Market Overview

The GCC Drone Pilot Training market current size stands at around USD ~ million, reflecting accelerating institutional demand for certified remote pilots across civil, industrial, and public safety missions. Training demand is shaped by licensing mandates, operational safety thresholds, and expanding mission complexity across inspection, surveillance, and logistics applications. Providers are scaling simulator capacity and instructor accreditation to address qualification bottlenecks, while enterprises increasingly require standardized competencies for BVLOS operations, night flights, and data governance compliance across regulated airspace.

The market exhibits concentration in metropolitan aviation hubs and industrial corridors with established airspace management, testing zones, and enterprise drone adoption. Gulf aviation clusters benefit from dense infrastructure projects, mature energy ecosystems, and strong public safety procurement. Regulatory clarity, designated training airspace, and availability of certified examiners reinforce localized demand nodes. Cross-border project execution encourages harmonized credential recognition, while national localization policies strengthen domestic training pipelines and employer-backed certification pathways.

Market Segmentation

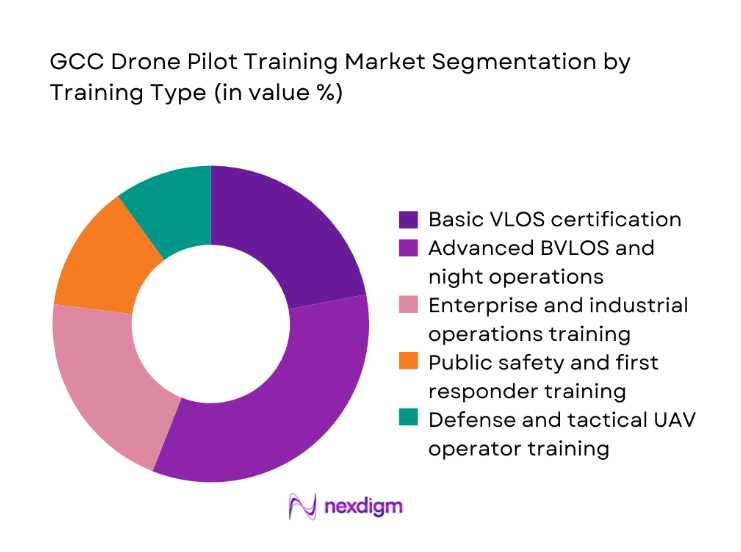

By Training Type

Advanced operational certifications dominate due to rising demand for BVLOS, night operations, and mission-specific endorsements required for industrial inspections and public safety deployments. Enterprises prioritize standardized curricula that integrate safety management systems, data governance, and emergency response drills, while defense-linked training emphasizes operational discipline and secure communications. Instructor certification programs expand to relieve capacity constraints, enabling accredited academies to scale cohorts without compromising assessment rigor. Entry-level programs remain relevant for compliance onboarding, but value accrues to advanced pathways that shorten enterprise deployment timelines, improve operational safety, and support regulatory approvals for complex missions across controlled airspace.

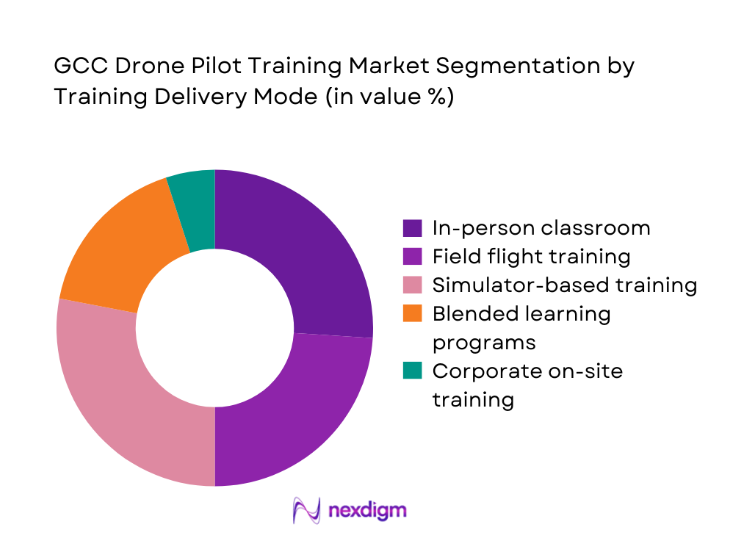

By Training Delivery Mode

Blended learning models lead adoption as operators combine classroom instruction, simulator hours, and field flights to accelerate readiness while managing safety risk. Simulator-first pathways reduce airspace congestion and improve standardization for emergency scenarios, while corporate on-site programs address project-specific risk profiles and expedite workforce mobilization. Fully in-person training remains essential for complex maneuvers and regulator-mandated assessments, yet digital modules support recurrent certification and refresher cycles. Demand is reinforced by enterprise compliance needs, scalable cohort training, and the requirement to demonstrate competency traceability across multi-site operations.

Competitive Landscape

The competitive environment features a mix of aviation training specialists and defense-aligned providers offering certified curricula, simulator access, and regulator-compliant assessment pathways. Differentiation centers on BVLOS authorization readiness, instructor depth, simulator fidelity, and the ability to deliver enterprise cohorts across multiple GCC jurisdictions. Providers compete on accreditation coverage, safety records, and operational integration with client workflows, while channel strength and regulatory readiness shape procurement outcomes for government and industrial buyers.

| Company Name | Establishment Year | Headquarters | Formulation Depth | Distribution Reach | Regulatory Readiness | Service Capability | Channel Strength | Pricing Flexibility |

| CAE | 1947 | Canada | ~ | ~ | ~ | ~ | ~ | ~ |

| Leonardo | 1948 | Italy | ~ | ~ | ~ | ~ | ~ | ~ |

| Thales | 1893 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus Defence and Space Training | 2014 | France | ~ | ~ | ~ | ~ | ~ | ~ |

| DJI Academy | 2019 | China | ~ | ~ | ~ | ~ | ~ | ~ |

GCC Drone Pilot Training Market Analysis

Growth Drivers

Expansion of BVLOS regulations and corridors in GCC

Civil aviation authorities across the GCC expanded controlled BVLOS trial corridors between 2022 and 2025, increasing approved flight test locations from 6 to 19 and designated training airspace sites from 12 to 31. Regulatory circulars issued in 2023 introduced competency matrices for BVLOS endorsements and night operations, requiring documented simulator hours and supervised sorties. Public safety agencies reported 240 incident-response deployments in 2024 requiring BVLOS-qualified crews, compared with 118 in 2022. National digital aviation platforms processed 4,600 remote pilot authorization requests in 2025, driving demand for standardized training pathways aligned with corridor approvals and safety management systems.

Large-scale infrastructure and mega-project inspection demand

Regional infrastructure programs intensified inspection cycles between 2022 and 2025, with transport corridors adding 1,420 bridge spans and energy networks commissioning 9,300 kilometers of new pipeline. Asset owners mandated remote inspection protocols for confined spaces and elevated structures, increasing drone sortie authorizations from 18,200 in 2022 to 41,700 in 2025. Safety regulators updated inspection compliance manuals in 2024 to include remote pilot competencies for complex environments. Utilities documented 1,180 near-miss incidents during rope-access inspections in 2023, accelerating substitution with aerial methods and raising training requirements for obstacle avoidance, payload management, and data integrity controls.

Challenges

Fragmented certification frameworks across GCC regulators

Between 2022 and 2025, aviation authorities issued 11 separate circulars governing remote pilot licensing, leading to inconsistent endorsement recognition across borders. Operators reported 3 different medical fitness thresholds and 4 knowledge-test formats across jurisdictions, complicating workforce mobility. Cross-border projects required dual authorization for 62 percent of missions in 2024, adding administrative cycles that delayed mobilization by 21 days on average. Training providers must align curricula with multiple syllabi and audit protocols, increasing compliance complexity. Inconsistent incident-reporting templates introduced in 2023 hindered standardized safety analytics and constrained mutual recognition initiatives across regional authorities.

Limited availability of BVLOS-approved training airspace

Approved BVLOS training zones expanded from 12 to 31 between 2022 and 2025, yet utilization rates exceeded 78 percent during peak months, creating scheduling bottlenecks. Weather-related closures averaged 37 days annually across coastal corridors, reducing field-training windows. Temporary airspace restrictions associated with 64 major events in 2024 displaced training sorties to peripheral sites, increasing transit times by 45 minutes per session. Simulator substitution mitigates constraints but regulators still require supervised live sorties for endorsement. Capacity limits slowed cohort throughput, extending certification timelines by 18 days and constraining enterprise deployment schedules.

Opportunities

Growth of delivery drone pilot certification programs

Postal and healthcare agencies piloted aerial delivery corridors during 2023 and 2024, completing 2,640 trial missions across remote and peri-urban routes. Safety authorities issued provisional guidance in 2024 for payload carriage, cold-chain monitoring, and contingency landing procedures, requiring specialized pilot endorsements. Public hospitals documented 1,120 urgent sample transfers using aerial routes in 2025, reducing ground transit delays during peak congestion. Logistics operators expanded drone fleet registrations from 310 in 2022 to 1,040 in 2025, creating demand for mission-specific certification, risk assessment drills, and recurrent competency validation aligned with corridor operations.

Defense and security modernization contracts for operator training

Security agencies expanded unmanned surveillance programs between 2022 and 2025, adding 96 tactical platforms to border monitoring units and increasing annual patrol sorties to 14,800. Updated doctrine issued in 2024 formalized operator proficiency requirements for encrypted links, electronic countermeasures awareness, and night-vision coordination. Joint exercises conducted in 2023 included 420 drone-enabled scenarios, highlighting gaps in standardized crew resource management for unmanned teams. Training pipelines now require advanced simulator scenarios and live coordination drills with ground units, creating sustained demand for accredited operator training aligned with security modernization roadmaps.

Future Outlook

The market outlook reflects continued regulatory maturation and expanding enterprise adoption across inspection, public safety, and logistics. Harmonization efforts are expected to improve credential portability within the GCC, while simulator-first models will scale capacity. Advanced endorsements for BVLOS and autonomous oversight will anchor premium training pathways through the latter half of the decade.

Major Players

- CAE

- Leonardo

- Thales

- Airbus Defence and Space Training

- DJI Academy

- General Atomics Aeronautical Systems

- Boeing Insitu

- Alpha Aviation Academy UAE

- Emirates Aviation University

- Qatar Aeronautical Academy

- Saudi Aviation Academy

- UAV Academy Middle East

- FlytBase Training

- T3 Aviation Academy

- DroneAcharya

Key Target Audience

- Energy and utilities asset operators

- Construction and infrastructure EPC contractors

- Logistics and last-mile delivery operators

- Public safety agencies and emergency services

- Defense and border security authorities

- Investments and venture capital firms

- Civil aviation authorities and national regulators

- Municipal smart city program offices

Research Methodology

Step 1: Identification of Key Variables

Regulatory endorsement criteria, BVLOS authorization protocols, simulator accreditation standards, and instructor licensing requirements were mapped across GCC jurisdictions. Operational use cases were prioritized by inspection, public safety, and logistics deployment profiles. Training capacity variables included airspace access, simulator availability, and examiner coverage.

Step 2: Market Analysis and Construction

Training pathways were constructed by delivery mode, platform class, and application sector. Institutional indicators on infrastructure build-out, safety directives, and authorization workflows informed demand modeling. Capacity constraints were evaluated through airspace utilization and certification throughput metrics.

Step 3: Hypothesis Validation and Expert Consultation

Operational assumptions were validated through consultations with regulators, safety managers, and training administrators. Scenario testing incorporated incident trends, authorization processing volumes, and exercise participation metrics to refine demand drivers and constraints.

Step 4: Research Synthesis and Final Output

Findings were synthesized into actionable insights on growth drivers, challenges, and opportunities. Cross-border harmonization prospects and simulator-first scaling pathways were integrated to inform strategic planning and capability investments.

- Executive Summary

- Research Methodology (Market Definitions and training scope across GCC UAV categories, Primary interviews with GCAA GACA CAA regulators and training heads, Curriculum benchmarking against ICAO and EASA remote pilot frameworks, Training capacity mapping of certified academies and simulators, Price benchmarking of course fees certification exams and simulator hours, Demand modeling from commercial defense and public safety operator pipelines)

- Definition and Scope

- Market evolution

- Usage and certification pathways

- Ecosystem structure

- Training delivery and channel structure

- Regulatory environment

- Growth Drivers

Expansion of BVLOS regulations and corridors in GCC

Large-scale infrastructure and mega-project inspection demand

Government investment in public safety and border surveillance drones

Rapid adoption of drones in oil and gas asset monitoring

Localization mandates for skilled UAV operators

Enterprise digitization and automation programs - Challenges

Fragmented certification frameworks across GCC regulators

Limited availability of BVLOS-approved training airspace

High cost of simulators and certified instructors

Shortage of standardized curricula for industrial use cases

Operational safety incidents impacting regulatory approvals

Seasonal weather constraints affecting flight training capacity - Opportunities

Growth of delivery drone pilot certification programs

Defense and security modernization contracts for operator training

Accredited simulator centers for high-risk mission rehearsal

Corporate training contracts with utilities and EPC firms

Public–private partnerships for national UAV academies

Upskilling programs for localization and national workforce targets - Trends

Shift toward simulator-first training pathways

Integration of AI-based flight assessment and debriefing

Standardization of curricula aligned with ICAO guidance

Subscription-based enterprise training packages

Cross-border recognition of pilot certifications within GCC

Increased focus on BVLOS and autonomous oversight training - Government Regulations

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Value, 2020–2025

- By Volume, 2020–2025

- By Installed Base, 2020–2025

- By Revenue per Test, 2020–2025

- By Training Type (in Value %)

Basic VLOS certification

Advanced BVLOS and night operations

Enterprise and industrial operations training

Public safety and first responder training

Defense and tactical UAV operator training

Instructor and examiner certification - By Platform Class (in Value %)

Micro and small UAS

Medium UAS

Large UAS

Fixed-wing UAS

VTOL and hybrid platforms - By Training Delivery Mode (in Value %)

In-person classroom

Field flight training

Simulator-based training

Blended learning programs

Corporate on-site training - By Application Sector (in Value %)

Energy and utilities inspection

Construction and infrastructure

Logistics and last-mile delivery

Agriculture and environmental monitoring

Media and surveying

Public safety and defense - By Country (in Value %)

Saudi Arabia

United Arab Emirates

Qatar

Kuwait

Oman

Bahrain

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (Course accreditation and regulatory approval status, BVLOS and advanced certification coverage, Simulator fidelity and fleet diversity, Instructor experience and safety record, Corporate training and customization capability, Geographic footprint across GCC, Pricing models and enterprise contracts, Post-certification support and recurrent training)

- SWOT Analysis of Key Players

- Pricing and Commercial Model Benchmarketing

- Detailed Profiles of Major Companies

CAE

Leonardo

Thales

Boeing Insitu

General Atomics Aeronautical Systems

DJI Academy

UAV Academy Middle East

DroneAcharya

FlytBase Training

Airbus Defence and Space Training

Alpha Aviation Academy UAE

T3 Aviation Academy

Saudi Aviation Academy

Emirates Aviation University

Qatar Aeronautical Academy

- Demand and utilization drivers

- Procurement and tender dynamics

- Buying criteria and vendor selection

- Budget allocation and financing preferences

- Implementation barriers and risk factors

- Post-purchase service expectations

- By Value, 2026–2035

- By Volume, 2026–2035

- By Installed Base, 2026–2035

- By Revenue per Test, 2026–2035