Market Overview

The Europe Non-Lethal Weapons market is estimated to reach approximately USD ~ in value. This growth is driven by the increasing demand from law enforcement agencies and military forces for safer alternatives to traditional weapons. The market’s expansion is supported by advancements in technology, including directed energy weapons, non-lethal projectiles, and electromagnetic systems. These technologies are evolving rapidly, providing solutions that are effective in controlling riots, crowd management, and tactical military operations. Key regulatory frameworks and government investments in defense modernization further propel the market.

Key regions dominating the Europe Non-Lethal Weapons market include the United Kingdom, Germany, and France. These countries are at the forefront due to strong defense budgets, well-established infrastructure, and a growing focus on non-lethal solutions for law enforcement and security purposes. Additionally, their advanced technological development and cooperation with international defense contractors have positioned them as leaders in this field. The increasing need for effective crowd control solutions and military modernization in these regions contributes significantly to their dominance in the market.

Market Segmentation

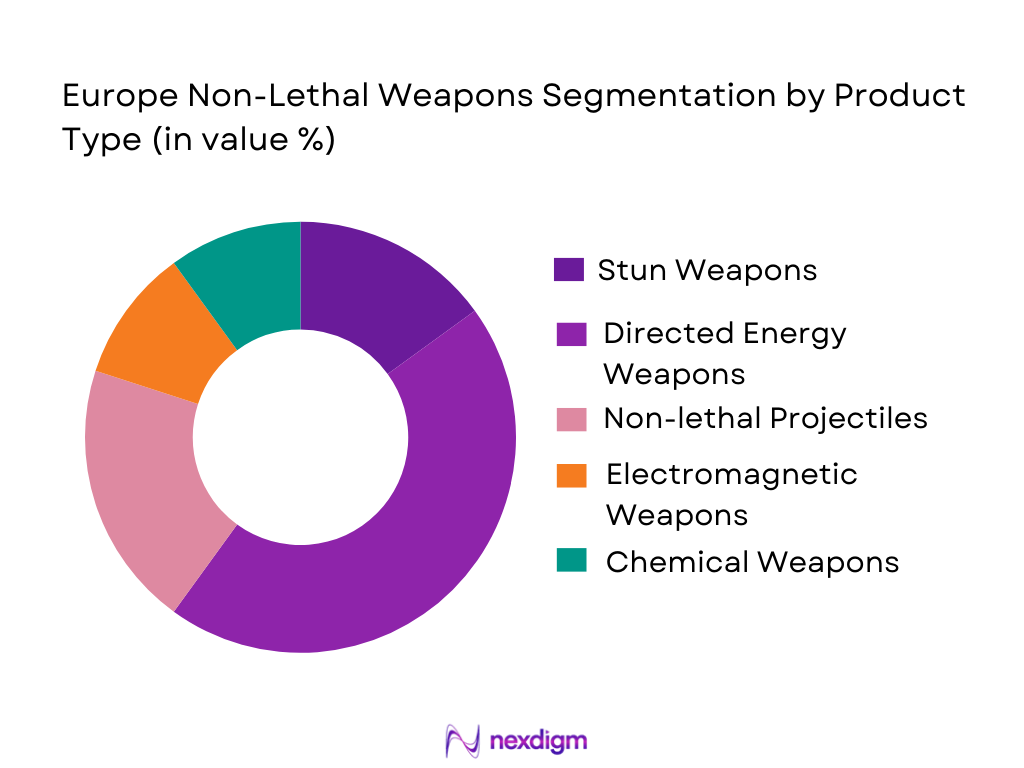

By Product Type

The Europe Non-Lethal Weapons market is segmented by product type into stun weapons, directed energy weapons, non-lethal projectiles, electromagnetic weapons, and chemical weapons. Among these, directed energy weapons dominate the market due to their precise control over non-lethal engagements and their capability to disable equipment or incapacitate targets without causing permanent harm. This segment’s dominance can be attributed to its advanced technological capabilities, including the use of lasers and microwave systems, which offer high operational efficiency and low collateral damage.

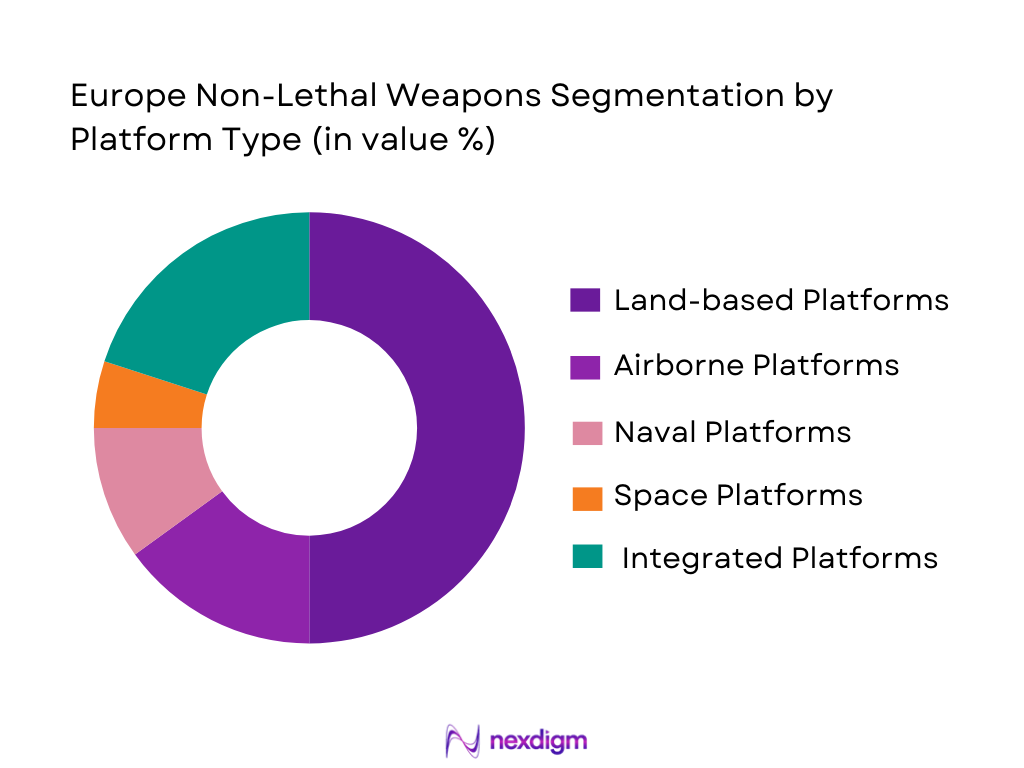

By Platform Type

The market is segmented by platform type into land-based platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Land-based platforms are the dominant sub-segment, primarily due to their extensive application in crowd control, law enforcement, and military operations. These platforms offer versatility in various operational settings, from urban environments to military bases, and are increasingly equipped with advanced non-lethal weapon systems. The strong infrastructure for land-based security operations, coupled with the high demand for non-lethal weapons in such contexts, further supports the dominance of land-based platforms.

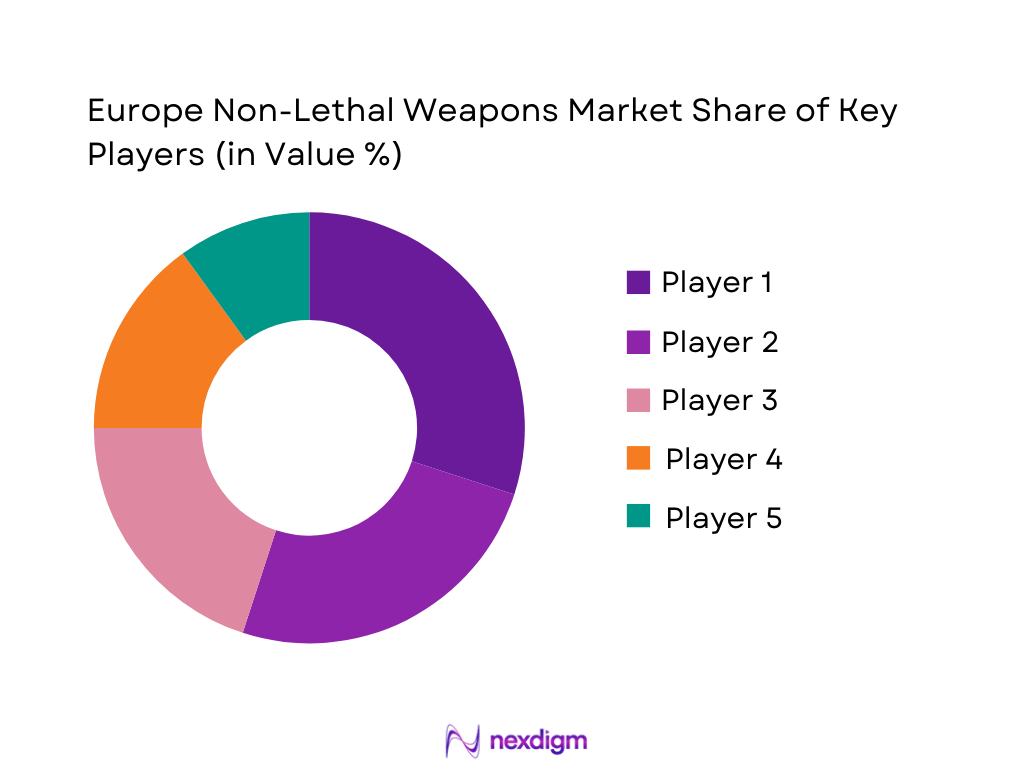

Competitive Landscape

The competitive landscape of the Europe Non-Lethal Weapons market is characterized by the presence of both large defense contractors and smaller specialized firms. Major players in the market are continuously innovating, focusing on the development of advanced non-lethal technologies. Mergers and acquisitions are common in this market as companies seek to expand their technological capabilities and market reach. Consolidation is expected to continue as players look to enhance product offerings and build stronger portfolios, especially in the area of directed energy weapons.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | Waltham, USA | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall AG | 1889 | Düsseldorf, Germany | ~ | ~ | ~ | ~ | ~ |

Europe Non-Lethal Weapons Market Analysis

Growth Drivers

Increased Adoption of Non-Lethal Solutions in Law Enforcement

The growing demand for non-lethal solutions in law enforcement is one of the primary drivers of the Europe Non-Lethal Weapons market. With the rise in civil unrest and protests, law enforcement agencies across Europe are increasingly adopting non-lethal weapons for crowd control, reducing fatalities and permanent injuries. These weapons are particularly useful for controlling large crowds while minimizing harm, making them preferable to traditional weapons. Additionally, non-lethal weapons such as stun guns, tasers, and pepper spray have become essential tools in the arsenal of modern police forces, offering them more control during tense situations. As public safety concerns increase, so does the emphasis on non-lethal options, with various governments and law enforcement agencies upgrading their equipment. The integration of advanced technologies such as directed energy systems also bolsters the appeal of non-lethal solutions, as these technologies offer precision and the ability to neutralize threats without causing lasting damage. As a result, the increasing adoption of these systems will continue to drive growth in the market.

Advancements in Directed Energy Weapons

Another major growth driver is the advancement of directed energy weapons (DEWs), particularly lasers and microwave-based systems. These weapons have seen significant technological improvements in terms of their range, accuracy, and energy efficiency. DEWs are now capable of incapacitating targets at a distance without causing permanent harm, making them ideal for military operations, law enforcement, and crowd control. These advancements are paving the way for new applications in both defense and civilian security, allowing non-lethal weapons to become more versatile and effective. The ability of DEWs to neutralize threats with minimal collateral damage is especially important in conflict zones where civilian safety is a priority. Additionally, the development of more compact and mobile directed energy weapons is expanding their use, as they can be integrated into various platforms such as vehicles, drones, and handheld devices. With growing investments in research and development by defense contractors, the demand for DEWs is expected to surge, contributing significantly to the market’s growth.

Market Challenges

Regulatory Barriers in Weapon Deployment

One of the main challenges facing the Europe Non-Lethal Weapons market is the complex regulatory landscape surrounding the deployment of these weapons. While non-lethal weapons offer an alternative to traditional arms, their use is often subject to stringent regulations, especially in terms of human rights, safety standards, and ethical concerns. Different countries in Europe have varying laws regarding the permissible use of non-lethal weapons by law enforcement and military personnel. These regulations can hinder the widespread adoption of certain technologies, as companies may face significant hurdles in gaining regulatory approvals. Furthermore, the deployment of certain non-lethal systems, such as directed energy weapons or chemical agents, can be controversial due to their potential side effects, leading to delays or even bans in some jurisdictions. As a result, companies may face uncertainty in product development timelines and market entry strategies, slowing the growth of the overall market.

High Research and Development Costs

The high costs associated with research and development (R&D) in the non-lethal weapons sector represent another significant challenge. Developing advanced non-lethal weapons, particularly directed energy systems, requires substantial investment in R&D to ensure effectiveness, safety, and reliability. The complexity of these systems, combined with the need for cutting-edge materials and technologies, results in long development cycles and high costs. Smaller companies may struggle to compete with larger defense contractors that have greater access to funding and resources. Additionally, ongoing advancements in weapon technology require constant innovation and refinement, further driving up R&D costs. These financial burdens can delay the commercialization of new products and prevent some companies from entering the market, ultimately affecting the overall growth rate of the sector.

Opportunities

Expansion of Non-Lethal Weapons for Crowd Control Applications

One of the most significant opportunities for the Europe Non-Lethal Weapons market lies in the growing demand for non-lethal weapons in crowd control applications. As civil unrest and protests become more frequent across Europe, law enforcement agencies are increasingly turning to non-lethal weapons as a safer alternative to traditional firearms. Non-lethal weapons, such as stun guns, water cannons, and directed energy systems, are being used to manage large crowds and prevent violent confrontations. This shift toward non-lethal solutions allows authorities to maintain order while reducing the risk of injury and fatalities. Additionally, the ability to use non-lethal methods without causing permanent harm makes these weapons more acceptable to the public and regulatory bodies. The expanding use of these systems by police forces, military units, and private security firms presents a significant growth opportunity for market players, especially as governments continue to prioritize public safety and human rights.

Technological Integration with Autonomous Systems

Another key opportunity for the Europe Non-Lethal Weapons market is the integration of non-lethal weapons with autonomous systems, such as drones and robotic vehicles. As technology advances, autonomous platforms are increasingly being used in security and defense operations, providing a cost-effective and efficient means of deploying non-lethal weapons. By integrating these systems with autonomous capabilities, non-lethal weapons can be deployed in environments that are too dangerous or inaccessible for human operators, such as conflict zones or disaster areas. This technological synergy allows for more precise targeting, reduced human risk, and improved operational efficiency. Furthermore, the use of autonomous systems in law enforcement operations can help address manpower shortages and provide more effective responses in emergency situations. The growing interest in autonomous technologies presents a substantial market opportunity for non-lethal weapon manufacturers, especially those focusing on developing integrated systems that combine both non-lethal and autonomous capabilities.

Future Outlook

The Europe Non-Lethal Weapons market is expected to experience steady growth over the next five years, driven by ongoing advancements in technology and increasing demand for safer alternatives in military and law enforcement operations. Technological innovations, particularly in directed energy weapons and autonomous systems, are expected to enhance the effectiveness and versatility of non-lethal weapons. Regulatory support from European governments, particularly in law enforcement and defense modernization, will also contribute to market growth. Additionally, as societal concerns regarding the safety and ethical implications of traditional weapons continue to rise, the demand for non-lethal solutions is anticipated to grow, particularly in crowd control and security applications.

Major Players

- Lockheed Martin

- Raytheon Technologies

- Thales Group

- BAE Systems

- Rheinmetall AG

- General Dynamics

- Leonardo

- L3 Technologies

- Saab Group

- Harris Corporation

- Northrop Grumman

- Elbit Systems

- Hewlett Packard Enterprise

- Boeing

- Sikorsky Aircraft

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Military forces

- Law enforcement agencies

- Private security firms

- Defense contractors

- Technology developers and integrators

- Manufacturers of non-lethal weapons

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the key market variables that affect demand and supply in the Europe Non-Lethal Weapons market. These variables include technological developments, regulatory changes, and consumer behavior.

Step 2: Market Analysis and Construction

Comprehensive data analysis is conducted to build market models, assess historical growth trends, and forecast future performance. This step involves the use of primary and secondary data sources to construct the market landscape.

Step 3: Hypothesis Validation and Expert Consultation

This step involves validating the initial hypotheses with industry experts, stakeholders, and market participants to ensure that the research findings align with real-world conditions and trends.

Step 4: Research Synthesis and Final Output

The final output is a comprehensive market report that synthesizes all findings, conclusions, and strategic recommendations for stakeholders based on the market analysis and expert insights.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Crowd Control

Technological Advancements in Non-Lethal Weapons

Government Focus on Law Enforcement Modernization - Market Challenges

High Development and Production Costs

Regulatory and Compliance Challenges

Public Perception and Ethical Concerns - Market Opportunities

Partnerships with Private Sector for Development

Growing Use in Civilian Law Enforcement

Increasing Demand for Autonomous Non-Lethal Systems - Trends

Rise in Adoption of Non-Lethal Drones

Integration of AI for Improved Targeting and Precision - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Stun Weapons

Directed Energy Weapons

Non-Lethal Projectiles

Electromagnetic Weapons

Chemical Weapons - By Platform Type (In Value%)

Land-based Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions - By End User Segment (In Value%)

Military Forces

Law Enforcement Agencies

Private Security Firms

Government Organizations - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Lockheed Martin

BAE Systems

Raytheon Technologies

Northrop Grumman

Thales Group

General Dynamics

Leonardo

L3 Technologies

Saab Group

Harris Corporation

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Focus on Tactical Control

- Law Enforcement Agencies’ Growing Adoption of Non-Lethal Solutions

- Private Security Firms’ Increasing Demand for Non-Lethal Options

- Government Organizations’ Role in Regulating and Purchasing Systems

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035