Market Overview

The Europe Smart Airport market current size stands at around USD ~ million, reflecting sustained investment in digital passenger processing, security automation, and airside operational intelligence across major and secondary airports. Deployment momentum is anchored in modernization of terminal systems, biometric identity management, and integrated operations platforms that coordinate airside, landside, and terminal workflows. Vendor ecosystems align solutions across IoT, AI-enabled analytics, and cloud-edge orchestration to support resilience, safety, and service quality, while procurement frameworks emphasize lifecycle support, cybersecurity assurance, and regulatory compliance.

Western European hubs and Northern European innovation clusters dominate deployments due to dense air traffic corridors, multimodal connectivity, and advanced digital infrastructure. Major gateway cities concentrate demand through large terminal footprints, complex baggage and security flows, and integrated urban mobility linkages. Mature systems integration capabilities and strong public procurement processes accelerate adoption, while region-wide policy alignment on data protection, aviation security, and sustainability standards shapes implementation priorities. Secondary airports in Southern and Central Europe show accelerating uptake driven by capacity optimization and service digitization programs.

Market Segmentation

By Solution Type

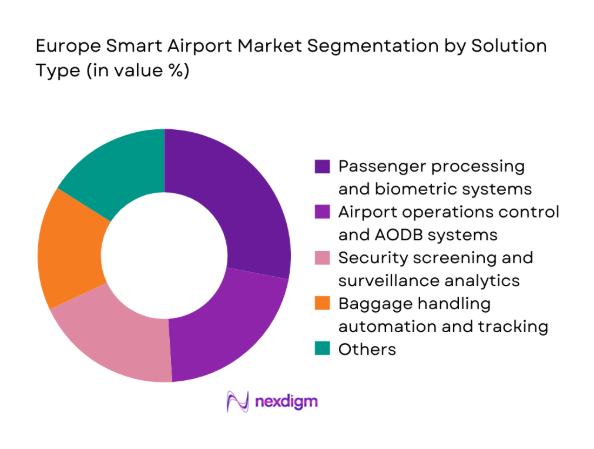

Passenger processing and biometric systems dominate adoption due to persistent terminal congestion, border control modernization, and the need for seamless identity verification across check-in, security, and boarding. Airport operations control platforms are prioritized to integrate flight information, stand allocation, and disruption management within unified dashboards. Security screening and surveillance analytics benefit from regulatory alignment and risk-based screening mandates. Baggage handling automation addresses misrouting and dwell-time reduction, while smart parking and curbside management improve landside throughput. Energy management systems gain traction through decarbonization targets, enabling predictive maintenance and real-time optimization across terminals and airside assets, strengthening operational continuity.

By Deployment Model

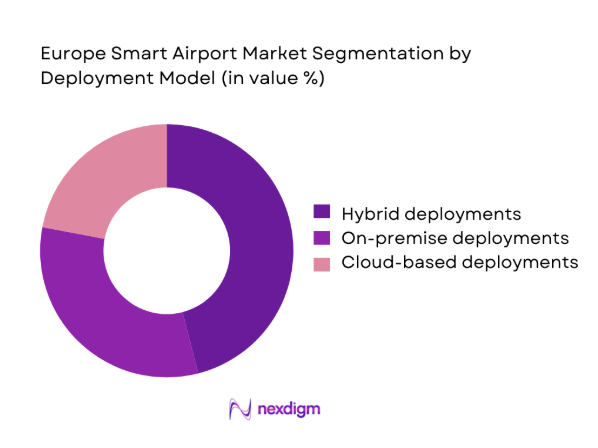

Hybrid deployments lead adoption as airports balance legacy system constraints with cloud scalability and edge processing for latency-sensitive use cases. On-premise deployments remain relevant for security-critical workloads, sovereign data requirements, and integration with airside control systems. Cloud-based deployments accelerate innovation cycles for analytics, digital twins, and passenger engagement platforms, supported by evolving data governance frameworks. The dominance of hybrid models reflects procurement risk management, phased migration strategies, and the need for resilience during peak operations. This mix enables airports to modernize incrementally while maintaining operational continuity, cybersecurity posture, and regulatory compliance across distributed terminal and airside environments.

Competitive Landscape

Competition centers on integrated solution breadth, systems integration capability, and regulatory readiness for aviation security and data protection. Differentiation is driven by reference deployments at large hubs, depth in AI-enabled operations, and lifecycle service models that reduce downtime and cybersecurity risk.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Amadeus IT Group | 1987 | Madrid, Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| Indra Sistemas | 1993 | Madrid, Spain | ~ | ~ | ~ | ~ | ~ | ~ |

| SITA | 1949 | Geneva, Switzerland | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | Paris, France | ~ | ~ | ~ | ~ | ~ | ~ |

| Siemens | 1847 | Munich, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Europe Smart Airport Market Analysis

Growth Drivers

Rising passenger volumes and congestion management needs

European hub terminals recorded passenger throughput rebounds in 2024 and 2025 following recovery in international routes, with monthly peak-day flows exceeding 120000 at major gateways. Border control queues extended beyond 45 minutes during summer peaks, stressing security lanes and boarding gates. Aviation authorities expanded slot coordination windows to 16 hours daily at congested airports, increasing stand utilization pressure. Ground handling turnarounds averaged 38 minutes on narrow-body fleets, creating cascading delays. These conditions accelerated investments in biometric e-gates, AI queue forecasting, and integrated operations control to stabilize flows, reduce missed connections, and maintain safety compliance under volatile demand patterns across interconnected airport systems.

EU-funded airport modernization and digital transformation programs

Public programs across transport and digital agendas allocated multi-year modernization envelopes to airports between 2022 and 2025, supporting terminal automation, cybersecurity hardening, and sustainability instrumentation. Cohesion and resilience frameworks funded pilot deployments at over 40 regional airports, prioritizing smart security lanes and integrated operations dashboards. National aviation strategies mandated interoperable data exchange standards for flight information and passenger processing systems, with compliance audits conducted annually. Energy performance directives required real-time monitoring across terminals exceeding 50000 square meters, driving sensor rollouts and analytics integration. These institutional mandates lowered procurement risk, standardized architectures, and accelerated adoption of interoperable smart airport platforms across jurisdictions.

Challenges

High upfront capital expenditure and long procurement cycles

Airport capital programs face multi-year approval gates, with tender cycles spanning 12 to 24 months for security, baggage, and operations platforms. Budget committees require staged milestones across 6 governance checkpoints, delaying system commissioning and benefits realization. Terminal retrofits disrupt operations for 8 to 16 weeks per phase, increasing contingency planning burdens. Financing constraints at secondary airports limit parallel modernization streams, forcing sequential upgrades that extend integration timelines. Public procurement thresholds trigger competitive dialogues and technical compliance audits, adding documentation cycles. These constraints slow deployment velocity for end-to-end smart airport architectures, delaying integration benefits across airside, landside, and terminal systems.

Complex integration with legacy airport IT and OT systems

Legacy AODB, BHS PLC controllers, and proprietary security interfaces complicate integration with modern cloud-edge platforms. Many terminals operate mixed-generation equipment with firmware older than 2016, requiring custom middleware and protocol translation. Downtime windows for OT upgrades are limited to 6 hours during overnight curfews, constraining migration speed. Data models vary across 14 common vendor schemas, hindering unified analytics. Cybersecurity hardening mandates segmentation across 3 network tiers, increasing integration overhead. Skills shortages in OT cybersecurity and middleware engineering extend commissioning timelines by 4 to 9 months, elevating project risk and operational disruption potential.

Opportunities

Expansion of biometric corridors and seamless travel initiatives

Interoperable biometric corridors across check-in, security, and boarding reduce manual document checks and queue dwell time. Trials conducted between 2023 and 2025 demonstrated throughput increases of 22 at peak lanes, with average processing time per passenger reduced by 18 seconds. Cross-border alignment on identity frameworks enables reciprocal recognition at participating airports, improving transfer experience. Airline participation agreements expanded to 27 carriers, enabling enrollment continuity across routes. Data protection compliance frameworks matured through standardized consent flows and on-device matching. Scaling these corridors unlocks network effects, improving passenger experience and operational predictability while maintaining security assurance.

Adoption of digital twins for capacity planning and resilience

Digital twins model terminal flows, stand utilization, and disruption scenarios to inform capital phasing and operational readiness. Between 2022 and 2025, simulation pilots reduced schedule recovery time by 14 hours during weather events and airspace constraints. Integrating weather feeds, gate allocation rules, and ground handling resources enables scenario testing across 365-day operating calendars. Decision cycles for re-gating compressed from 20 minutes to 5 minutes using prescriptive analytics. These capabilities support evidence-based investments in terminal reconfiguration, remote stands, and staffing rosters, enhancing resilience against demand volatility and operational shocks while improving service continuity.

Future Outlook

The market is expected to advance through phased modernization of terminals, deeper IT–OT convergence, and standardized biometric travel frameworks across Europe. Policy alignment on data protection and aviation security will continue shaping deployment models. Cloud-edge orchestration, digital twins, and sustainability instrumentation will anchor long-term transformation agendas through 2035.

Major Players

- Amadeus IT Group

- Indra Sistemas

- SITA

- Thales Group

- Siemens

- Honeywell

- Schneider Electric

- Leonardo

- NEC Corporation

- IBM

- Cisco Systems

- SAP

- Atos

- Fraport AG

- T-Systems

Key Target Audience

- Airport authorities and airport operating companies

- Airlines and ground handling service providers

- Civil aviation authorities and airport security agencies

- Ministries of transport and digitalization agencies

- Border control and immigration agencies

- Investments and venture capital firms

- Systems integrators and airport infrastructure developers

- Smart mobility platform operators

Research Methodology

Step 1: Identification of Key Variables

Scope definition covered passenger processing, security, operations control, baggage automation, and smart facilities. Variables mapped across IT and OT domains, compliance constraints, and lifecycle service requirements. Use cases were prioritized by terminal throughput, disruption sensitivity, and cybersecurity exposure.

Step 2: Market Analysis and Construction

Demand indicators were constructed using traffic recovery patterns, terminal capacity constraints, and policy mandates. Technology stacks were mapped across cloud-edge, AI analytics, and identity frameworks. Adoption pathways were structured by airport size, procurement models, and integration complexity.

Step 3: Hypothesis Validation and Expert Consultation

Operational assumptions were validated with airport operations leaders, security program managers, and systems engineers. Scenario testing incorporated disruption recovery, staffing constraints, and interoperability readiness. Policy alignment and compliance feasibility were stress-tested against aviation security and data protection frameworks.

Step 4: Research Synthesis and Final Output

Findings were synthesized into adoption pathways, risk frameworks, and investment prioritization lenses. Cross-domain insights were consolidated to reflect IT–OT convergence realities. Outputs were structured for strategic planning, procurement design, and phased deployment roadmaps.

- Executive Summary

- Research Methodology (Market Definitions and smart airport technology scope alignment, Primary interviews with airport authorities and system integrators, Analysis of airport IT and OT procurement tenders, Vendor shipment and installed base tracking, Traffic growth and CAPEX/OPEX modeling by airport size, Regulatory and funding program review across EU and UK, Triangulation using passenger throughput and infrastructure datasets)

- Definition and Scope

- Market evolution

- Usage and passenger journey pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising passenger volumes and congestion management needs

EU-funded airport modernization and digital transformation programs

Demand for contactless and biometric passenger processing

Operational efficiency and cost reduction pressures on airports

Security compliance and enhanced surveillance requirements

Sustainability targets driving smart energy and asset management - Challenges

High upfront capital expenditure and long procurement cycles

Complex integration with legacy airport IT and OT systems

Data privacy and biometric regulation compliance constraints

Fragmented vendor ecosystem and interoperability gaps

Cybersecurity risks across connected airport infrastructure

Budget constraints at regional and secondary airports - Opportunities

Expansion of biometric corridors and seamless travel initiatives

Adoption of digital twins for capacity planning and resilience

Public-private partnerships for smart infrastructure deployment

AI-driven predictive maintenance for airside and terminal assets

Green airport initiatives using smart energy and waste management

Commercialization of passenger data insights for non-aeronautical revenue - Trends

Convergence of IT and OT platforms in airport operations

Edge AI deployment for real-time security and flow management

Cloud migration of AODB and airport management systems

Integration of multimodal transport platforms with airports

Use of robotics and autonomous vehicles in airside logistics

Standardization of biometric travel frameworks across Europe - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Solution Type (in Value %)

Passenger processing and biometric systems

Airport operations control and AODB systems

Security screening and surveillance analytics

Baggage handling automation and tracking

Smart parking and curbside management

Energy management and smart facilities - By Technology (in Value %)

Internet of Things sensors and gateways

Artificial intelligence and computer vision

Biometric identification technologies

Cloud and edge computing platforms

Big data and advanced analytics

Digital twin and simulation tools - By Airport Size (in Value %)

Large hub airports

Medium-sized international airports

Small regional and domestic airports - By Deployment Model (in Value %)

On-premise deployments

Cloud-based deployments

Hybrid deployments - By Geography (in Value %)

Western Europe

Northern Europe

Southern Europe

Central and Eastern Europe

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (solution breadth, system integration capability, airport reference base, regulatory compliance readiness, cybersecurity certifications, deployment scalability, local service coverage, total cost of ownership) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

Amadeus IT Group

Indra Sistemas

SITA

Thales Group

Siemens

Honeywell

Schneider Electric

Leonardo

NEC Corporation

IBM

Cisco Systems

SAP

Atos

Fraport AG

T-Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035