Market Overview

The Europe UAE Aviation Infrastructure market is expected to experience steady growth, with the market size driven by infrastructure expansion and technological adoption in airports and aviation hubs. According to recent assessments, the market size is projected to reach USD ~ by 2025, driven by increased demand for air travel and growing investments from both the public and private sectors. Furthermore, significant developments in airport automation, air traffic control systems, and passenger management technologies are propelling the demand for innovative solutions within the infrastructure space. The growth of aviation infrastructure is closely tied to the region’s strategic initiatives aimed at enhancing connectivity, improving safety measures, and supporting economic growth.

Major cities and countries in the region, including Dubai, Abu Dhabi, and London, continue to dominate the aviation infrastructure market due to their advanced airports and connectivity hubs. The UAE’s efforts to strengthen its position as a global aviation leader and the consistent investments in major projects like Dubai International Airport and Al Maktoum International are crucial in this dominance. Similarly, European cities like London, Frankfurt, and Paris maintain a leadership position due to their large-scale airport systems, strategic location, and the capacity to handle growing passenger traffic. These countries are also heavily supported by strong regulatory frameworks and significant government investments in aviation infrastructure projects.

Market Segmentation

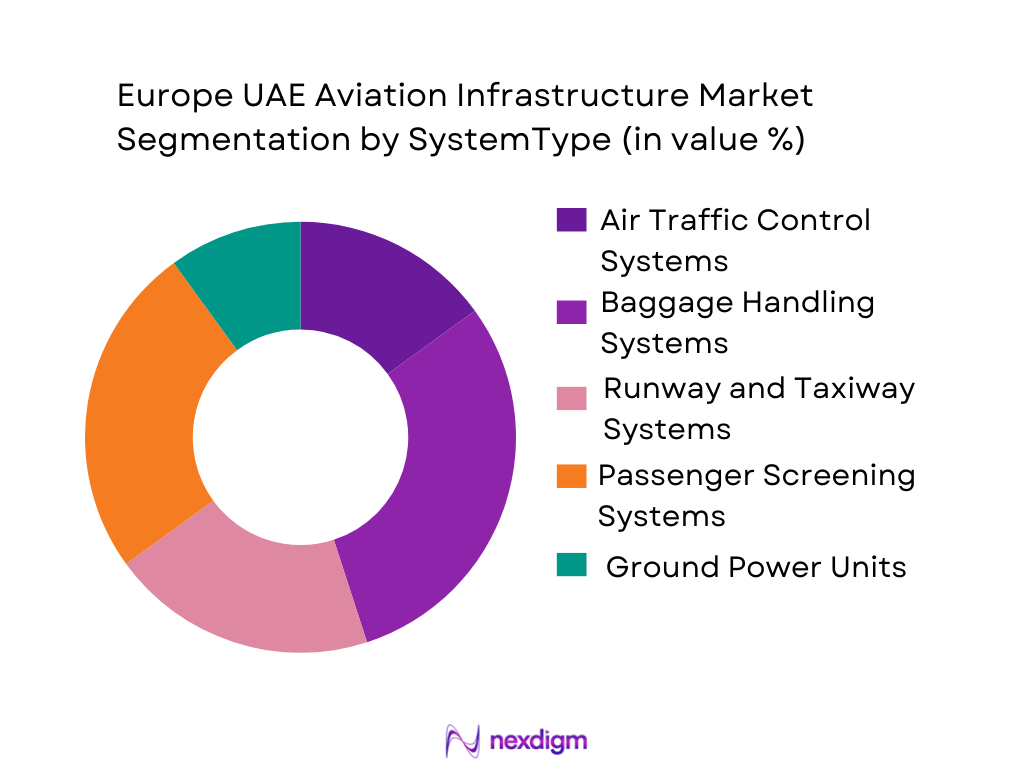

By System Type

The Europe UAE Aviation Infrastructure market is segmented by system type into air traffic control systems, baggage handling systems, runway and taxiway systems, passenger screening systems, and ground power units. Recently, the baggage handling systems sub-segment has gained dominance due to the increasing number of air travelers, which drives demand for more efficient and automated baggage handling. Baggage handling systems have become a critical part of airport infrastructure, as these systems help improve efficiency, reduce wait times, and enhance overall passenger experience. The global push for automation and streamlined operations has further accelerated the adoption of modern baggage handling technologies across major airports in the UAE and Europe. This growing demand for efficiency and scalability within airports has placed baggage handling systems at the forefront of aviation infrastructure investment.

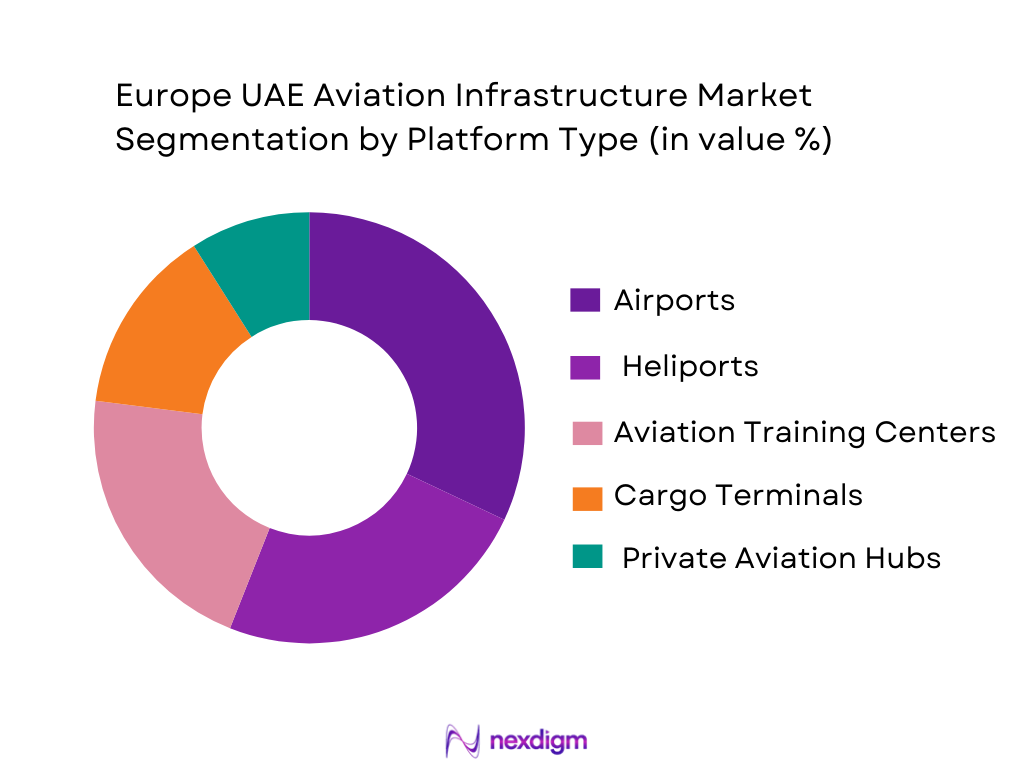

By Platform Type

The Europe UAE Aviation Infrastructure market is segmented by platform type into airports, heliports, aviation training centers, cargo terminals, and private aviation hubs. Airports dominate this segment due to the increasing number of passengers traveling across both regions. The growth of international travel, particularly to and from the UAE, and increasing air cargo shipments, has significantly contributed to the growth of airports. Airports are essential platforms for both passenger and cargo traffic, leading to substantial investments in terminal infrastructure, advanced screening systems, and baggage handling technologies. This segment continues to witness large-scale upgrades and expansions, aiming to handle higher traffic volumes and improve operational efficiencies. Additionally, airports in the UAE, particularly Dubai International, continue to evolve as global hubs, contributing to their leadership in the platform type market.

Competitive Landscape

The Europe UAE Aviation Infrastructure market is highly competitive, with a mix of established players and emerging firms vying for market share. The consolidation trend is prevalent, with large companies increasingly acquiring smaller firms to strengthen their product portfolios and expand their geographical reach. This competitive environment is characterized by significant investments in technology, innovation, and customer service, with major players leading the way in terms of product offerings and market influence.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD Billion) | Additional Parameter |

| Siemens | 1847 | Germany | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | France | ~ | ~ | ~ | ~ | ~ |

| Honeywell | 1906 | USA | ~ | ~ | ~ | ~ | ~ |

| Indra Sistemas | 1993 | Spain | ~ | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 2020 | USA | ~ | ~ | ~ | ~ | ~ |

Europe UAE Aviation Infrastructure Market Analysis

Growth Drivers

Increased Government Investment in Aviation Infrastructure

Government investment in aviation infrastructure is a major driver of market growth in the Europe UAE region. With both the UAE and key European countries investing heavily in airport modernization, there has been a significant increase in infrastructure projects aimed at expanding capacity and improving efficiency. The UAE has allocated substantial resources to enhancing its airports, including Dubai International and Abu Dhabi International, with advanced security, automation, and baggage handling systems being prioritized. Similarly, European countries are focusing on enhancing their airport infrastructure to cope with the rising demand for air travel. Investments are also being funneled into digital technologies such as air traffic control systems, aimed at improving operational efficiency and reducing congestion at major airports. These government initiatives and funding have bolstered the development of airports and surrounding aviation infrastructure, making it a crucial factor in the growth of the market.

Technological Advancements in Automation and IoT

The aviation infrastructure market is being driven by technological advancements, particularly in automation and IoT. Automation in areas such as air traffic management, baggage handling, and passenger processing has led to smoother airport operations and better passenger experiences. IoT technologies are enabling more efficient monitoring of airport assets, tracking of baggage, and managing airside and landside activities. The integration of these technologies is driving the growth of aviation infrastructure, as airports aim to adopt cutting-edge systems to reduce operational costs and enhance customer service. The increasing demand for smart airports, with advanced communication and operational technologies, has pushed major players to innovate and provide more integrated solutions. These advancements not only optimize operations but also offer long-term sustainability by improving energy efficiency and reducing environmental impacts.

Market Challenges

High Capital Investment and Operational Costs

One of the major challenges facing the Europe UAE Aviation Infrastructure market is the high capital investment and operational costs associated with developing and upgrading airport infrastructure. The construction and implementation of advanced systems such as air traffic control, baggage handling, and terminal expansion require substantial financial outlays. This high initial investment can pose a barrier to entry for smaller players and limit the pace of infrastructure development in certain regions. Additionally, maintaining these systems and ensuring compliance with regulatory standards incurs ongoing operational costs. Given the complexity of integrating new technologies into existing airport infrastructure, these costs are expected to remain a key challenge in the near future. The need for constant upgrades to accommodate growing passenger and cargo traffic further strains financial resources, making it essential for stakeholders to carefully balance costs with the expected return on investment.

Regulatory Compliance and Safety Standards

The aviation infrastructure market is heavily influenced by strict regulatory compliance and safety standards, which can create challenges for operators and developers. The European Union and the UAE have implemented stringent regulations regarding aviation safety, security, environmental protection, and data privacy. These regulations often require significant investment in advanced security measures, safety technologies, and sustainable practices. Compliance with these standards can slow down the pace of infrastructure development, especially in regions where regulatory frameworks are constantly evolving. Additionally, ensuring the compatibility of new systems with existing infrastructure while meeting these regulatory requirements adds complexity to the development process. As the aviation industry continues to expand, stakeholders will face the ongoing challenge of keeping up with changing regulations and ensuring their projects meet the necessary standards.

Opportunities

Expansion of Regional Airport Networks

The expansion of regional airport networks presents a significant opportunity for growth in the Europe UAE Aviation Infrastructure market. As air travel continues to rise, there is an increasing need for more airports to handle growing passenger numbers. Regional airports in the UAE and Europe are undergoing upgrades and expansions to accommodate more flights and improve connectivity between major hubs. This expansion provides opportunities for infrastructure developers to integrate modern technologies, such as automated baggage systems and AI-driven air traffic control systems, into new airports and terminals. Additionally, regional airports in the UAE, such as those in Sharjah and Abu Dhabi, are expected to see continued growth in both passenger and cargo traffic, further enhancing the need for advanced infrastructure solutions. The focus on regional networks will stimulate demand for infrastructure investment and technological innovation across both regions.

Sustainability and Green Initiatives in Airport Design

With the growing global focus on sustainability and reducing environmental impacts, the Europe UAE Aviation Infrastructure market is poised for growth in the adoption of green building practices and energy-efficient technologies. The demand for sustainable airports is increasing, with governments and stakeholders prioritizing the integration of renewable energy sources, energy-efficient designs, and environmentally-friendly materials in new projects. Airports are investing in sustainable infrastructure, such as energy-efficient lighting systems, waste management solutions, and low-carbon transportation options for passengers. This trend is driven by both regulatory pressures and consumer demand for eco-friendly travel options. The opportunity for green initiatives in airport design offers a pathway to innovation, with companies developing and deploying technologies that reduce emissions and improve energy efficiency. This shift towards sustainability is expected to provide a significant market opportunity over the coming years.

Future Outlook

The future outlook for the Europe UAE Aviation Infrastructure market is promising, with anticipated growth driven by technological advancements, sustainability trends, and increased government investments in airport development. The integration of automation, AI, and IoT technologies is expected to enhance operational efficiency, reduce costs, and improve the passenger experience. Furthermore, regulatory support and a global push for sustainable practices will contribute to the growth of environmentally friendly and energy-efficient infrastructure. Demand for modernized and expanded airport networks will continue to increase, particularly in the UAE and Europe, as passenger traffic rises and airlines seek improved connectivity. The market is poised for continued innovation, with smart airports and advanced systems paving the way for future growth.

Major Players

- Siemens

- Thales Group

- Honeywell

- Indra Sistemas

- Raytheon Technologies

- L3 Technologies

- SITA

- Rockwell Collins

- Aeroports de Paris

- TAV Airports

- Schiphol Group

- Fraport AG

- Dubai Airports

- Flughafen Zürich AG

- Vinci Airports

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Airport operators

- Aviation infrastructure developers

- Airlines

- Aviation technology suppliers

- Construction firms specializing in airports

- International aviation organizations

Research Methodology

Step 1: Identification of Key Variables

The first step in the research process involves identifying the key variables that will influence the market, including technological advancements, regional growth trends, and regulatory policies. This step helps set the foundation for data collection and analysis.

Step 2: Market Analysis and Construction

The next step involves analyzing the collected data and constructing a detailed market model based on historical trends, current market conditions, and anticipated future developments.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations are conducted to validate the research hypothesis and refine the market model. This step ensures that the insights are accurate and reliable.

Step 4: Research Synthesis and Final Output

The final step synthesizes all the research findings and generates the final report, which includes a comprehensive analysis of the market, growth drivers, challenges, opportunities, and future projections.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Aviation Traffic

Government Investments in Infrastructure Development

Technological Advancements in Automation - Market Challenges

High Initial Capital Investment

Regulatory Compliance and Safety Standards

Geopolitical Instability and Market Uncertainty - Market Opportunities

Expansion of Regional Airport Networks

Integration of Sustainable Aviation Technologies

Growth of Airport Smart Technologies - Trends

Automation in Air Traffic Management

Adoption of AI and IoT in Airport Operations - Government Regulations

Aviation Safety Regulations

Environmental and Emissions Standards

Import and Export Control Policies - SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Air Traffic Control Systems

Baggage Handling Systems

Runway and Taxiway Systems

Passenger Screening Systems

Ground Power Units - By Platform Type (In Value%)

Airports

Heliports

Aviation Training Centers

Cargo Terminals

Private Aviation Hubs - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions - By End User Segment (In Value%)

Commercial Airlines

Private Aviation Operators

Cargo Operators

Airport Authorities - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

- Market Share Analysis

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Siemens

Thales Group

Honeywell

Indra Sistemas

Raytheon Technologies

L3 Technologies

SITA

Rockwell Collins

Aeroports de Paris

TAV Airports

Schiphol Group

Fraport AG

Dubai Airports

Flughafen Zürich AG

Vinci Airports

- Increasing Demand from Commercial Airlines

- Rise of Private Aviation Hubs

- Cargo Operators Expanding Regional Reach

- Airport Authorities Upgrading Existing Infrastructure

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035