Market Overview

The GCC Business Jet market current size stands at around USD ~ million, reflecting sustained demand for premium point-to-point aviation services across corporate, government, and ultra-high-net-worth travel. The market is shaped by fleet modernization cycles, high utilization of long-range aircraft for intercontinental missions, and growing adoption of managed ownership and charter programs. Ongoing investments in fixed-base operator networks, maintenance capabilities, and cabin completion services support operational reliability and service depth across the region.

Demand is concentrated in major aviation hubs with mature business aviation ecosystems, supported by world-class airports, dedicated terminals, and strong service networks. High traffic volumes and slot availability at select gateways attract charter operators and fleet managers. Regulatory clarity and customs facilitation enhance turnaround efficiency. The presence of specialized MRO facilities, completion centers, and experienced crews reinforces hub dominance, while secondary airports benefit from spillover demand linked to industrial clusters and tourism developments.

Market Segmentation

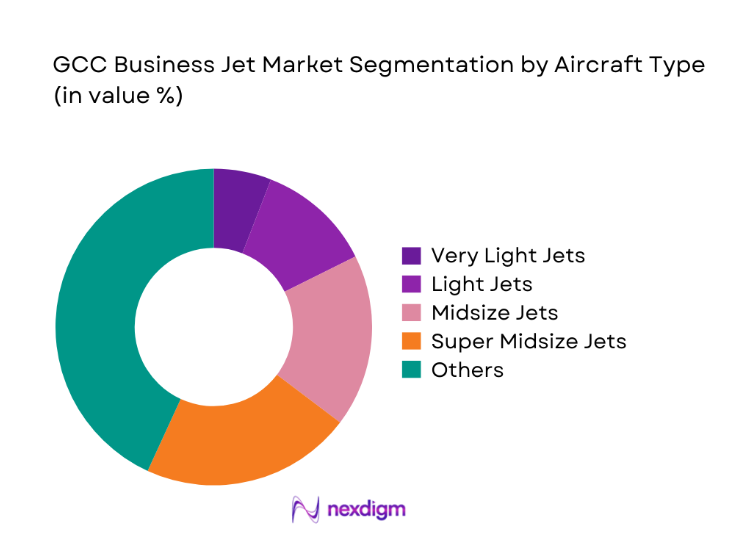

By Aircraft Type

Large cabin and ultra-long-range jets dominate due to mission profiles linking the Gulf with Europe, North America, and East Asia, favoring extended range, high cabin comfort, and nonstop connectivity. Corporates and royal flight departments prioritize reliability, redundancy, and onboard productivity features. Midsize and super midsize jets remain relevant for intra-regional travel and short-notice charters between energy hubs and financial centers. Very light and light jets play niche roles in training, short hops, and specialized missions, constrained by range and cabin capacity relative to prevailing demand patterns.

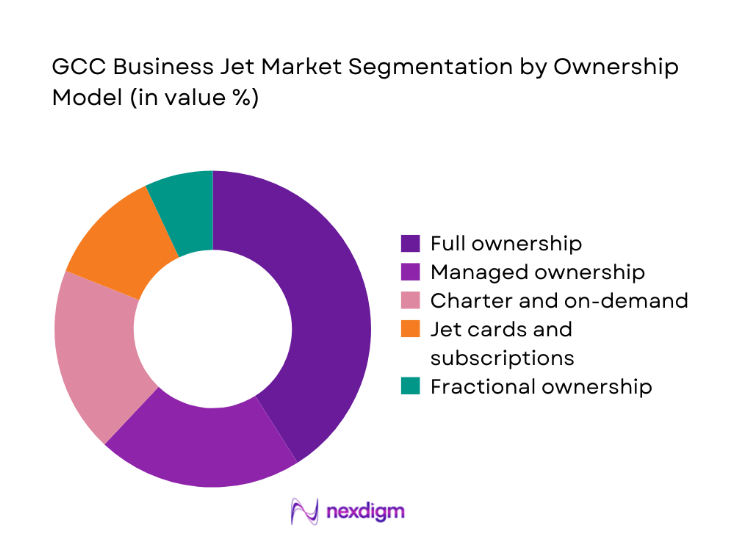

By Ownership Model

Full ownership leads in high-utilization corporate and government fleets where control, security, and customization are critical. Managed ownership programs expand access to professional flight operations and predictable availability. Charter and on-demand services grow with flexible travel needs, event-driven traffic, and short-notice routing. Jet cards and subscription programs attract frequent travelers seeking cost predictability and simplified booking. Fractional ownership remains selective, constrained by regulatory harmonization and cross-border operating complexities, but appeals to buyers seeking shared capital exposure and guaranteed access.

Competitive Landscape

The competitive environment reflects a mix of OEMs, operators, and service providers with differentiated capabilities across fleet offerings, operational depth, and regional networks.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| Gulfstream Aerospace | 1958 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

| Bombardier Aviation | 1942 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Dassault Aviation | 1929 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Embraer Executive Jets | 1969 | Brazil | ~ | ~ | ~ | ~ | ~ | ~ |

| Textron Aviation | 2014 | United States | ~ | ~ | ~ | ~ | ~ | ~ |

GCC Business Jet Market Analysis

Growth Drivers

Rising UHNW population and wealth concentration in the GCC

Between 2024 and 2025, private aviation demand aligned with rising concentrations of high-net-worth residents across Dubai, Abu Dhabi, and Riyadh, supported by 12 new residency and investor visa pathways introduced since 2022. In 2024, 47 family offices expanded regional operations, increasing intercity executive travel days. Business aviation movements at dedicated terminals rose alongside 3 new VIP facilities commissioned since 2023. Airport authorities recorded 28 additional international city pairs served by non-stop business jet routes. Regional wealth management registrations grew by 9 entities in 2025, increasing flight department utilization and multi-aircraft fleet deployment.

Expansion of regional headquarters and cross-border executive travel

From 2022 to 2025, 160 multinational firms established regional headquarters under localization mandates, increasing executive mobility between Dubai, Riyadh, Doha, and Manama. Corporate travel policies prioritized time-critical routing, driving higher utilization of long-range jets on 22 intercontinental corridors. Airport slot allocations for business aviation increased at 4 major gateways in 2024, reducing congestion delays. Government-backed business programs supported 11 new economic zones, expanding site visits and inspection flights. Business visa issuances across GCC hubs recorded sustained annual growth, reinforcing recurring executive travel patterns and fleet scheduling density.

Challenges

High acquisition and operating costs including fuel and crew

Between 2022 and 2025, fuel price volatility increased planning uncertainty across flight departments, with jet fuel benchmarks fluctuating over 18 months of elevated variance. Crew shortages intensified as 1,400 regional pilots transitioned to commercial carriers, tightening availability for business aviation. Maintenance lead times extended at 6 certified facilities due to parts logistics constraints following 2023 supply disruptions. Training pipelines struggled to replace specialized crews, with only 9 accredited regional training centers expanding capacity by 2024. These pressures constrained utilization planning and limited fleet expansion timelines for operators.

Limited dedicated business aviation infrastructure at secondary airports

From 2022 to 2025, only 7 secondary airports across the GCC added dedicated business aviation terminals, constraining network flexibility beyond major hubs. Ramp space availability remained limited during peak event periods, affecting aircraft parking and overnight stays. Customs and immigration processing at 14 regional gateways lacked 24-hour dedicated business aviation lanes in 2024, increasing turnaround times. Hangar availability expanded modestly with 5 new facilities commissioned by 2025, insufficient for fleet growth. Infrastructure gaps reduced mission reliability for industrial site access and cross-border point-to-point routing.

Opportunities

Development of dedicated business aviation terminals and FBO networks

Between 2023 and 2025, aviation authorities approved 8 new fixed-base operator concessions across emerging airports, expanding coverage for point-to-point business travel. Passenger processing capacity at private terminals increased with 6 upgraded facilities commissioned in 2024. Runway access windows for business aviation widened at 3 international gateways, improving scheduling reliability. Regional tourism authorities supported private terminal integration within 5 mixed-use airport developments. These expansions improve turnaround efficiency, reduce congestion exposure, and enhance service differentiation for charter and managed fleet operators, strengthening regional connectivity and operational resilience.

Fleet modernization with fuel-efficient and long-range aircraft

From 2022 to 2025, operators accelerated fleet renewal cycles as 24 next-generation aircraft models entered active service across the region, enhancing range and dispatch reliability. Connectivity upgrades were installed on 31 aircraft, supporting secure inflight productivity for executives. Noise and emissions compliance tightened at 9 airports in 2024, favoring newer platforms with advanced avionics. Maintenance programs aligned with digital health monitoring expanded to 14 regional facilities by 2025, improving aircraft availability. Modernized fleets support longer non-stop missions and higher utilization across intercontinental routes.

Future Outlook

The outlook to 2035 reflects steady expansion in premium point-to-point travel, supported by infrastructure investments, regulatory facilitation, and regional headquarters growth. Fleet modernization and sustainable aviation initiatives will shape procurement priorities. Dedicated terminals and service networks will deepen hub competitiveness. Secondary airport development will unlock new routing patterns, improving access to industrial clusters and tourism destinations. Managed ownership and subscription models are expected to broaden access across frequent travelers.

Major Players

- Gulfstream Aerospace

- Bombardier Aviation

- Dassault Aviation

- Embraer Executive Jets

- Textron Aviation

- NetJets

- VistaJet

- Jetex

- ExecuJet Middle East

- Royal Jet

- Qatar Executive

- DC Aviation Al-Futtaim

- Abu Dhabi Aviation

- Empire Aviation Group

- Comlux Aviation

Key Target Audience

- Corporate flight departments

- Ultra-high-net-worth individuals and family offices

- Charter and managed fleet operators

- Aircraft leasing companies

- Fixed-base operators and MRO providers

- Airport authorities and free zone administrations

- Investments and venture capital firms

- Government and regulatory bodies with agency names

Research Methodology

Step 1: Identification of Key Variables

Demand drivers, fleet composition, utilization intensity, infrastructure coverage, regulatory constraints, and service capacity were mapped across major hubs and secondary airports. Variables reflected mission profiles, ownership models, and maintenance ecosystems. Data points were aligned with regional operating environments and policy frameworks.

Step 2: Market Analysis and Construction

Operational indicators, traffic movements, fleet registrations, and facility expansions were synthesized to construct a coherent market structure. Intercity connectivity patterns and hub capacity constraints were integrated with service network maturity to frame competitive dynamics and access bottlenecks.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions were stress-tested through structured consultations with operators, flight department managers, airport authorities, and maintenance providers. Scenario testing incorporated infrastructure rollout timelines, regulatory facilitation measures, and fleet modernization trajectories to validate directional insights.

Step 4: Research Synthesis and Final Output

Findings were consolidated into thematic narratives across segmentation, competition, and outlook. Cross-validation ensured internal consistency across operational indicators, regulatory environments, and ecosystem maturity. Outputs were refined for strategic relevance and decision-grade clarity.

- Executive Summary

- Research Methodology (Market Definitions and fleet classification standards, Primary interviews with GCC-based operators and flight departments, Airport slot and movement data analysis from regional business aviation terminals, Aircraft registry and fleet tracking across UAE GCAA and regional CAA databases, Charter operator utilization and pricing surveys, OEM and MRO backlog and delivery pipeline assessment)

- Definition and Scope

- Market evolution

- Usage and mission profiles

- Ecosystem structure

- Supply chain and channel structure

- Regulatory environment

- Growth Drivers

Rising UHNW population and wealth concentration in the GCC

Expansion of regional headquarters and cross-border executive travel

Growth of luxury tourism and high-end hospitality destinations

Strategic location of GCC for intercontinental connectivity

Time-sensitive travel needs for energy, finance, and government sectors

Post-pandemic preference for private aviation over commercial flights - Challenges

High acquisition and operating costs including fuel and crew

Limited dedicated business aviation infrastructure at secondary airports

Airspace congestion and slot constraints at major hubs

Regulatory fragmentation across GCC jurisdictions

Volatility in oil prices affecting corporate travel budgets

Dependence on imported aircraft and parts supply chains - Opportunities

Development of dedicated business aviation terminals and FBO networks

Fleet modernization with fuel-efficient and long-range aircraft

Growth of jet card and subscription-based access models

Expansion of MRO capabilities and regional completion centers

Increasing demand for medical evacuation and special mission aircraft

Digital platforms for charter aggregation and fleet optimization - Trends

Shift toward ultra long-range and large cabin jets for intercontinental routes

Rising adoption of sustainable aviation fuel and carbon offset programs

Growth of managed fleet and fractional ownership structures

Integration of advanced connectivity and cabin digitalization

Increased utilization of Dubai and Riyadh as business aviation hubs

Rising demand for bespoke aircraft interiors and VIP completions - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Average Selling Price, 2020–2025

- By Aircraft Type (in Value %)

Very Light Jets

Light Jets

Midsize Jets

Super Midsize Jets

Large Cabin Jets

Ultra Long-Range Jets - By Ownership Model (in Value %)

Full ownership

Fractional ownership

Charter and on-demand

Jet cards and subscription programs

Corporate fleet programs - By End User (in Value %)

Ultra-high-net-worth individuals

Corporate and multinational enterprises

Government and royal flight departments

Charter operators

Medical and special mission operators - By Range Category (in Value %)

Short-range

Medium-range

Long-range

Ultra long-range - By Application (in Value %)

Business travel

VIP and leisure travel

Medical evacuation

Government and diplomatic missions

Special mission and surveillance - By Country (in Value %)

United Arab Emirates

Saudi Arabia

Qatar

Kuwait

Oman

Bahrain

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (fleet size, aircraft age profile, range capability, regional service network, pricing and charter rates, delivery lead times, MRO partnerships, customer support coverage)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

Gulfstream Aerospace

Bombardier Aviation

Dassault Aviation

Embraer Executive Jets

Textron Aviation

NetJets

VistaJet

Jetex

ExecuJet Middle East

Royal Jet

Qatar Executive

DC Aviation Al-Futtaim

Abu Dhabi Aviation

Empire Aviation Group

Comlux Aviation

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Average Selling Price, 2026–2035