Market Overview

The Europe Unmanned Systems market current size stands at around USD ~ million, reflecting sustained procurement by public security bodies and steady commercial adoption across inspection, monitoring, and logistics missions. The ecosystem spans platform manufacturing, payload integration, software autonomy stacks, secure communications, and lifecycle services. Demand is shaped by operational reliability requirements, safety certification burdens, and mission-critical performance expectations. Value creation concentrates on modular payloads, autonomy upgrades, and data services embedded within deployed fleets and multi-mission platforms.

Activity concentrates in Western and Northern Europe, where dense infrastructure, advanced testing corridors, and mature aerospace and robotics clusters support deployment at scale. Coastal and offshore regions anchor maritime and underwater systems for energy and security operations, while urban nodes host BVLOS corridors, C2 integration centers, and public safety pilots. Policy harmonization initiatives and defense cooperation frameworks accelerate cross-border programs, enabling vendor qualification, joint procurement, and interoperability across national agencies and industrial primes.

Market Segmentation

By Platform Type

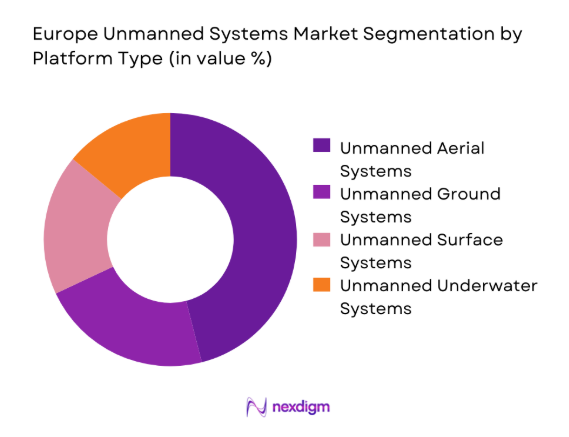

Unmanned aerial systems dominate value creation due to multi-mission adaptability, rapid deployment, and payload modularity supporting surveillance, inspection, and emergency response. Ground and surface platforms expand in perimeter security, logistics within controlled environments, and port operations, while underwater systems gain traction for subsea inspection and maritime security. The maturity of avionics, autonomy software, and secure datalinks reinforces aerial leadership, while ruggedization, endurance improvements, and mission autonomy drive uptake across non-aerial platforms. Procurement programs increasingly bundle mixed fleets to enable coordinated operations, pushing vendors toward interoperable C2 architectures and standardized payload interfaces across domains.

By End Use Sector

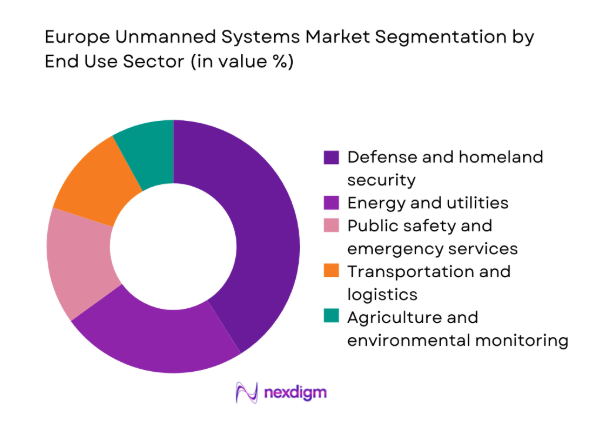

Defense and homeland security anchor demand through ISR, border surveillance, and maritime domain awareness missions requiring certified platforms, encrypted links, and resilient operations. Energy and utilities follow, driven by offshore wind inspection, pipeline monitoring, and hazardous environment access. Public safety agencies adopt managed drone services for disaster response and search operations, while transportation and logistics pilots advance yard automation and inventory inspection within controlled corridors. Agriculture and environmental monitoring expand regionally where policy frameworks permit BVLOS operations, reinforcing demand for endurance, weather tolerance, and analytics-driven workflows integrated into enterprise systems.

Competitive Landscape

The competitive landscape is shaped by diversified primes and specialized unmanned platform providers offering integrated payloads, autonomy software, and lifecycle services. Competitive differentiation centers on certification readiness, interoperability with national C2 systems, secure communications, and field-proven reliability across multi-domain operations.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Airbus Defence and Space | 1970 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | United Kingdom | ~ | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Germany | ~ | ~ | ~ | ~ | ~ | ~ |

Europe Unmanned Systems Market Analysis

Growth Drivers

Rising European defense modernization and ISR demand

European defense modernization has intensified since 2022, with expanded ISR requirements across borders, coastlines, and critical infrastructure. In 2024, joint exercises involved 18 member states and 42 operational sites integrating unmanned ISR into command networks. National programs added 64 new test corridors for persistent surveillance trials, while 27 secure C2 nodes were commissioned for encrypted links. Maritime patrol coverage increased across 3 sea basins using unmanned surface and underwater assets. Defense R&D programs approved 112 autonomy validation projects in 2025, accelerating sensor fusion and edge processing deployment. Training pipelines expanded to 9 multinational centers, raising operator certification throughput and mission readiness across agencies.

Increased border surveillance and maritime domain awareness needs

Border management intensified across 2023 and 2024, with 24 coastal monitoring zones upgraded to persistent unmanned coverage and 11 riverine corridors piloted for autonomous patrol. Maritime domain awareness programs integrated 36 surface and underwater patrol routes into national C2 rooms, enhancing response coordination across 14 ports. Aerial ISR corridors expanded to 58 BVLOS segments approved for security missions in controlled airspace. Inter-agency drills in 2025 coordinated 7 national coast guards with shared data schemas. Sensor payloads standardized across 21 maritime patrol kits, improving interoperability. Training curricula added 6 maritime autonomy modules to improve multi-domain mission effectiveness and resilience.

Challenges

Fragmented regulatory regimes and airspace access constraints

Regulatory fragmentation across Europe constrains deployment, with 27 national aviation authorities applying differing BVLOS conditions during 2023 and 2024. Approval cycles average 210 days for multi-country missions, delaying corridor scaling. In 2024, only 19 harmonized operational scenarios were mutually recognized across borders, limiting cross-border ISR continuity. Airspace coordination requires integration with 41 civil-military coordination units, complicating real-time mission planning. Temporary flight restrictions affected 23 urban test zones during public events in 2025, disrupting continuity of operations. Divergent safety cases for detect-and-avoid across 12 jurisdictions slow certification of identical platforms, raising compliance overhead and operational friction.

Cybersecurity vulnerabilities and data sovereignty concerns

Cybersecurity risks escalated with 14 reported command-link interference incidents during 2024 exercises, prompting revised security baselines. Data sovereignty requirements mandate in-country storage across 21 jurisdictions, complicating cloud-based mission analytics. Encryption standards differ among 9 defense networks, forcing parallel integrations for identical payloads. In 2023, 6 penetration testing frameworks were applied to unmanned C2 software, increasing validation cycles. Supply chain vetting expanded to 47 component categories with provenance documentation, delaying platform qualification. National cyber agencies conducted 32 audits in 2025, elevating compliance burdens for operators and integrators while slowing deployment schedules across multi-domain programs.

Opportunities

EU and national funding for unmanned maritime and underwater systems

Public funding streams in 2024 approved 29 maritime autonomy programs targeting port security, seabed inspection, and offshore energy support. Test ranges expanded across 12 coastal zones, enabling endurance trials over 96-hour missions. Underwater navigation standards were piloted in 5 national ranges, improving interoperability. In 2025, 18 collaborative projects linked shipyards, sensor firms, and autonomy labs to accelerate field validation. Fleet integration exercises coordinated 7 navies to test shared data layers. Workforce development initiatives certified 1,200 technicians for subsea robotics maintenance, strengthening service capacity and creating sustained demand for lifecycle support across maritime unmanned operations.

Defense-industrial collaboration and joint procurement programs

Joint procurement frameworks expanded during 2023 and 2024, with 10 multinational programs aligning requirements for ISR payloads and secure datalinks. Standardization committees issued 4 interoperability profiles for C2 integration, reducing duplication across national fleets. Shared testing facilities hosted 22 vendor-neutral trials, accelerating certification cycles. In 2025, cooperative sustainment hubs were established in 6 locations to pool spares and maintenance capabilities. Common training syllabi aligned across 8 defense academies, improving operator mobility. Data governance charters adopted by 13 agencies enabled federated mission analytics, lowering integration friction and supporting scalable multi-country deployments of unmanned systems.

Future Outlook

The market outlook to 2035 reflects deeper regulatory harmonization, wider BVLOS corridors, and stronger maritime autonomy programs. Multi-domain interoperability and secure data layers will anchor procurement decisions. Defense cooperation frameworks will sustain joint testing and pooled sustainment. Civil adoption will expand in energy and public safety as certification pathways mature.

Major Players

- Airbus Defence and Space

- Thales Group

- Leonardo

- BAE Systems

- Rheinmetall

- Saab AB

- Parrot Drones

- Elbit Systems Europe

- Teledyne FLIR

- Schiebel Group

- QinetiQ

- ECA Group

- Kongsberg Gruppen

- Ocean Infinity

- Tekever

Key Target Audience

- National defense ministries and armed forces procurement agencies

- Border security and coast guard authorities

- Civil aviation authorities and unmanned traffic management agencies

- Energy utilities and offshore wind operators

- Port authorities and maritime security agencies

- Public safety and emergency management agencies

- Systems integrators and managed service operators

- Investments and venture capital firms

Research Methodology

Step 1: Identification of Key Variables

Core variables included platform classes, autonomy maturity, payload interoperability, certification pathways, secure communications, and lifecycle service depth. Demand indicators were mapped across defense, maritime security, energy inspection, and public safety missions. Regulatory constraints and corridor availability were defined as deployment enablers. Supply-side readiness was scoped through component provenance, integration capacity, and service coverage.

Step 2: Market Analysis and Construction

Operational use cases were constructed across aerial, surface, ground, and underwater domains with mission profiles and interoperability requirements. Deployment pathways were aligned to regulatory readiness and corridor availability. Ecosystem mapping connected OEMs, payload providers, software integrators, and service operators. Channel structures and procurement dynamics were modeled for national and joint programs.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions on autonomy adoption, interoperability needs, and cybersecurity compliance were validated through practitioner workshops and technical roundtables. Scenario testing evaluated multi-domain coordination, sustainment pooling, and data governance frameworks. Feedback loops refined operational constraints, certification timelines, and service capacity requirements.

Step 4: Research Synthesis and Final Output

Findings were synthesized into deployment scenarios, ecosystem implications, and strategic priorities. Comparative insights informed platform, payload, and service positioning. The final output integrates regulatory pathways, operational readiness, and collaboration models to support investment, procurement, and partnership decisions.

- Executive Summary

- Research Methodology (Market Definitions and platform classification across UAS, UGV, USV and UUV, OEM shipment and backlog tracking from European primes, defense and civil operator procurement database analysis, fleet activity and utilization telemetry assessment, regulatory and certification pathway mapping across EASA and national authorities, supply chain tier mapping and component sourcing interviews)

- Definition and Scope

- Market evolution

- Operational deployment pathways

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising European defense modernization and ISR demand

Increased border surveillance and maritime domain awareness needs

Expansion of BVLOS regulatory frameworks enabling commercial drone operations

Growing adoption of robotics for hazardous and remote inspection tasks

Advancements in AI-enabled autonomy and sensor fusion

Public funding for civil security and disaster response modernization - Challenges

Fragmented regulatory regimes and airspace access constraints

Cybersecurity vulnerabilities and data sovereignty concerns

High certification and compliance costs for safety-critical operations

Supply chain dependence on non-European electronics and sensors

Limited interoperability standards across platforms and control systems

Public acceptance and privacy concerns in urban deployments - Opportunities

EU and national funding for unmanned maritime and underwater systems

Defense-industrial collaboration and joint procurement programs

Growth in offshore wind inspection and maintenance automation

Integration of unmanned systems with manned platforms and C2 networks

Development of indigenous propulsion, avionics and payload ecosystems

Expansion of urban air mobility test corridors for dual-use technologies - Trends

Shift toward multi-mission modular payload architectures

Rising use of swarming and collaborative autonomy concepts

Edge AI processing for onboard analytics and target recognition

Hybrid propulsion and longer-endurance platforms

Secure data links and encrypted command-and-control systems

Increased adoption of service-based drone operations and managed fleets - Government Regulations

SWOT Analysis

Stakeholder and Ecosystem Analysis

Porter’s Five Forces Analysis

Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Active Systems, 2020–2025

- By Average Selling Price, 2020–2025

- By Platform Type (in Value %)

Unmanned Aerial Systems

Unmanned Ground Systems

Unmanned Surface Systems

Unmanned Underwater Systems - By Autonomy Level (in Value %)

Remotely piloted

Semi-autonomous

Fully autonomous - By Application (in Value %)

Intelligence, surveillance and reconnaissance

Combat and strike missions

Border security and maritime patrol

Critical infrastructure inspection

Search and rescue and disaster response

Environmental monitoring and surveying - By End Use Sector (in Value %)

Defense and homeland security

Energy and utilities

Transportation and logistics

Agriculture and forestry

Public safety and emergency services

Marine and offshore industries - By Country (in Value %)

United Kingdom

Germany

France

Italy

Spain

Nordics

Rest of Europe

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (platform portfolio breadth, autonomy maturity, payload integration capability, endurance and performance metrics, regulatory certification readiness, cybersecurity and data link security, manufacturing scale and localization, lifecycle support and services)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarking

- Detailed Profiles of Major Companies

- Airbus Defence and Space

Thales Group

Leonardo

BAE Systems

Rheinmetall

Saab AB

Parrot Drones

Elbit Systems Europe

Teledyne FLIR

Schiebel Group

QinetiQ

ECA Group

Kongsberg Gruppen

Ocean Infinity

Tekever

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Active Systems, 2026–2035

- By Average Selling Price, 2026–2035