Market Overview

The Europe Satellite Launch Vehicle market is estimated to be valued at ~, driven primarily by the increasing demand for satellite launches across commercial, governmental, and defense sectors. This growth is fueled by technological advancements in space exploration, with particular emphasis on reusable launch systems and advancements in propulsion technologies. A major driver is the rapid deployment of small satellites for communication, earth observation, and research purposes, increasing the frequency and cost-effectiveness of satellite launches. With growing geopolitical concerns, European nations are investing heavily in space programs, further propelling the market’s expansion.

Based on a recent historical assessment, countries such as France, Germany, and the United Kingdom dominate the European satellite launch vehicle market. France, with its stronghold in space exploration through agencies like CNES and Arianespace, leads the industry due to its advanced infrastructure and established presence in both commercial and government launches. The UK and Germany are also key players, with their involvement in the European Space Agency (ESA) and an increasing number of private space companies fostering the regional market growth. The concentration of industry players and significant government support in these countries cements their dominance in the sector.

Market Segmentation

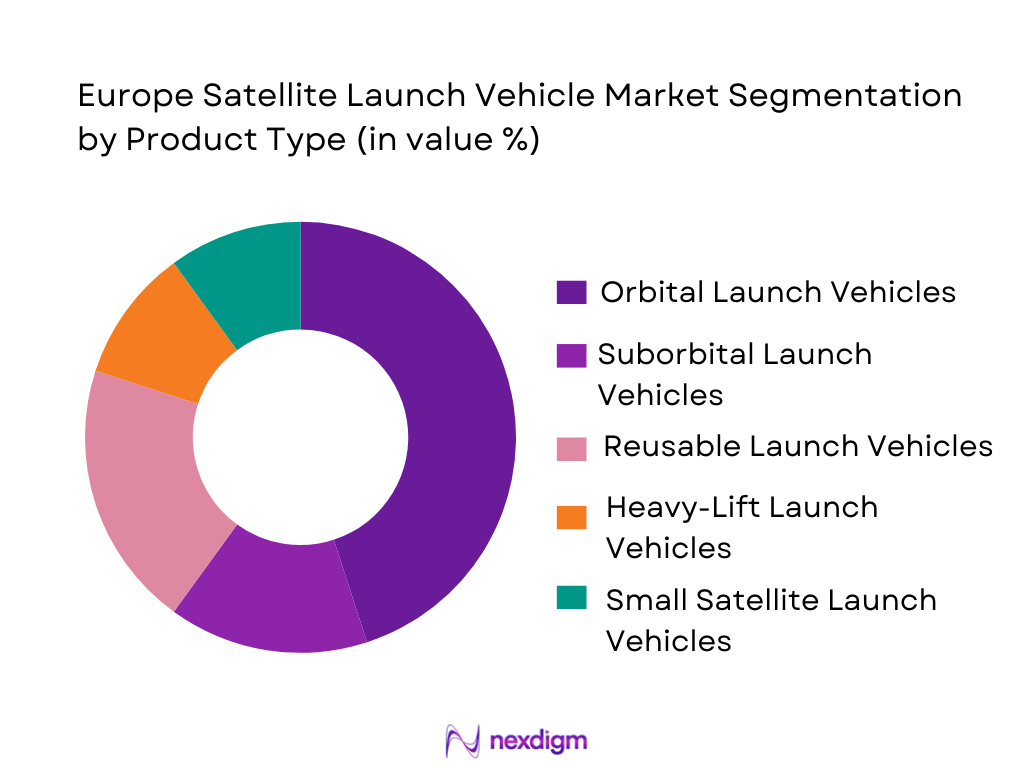

By Product Type

The Europe Satellite Launch Vehicle market is segmented by product type into orbital launch vehicles, suborbital launch vehicles, reusable launch vehicles, heavy-lift launch vehicles, and small satellite launch vehicles. Recently, orbital launch vehicles have dominated the market share due to their broad application in launching payloads to specific orbits for a variety of uses, from communications to satellite constellations. Their proven technology, high payload capacities, and ability to deliver payloads to geosynchronous and low Earth orbits make them the preferred choice for both government and commercial space missions. Orbital vehicles are integral to large-scale satellite launches and have seen continuous improvements in efficiency, which ensures their leading position in the market.

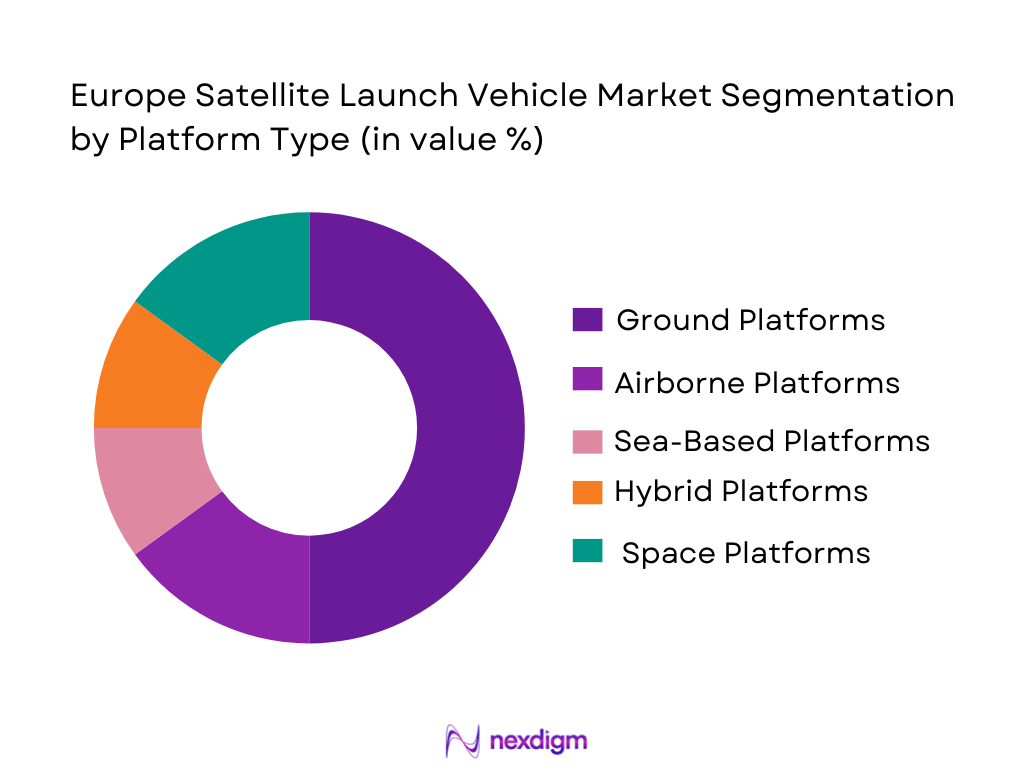

By Platform Type

The Europe Satellite Launch Vehicle market is segmented by platform type into ground platforms, airborne platforms, sea-based platforms, hybrid platforms, and space platforms. Recently, ground platforms have dominated the market share as they offer high stability, cost-effectiveness, and the required infrastructure for consistent and safe launch operations. Ground-based launch sites are strategically located in Europe to cater to a variety of payload types and mission requirements. The use of ground platforms allows for easier maintenance and operational control, contributing to their prominence in the market.

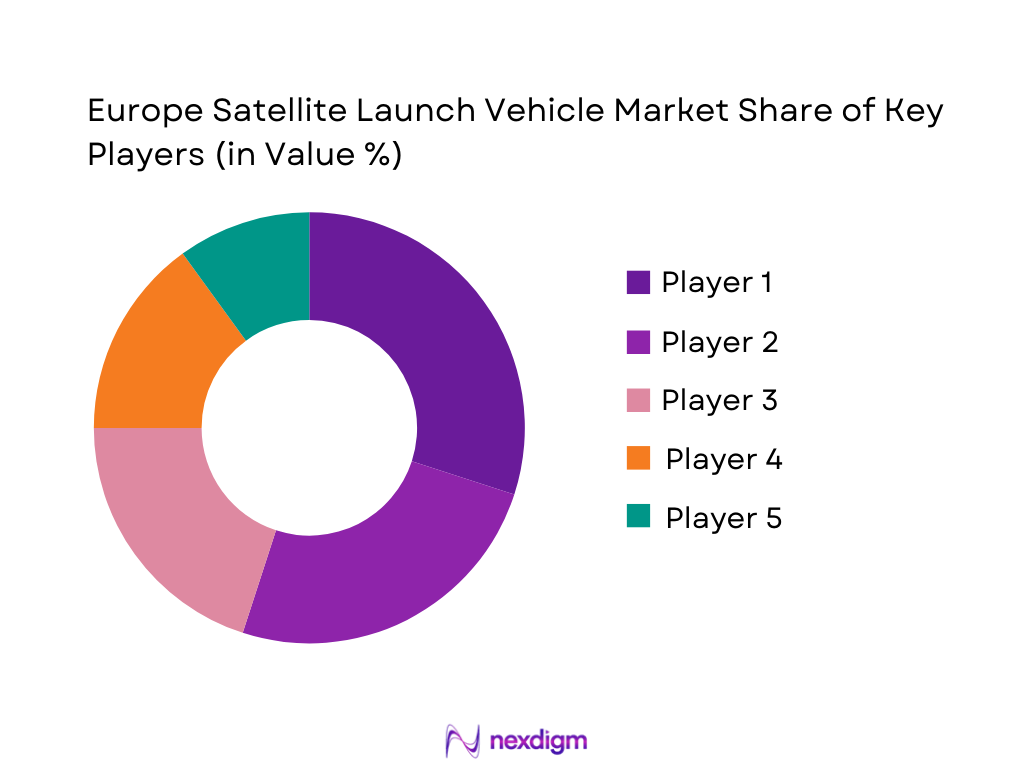

Competitive Landscape

The Europe Satellite Launch Vehicle market is characterized by a highly competitive landscape with both established aerospace giants and emerging private space companies. Key players dominate the market through advanced technologies, innovative solutions, and long-standing partnerships with government agencies and commercial clients. Additionally, new entrants focus on reusability and cost reduction, shaking up the traditional aerospace space. As demand for satellite launches rises, market consolidation is anticipated with mergers and partnerships forming between private companies and governmental entities, accelerating technological advancement.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameter |

| Arianespace | 1980 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| SpaceX | 2002 | Hawthorne, USA | ~ | ~ | ~ | ~ | ~ |

| Blue Origin | 2000 | Kent, USA | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, USA | ~ | ~ | ~ | ~ | ~ |

| Rocket Lab | 2006 | Long Beach, USA | ~ | ~ | ~ | ~ | ~ |

Europe Satellite Launch Vehicle Market Analysis

Growth Drivers

Technological Advancements in Reusable Launch Systems

Technological advancements in reusable launch systems are rapidly transforming the European satellite launch vehicle market. With companies like SpaceX leading the charge, the cost per launch has dramatically decreased, which is making space more accessible for governments and commercial entities. Reusability allows for the rapid turnaround of launch vehicles, thereby reducing operational costs and enabling more frequent missions. This is proving to be a significant advantage, especially for smaller companies and startups that are now able to afford satellite launches previously out of their budget. The European industry is also adopting reusable technologies, with companies such as Arianespace working towards cost-efficient launches with reusable boosters. This innovation is expected to drive further demand for launch vehicles as the process becomes more affordable and streamlined, opening up new opportunities for companies involved in telecommunications, earth observation, and more.

Expansion of Small Satellite Markets

The increasing demand for small satellites has emerged as a key driver in the satellite launch vehicle market. With applications ranging from communications and navigation to earth observation and scientific research, small satellites are transforming industries by offering cost-effective and flexible solutions. These small satellites are highly valued in commercial and governmental space missions, particularly due to their affordability and ease of deployment. The growing trend towards satellite constellations, which enable services such as global internet coverage and weather forecasting, is expanding the demand for launches specifically catered to smaller payloads. To support this, space companies are adapting their launch vehicles, such as developing smaller rockets and dedicated rideshare programs. These developments make space more accessible to various industries, further enhancing the demand for launch vehicles in Europe.

Market Challenges

High Capital Expenditure in Space Infrastructure

One of the significant challenges facing the European satellite launch vehicle market is the high capital expenditure required to maintain and develop launch infrastructure. The development of launch vehicles, ground facilities, and support infrastructure is a capital-intensive process, requiring significant financial investment. Despite government funding in Europe, private companies are still required to secure substantial investments for ongoing operations and research. The long development cycles and the need for continuous advancements in technology to ensure the vehicles remain competitive place additional pressure on companies operating in the sector. As the demand for satellite launches grows, the need to expand infrastructure while keeping operational costs low becomes increasingly challenging for stakeholders.

Regulatory and Compliance Hurdles

Regulatory and compliance hurdles are a major challenge for the European satellite launch vehicle market. The space industry is heavily regulated, with stringent rules set by national governments, as well as the European Space Agency (ESA). These regulations cover aspects ranging from environmental considerations to safety standards for launch vehicles. Companies looking to operate in the market must navigate complex licensing procedures, insurance requirements, and adherence to international treaties. This regulatory burden can delay projects and increase the time it takes to launch new vehicles, creating barriers to entry for smaller companies. Additionally, the evolving regulatory landscape around space traffic management and orbital debris mitigation poses another challenge for companies seeking to expand their operations.

Opportunities

Growth in Satellite Constellations

The demand for satellite constellations is a major opportunity for the European satellite launch vehicle market. With satellite constellations enabling continuous, low-latency communication services for global coverage, the requirement for regular launches of multiple satellites is growing. Companies like SpaceX and OneWeb are already deploying their own constellations, and similar initiatives are being developed in Europe. These large-scale satellite networks, which offer a variety of services from broadband internet to Earth observation, are a key area for future growth. With increasing demand from commercial enterprises, telecommunication providers, and governments, the need for reliable and affordable launch services is expected to expand significantly in the coming years, driving the satellite launch vehicle market forward.

Space Tourism and Private Space Missions

The rise of space tourism and private space missions represents a significant growth opportunity for the European satellite launch vehicle market. SpaceX, Blue Origin, and other private companies have demonstrated the potential of using reusable vehicles for commercial space travel, and Europe is poised to participate in this sector. With advancements in reusable launch vehicle technologies, the cost of launching human and non-human payloads into space is decreasing, making space travel more accessible. Companies operating in the space tourism sector are expected to require dedicated vehicles for this market, creating new opportunities for European satellite launch providers to cater to the growing demand for commercial space missions.

Future Outlook

The Europe Satellite Launch Vehicle market is expected to experience robust growth over the next five years, driven by advancements in technology, increased demand for small satellite launches, and the continued rise of space exploration. Technological developments, such as reusable launch systems and improved propulsion technologies, will make space access more affordable and efficient. Additionally, regulatory support from European governments and agencies, including the European Space Agency, will help facilitate market growth by creating a conducive environment for private sector investment. On the demand side, the increasing deployment of satellite constellations and growing interest in space tourism are expected to drive further expansion in the sector.

Major Players

- Arianespace

- SpaceX

- Blue Origin

- Northrop Grumman

- Rocket Lab

- ISRO

- Lockheed Martin

- Boeing

- United Launch Alliance

- Relativity Space

- OneWeb

- Virgin Orbit

- Firefly Aerospace

- Orbital ATK

- Sierra Nevada Corporation

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace and defense manufacturers

- Satellite communication companies

- Space exploration agencies

- Space-based data and analytics providers

- Private sector space companies

- Commercial satellite operators

Research Methodology

Step 1: Identification of Key Variables

The first step in the research methodology involves identifying the key variables that will affect the market, including technological advancements, regulatory frameworks, and economic factors.

Step 2: Market Analysis and Construction

In this phase, a comprehensive analysis of the market’s existing landscape is conducted, which includes evaluating historical data, current trends, and emerging developments in satellite launch technologies.

Step 3: Hypothesis Validation and Expert Consultation

The next step involves validating hypotheses through expert consultations with industry leaders, space agencies, and other stakeholders to ensure the market projections are accurate and reliable.

Step 4: Research Synthesis and Final Output

The final step is the synthesis of the gathered data and analysis into a coherent market report, providing actionable insights, forecasts, and recommendations for stakeholders in the satellite launch vehicle industry.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Demand for Small Satellites

Government Investment in Space Exploration

Advancements in Reusable Rocket Technology - Market Challenges

High Costs of Launch Services

Technological Barriers to Innovation

Regulatory and Safety Compliance Issues - Market Opportunities

Expansion in Small Satellite Launches

Partnerships Between Private Companies and Governments

Emerging Space Exploration Initiatives - Trends

Development of Commercial Space Ports

Advances in Eco-friendly Propulsion Systems - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Orbital Launch Vehicles

Suborbital Launch Vehicles

Reusable Launch Vehicles

Heavy-Lift Launch Vehicles

Small Satellite Launch Vehicles - By Platform Type (In Value%)

Ground Platforms

Airborne Platforms

Sea-Based Platforms

Hybrid Platforms

Space Platforms - By Fitment Type (In Value%)

On-demand Launch Services

Dedicated Launch Services

Ride-share Launch Services

Platform-agnostic Launch Services - By End User Segment (In Value%)

Government and Space Agencies

Private Space Companies

Telecommunication Operators

Research and Educational Institutions - By Procurement Channel (In Value%)

Direct Procurement

Private Sector Contracts

Government Tendering

Third-party Providers

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Arianespace

SpaceX

Blue Origin

Northrop Grumman Innovation Systems

Virgin Orbit

Sierra Nevada Corporation

Rocket Lab

ULA

ISRO

OneWeb

Firefly Aerospace

Relativity Space

Orbital ATK

PLD Space

ExPace

- Government Agencies’ Dependence on Satellite Launches

- Private Companies Increasing Launch Demand

- Technological Innovation from Educational Institutions

- Research Organizations’ Demand for Cost-effective Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035