Market Overview

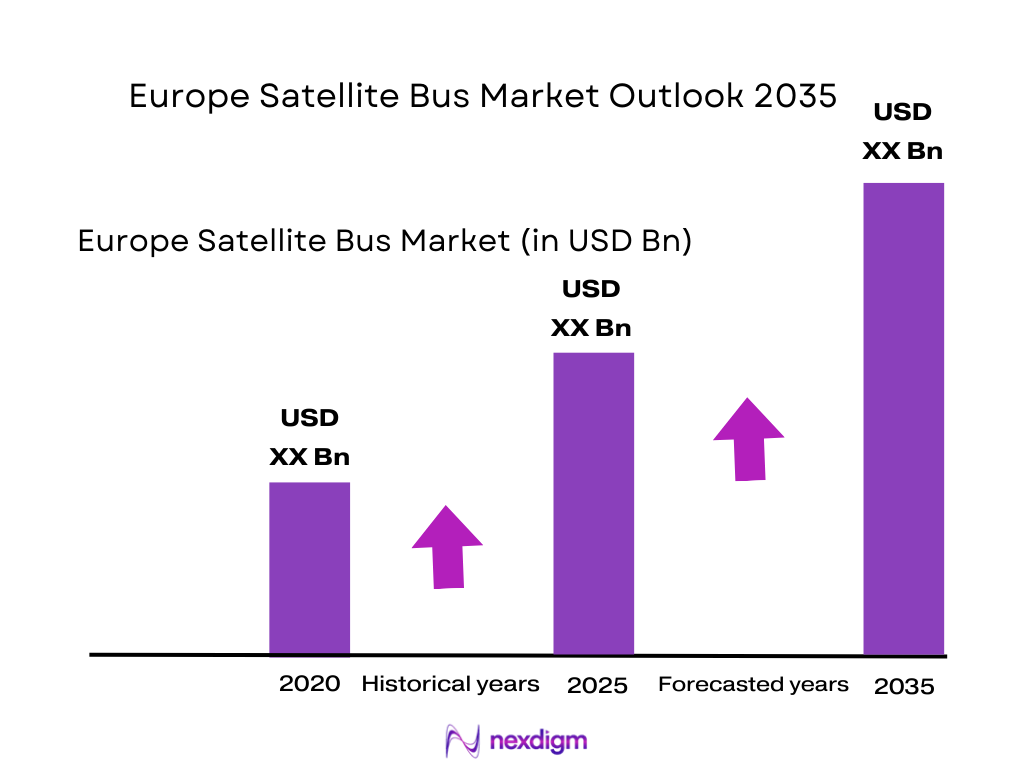

The Europe Satellite Bus Market is projected to reach a value of USD ~ based on a recent historical assessment. Growth in this market is primarily driven by the increasing demand for satellite connectivity, advancements in satellite miniaturization, and rising government investments in space exploration and communications infrastructure. As the space industry expands, satellite buses are becoming essential in the development of low-Earth orbit (LEO) satellites, with applications across telecommunications, defense, and Earth observation sectors.

Dominant countries such as Germany, France, and the United Kingdom lead the Europe Satellite Bus Market due to their strong aerospace industry infrastructure, government backing for space initiatives, and established relationships with global aerospace giants. The presence of key players like Airbus, Thales Alenia Space, and Arianespace further enhances these nations’ competitive positioning. Government investment in space technologies, especially in satellite systems, has spurred the market’s growth, with these countries offering high-tech manufacturing capabilities and access to advanced propulsion technologies.

Market Segmentation

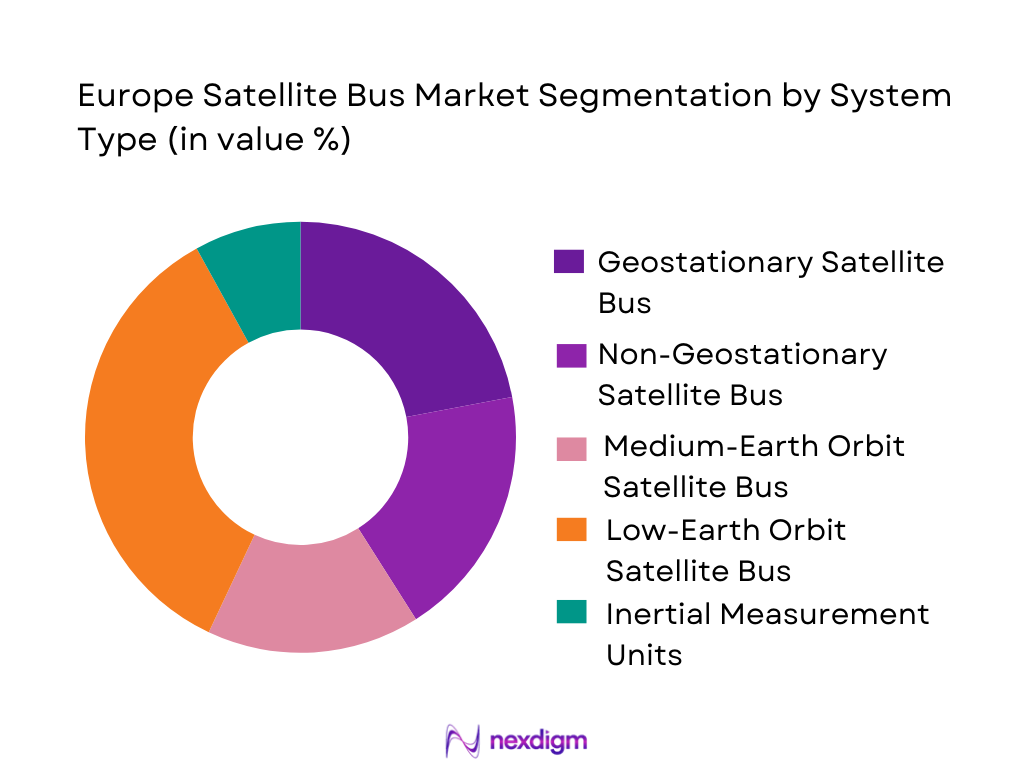

By System Type

The Europe Satellite Bus Market is segmented by system type into geostationary satellite bus, non-geostationary satellite bus, medium-Earth orbit (MEO) satellite bus, low-Earth orbit (LEO) satellite bus, and CubeSat bus. The dominant sub-segment in this market is the low-Earth orbit (LEO) satellite bus, driven by increasing demand for global communication, remote sensing, and Earth observation applications. LEO satellites provide low-latency data transfer and cost-effective solutions, making them highly attractive to both private companies and governmental space agencies. The expansion of LEO satellite constellations, such as SpaceX’s Starlink, further contributes to the dominance of this sub-segment, as these satellites offer services across a wide range of industries, from telecommunications to environmental monitoring.

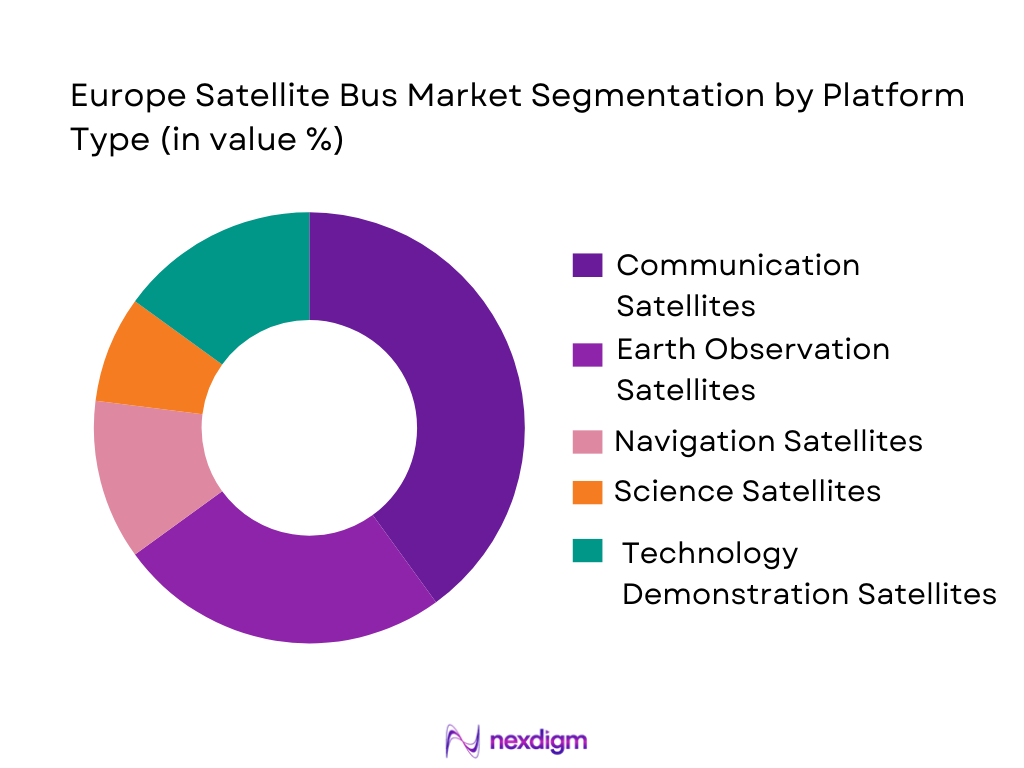

By Platform Type

The Europe Satellite Bus Market is segmented by platform type into communication satellites, Earth observation satellites, navigation satellites, science satellites, and technology demonstration satellites. The communication satellite sub-segment holds a dominant share due to the growing demand for global connectivity, especially in remote and underserved regions. As internet demand continues to surge, particularly with advancements in 5G and broadband services, communication satellites are essential for providing high-speed internet access and broadcasting services. Moreover, the increasing number of satellite constellations in LEO, which are designed to provide global broadband coverage, further strengthens this sub-segment’s market position.

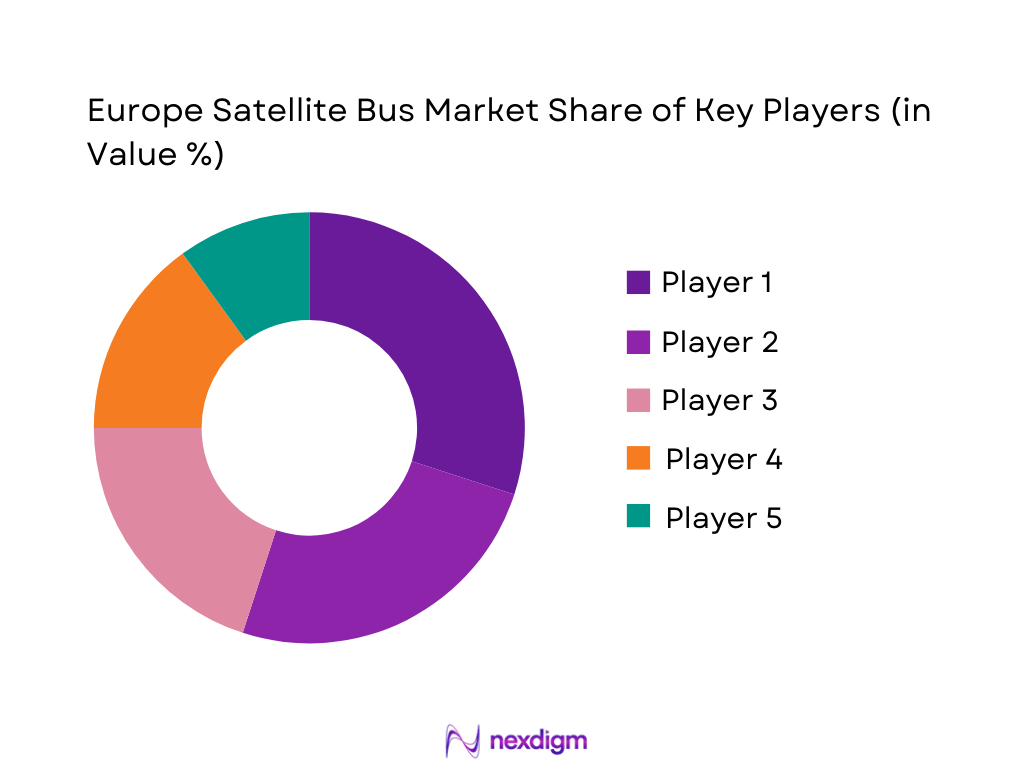

Competitive Landscape

The Europe Satellite Bus Market is highly competitive, with consolidation observed among major players. These companies leverage technological advancements in satellite propulsion systems, payload integration, and miniaturization to maintain their market dominance. The growing number of partnerships between private companies and government agencies has intensified competition, with key players continuously innovating to capture market share. As new entrants emerge, established companies are focusing on enhancing their production capabilities and expanding their service offerings to cater to an increasingly diverse range of end users.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Airbus Defence and Space | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ | ~ |

| Thales Alenia Space | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Arianespace | 1980 | France | ~ | ~ | ~ | ~ | ~ |

| Maxar Technologies | 1969 | USA | ~ | ~ | ~ | ~ | ~ |

Europe Satellite Bus Market Analysis

Growth Drivers

Increased demand for global connectivity

The increasing need for reliable, high-speed internet across the world has been a primary growth driver for the Europe Satellite Bus Market. Advancements in satellite technology, particularly for LEO constellations, have led to a surge in demand for satellites capable of providing global broadband coverage. These satellites are able to offer low-latency and high-throughput communications, enabling rapid data transfer in areas where traditional infrastructure is limited or unavailable. As governments and private companies alike invest in these satellite systems, the growth of global connectivity is expected to drive further innovation in the satellite bus market. Another key aspect contributing to the growth of satellite communication systems is the ongoing 5G rollout. The deployment of 5G networks around the world is fueling the need for enhanced satellite communications infrastructure, which will further increase the demand for satellite buses designed to support communication satellites. Governments in Europe have recognized the strategic importance of this technology, investing heavily in space infrastructure to foster connectivity, particularly in remote areas. The rise of private space ventures, such as SpaceX’s Starlink, has also played a critical role in accelerating demand for satellite bus solutions, ensuring that the technology is increasingly seen as a key enabler of future connectivity.

Regulatory support for satellite infrastructure

Governments across Europe are offering substantial funding and regulatory support for satellite infrastructure development. The European Union’s space policy, aimed at fostering the growth of European space capabilities, has provided funding for satellite-based services such as Earth observation, navigation, and communication. Notably, the EU’s Space Strategy for Europe, which seeks to expand Europe’s space exploration capabilities, has created a supportive environment for satellite bus manufacturers. Furthermore, space-related initiatives such as the Galileo satellite navigation system and Copernicus Earth observation program are benefiting from regulatory frameworks that provide a clear path for infrastructure investment. These regulatory initiatives ensure that European players in the satellite bus market can compete effectively on a global scale while maintaining technological leadership. With continued regulatory backing, satellite bus manufacturers are incentivized to develop cutting-edge technologies that meet the growing demands for satellite-based services.

Market Challenges

High development costs for satellite systems

One of the significant challenges facing the Europe Satellite Bus Market is the high cost of satellite system development. The development and manufacturing of satellite buses, especially for advanced LEO constellations, require substantial investments in research, development, and production. This high capital expenditure often results in delayed project timelines and limited funding for small and medium-sized players. Despite advancements in satellite miniaturization, satellite buses remain expensive to produce due to the complexity of integrating various subsystems, including propulsion, communication, and power systems. Additionally, the costs of testing and validating satellite components before launch add further financial burdens on manufacturers. These high costs have created financial barriers for some companies attempting to enter the market, with established players holding a competitive advantage due to their financial resources. For governments and private entities, securing sufficient funding for space projects can be a challenge, especially when satellite systems experience delays or cost overruns.

Technological limitations and integration issues

Another challenge faced by the satellite bus market in Europe is the technological limitations surrounding satellite design and integration. Although technological advancements have made satellite buses more efficient, there are still several technical hurdles to overcome. One major challenge is the integration of new technologies, such as AI-driven satellite management systems, into existing satellite buses. The integration of different subsystems, such as power generation, propulsion, and communication, is a complex task that requires precise coordination. Additionally, the development of environmentally sustainable satellite buses, capable of reducing space debris, presents a significant challenge in terms of technology development and compliance with evolving regulations. Furthermore, many satellite manufacturers are still relying on traditional propulsion systems, which may not meet the growing demand for high-efficiency, low-cost alternatives.

Opportunities

Increasing demand for Earth observation services

The growing demand for Earth observation services presents a significant opportunity for the Europe Satellite Bus Market. Earth observation satellites are crucial for monitoring environmental changes, urban development, and natural disasters, among other applications. As climate change continues to drive the need for better environmental monitoring, the demand for Earth observation satellites is expected to rise. This demand is particularly strong in Europe, where countries such as France and Germany have already established Earth observation programs. These satellites rely heavily on satellite buses for integration and deployment, presenting a major opportunity for satellite bus manufacturers to cater to this market. Furthermore, the rise of commercial satellite constellations for Earth observation, such as Planet Labs, has further increased demand for cost-effective satellite buses. As satellite technology improves, the accuracy and resolution of Earth observation data will also improve, further increasing the demand for satellite buses.

Expansion of private space ventures

The rapid expansion of private space ventures presents a significant opportunity for satellite bus manufacturers in Europe. Companies such as SpaceX, OneWeb, and Amazon are aggressively pursuing satellite constellations in LEO to provide global broadband connectivity and other services. As the private space sector continues to grow, there will be an increasing demand for reliable, cost-effective satellite buses that can support these large-scale satellite systems. The growth of private satellite constellations presents a diversification opportunity for satellite bus manufacturers, allowing them to tap into new markets outside of traditional government contracts. Additionally, private companies are often more flexible and willing to adopt innovative technologies, providing manufacturers with the opportunity to experiment with new satellite bus designs and propulsion systems. As private sector investments in space increase, satellite bus manufacturers are well-positioned to capitalize on this trend by offering customized solutions that meet the specific needs of private space ventures.

Future Outlook

The Europe Satellite Bus Market is expected to continue expanding over the next five years, driven by increasing demand for global connectivity, advancements in satellite miniaturization, and government initiatives supporting space exploration. Technological developments, including advancements in propulsion systems and satellite integration, will play a key role in shaping the future of satellite buses. Additionally, regulatory frameworks supporting the growth of space industries, along with the expansion of private sector ventures, will create opportunities for further market growth. As satellite technology becomes more cost-effective, the demand for satellite buses will continue to rise, particularly for LEO constellations and Earth observation applications.

Major Players

- Airbus Defence and Space

- Lockheed Martin

- Thales Alenia Space

- Arianespace

- Maxar Technologies

- Boeing

- Northrop Grumman Innovation Systems

- SES S.A.

- Iridium Communications

- Orbital Sciences Corporation

- SpaceX

- OneWeb

- Planet Labs

- Surrey Satellite Technology Ltd

- Rocket Lab

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Satellite operators

- Aerospace manufacturers

- Private space companies

- Satellite communication service providers

- Defense contractors

- Earth observation agencies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the critical factors that affect the market, such as key drivers, technological trends, and market demands.

Step 2: Market Analysis and Construction

Market analysis is performed to build a detailed framework by assessing historical data, competitor actions, and market conditions.

Step 3: Hypothesis Validation and Expert Consultation

This stage focuses on refining the research hypothesis through consultations with industry experts and professionals.

Step 4: Research Synthesis and Final Output

The research findings are synthesized into actionable insights, which form the foundation of the final market report.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Satellite Connectivity

Advancements in Miniaturization and Integration

Government Initiatives for Space Exploration - Market Challenges

High Development and Launch Costs

Technological Complexities in Satellite Bus Design

Regulatory and Compliance Barriers - Market Opportunities

Rise in Private Space Ventures

Adoption of CubeSats for Commercial Applications

Technological Advancements in Satellite Propulsion - Trends

Miniaturization of Satellite Systems

Integration of AI in Satellite Operations - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Geostationary Satellite Bus

Non-Geostationary Satellite Bus

Medium-Earth Orbit (MEO) Satellite Bus

Low-Earth Orbit (LEO) Satellite Bus

CubeSat Bus - By Platform Type (In Value%)

Communication Satellites

Earth Observation Satellites

Navigation Satellites

Science Satellites

Technology Demonstration Satellites - By Fitment Type (In Value%)

Onboard Propulsion Systems

Solar Power Systems

Thermal Control Systems

Satellite Control and Communication Systems - By End User Segment (In Value%)

Government and Defense

Private Satellite Operators

Telecommunication Providers

Research Institutions - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus Defence and Space

Lockheed Martin

Boeing Space and Launch

Northrop Grumman Innovation Systems

Thales Alenia Space

Maxar Technologies

SSTL

Rocket Lab

OneWeb

Blue Origin

SpaceX

Astroscale

Arianespace

China Academy of Space Technology

Indian Space Research Organisation

- Government and Defense Investment in Space Infrastructure

- Private Sector’s Shift Toward Low-Cost Satellites

- Growing Adoption of Satellites for Earth Observation

- Increasing Demand for Satellite Communication Services

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035