Market Overview

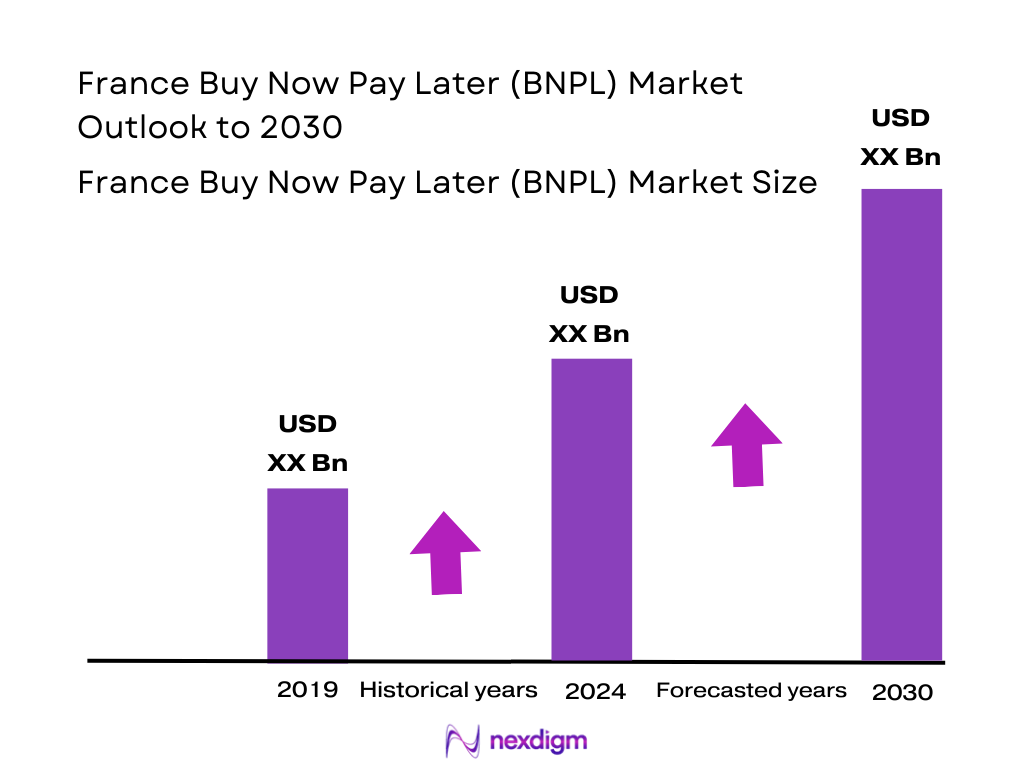

The France BNPL market is valued at USD 11.40 billion, according to Nexdigm, reflecting the latest verified data for 2024. This robust figure underscores significant expansion over the previous year and is powered by rising e‑commerce activity, cost‑of‑living pressures driving demand for flexible payments, and continued introduction of BNPL in both online and offline retail ecosystems. Growth is further supported by evolving consumer preference for interest‑free installments over traditional credit.

Leading French e‑commerce hubs such as Île‑de‑France (Paris region) and Provence‑Alpes‑Côte d’Azur dominate BNPL usage, owing to higher digital infrastructure maturity, dense populations, and elevated disposable incomes that drive online spending. These regions benefit from strong merchant ecosystems and tech-savvy consumers. Additionally, large metropolitan centers with significant urban youth populations and affluent middle-class segments enable rapid uptake of BNPL solutions across categories like fashion, electronics, and home goods.

Market Segmentation

By Channel

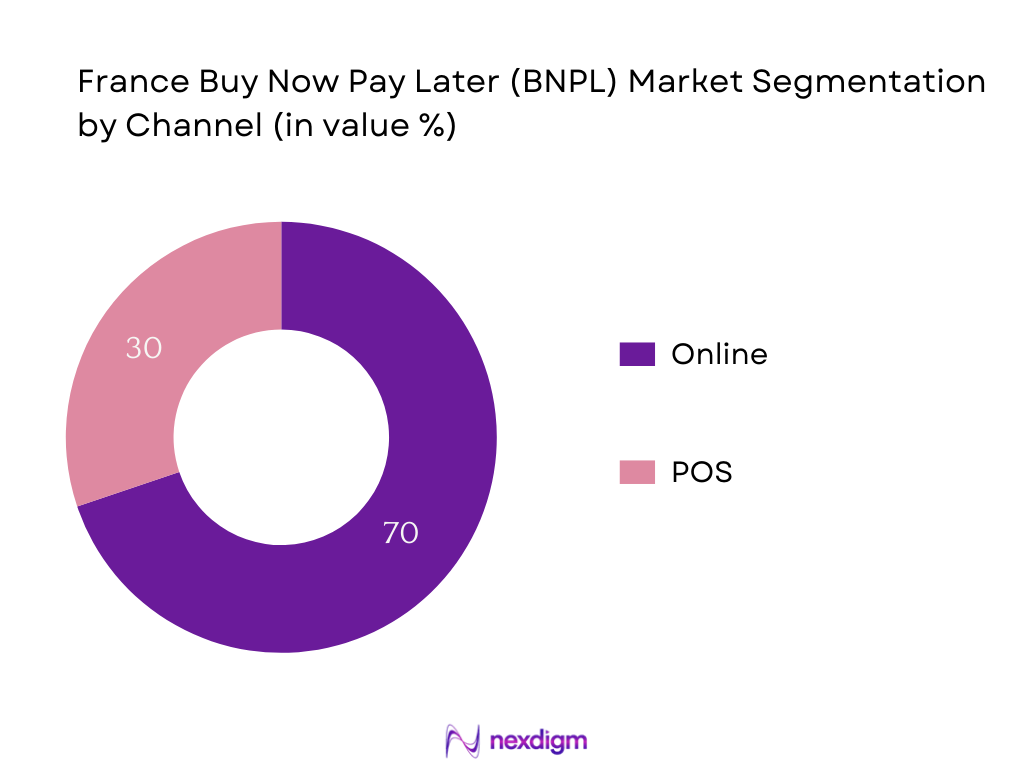

Online BNPL clearly holds the lion’s share, attributed to seamless integration with e‑commerce platforms, convenience, and widespread digital literacy among French consumers. According to Nexdigm, the online channel accounted for 70% of market share in 2024. This dominance stems from merchants embedding BNPL at checkout, reducing cart abandonment and driving average order values. While POS (in-store) BNPL is growing—supported by 18.2% CAGR projections—it remains secondary due to slower merchant adoption in physical retail and infrastructure integration challenges.

By Vertical / End‑Use Industry

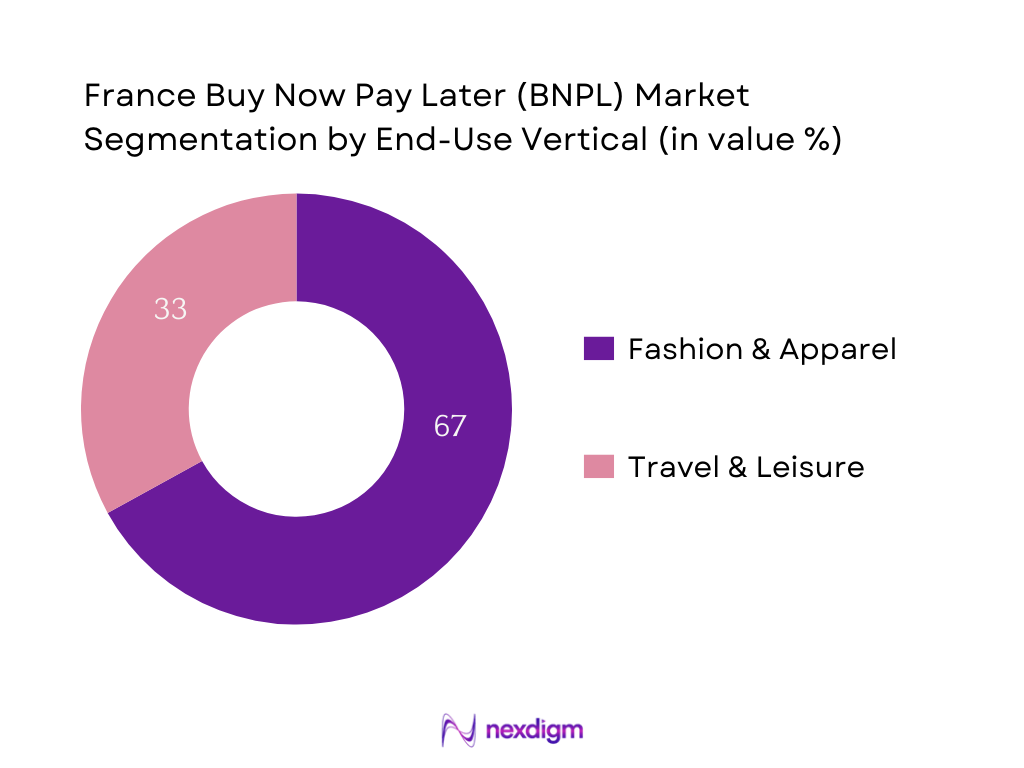

Fashion & Apparel leads the BNPL verticals in 2024. This dominance is driven by consumer preferences for trial purchases, high return rates, and the alignment between BNPL’s flexible payment structure and fashion’s often impulsive, trend-based purchasing behavior. Travel & Leisure, while not leading now, projects rapid expansion, reflecting rising adoption for high‑value, experiential purchases.

Competitive Landscape

The France BNPL ecosystem is shaped by both local and global players. The market shows increasing consolidation around major fintech vendors and banks offering embedded BNPL solutions. Below table gives a snapshot of the competitive dynamics: international fintechs like Klarna leverage agile tech and broad global reach, while French banks bring strong regulatory alignment and conservative risk models.

| Company | Establishment Year | Headquarters | Funding Model | Integration Mode | Core Segment Focus | Regulatory Readiness | Risk Underwriting Approach |

| Klarna | 2005 | – | – | – | – | – | – |

| Alma | 2017 | – | – | – | – | – | – |

| Oney | 2009 | – | – | – | – | – | – |

| Floa Bank | 2019 | – | – | – | – | – | – |

| Scalapay | 2019 | – | – | – | – | – | – |

France BNPL Market Analysis

Key Growth Drivers

E‑commerce Acceleration Post‑Pandemic

Online retail continues to expand within the broader French retail ecosystem. In 2023, total online spending (including products and services) reached €159.9 billion, marking an increase from €144.7 billion in 2022. Online product retail, while slightly down, still accounted for €61.2 billion with 2.35 billion transactions recorded, highlighting sustained consumer engagement with digital channels. The structure of e‑commerce spending favors household goods (28 % share), fashion (23 %, translating to €7.7 billion in sales), and fast-moving consumer goods (10.8 %, or €13.2 billion). These strong figures underscore the accelerating digital adoption of consumers—driving demand for flexible payment options like BNPL at checkout. The scale and diversity of goods sold online reinforce the reliance of both merchants and consumers on flexible financing to facilitate high-volume, recurring digital commerce in France.

Youth Credit Aversion and Preference for Alternative Credit

Although direct France-specific Eurostat data on age-wise preference for BNPL is absent, broader digital usage trends among young adults signal heightened affinity for alternative payment methods. As of 2024, one third of the French population had used generative AI tools, rising to 77 % among individuals aged 18–24, indicating both high digital fluency and early adoption behaviors. At the same time, 91 % of people aged 12 and up owned a smartphone in 2024, while mobile phone ownership stood at 98 %, showing near-universal mobile access. These figures imply that younger demographics are not only digitally connected but are predisposed to seamless, mobile-first payment experiences, including BNPL. This population—highly habituated to app-based services, digital wallets, and immediate funding—is more likely to shun traditional credit in favor of embedded, frictionless financing options.

Key Market Challenges

Delinquency Rates in Low‑Income Segments

France’s macroeconomic consumer debt context provides critical insight. In 2024, inbound internet traffic to major ISPs reached 50.8 Tb/s, while outbound interconnection traffic reached 5.1 Tb/s, illustrating heightened internet usage—often leveraged for e‑retail—including BNPL services—but not equally across income tiers. At the same time, France remains sensitive to household debt management; although specific BNPL delinquency data is unavailable, the presence of rising digital consumption (as shown by traffic growth of 9.2 % inbound and 17.5 % outbound) indicates that financially strained households may face challenges repaying BNPL obligations when usage is facilitated at digital speed. Thus, despite thriving digital use, segments with lower credit buffers risk rising delinquency, posing a threat to BNPL profitability and requiring robust underwriting.

Regulatory Scrutiny Under Consumer Credit Law

France enforces the EU Consumer Credit Directive (CCD), mandating transparent disclosure of interest and fees for credit-like instruments—including deferred payment BNPL. Though no numeric penalty data exists, the legal perimeters of CCD create a compliance burden. Additionally, France maintains rigorous data consent regulations under the Digital Services Directive, adding legal complexities for fintechs engaging in consumer data processing for BNPL risk assessments. The weight of these directives—though not quantified here—introduces operational friction, raising cost and time barriers for BNPL providers to meet regulatory clarity and avoid fines.

Emerging Opportunities

Healthcare and Education BNPL Rollouts

While specific France BNPL adoption in healthcare and education lacks direct figures, OECD data offers a context foundation. France’s out-of-pocket healthcare spending per capita in 2022 stood around USD 763, indicating a consistent financial burden borne directly by consumers (OECD Health Data). Similarly, tertiary education expenditure per student approximates USD 12,000 annually, suggesting substantial recurrent costs. These large consumer spending categories—locally significant—present opportunity for BNPL to ease immediacy of payment through installment models. Financial pressure in these areas, combined with France’s digital infrastructure (e.g., 75 % fibre subscription, 24 million 5G SIMs), establishes favorable conditions for BNPL expansion into non‑retail verticals, leveraging digital payment platforms to serve critical social sectors.

BNPL for Subscription‑Based Services

France demonstrates strong sustained digital engagement. For instance, 41 million premises were eligible for fibre-to-the-home, and heavy internet traffic reflects high usage for streaming and online services. Also, one-third of the population had tried generative AI tools by end‑2024, indicating propensity to engage with digital subscription platforms. These indicators suggest a ripe market for BNPL models tailored to subscription-based services (e.g., SaaS, streaming, online learning), where consumers prefer spreading recurring payments. High digital infrastructure capacity and user familiarity with online services support embedding BNPL into subscription billing—offering providers a channel to expand financial flexibility in increasingly subscription-dominated digital consumption patterns.

Future Outlook

Over the forecasting horizon, the France BNPL market is expected to maintain strong double-digit growth, driven by digital-first consumer behavior, increased BNPL adoption among small and mid-sized merchants, and evolving regulatory frameworks that enhance trust. Technological advancements in underwriting (AI credit scoring, TIPS for instant funding), combined with expanded BNPL integration into non-traditional sectors (travel, healthcare, education), will further fuel adoption. While frameworks like the EU Consumer Credit Directive (CCD2) will introduce tighter oversight, they also elevate credibility, enabling financial institutions and fintechs to scale responsibly-backed BNPL intermediation.

Major Players

- Klarna

- Alma

- Oney

- Floa Bank

- PayPlug BNPL

- Scalapay

- Splitit

- Cofidis

- Younited Credit

- FinFrog

- Lydia Pay Later

- BNP Paribas (BNPL service)

- Carrefour Banque (BNPL solution)

- Cetelem (BNPL offerings)

- Afterpay/Clearpay

Key Target Audience

- Retail Investors & Private Equity Funds

- Venture Capital Firms (specializing in FinTech and Payment Innovation)

- Digital-First Retail Chains (Fashion, Electronics, Home Goods)

- Large Banking Groups & Payment Service Providers

- E-commerce Platform Operators

- Regulators & Government Bodies (e.g., Banque de France, ACPR)

- Embedded Finance Strategy Teams in Corporates

- Telecommunications & Digital Wallet Providers (seeking BNPL integration)

Research Methodology

Step 1: Data Collection & Market Definition

We map the BNPL ecosystem across stakeholders—including fintech providers, banks, merchants, and consumers—using secondary research from reputable databases and define variables like transaction volume, value, user base, and average order value.

Step 2: Historical Data Analysis & Forecast Modeling

We collate 2023 and 2024 historical data points and deploy bottom-up modeling, leveraging actual payment values (e.g., USD 11.40 billion in 2024) and apply validated CAGR projections (e.g., 8.8% for near-term, 16.09% for later years) to derive forward-looking projections.

Step 3: Expert Engagement & Validation

We conduct structured interviews with industry professionals—including BNPL providers like Alma and Oney, regulatory bodies such as the ACPR, and France’s retail associations—to validate model assumptions, channel adoption patterns, and risk factors.

Step 4: Analytical Synthesis & Quality Assurance

We integrate findings, refine segmentation, competitor profiling, and scenario analyses, ensuring consistency and triangulation across sources. The final output has undergone peer review within our firm to ensure accuracy, relevance, and actionable insight.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Key Growth Drivers

E-Commerce Acceleration Post-Pandemic [BNPL Share in Online Retail – Fevad]

Youth Credit Aversion and Preference for Alternative Credit [Age-wise Adoption – Eurostat]

Mobile Payment and Wallet Expansion [Smartphone Penetration – ARCEP]

Supportive Regulatory Sandbox for FinTech [Banque de France/ACPR] - Key Market Challenges

Delinquency Rates in Low-Income Segments [Consumer Debt Ratio – Banque de France]

Regulatory Scrutiny Under Consumer Credit Law [Interest Fee Disclosure – EU CCD]

Merchant Reluctance Due to Commission Squeeze [Gross Margin Impact – Fnac Darty Annual Reports]

Fraud Risk in BNPL Transactions [Digital Payment Fraud – ANSSI] - Emerging Opportunities

Healthcare and Education BNPL Rollouts [Out-of-Pocket Spend – OECD Health Data]

BNPL for Subscription-Based Services [Streaming & SaaS Growth – ARCEP]

Micro-SME Enablement via Simplified BNPL Integration [SME Count – INSEE]

BNPL Loyalty Integration with Major French Retailers [Retail Coalition Partnerships – Carrefour/Decathlon] - Consumer Trends and Preferences

AOV Boost for Merchants via BNPL [Basket Size Comparison – Nielsen France]

BNPL Usage by Age and Income Tier [BNPL Usage Stats – Statista France]

Repeat Usage and Late Repayment Patterns [User Behavior – ACPR reports] - Government Regulation

ACPR Licensing Norms and FinTech Compliance

Data Privacy Mandates under CNIL (GDPR-compliant)

EU-Wide Consumer Credit Directive (CCD) Impact - SWOT Analysis

- Stake Ecosystem

- Porter’s Five Forces Analysis

- By Value (EUR Million), 2019-2024

- By Number of Transactions, 2019-2024

- By Active User Base, 2019-2024

- By Average Order Value (AOV), 2019-2024

- By User Type (In Value %)

Individual Consumers

SME Merchants

Large Retail Chains - By Payment Model (In Value %)

Zero Interest Split Pay

Deferred Payment with Fees

Embedded Credit via Partner Bank - By Merchant Vertical (In Value %)

Fashion and Apparel

Consumer Electronics

Furniture and Home Décor

Travel & Tourism

Grocery & Daily Essentials - By Transaction Channel (In Value %)

E-Commerce Websites

Mobile Applications

In-Store POS Systems

Social Commerce - By Region (In Value %)

Île-de-France

Provence-Alpes-Côte d’Azur

Auvergne-Rhône-Alpes

Nouvelle-Aquitaine

Others

- Market Share of Major Players [Value & Transaction Share – SIA Partners]

- Cross Comparison Parameters (Funding Source, Product Structure, Integration Model, Risk and Underwriting Engine, Regulatory Compliance, Category Specialization, Merchant Base & Penetration, Value Proposition)

- SWOT Analysis of Major Players

- Pricing Analysis – Fee & Commission Structure Comparison

- Detailed Company Profiles

Klarna

Alma

Oney Bank

Floa Bank

PayPlug

Scalapay

Splitit

Cofidis

Younited Credit

FinFrog

ViaBill

Lydia Pay Later

BNP Paribas BNPL

Carrefour Banque

Cetelem

- User Acquisition Channels

- Decision-Making Journey

- Consumer Credit Literacy

- Psychological Pricing Effect of BNPL

- Financial Health and BNPL Usage Correlation

- By Value, 2025-2030

- By Number of Transactions, 2025-2030

- By Average Order Value, 2025-2030