Market Overview

The Europe Small UAV market current size stands at around USD ~ million, reflecting sustained adoption across commercial services, public safety, and defense applications. Demand momentum is supported by recurring procurement cycles, fleet replacements, and expanding operational permissions for beyond-visual-line-of-sight missions. Capital deployment into domestic manufacturing capabilities, secure navigation modules, and autonomous docking solutions continues to underpin ecosystem resilience. Service-led deployment models and software-defined payload upgrades further reinforce platform utilization intensity across diverse mission profiles.

Operational concentration is strongest in Germany, France, and the United Kingdom, supported by dense transport and energy infrastructure, mature service provider ecosystems, and advanced airspace management frameworks. Southern Europe shows accelerating uptake linked to renewable energy inspection and agriculture digitization. Nordic countries lead in offshore wind and maritime surveillance use cases. Urban clusters with smart city programs and public safety modernization initiatives concentrate deployments, while defense testing corridors and coastal zones anchor specialized operational demand.

Market Segmentation

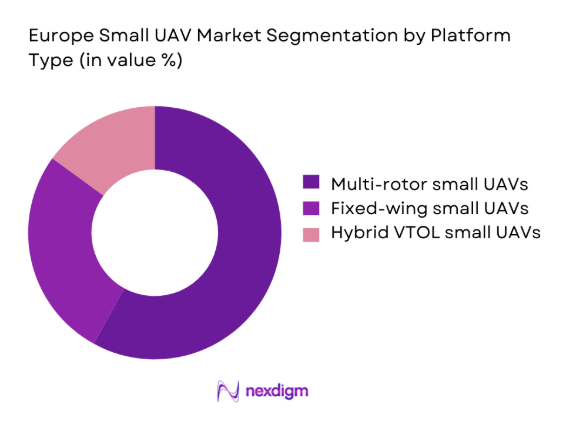

By Platform Type

Multi-rotor platforms dominate near-term deployments due to operational flexibility across inspection, emergency response, and urban mapping missions. Fixed-wing systems retain strong relevance in corridor mapping and maritime patrol where endurance and range are critical. Hybrid VTOL adoption is rising as operators seek runway-independent launch with fixed-wing efficiency for linear asset monitoring. Procurement preferences increasingly favor modular airframes that can switch payloads across optical, thermal, and multispectral sensors, reducing fleet complexity. Regulatory compliance requirements further reinforce demand for platforms with integrated remote identification and geofencing, while mission-specific endurance profiles drive differentiated platform selection across infrastructure, agriculture, and coastal surveillance operations.

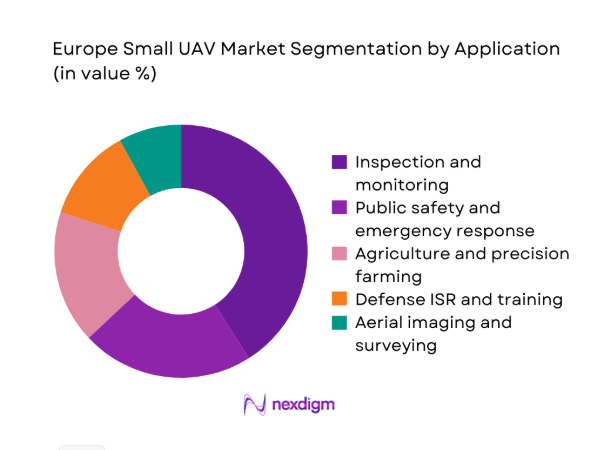

By Application

Inspection and monitoring dominate deployments driven by dense transport networks, energy grids, and utilities maintenance cycles. Public safety and emergency response adoption continues to expand with integration into command-and-control workflows and rapid incident assessment protocols. Agriculture and precision farming usage concentrates in regions with high-value crops and fragmented land parcels, where targeted imaging improves yield management. Defense ISR and training remain specialized but stable, anchored in border surveillance and tactical training ranges. Logistics pilots remain localized within regulatory sandboxes, while aerial imaging sustains demand across construction, insurance, and urban planning programs.

Competitive Landscape

The competitive environment is characterized by diversified platform portfolios, strong software integration capabilities, and growing emphasis on regulatory compliance readiness. Companies differentiate through autonomous features, service networks, and interoperability with fleet management platforms to secure enterprise and government contracts.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| DJI | 2006 | Shenzhen, China | ~ | ~ | ~ | ~ | ~ | ~ |

| Parrot | 1994 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

| senseFly | 2009 | Lausanne, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Wingtra | 2016 | Zurich, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Quantum-Systems | 2015 | Gilching, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Europe Small UAV Market Analysis

Growth Drivers

Expansion of BVLOS operations enabled by regulatory frameworks

EASA’s common rules enabled BVLOS trials across 12 European states during 2024, expanding corridors for energy and rail inspection. National aviation authorities processed 146 operational authorizations in 2025 for BVLOS missions, compared with 89 in 2024, reflecting administrative capacity growth. U-space pilots covered 9 metropolitan areas by 2025, improving deconfliction with crewed aviation. Digital remote identification modules were mandated in 2024 across EU member states, accelerating compliant fleet upgrades. Public agencies integrated 74 new operational scenarios for emergency response in 2025, increasing routine deployment frequency and operational normalization across regulated airspace.

Rising demand for drone-based inspection of energy and transport infrastructure

Europe added 21 offshore wind projects between 2024 and 2025, increasing asset density requiring periodic inspection. Transmission system operators scheduled 38 corridor maintenance programs in 2025 using unmanned inspection to reduce outage windows. Rail authorities recorded 4,200 bridge inspections in 2024 transitioning to aerial surveys for rapid triage. Road agencies expanded slope stability monitoring across 19 mountainous corridors in 2025 following climate-related incidents in 2023. Grid operators reported 6 regional storm events in 2024 that required rapid asset assessment, reinforcing routine adoption of aerial inspection for resilience planning and preventive maintenance scheduling.

Challenges

Fragmented regulatory implementation across European states

Despite common rules, 27 national authorities maintained distinct authorization workflows in 2024, extending approval timelines. BVLOS approval processing ranged from 21 days to 96 days across jurisdictions in 2025, creating operational uncertainty for cross-border service providers. Variations in geofencing data standards across 14 states required parallel software configurations in 2024. Remote identification enforcement protocols differed across 9 countries in 2025, complicating fleet compliance audits. Training certification requirements varied between 3 license tiers in 2024, increasing operator onboarding time and constraining rapid scaling of multi-country inspection contracts.

Airspace integration and U-space readiness constraints

U-space services were operational in 9 metropolitan areas by 2025, leaving large logistics corridors without dynamic traffic management coverage. Air navigation service providers conducted 47 integration trials in 2024, yet real-time conflict resolution remained limited outside pilot zones. Legacy ATM systems required 18 interface upgrades across 2025 to support unmanned traffic data exchange. Temporary flight restrictions were imposed 62 times in 2024 due to major events, disrupting scheduled inspection missions. Limited sensor fusion coverage across 11 rural regions constrained detect-and-avoid validation, delaying scalable deployment in low-density airspace environments.

Opportunities

Commercial scaling of BVLOS-enabled inspection services

Energy utilities issued 31 multi-year service tenders in 2025 to shift corridor inspections toward BVLOS operations. Rail infrastructure managers consolidated 14 regional inspection contracts into national frameworks in 2024, favoring operators with BVLOS authorization capacity. Pipeline operators planned 22 linear asset monitoring programs in 2025 following integrity audits in 2023. Insurance providers mandated aerial evidence capture for 7 catastrophe response frameworks in 2024, creating recurring service demand. Port authorities initiated 6 coastal surveillance programs in 2025, enabling scalable BVLOS service models aligned with compliance-ready fleet deployment.

Localization of critical UAV components and secure supply chains

Industrial policy programs supported 11 component manufacturing projects in 2024 to localize navigation, datalink, and imaging modules. Secure communication standards were adopted by 8 defense procurement agencies in 2025, prioritizing domestically validated subsystems. Semiconductor packaging facilities expanded capacity across 5 regions in 2024, improving lead times for flight controllers. Cybersecurity certification frameworks were introduced by 3 national agencies in 2025, encouraging supplier compliance investments. Public procurement rules in 2024 mandated secure-origin components for 9 categories of unmanned systems, strengthening localized supply ecosystems.

Future Outlook

The Europe Small UAV market is positioned for steady operational normalization as regulatory harmonization deepens and U-space services extend beyond pilot zones. Cross-border service frameworks and standardized digital identification will support scalable deployments. Growth will be shaped by infrastructure resilience programs, public safety modernization, and defense ISR requirements, alongside increasing software-driven autonomy and fleet orchestration capabilities through 2035.

Major Players

- DJI

- Parrot

- senseFly

- Wingtra

- Skydio

- Quantum-Systems

- Delair

- Flyability

- Airobotics

- Azur Drones

- Autel Robotics

- Microdrones

- Drone Volt

- Yuneec

- Teledyne FLIR

Key Target Audience

- Energy and utilities asset owners

- Transport infrastructure operators and rail authorities

- Defense procurement agencies and border security commands

- National police services and civil protection agencies

- Port authorities and maritime surveillance operators

- Smart city program offices in municipal governments

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

The scope defined operational classes, payload categories, and regulatory readiness parameters across civil and defense use cases. Demand drivers were mapped to infrastructure density, inspection frequency, and emergency response protocols. Supply variables captured manufacturing localization, software autonomy maturity, and compliance readiness. Channel variables reflected service models and procurement pathways.

Step 2: Market Analysis and Construction

Data was structured across platform types, applications, and country clusters to reflect operational concentration patterns. Deployment workflows were mapped to regulatory regimes and airspace integration maturity. Adoption intensity was assessed through fleet utilization patterns and mission profiles. Ecosystem linkages between operators, software providers, and service partners were consolidated.

Step 3: Hypothesis Validation and Expert Consultation

Operational hypotheses were validated through structured consultations with regulators, fleet operators, and infrastructure owners. Scenario testing incorporated U-space rollout stages and authorization timelines. Feedback loops refined assumptions on BVLOS scalability and service model adoption. Regulatory alignment risks and integration bottlenecks were stress-tested across country clusters.

Step 4: Research Synthesis and Final Output

Findings were synthesized into market narratives aligned to policy, infrastructure, and ecosystem maturity. Segment-level insights were consolidated into actionable frameworks for platform selection and service deployment. Cross-functional implications for compliance, operations, and procurement were integrated. Final outputs were structured for executive decision-making and strategic planning.

- Executive Summary

- Research Methodology (Market Definitions and classification by MTOW and use case, Primary interviews with European UAV OEMs and operators, Analysis of EASA and national aviation authority datasets, Import-export and shipment tracking across EU-27 and UK, Tender and contract award tracking for public safety and defense UAVs, Fleet and installed base modeling by application)

- Definition and Scope

- Market evolution

- Usage pathways across civil, commercial, and defense

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising demand for drone-based inspection of energy and transport infrastructure

Adoption of UAVs in precision agriculture and crop analytics

Public safety modernization and emergency response digitization

Growing use of small UAVs for tactical ISR by European defense forces

Urban planning and smart city monitoring initiatives - Challenges

Fragmented regulatory implementation across European states

Airspace integration and U-space readiness constraints

Data privacy and cybersecurity compliance burdens

Limited endurance and payload constraints of small UAVs

Supply chain dependence on non-European components

Public acceptance and noise concerns in urban deployments - Opportunities

Commercial scaling of BVLOS-enabled inspection services

Localization of critical UAV components and secure supply chains

Growth of drone-in-a-box and autonomous docking solutions

Integration of AI analytics for automated data processing

Expansion of UAV services in offshore wind and maritime surveillance

Cross-border harmonization of operational approvals within EASA framework - Trends

Miniaturization of sensors and edge AI payloads

Shift toward platform-agnostic fleet management software

Adoption of hydrogen and extended endurance power modules

Growth of subscription-based UAV service models

Standardization of remote ID and geofencing compliance

Increased procurement of counter-UAS compatible small UAV fleets - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Shipment Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Platform Type (in Value %)

Fixed-wing small UAVs

Multi-rotor small UAVs

Hybrid VTOL small UAVs - By Maximum Take-Off Weight Class (in Value %)

<250 grams

250 g–2 kg

2 kg–25 kg - By Application (in Value %)

Aerial imaging and surveying

Inspection and monitoring

Agriculture and precision farming

Public safety and emergency response

Defense ISR and training

Logistics and light delivery pilots - By End Use Sector (in Value %)

Commercial enterprises

Government and public safety agencies

Defense and military

Research and academia - By Country (in Value %)

Germany

France

United Kingdom

Italy

Spain

Rest of Europe

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (platform performance, payload capacity, endurance, BVLOS readiness, regulatory compliance, software ecosystem, service network coverage, pricing tiers) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

DJI

Parrot

senseFly

Wingtra

Skydio

Quantum-Systems

Delair

Flyability

Airobotics

Azur Drones

Autel Robotics

Microdrones

Drone Volt

Yuneec

Teledyne FLIR

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Shipment Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035