine warfare, where human intervention may not be ideal. As European countries look to enhance their naval capabilities, the integration of autonomous vessels into their fleets could revolutionize naval operations, creating opportunities for manufacturers to develop and supply these advanced vessels.

International Partnerships for Fleet Expansion

Another key opportunity for the Europe Naval Vessels Market lies in international collaborations for fleet expansion and technological development. Many European countries are forming alliances and partnerships to jointly develop, procure, and maintain naval vessels. This cooperative approach allows countries with smaller budgets to pool their resources and invest in advanced naval platforms that might otherwise be unaffordable. These international partnerships not only facilitate the sharing of knowledge and resources but also enhance the ability to meet regional defense requirements more efficiently. For example, collaborations between European nations and NATO are expected to drive demand for new naval vessels, including amphibious assault ships and multi-role surface combatants. As European countries continue to strengthen their defense cooperation, international partnerships will create significant opportunities for the market.

Future Outlook

The Europe Naval Vessels Market is expected to see continued growth over the next five years, driven by factors such as technological advancements, rising defense budgets, and the need for enhanced maritime security. Technological innovations, including the integration of AI, autonomous systems, and energy-efficient vessels, will play a central role in shaping the market. Governments are likely to focus on modernizing their fleets to address new threats, and international partnerships will continue to be a key enabler of fleet expansion. Regulatory support and rising geopolitical tensions will further spur investments in naval defense capabilities, ensuring robust market growth in the coming years.

Major Players

- BAE Systems

- Naval Group

- Lockheed Martin

- Fincantieri

- Thyssenkrupp Marine Systems

- Navantia

- Huntington Ingalls Industries

- Damen Shipyards

- Saab Group

- General Dynamics

- Lürssen

- DCN

- Kongsberg Gruppen

- Rolls-Royce

- Leonardo

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Private defense technology firms

- Public and private sector organizations involved in maritime security

- OEMs in defense technology

- Defense agencies in Europe

Research Methodology

Step 1: Identification of Key Variables

Identify critical factors driving the market, including defense budgets, technological advancements, and geopolitical factors.

Step 2: Market Analysis and Construction

Analyze market trends, growth drivers, and competitive landscape using primary and secondary research methods.

Step 3: Hypothesis Validation and Expert Consultation

Validate market hypotheses through expert interviews, consultations with defense agencies, and industry reports.

Step 4: Research Synthesis and Final Output

Synthesize findings into a comprehensive report, ensuring data accuracy and alignment with market trends.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased National Security Budgets

Advancements in Naval Technologies

Growing Geopolitical Tensions - Market Challenges

High Capital Expenditure for New Vessels

Technological Integration and Interoperability Issues

Political Resistance to Defense Spending - Market Opportunities

Rising Demand for Autonomous Naval Vessels

Emerging Opportunities in Hybrid and Green Technology

Partnerships for Technological Advancements - Trends

Surge in Autonomous Naval Systems

Integration of AI and Cybersecurity in Naval Operations - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Surface Combatants

Submarines

Amphibious Assault Ships

Auxiliary Vessels

Aircraft Carriers - By Platform Type (In Value%)

Surface Vessels

Submarine Platforms

Hybrid Platforms

Support Platforms

Integrated Platforms - By Fitment Type (In Value%)

Modular Systems

Integrated Systems

Customized Systems

Legacy Systems - By End User Segment (In Value%)

Military Forces

Naval Defense Contractors

Government Agencies

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

BAE Systems

Navantia

Thales Group

Lockheed Martin

Huntington Ingalls Industries

DCN

General Dynamics Electric Boat

Fincantieri

Lürssen

Saab Group

Kongsberg Gruppen

Naval Group

Toshiba Corporation

Tata Advanced Systems

Elbit Systems

- Military Forces’ Growing Demand for Advanced Naval Systems

- Naval Contractors’ Shift Toward Technological Innovation

- Government Agencies’ Role in Defense Procurement

- Private Sector’s Involvement in Advanced Technology Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035