Market Overview

The Europe Tactical UAV market current size stands at around USD ~ million, reflecting sustained procurement cycles across defense and security stakeholders, with steady platform replenishment and incremental capability upgrades shaping demand. Budget allocations prioritize ISR, communications relay, and electronic warfare payload integration within tactical classes, while lifecycle support contracts extend operational availability. Platform modernization and interoperability requirements continue to anchor procurement decisions, supported by domestic industrial participation and cross-border collaboration frameworks across the regional ecosystem.

Western and Northern Europe anchor demand concentration due to dense defense infrastructure, mature integrator ecosystems, and sustained operational readiness requirements. Southern Europe exhibits expanding adoption linked to maritime surveillance and border management needs, while Central and Eastern Europe show accelerated ecosystem maturation driven by force modernization agendas and interoperability mandates. Industrial clusters around aerospace manufacturing hubs support supply chain resilience, while policy alignment with NATO standards, export control regimes, and airspace integration frameworks shapes deployment pathways and training ecosystems.

Market Segmentation

By Platform Type

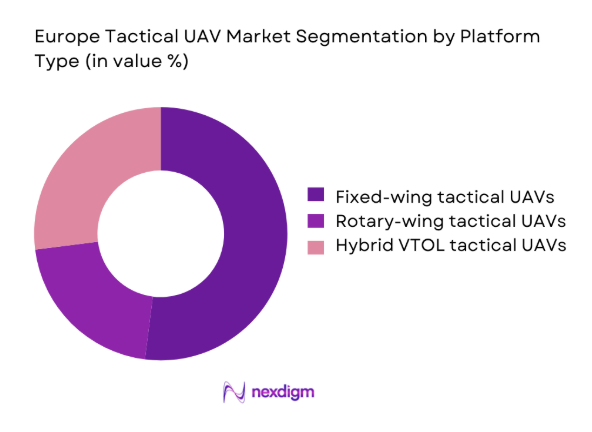

Fixed-wing tactical UAVs dominate deployments due to superior endurance, stable ISR performance, and compatibility with longer-range reconnaissance missions across land and maritime environments. Their operational reliability in adverse weather and established logistics support frameworks reinforce preference among land forces and naval units. Rotary-wing platforms maintain niche relevance for confined terrain and shipborne operations, while hybrid VTOL systems gain traction for dispersed operations requiring runway independence. Integration with modular payload bays and encrypted datalinks further consolidates fixed-wing dominance across multi-mission profiles within tactical force structures.

By End User

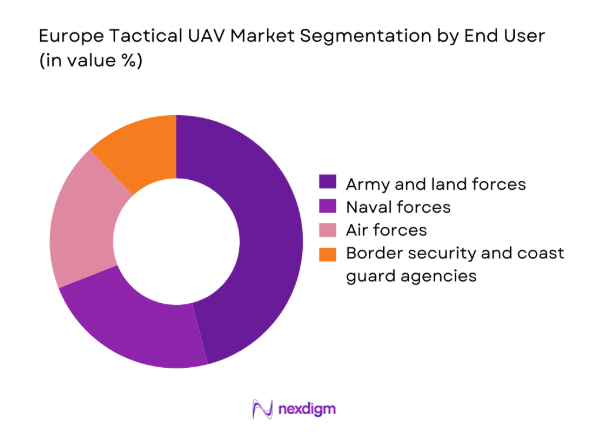

Army and land forces represent the primary end user due to persistent ISR requirements, force protection mandates, and integration with brigade-level command networks. Naval forces exhibit growing demand for shipborne surveillance and littoral monitoring, while air forces focus on tactical reconnaissance integration with airspace management systems. Border security and coast guard agencies increasingly deploy tactical UAVs for persistent monitoring, search and rescue coordination, and rapid response in remote terrains, supported by expanding inter-agency procurement frameworks and shared service models.

Competitive Landscape

The competitive environment is shaped by platform developers, system integrators, and payload specialists focused on interoperability, lifecycle support, and secure communications. Vendor differentiation centers on endurance profiles, modular payload integration, training ecosystems, and compliance with regional regulatory and interoperability standards.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Airbus Defence and Space | 2000 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Saab | 1937 | Sweden | ~ | ~ | ~ | ~ | ~ | ~ |

Europe Tactical UAV Market Analysis

Growth Drivers

Rising ISR demand for border security and force protection

Escalating cross-border surveillance needs across European land and maritime frontiers intensified between 2022 and 2025, with patrol hours expanding from 1800 to 2600 annually across multi-agency tasking frameworks. Operational tempo increased after 2023 due to heightened monitoring of critical infrastructure, energy corridors, and maritime approaches. Land forces expanded brigade-level reconnaissance detachments from 4 to 6 units, improving ISR coverage density. Naval patrol zones widened by 120 nautical miles in specific corridors, requiring persistent aerial observation. Interoperability exercises rose from 18 to 31 events, strengthening data fusion readiness. These indicators sustain procurement momentum for tactical UAV platforms and payload integration programs.

Modernization of land forces with organic reconnaissance assets

Land force modernization programs prioritized organic ISR integration between 2022 and 2025, expanding battalion-level reconnaissance teams from 2 to 4 per brigade. Training throughput at dedicated UAV schools increased from 900 to 1400 operators annually, improving unit-level readiness. Secure datalink nodes across brigade command posts rose from 6 to 11 per formation, enhancing real-time situational awareness. Field trials expanded across 14 training areas, up from 9, validating deployment in forested and urban terrains. Doctrine updates introduced 7 standardized reconnaissance mission profiles, reinforcing institutional adoption. These institutional shifts anchor sustained platform acquisition, payload standardization, and lifecycle support demand across European land forces.

Challenges

Export control and ITAR restrictions affecting supply chains

Cross-border platform and payload integration faced delays between 2022 and 2025 due to export control clearances extending lead times from 90 to 180 days for certain subsystems. Multi-national programs required compliance reviews across 7 regulatory authorities, increasing administrative cycles. Component substitution rates rose from 2 to 5 per platform variant, complicating certification pathways. Training pipeline disruptions occurred when spare part replenishment cycles extended from 30 to 75 days. Interoperability trials were postponed across 4 scheduled exercises, limiting operational validation. These constraints restrict timely deployment, elevate integration complexity, and pressure procurement schedules across cooperative European programs.

Spectrum management and secure datalink availability constraints

Spectrum congestion intensified across operational theaters from 2022 to 2025, with contested bandwidth incidents rising from 12 to 27 reported cases annually during exercises. Secure datalink deployment expanded from 3 to 7 frequency bands, increasing configuration complexity at unit level. Command post integration required upgrades across 28 nodes, up from 17, to mitigate interference risks. Encryption key rotation cycles shortened from 90 to 45 days, adding operational overhead for deployed units. Field testing hours increased from 4200 to 6900 annually to validate link resilience. These constraints elevate deployment friction and training burdens for tactical UAV operations.

Opportunities

Fleet replacement cycles for legacy tactical UAVs

Legacy tactical UAV fleets commissioned before 2012 approach end-of-service windows, with decommissioning schedules between 2024 and 2028 accelerating replacement planning. Maintenance downtime days increased from 38 to 64 per platform annually during 2022 to 2025, prompting readiness concerns. Obsolescence notices affected 14 avionics modules, limiting upgrade pathways. Training conversion courses expanded from 6 to 11 programs to transition crews to newer mission systems. Depot-level overhaul queues lengthened from 22 to 41 units, signaling capacity strain. These indicators support near-term procurement waves focused on modern airframes, secure datalinks, and modular payload ecosystems.

Growth in VTOL tactical UAVs for naval and urban operations

Operational requirements for confined-area launch expanded between 2022 and 2025 as shipborne deployment sites increased from 24 to 39 platforms across patrol vessels and auxiliaries. Urban training sorties grew from 1100 to 1900 annually, validating VTOL suitability for dense terrain. Deck handling cycles reduced from 14 to 9 minutes with compact airframe designs, improving sortie generation rates. Interoperability trials across 6 port facilities expanded to 10, enhancing maritime integration readiness. Mission profiles incorporating vertical recovery increased from 3 to 7 standardized templates, reinforcing institutional uptake for naval and urban ISR deployments.

Future Outlook

The Europe Tactical UAV market is expected to evolve through deeper integration with NATO command networks, expanded VTOL adoption for maritime and urban use, and wider use of open architecture mission systems through 2035. Regulatory harmonization and airspace integration frameworks will mature, while autonomy-enabled ISR and resilient datalink architectures will shape procurement priorities. Cross-border collaboration and fleet replacement cycles will sustain platform modernization.

Major Players

- Airbus Defence and Space

- Leonardo

- Thales Group

- BAE Systems

- Saab

- Rheinmetall

- Elbit Systems

- Israel Aerospace Industries

- Baykar

- Turkish Aerospace Industries

- Schiebel

- UAVOS

- AeroVironment

- Teledyne FLIR

- General Atomics Aeronautical Systems

Key Target Audience

- Defense ministries and armed forces procurement directorates

- Border security and coast guard agencies

- Naval fleet commands and maritime surveillance units

- Defense system integrators and prime contractors

- Platform MRO and lifecycle support providers

- Investments and venture capital firms

- European Defence Agency and national aviation authorities

- Export control and airspace regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

Key variables were mapped across mission classes, payload configurations, datalink architectures, training ecosystems, and lifecycle support pathways. Operational readiness indicators and regulatory constraints were identified to frame procurement and deployment dynamics across European defense environments. Data boundaries were set to exclude market size indicators.

Step 2: Market Analysis and Construction

The market construct was developed by aligning platform categories with mission roles, end-user structures, and deployment environments. Interoperability requirements, airspace integration constraints, and lifecycle support models were incorporated to reflect operational realities. Analytical boundaries ensured exclusion of revenue and valuation metrics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on demand drivers, constraints, and adoption pathways were validated through structured consultations with operators, program managers, and technical specialists. Feedback loops refined assumptions around deployment readiness, training throughput, and integration friction points within multi-agency operating contexts.

Step 4: Research Synthesis and Final Output

Findings were synthesized into a coherent market narrative emphasizing operational indicators, regulatory context, and institutional adoption pathways. Cross-validation ensured internal consistency across segmentation, competitive dynamics, and future outlook without disclosing market size or valuation metrics.

- Executive Summary

- Research Methodology (Market Definitions and mission class taxonomy alignment, Defense procurement database triangulation, Operator and integrator interviews across EU and NATO states, Platform shipment and fleet inventory tracking, Payload and datalink supplier revenue mapping, Export control and offset program assessment)

- Definition and Scope

- Market evolution

- Usage and mission pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising ISR demand for border security and force protection

Modernization of land forces with organic reconnaissance assets

NATO interoperability requirements driving platform upgrades

Increased defense spending and multi-year UAV procurement programs

Operational lessons from recent conflicts accelerating adoption

Growth of electronic warfare and contested airspace requirements - Challenges

Export control and ITAR restrictions affecting supply chains

Spectrum management and secure datalink availability constraints

Regulatory hurdles for airspace integration and training operations

High lifecycle costs including spares and MRO

Cybersecurity vulnerabilities in command-and-control links

Fragmented procurement across European defense agencies - Opportunities

Fleet replacement cycles for legacy tactical UAVs

Growth in VTOL tactical UAVs for naval and urban operations

Domestic industrial participation and co-development programs

Integration of AI-enabled onboard processing and autonomy

Demand for modular payload ecosystems

Cross-border joint procurement and standardization initiatives - Trends

Shift toward encrypted multi-band datalinks and SATCOM augmentation

Adoption of open architecture mission systems

Increased endurance through hybrid propulsion and fuel cells

Proliferation of counter-UAS and low-observable features

Growing use of swarm-enabled tactical reconnaissance concepts

Emphasis on interoperability with NATO C2 networks - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Platform Type (in Value %)

Fixed-wing tactical UAVs

Rotary-wing tactical UAVs

Hybrid VTOL tactical UAVs - By Range and Endurance Class (in Value %)

Short-range tactical UAVs

Medium-range tactical UAVs

Long-endurance tactical UAVs - By Payload and Mission Role (in Value %)

ISR payloads

Electronic warfare and SIGINT payloads

Target acquisition and laser designation payloads

Communications relay payloads - By Launch and Recovery Mode (in Value %)

Catapult-launched systems

Hand-launched systems

Runway-dependent systems

VTOL systems - By End User (in Value %)

Army and land forces

Naval forces

Air forces

Border security and coast guard agencies - By Geography (in Value %)

Western Europe

Central and Eastern Europe

Nordic countries

Southern Europe

- Market structure and competitive positioning

- Market share snapshot of major players

Cross Comparison Parameters (platform endurance, payload capacity, datalink security, autonomy level, unit price band, lifecycle support, NATO compliance, delivery lead time) - SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Airbus Defence and Space

Leonardo

Thales Group

BAE Systems

Saab

Rheinmetall

Elbit Systems

IAI (Israel Aerospace Industries)

Baykar

Turkish Aerospace Industries

Schiebel

UAVOS

AeroVironment

Teledyne FLIR

General Atomics Aeronautical Systems

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035