Market Overview

The Europe Space Propulsion market current size stands at around USD ~ million, reflecting active demand across commercial, institutional, and defense-led missions that require reliable in-orbit maneuvering, launch vehicle stage propulsion, and precision attitude control. The market is shaped by multi-mission propulsion architectures, strong emphasis on safety-compliant propellants, and long qualification cycles. Supply ecosystems are tightly coupled with satellite manufacturing programs and launcher integration pipelines, with procurement influenced by program-based contracting and long-term framework agreements across Europe’s space value chain.

Regional demand concentration is strongest in Western Europe, anchored by dense satellite manufacturing clusters, launch infrastructure, and propulsion testing facilities. France and Germany benefit from mature industrial ecosystems, deep engineering talent pools, and anchor institutional programs. Southern Europe is emerging through micro-launcher development and smallsat manufacturing hubs, while Nordic countries contribute electric propulsion innovation. Policy alignment across European institutions, export controls, and safety regulation frameworks further shapes procurement patterns and ecosystem coordination across borders.

Market Segmentation

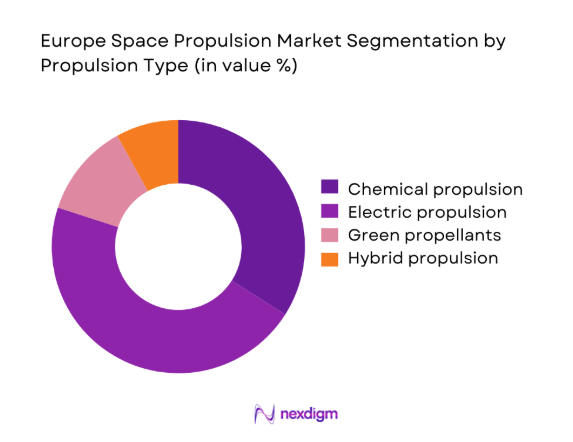

By Propulsion Type

Electric propulsion dominates deployment decisions as operators prioritize endurance, mass efficiency, and mission flexibility across LEO and GEO platforms. Chemical propulsion retains relevance for launch vehicle stages, high-thrust maneuvers, and responsive mission profiles where rapid impulse delivery is required. Green propellant systems are gaining traction due to tightening safety standards and ground handling constraints. Hybrid architectures are increasingly selected for multi-orbit missions requiring both efficient station keeping and high-thrust orbit raising, reflecting evolving mission design preferences among European platform integrators.

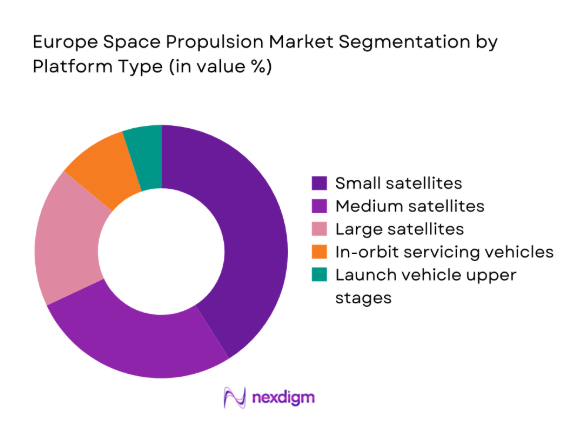

By Platform Type

Small satellites account for the largest deployment base due to constellation growth, technology demonstration missions, and responsive launch programs. Medium satellites sustain stable demand across Earth observation and communications programs, while large satellites continue to drive high-performance propulsion requirements for GEO missions. In-orbit servicing vehicles are emerging as a distinct platform category as European programs prioritize life-extension, relocation, and debris mitigation capabilities. Launch vehicle upper stages remain strategically important due to sovereign access-to-space objectives and reusable launcher development programs.

Competitive Landscape

The competitive environment is shaped by vertically integrated aerospace primes, specialized propulsion subsystem manufacturers, and emerging innovators focused on electric and green propellant technologies. Market positioning is influenced by qualification heritage, compliance readiness, delivery reliability, and long-term partnerships with platform integrators and institutional programs.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| ArianeGroup | 2015 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Safran | 1924 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| OHB System | 1958 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space | 2014 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Avio | 1908 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

Europe Space Propulsion Market Analysis

Growth Drivers

Rising European smallsat constellation deployments

European operators expanded small satellite manufacturing lines across France, Germany, and Spain, with 2024 seeing 214 spacecraft integrated for LEO missions, rising from 167 in 2022. Institutional procurement supported 12 multi-satellite programs under European framework agreements, while national agencies approved 9 demonstration missions focused on propulsion miniaturization. Test facilities in Lampoldshausen conducted 486 engine firings in 2025 versus 352 in 2023, increasing qualification throughput. Launcher availability improved with 6 European orbital launches in 2024 and 4 in 2025, expanding near-term integration schedules. Manufacturing workforce additions totaled 3,800 engineers across propulsion suppliers during 2023–2025.

Increased institutional funding for sovereign launch capability

European governments prioritized sovereign access-to-space programs, approving 5 launcher modernization programs between 2022 and 2025. Engine development test campaigns increased from 41 in 2022 to 73 in 2024 across national propulsion centers. Public procurement frameworks supported 28 long-lead component qualification projects, improving supply resilience. Spaceport modernization initiatives completed 3 pad upgrades by 2025, enabling higher cadence integration cycles. Workforce development programs trained 1,200 propulsion specialists during 2023–2025. Regulatory streamlining reduced average certification review cycles by 18 months across institutional programs, accelerating propulsion subsystem readiness for upcoming launcher and upper-stage deployments.

Challenges

High development and qualification costs of propulsion systems

European propulsion programs face extended test and qualification requirements, with average engine development cycles spanning 48 months between 2022 and 2025. Ground test campaigns increased to 620 firings in 2024, raising infrastructure utilization rates beyond 0.8 capacity across major facilities. Specialized material qualification required 27 additional audits per program during 2023–2025, extending schedules. Limited availability of cryogenic test windows constrained throughput to 9 campaigns per quarter in 2024. Certification dossiers averaged 1,200 technical pages, increasing compliance workloads. Engineering teams reported 22 percent schedule slippage across multi-mission propulsion developments during recent institutional program reviews.

Long certification cycles and mission qualification timelines

Propulsion subsystems undergo multi-stage certification involving 14 discrete verification gates across European institutional frameworks. Average mission qualification timelines extended to 36 months for new architectures approved between 2023 and 2025. Environmental test cycles expanded to 120 thermal-vacuum runs per engine family in 2024. Cross-border compliance reviews added 6 approval checkpoints when integrating components from 4 different member states. Limited harmonization between civil and defense standards required duplicate documentation sets exceeding 900 pages. Program managers reported 17 schedule realignments across propulsion-intensive missions in 2024, delaying integration into launcher and satellite assembly lines.

Opportunities

Commercialization of in-orbit refueling and propulsion upgrades

European in-orbit servicing roadmaps authorized 7 technology demonstrators between 2023 and 2025, enabling propulsion upgrade trials for aging platforms. Docking interface standards progressed through 3 interagency working groups, improving cross-platform compatibility. Orbital logistics mission concepts increased to 11 approved studies by 2024, supporting refueling architectures. On-orbit rendezvous simulations executed 64 high-fidelity scenarios in 2025, validating guidance and control readiness. Servicing vehicle assembly lines commissioned 2 new integration bays in 2024, increasing throughput capacity. Institutional programs aligned with 5 regulatory workstreams to define safety protocols for propellant transfer in orbit.

Adoption of high-power electric propulsion for large LEO constellations

High-power electric propulsion adoption accelerated as 4 European primes qualified 20 kilowatt class thrusters between 2022 and 2025. Ground endurance testing surpassed 9,000 operational hours per unit by 2024, validating long-duration performance. Power processing unit manufacturing capacity expanded by 2 production lines in 2025, supporting constellation-scale deployment. Grid-connected vacuum chambers supported 31 continuous test campaigns in 2024, reducing queue times by 40 days. Institutional technology programs funded 8 platform integration trials, enabling standardized interfaces. Satellite bus designs integrated modular propulsion bays across 6 new platforms introduced during 2023–2025.

Future Outlook

The Europe Space Propulsion market is positioned for steady structural expansion through 2035 as institutional launch programs mature and commercial constellation deployments stabilize. Regulatory harmonization and propulsion standardization are expected to shorten qualification cycles. Growth will be supported by electric propulsion scale-up, green propellant adoption, and emerging in-orbit servicing missions across European space ecosystems.

Major Players

- ArianeGroup

- Safran

- OHB System

- Airbus Defence and Space

- Avio

- Thales Alenia Space

- Nammo

- Isar Aerospace

- PLD Space

- Exotrail

- Accion Systems

- Bradford Space

- ECAPS

- ENPULSION

- Orbital Propulsion Centre

Key Target Audience

- Commercial satellite operators

- Launch service providers

- Satellite OEMs and platform integrators

- In-orbit servicing and space logistics companies

- Government and regulatory bodies with agency names

- Defense and security agencies

- Investments and venture capital firms

- Space infrastructure operators

Research Methodology

Step 1: Identification of Key Variables

Key demand drivers, mission profiles, propulsion architectures, and regulatory constraints were mapped across commercial and institutional programs. Variables included platform classes, qualification pathways, and technology readiness indicators. Supply-side capabilities and testing infrastructure availability were also cataloged.

Step 2: Market Analysis and Construction

Segment structures were constructed based on propulsion type and platform deployment patterns. Program pipelines, integration cadences, and certification pathways were analyzed to model adoption dynamics. Ecosystem interdependencies across manufacturing, testing, and launch integration were synthesized.

Step 3: Hypothesis Validation and Expert Consultation

Working assumptions on technology transition, regulatory harmonization, and propulsion standardization were validated through consultations with propulsion engineers, program managers, and institutional stakeholders. Divergent scenarios were stress-tested against operational constraints and infrastructure readiness.

Step 4: Research Synthesis and Final Output

Findings were consolidated into coherent thematic narratives linking drivers, constraints, and opportunities. Segment-level insights were integrated with ecosystem analysis to ensure consistency. Final outputs emphasize actionable implications for stakeholders across the propulsion value chain.

- Executive Summary

- Research Methodology (Market Definitions and propulsion architecture taxonomy, Primary interviews with European satellite primes and launch integrators, OEM shipment and engine delivery tracking, Government and ESA program budget triangulation, Export control and ITAR/EU dual-use policy analysis, Technology readiness and test campaign benchmarking, Competitive intelligence from supplier contracts and tenders)

- Definition and Scope

- Market evolution

- Usage and mission pathways

- Ecosystem structure

- Supply chain structure

- Regulatory environment

- Growth Drivers

Rising European smallsat constellation deployments

Increased institutional funding for sovereign launch capability

Shift toward electric propulsion for GEO and LEO satellites

Demand for green propellants driven by safety regulations

Growth of in-orbit servicing and debris removal missions

Expansion of reusable and micro-launcher programs - Challenges

High development and qualification costs of propulsion systems

Long certification cycles and mission qualification timelines

Supply chain dependence on specialized materials and components

Export control and cross-border technology transfer constraints

Limited flight heritage for novel green propellant systems

Fragmented demand across diverse mission profiles - Opportunities

Commercialization of in-orbit refueling and propulsion upgrades

Adoption of high-power electric propulsion for large LEO constellations

Public–private partnerships for propulsion test infrastructure

Growth of responsive launch and rapid deployment capabilities

Integration of additive manufacturing for engine components

R&D incentives for low-toxicity propellant technologies - Trends

Miniaturization of propulsion units for nanosatellites

Transition from hydrazine to ADN-based and HAN-based propellants

Standardization of propulsion modules for satellite platforms

Increased ground test automation and digital twins

Hybrid propulsion adoption for flexible mission profiles

Co-development between satellite OEMs and propulsion specialists - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Propulsion Type (in Value %)

Chemical propulsion

Electric propulsion

Hybrid propulsion

Green propellants

Cold gas propulsion - By Platform Type (in Value %)

Small satellites

Medium satellites

Large satellites

Launch vehicle upper stages

In-orbit servicing vehicles - By Application (in Value %)

Orbit raising and station keeping

Launch vehicle main propulsion

Reaction control systems

Deep space propulsion

In-space mobility and logistics - By End Use (in Value %)

Commercial satellite operators

Government and defense agencies

Space agencies and research institutions

Launch service providers

In-orbit service providers

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (propulsion type coverage, thrust and power range, flight heritage, TRL maturity, cost per Newton, delivery lead times, regulatory compliance readiness, aftermarket support footprint) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

ArianeGroup

Safran

OHB System

Airbus Defence and Space

Avio

Thales Alenia Space

Nammo

Isar Aerospace

PLD Space

Exotrail

Accion Systems

Bradford Space

ECAPS

ENPULSION

Orbital Propulsion Centre

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035