Market Overview

The Europe Remote Sensing Satellites market has seen substantial growth, driven by advancements in satellite technology and increasing demand for real-time data from various industries. The market size for this sector is valued at over USD ~ based on a recent historical assessment. This growth is largely driven by the expanding applications of remote sensing satellites in environmental monitoring, defense, agriculture, and urban planning. The ability to provide high-resolution data with enhanced imaging capabilities has made this market an essential component in sectors such as climate monitoring, disaster management, and national security.

Key countries such as Germany, France, and the UK dominate the European remote sensing satellite market, primarily due to their advanced aerospace capabilities and strong governmental and private sector investments in space technologies. These nations benefit from well-established aerospace industries, robust defense spending, and strategic geographic positioning. Furthermore, the collaborative efforts between governmental agencies and private companies in these regions have been pivotal in fostering innovation and driving market expansion. The European Space Agency (ESA) also plays a significant role in shaping the market landscape, contributing to the region’s prominence in satellite-based remote sensing technologies.

Market Segmentation

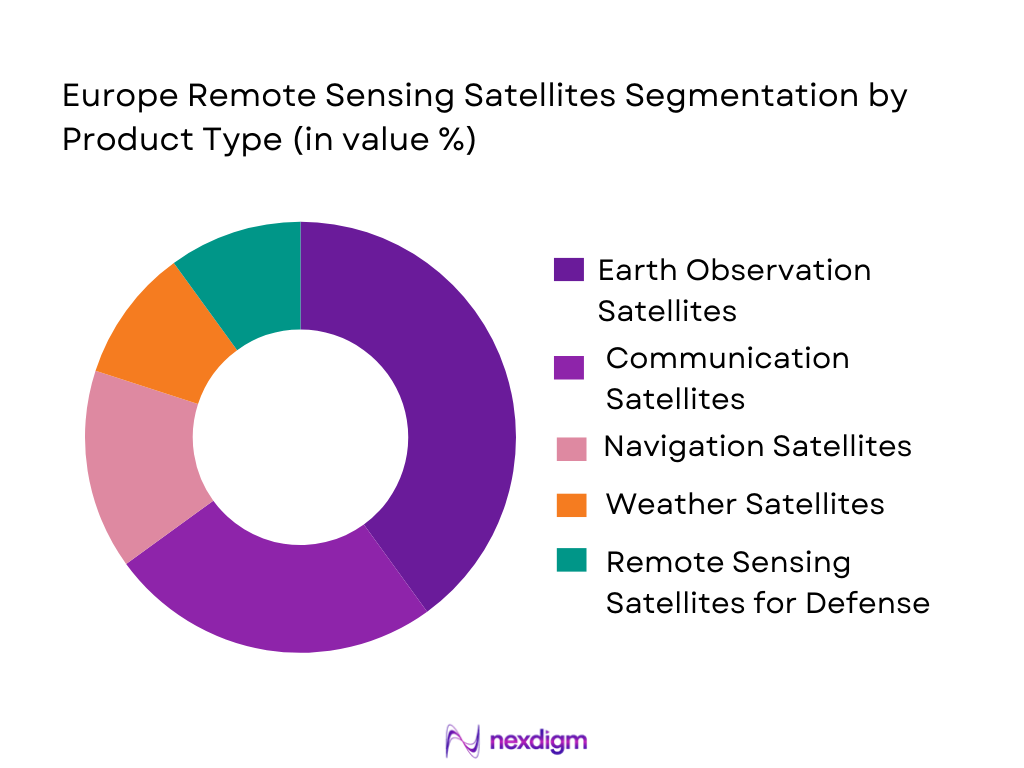

By Product Type

The Europe Remote Sensing Satellites market is segmented by product type into Earth Observation Satellites, Communication Satellites, Navigation Satellites, Weather Satellites, and Remote Sensing Satellites for Defense. Recently, Earth Observation Satellites have a dominant market share due to factors such as high demand for environmental data, improved imaging technology, and increasing applications across sectors like agriculture, forestry, and disaster management. These satellites play a crucial role in real-time monitoring of land, water, and urban areas, providing invaluable insights for governments, research agencies, and private enterprises.

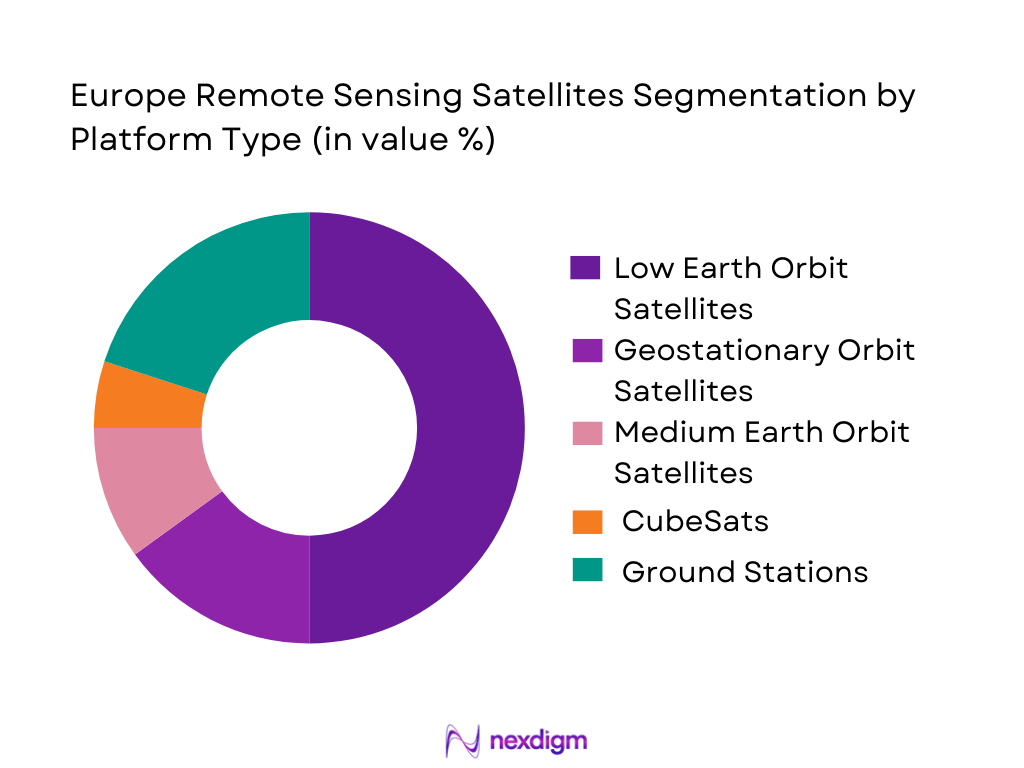

By Platform Type

The Europe Remote Sensing Satellites market is segmented by platform type into Low Earth Orbit Satellites, Geostationary Orbit Satellites, Medium Earth Orbit Satellites, CubeSats, and Ground Stations. Low Earth Orbit Satellites have a dominant market share due to their ability to capture high-resolution images with minimal delay. These satellites are ideal for applications such as environmental monitoring, disaster response, and surveillance. The increasing reliance on real-time data and the ongoing reduction in satellite launch costs have contributed to the growing adoption of Low Earth Orbit Satellites in the remote sensing market.

Competitive Landscape

The competitive landscape of the Europe Remote Sensing Satellites market is marked by consolidation and the influence of major aerospace companies. Several key players have established strongholds in the market through their technological expertise and collaborations with governmental agencies. The industry is witnessing significant mergers and acquisitions, as companies look to expand their product portfolios and enhance their technological capabilities.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Airbus | 1970 | Leiden, Netherlands | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 2005 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | Bethesda, USA | ~ | ~ | ~ | ~ | ~ |

| Maxar Technologies | 1969 | Westminster, USA | ~ | ~ | ~ | ~ | ~ |

| Planet Labs | 2010 | San Francisco, USA | ~ | ~ | ~ | ~ | ~ |

Europe Remote Sensing Satellites Market Analysis

Growth Drivers

Government Investments in Space Exploration

The continuous increase in government investments in space exploration and satellite programs has been a key growth driver for the Europe Remote Sensing Satellites market. European governments, including France, Germany, and the UK, are making significant investments to bolster their space capabilities. These investments are driven by the need to maintain competitive advantages in defense, environmental monitoring, and disaster management. Programs like the European Space Agency’s (ESA) Earth observation projects have led to the development of new satellite technologies and the expansion of remote sensing capabilities. These initiatives have created opportunities for collaboration between governments and private sector companies, further driving market growth. Additionally, such investments allow for the advancement of satellite technologies, increasing the capabilities of remote sensing satellites, and improving data acquisition and processing efficiency. The European Union’s commitment to strengthening its space infrastructure also contributes to the market’s expansion. The European Union’s space strategy includes significant funding for satellite systems, ensuring that remote sensing satellites continue to be a priority for the region.

Technological Advancements in Satellite Systems

Another key driver for the growth of the Europe Remote Sensing Satellites market is the technological advancements in satellite systems. Innovations in satellite design, sensor technologies, and imaging capabilities are enabling satellites to capture higher-quality data and provide more detailed images. The development of smaller, lighter satellites, such as CubeSats, has made satellite deployment more cost-effective and efficient, contributing to the growth of the market. Additionally, advancements in satellite propulsion systems and communication technologies have improved the operational capabilities of satellites, allowing them to remain in orbit longer and gather more data. As technology continues to evolve, remote sensing satellites are expected to become even more accurate and efficient, providing valuable insights for a range of industries, including climate monitoring, defense, and disaster management. These advancements are not only enhancing the capabilities of existing satellites but are also paving the way for new applications of remote sensing technology, such as the monitoring of climate change and the tracking of environmental degradation.

Market Challenges

Regulatory Barriers in Space Policy

One of the key challenges faced by the Europe Remote Sensing Satellites market is the regulatory barriers in space policy. Although space exploration is an essential part of the European Union’s strategic agenda, regulations surrounding satellite launches, data transmission, and space traffic management pose challenges for companies operating in this sector. Strict regulations govern the launch and operation of remote sensing satellites, which can slow down project timelines and increase operational costs. Space debris management, licensing of frequencies, and compliance with international space laws are additional regulatory challenges that companies must navigate. The complexity of these regulations, combined with the need for intergovernmental cooperation, can result in delays and cost overruns for satellite developers. Furthermore, the lack of harmonized regulatory standards across different countries in the European Union adds to the complexity of satellite deployment and operations. Companies must also work with multiple national and international agencies, including the European Space Agency (ESA) and national space agencies, to ensure compliance with all applicable laws.

Technological and Operational Costs

Another challenge in the Europe Remote Sensing Satellites market is the high technological and operational costs associated with satellite development and deployment. The cost of manufacturing and launching remote sensing satellites is significant, particularly for high-resolution imaging systems that require advanced technology and specialized equipment. The expense of satellite launches, combined with the ongoing costs of maintaining and operating the satellites in orbit, can be a barrier for companies, especially smaller firms with limited budgets. Additionally, the research and development required to design and build cutting-edge satellite systems also entails high costs, which can hinder market growth. Many companies rely on public sector funding or partnerships with government agencies to offset these costs. However, despite the availability of financial support, the substantial investment required to develop and operate remote sensing satellites remains a significant challenge.

Opportunities

Emerging Demand for Commercial Satellite Data

One of the key opportunities for growth in the Europe Remote Sensing Satellites market is the emerging demand for commercial satellite data. Businesses across various industries, including agriculture, urban planning, and environmental monitoring, are increasingly turning to satellite data to improve operational efficiency and decision-making. Remote sensing satellites provide high-resolution images and real-time data that are invaluable for applications such as precision agriculture, urban development, and disaster management. Companies in these sectors are seeking satellite data to enhance their services and reduce costs. The growing interest in commercial satellite data presents a significant opportunity for satellite operators to expand their service offerings and cater to a broader range of industries. As technology advances and the cost of satellite launches decreases, more companies are expected to invest in remote sensing satellites, leading to a surge in demand for satellite data. This growing market for commercial satellite data is expected to create new revenue streams for satellite operators, boosting the overall growth of the remote sensing satellites market.

Collaboration Between Private and Public Sectors

Another significant opportunity in the Europe Remote Sensing Satellites market is the collaboration between private and public sectors. The growing need for high-resolution satellite data has prompted government agencies and private companies to work together in satellite development and deployment. Public-private partnerships (PPPs) are becoming more common in the space industry, as they allow for the pooling of resources and expertise to develop advanced satellite systems. These collaborations can help reduce the financial burden on individual companies and provide access to government funding and infrastructure. Governments, including those of France, Germany, and the UK, are actively encouraging private sector involvement in space programs to promote innovation and expand the capabilities of remote sensing satellites. The European Space Agency (ESA) has also played a pivotal role in fostering public-private partnerships, particularly in the areas of Earth observation and environmental monitoring.

Future Outlook

The future outlook for the Europe Remote Sensing Satellites market over the next five years is positive, with expected growth driven by technological advancements and increasing demand for satellite-based data across various sectors. The market is likely to see a rise in demand for small satellite systems, particularly CubeSats, as their lower costs and shorter development timelines make them attractive to both governments and private companies. Technological innovations in satellite imaging and communication will improve data resolution and delivery speed, expanding the potential applications of remote sensing satellites. Moreover, government support for space exploration, along with increasing investments in satellite infrastructure, will continue to drive growth. The next few years will likely witness a greater focus on environmental monitoring, disaster management, and defense applications, further bolstering the market’s growth.

Major Players

- Airbus

- Thales Alenia Space

- Lockheed Martin

- Maxar Technologies

- Planet Labs

- Northrop Grumman

- Boeing

- BlackSky Global

- SES S.A.

- SSTL

- Rocket Lab

- Arianespace

- SES Networks

- Telesat

- China Aerospace Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Space agencies

- Aerospace companies

- Environmental organizations

- Research and development firms

- Satellite manufacturers

- Commercial and industrial enterprises

Research Methodology

Step 1: Identification of Key Variables

In this step, key market drivers, restraints, opportunities, and technological trends are identified and analyzed.

Step 2: Market Analysis and Construction

The collected data is analyzed and segmented based on market characteristics to build a structured market model.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and future growth are validated through expert interviews and consultations with industry specialists.

Step 4: Research Synthesis and Final Output

The final market insights and findings are synthesized into a comprehensive report, providing actionable insights for stakeholders.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising Demand for Earth Observation Data

Advancements in Satellite Communication Technologies

Increasing Applications in Climate Monitoring - Market Challenges

High Launch and Maintenance Costs

Regulatory and Compliance Hurdles

Technological Limitations in Satellite Imaging - Market Opportunities

Expansion in Commercial Satellite Deployments

Integration of AI and Machine Learning for Data Processing

Emerging Applications in Smart Cities and Infrastructure Monitoring - Trends

Growth in Small Satellite Deployments

Increased Collaboration Between Public and Private Sectors - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Earth Observation Satellites

Communication Satellites

Navigation Satellites

Weather Satellites

Remote Sensing Satellites for Defense - By Platform Type (In Value%)

Low Earth Orbit Satellites

Geostationary Orbit Satellites

Medium Earth Orbit Satellites

CubeSats

Ground Stations - By Fitment Type (In Value%)

Standalone Satellites

Integrated Satellite Systems

Modular Satellite Platforms

Hybrid Satellites - By End User Segment (In Value%)

Government & Defense

Agriculture & Forestry

Weather Monitoring

Environmental Monitoring

Geospatial Intelligence - By Procurement Channel (In Value%)

Direct Procurement

Public Tenders

Private Sector Contracts

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, End User Segment, Procurement Channel, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus

Lockheed Martin

Thales Alenia Space

Maxar Technologies

Northrop Grumman

SpaceX

Ball Aerospace

Planet Labs

OneWeb

Sierra Nevada Corporation

Space Systems Loral

Rocket Lab

BlackSky Global

Boeing

Harris Corporation

- Government and Military Adoption of Remote Sensing Technology

- Agricultural Sector’s Use of Remote Sensing for Precision Farming

- Environmental Agencies Using Satellite Data for Conservation

- Private Sector Expansion in Satellite Data Analytics

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035