Market Overview

The market size of the Europe Satellite Attitude and Orbit Control System (AOCS) industry is estimated to reach USD ~, based on a recent historical assessment. This market is primarily driven by the increasing demand for satellite communications, Earth observation, and navigation services, which require precise attitude and orbit control systems for optimal functionality. A significant factor propelling market growth is the ongoing development of advanced technologies like reaction wheels, control moment gyroscopes, and magnetorquers, enhancing the precision and reliability of satellite systems. Investments in small satellite constellations and government programs further support this sector’s expansion.

The dominant countries in this market include the United Kingdom, France, Germany, and Italy, driven by their robust space programs, cutting-edge technological advancements, and large-scale satellite projects. These nations lead in satellite manufacturing, space exploration, and defense applications, supported by government agencies like the European Space Agency (ESA) and national space research institutions. The European Union’s investments in satellite technology and space infrastructure also contribute to regional dominance, with the continent seeing increasing demand for both commercial and government-led satellite initiatives, making these regions the key hubs for AOCS technology.

Market Segmentation

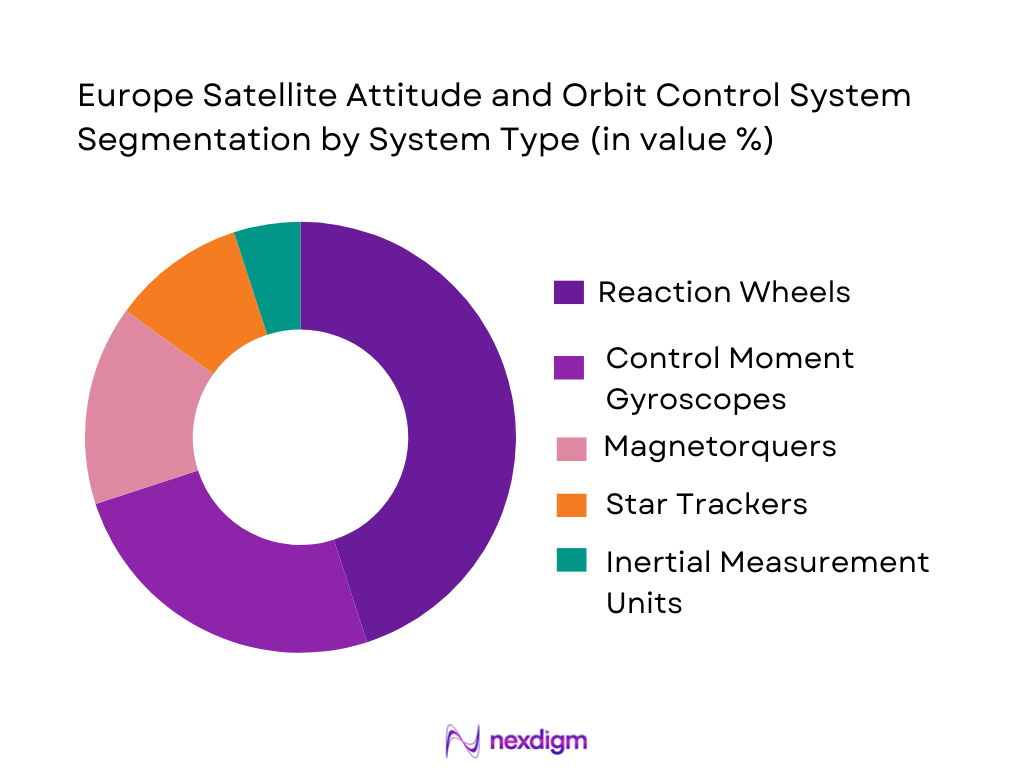

By System Type

The Europe Satellite Attitude and Orbit Control System market is segmented by system type into reaction wheels, control moment gyroscopes, magnetorquers, star trackers, and inertial measurement units. The dominant sub-segment is reaction wheels, driven by their compact size, high efficiency, and suitability for small and medium-sized satellites. Reaction wheels offer superior precision in attitude control, which makes them a preferred choice for satellite operators in Europe, especially in Earth observation and communication satellites.

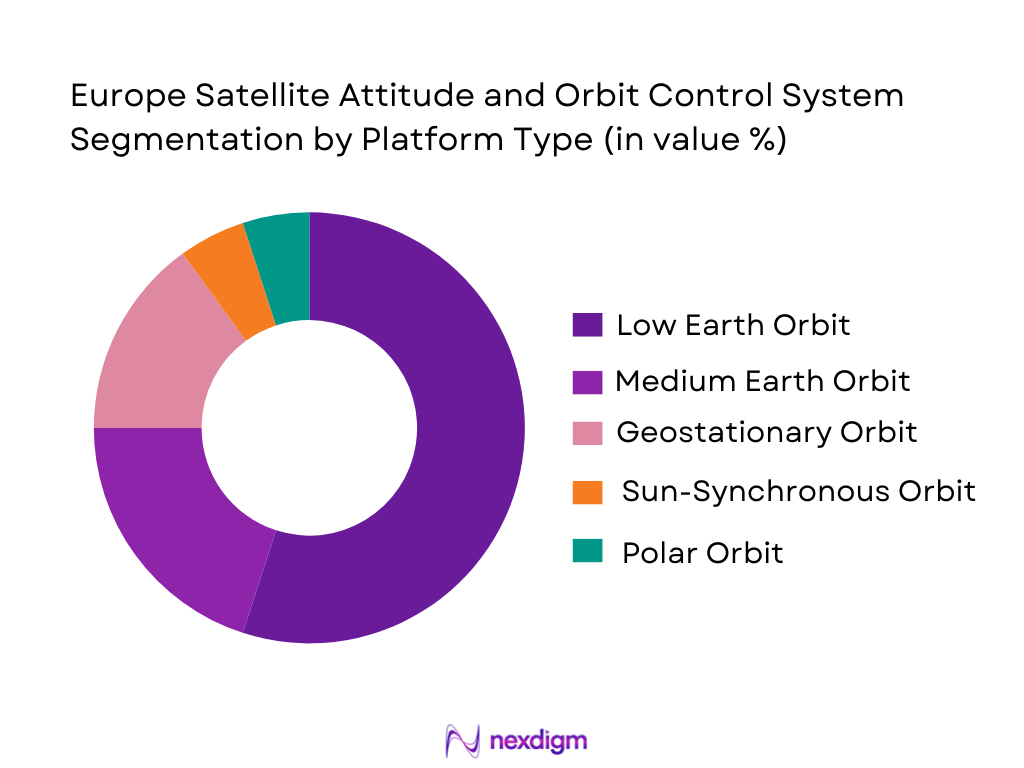

By Platform Type

The market is segmented by platform type into low Earth orbit (LEO), medium Earth orbit (MEO), geostationary orbit (GEO), sun-synchronous orbit, and polar orbit satellites. The dominant sub-segment is LEO, as it is widely used for communication, Earth observation, and scientific research. The proliferation of low-cost small satellites and the growing demand for real-time data transmission in LEO makes this platform type the primary choice for AOCS technologies in the region, contributing to its dominance.

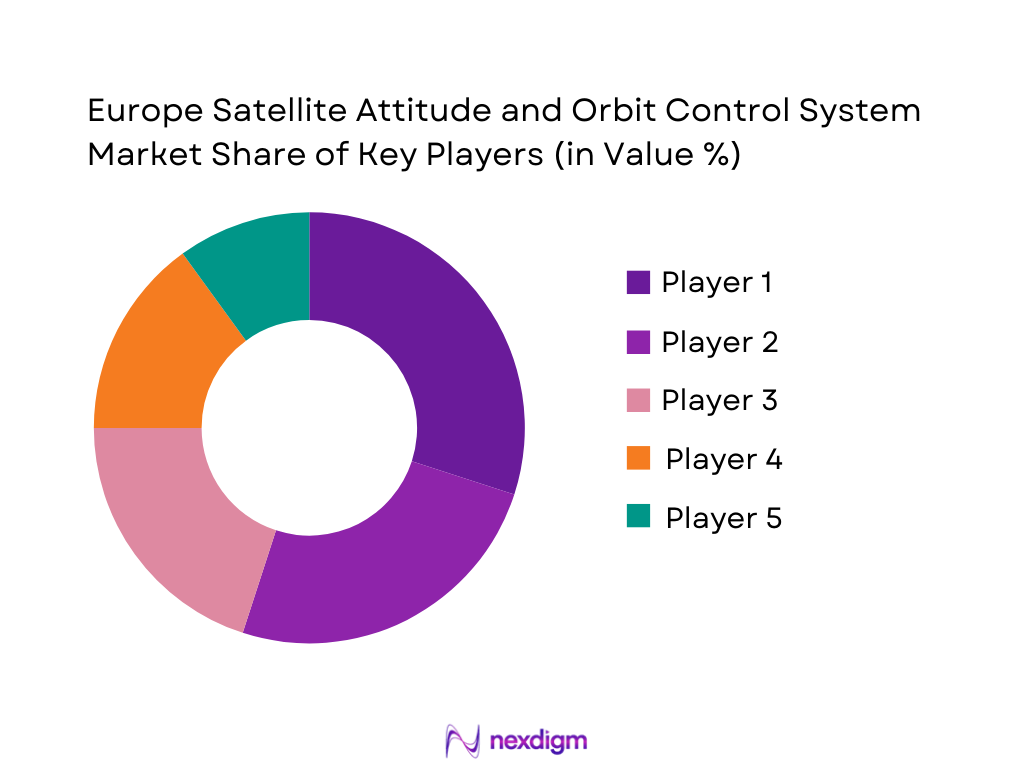

Competitive Landscape

The competitive landscape of the Europe Satellite Attitude and Orbit Control System market is characterized by the dominance of several global aerospace companies and the increasing consolidation within the sector. Major players are actively pursuing mergers and acquisitions to strengthen their technological capabilities and market position. Companies like Airbus, Lockheed Martin, and Thales are at the forefront of innovations, making substantial investments in R&D to cater to the growing demand for satellite control systems. These companies’ collaborations with space agencies and government programs also contribute to their competitive advantage in the market.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Market-Specific Parameter |

| Airbus | 1970 | France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Boeing | 1916 | USA | ~ | ~ | ~ | ~ | ~ |

| Maxar Technologies | 1969 | USA | ~ | ~ | ~ | ~ | ~ |

Europe Satellite Attitude and Orbit Control System Market Analysis

Growth Drivers

Technological Advancements in AOCS

Continuous advancements in AOCS technologies such as reaction wheels, control moment gyroscopes, and magnetorquers are key drivers of the European satellite market. These innovations allow for enhanced precision, stability, and efficiency in satellite operations. The miniaturization of these systems is making them more affordable and efficient, thereby broadening their applicability in both small and large satellite constellations. The integration of AI and machine learning algorithms into AOCS is also providing real-time operational improvements, enabling satellites to adapt to unforeseen circumstances. These technological advancements are particularly critical in space exploration and communication satellites, driving growth in demand across the region.

Government and Private Sector Investments

The increasing collaboration between private sector companies and governmental bodies in Europe is fostering growth in the satellite AOCS market. Space agencies such as the European Space Agency (ESA) and national entities like the UK Space Agency are allocating significant resources to space missions, satellite programs, and advanced satellite technology. Additionally, private players, including SpaceX and OneWeb, are investing heavily in building satellite constellations, which require advanced AOCS technology to maintain precise orbit and control. This growing collaboration is crucial for accelerating satellite deployment and driving the demand for AOCS systems.

Market Challenges

High Cost of Satellite Launch and Maintenance

One of the most significant challenges facing the Europe Satellite AOCS market is the high cost of satellite launch and maintenance. The integration of AOCS systems into satellites involves significant expenses in terms of both hardware and the complex calibration processes required. This is compounded by the expensive nature of maintaining and replacing these systems in orbit, which can deter smaller entities and startups from entering the market. Government and private sector initiatives must address these cost barriers to facilitate broader adoption.

Regulatory Barriers and Space Debris Management

Regulatory challenges related to space debris management and satellite de-orbiting are growing concerns for the European AOCS market. The European Union and other regulatory bodies have implemented stringent regulations aimed at reducing space debris, which could increase the operational costs for satellite operators. Satellites equipped with AOCS must ensure compliance with these regulations, necessitating complex planning for end-of-life disposal, which adds to the overall market complexity. This issue presents a significant challenge to the development and deployment of new satellite technologies.

Opportunities

Expansion of Small Satellite Constellations

The rapid growth of small satellite constellations presents a significant opportunity for the AOCS market in Europe. These small satellites are increasingly being used for communication, Earth observation, and scientific research. With advancements in AOCS technology, small satellite constellations can now be launched and maintained more efficiently, creating a lucrative market opportunity for manufacturers and service providers. Companies involved in satellite AOCS technologies can seize this opportunity to expand their product offerings and cater to the growing demand for affordable satellite systems.

Rise of Space-Based Internet Services

The demand for global, low-latency, and reliable internet services is driving the development of satellite-based internet networks. Companies like SpaceX’s Starlink and OneWeb are deploying massive satellite constellations in low Earth orbit, which require sophisticated AOCS systems for their proper functioning. This demand is expected to grow significantly as more nations and businesses look to satellite technology to provide broadband internet access in remote and underserved areas. This rising demand creates a strong opportunity for players in the satellite AOCS market to offer solutions that can meet the growing need for stable, cost-effective satellite networks.

Future Outlook

The next five years are expected to witness significant growth in the Europe Satellite AOCS market, driven by increasing investments in satellite infrastructure and technological innovations. Advancements in satellite miniaturization, AI integration, and AOCS systems will continue to fuel the growth of small satellite constellations. Regulatory support, especially for satellite de-orbiting and debris management, will enhance the operational efficiency of satellite systems. Additionally, demand for satellite-based communication and Earth observation will drive further adoption of AOCS technologies, creating substantial opportunities for market players.

Major Players

- Airbus

- Lockheed Martin

- Thales Alenia Space

- Boeing

- Maxar Technologies

- Sierra Nevada Corporation

- Ball Aerospace

- SpaceX

- OHB System AG

- Rocket Lab

- L3 Technologies

- ExPace

- OneWeb

- Northrop Grumman

- General Dynamics

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite manufacturers

- Aerospace and defense companies

- Space exploration agencies

- Communications service providers

- Satellite technology developers

- Research and development organizations

Research Methodology

Step 1: Identification of Key Variables

This involves identifying the critical parameters and variables that affect the market, such as system types, market segments, and key geographic regions.

Step 2: Market Analysis and Construction

In this step, the collected data is analyzed, and the market structure is built, ensuring all relevant sub-segments are covered in the report.

Step 3: Hypothesis Validation and Expert Consultation

Engaging with industry experts and conducting expert consultations ensures that all assumptions and hypotheses are validated for accuracy.

Step 4: Research Synthesis and Final Output

The final research output is synthesized by compiling all the data, analyses, and expert opinions into a comprehensive report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Communication Satellites

Advancements in Miniaturization of Satellite Components

Growth in Satellite-Based Earth Observation Applications - Market Challenges

High Cost of Satellite Launch and Maintenance

Technological Complexity in Attitude and Orbit Control

Limited Availability of Skilled Workforce - Market Opportunities

Development of Advanced Propulsion Systems

Collaborations between Private Sector and Government Agencies

Rising Investments in Small Satellite Programs - Trends

Integration of AI and Machine Learning in Satellite Control Systems

Increase in Demand for Multi-Function Satellite Systems - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Reaction Wheels

Control Moment Gyroscopes

Magnetorquers

Star Trackers

Inertial Measurement Units - By Platform Type (In Value%)

Low Earth Orbit (LEO) Satellites

Medium Earth Orbit (MEO) Satellites

Geostationary Orbit (GEO) Satellites

Sun-Synchronous Orbit Satellites

Polar Orbit Satellites - By Fitment Type (In Value%)

Standalone Systems

Integrated Systems

Modular Systems

Hybrid Systems - By End User Segment (In Value%)

Commercial Satellites

Military Satellites

Government Satellites

Research & Development Satellites - By Procurement Channel (In Value%)

Direct Procurement

Government Contracts

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus

Lockheed Martin

Northrop Grumman

Thales Alenia Space

Maxar Technologies

Sierra Nevada Corporation

Ball Aerospace

Boeing

SpaceX

OHB System AG

China Aerospace Corporation

Rocket Lab

L3 Technologies

ExPace

OneWeb

- Growing Role of Private Space Companies

- Increased Focus on National Security Applications

- Expansion of Satellite Constellations

- Rising Demand for Earth Observation Data

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035