Market Overview

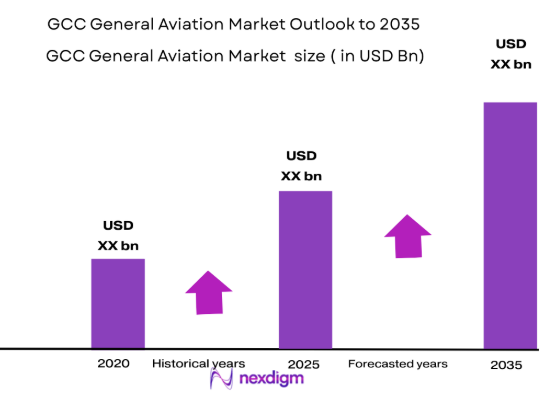

The GCC general aviation market has witnessed significant growth, driven by increasing demand for private and business aviation services. Based on a recent historical assessment, the market size was valued at approximately USD ~ billion. This growth is primarily driven by factors such as rising affluence in the region, government initiatives, and the growing demand for air travel connectivity. The market is further propelled by infrastructure development in key airports and aviation hubs across the GCC, making it an attractive sector for investment and growth.

Several countries in the GCC, such as the UAE and Saudi Arabia, dominate the market due to their robust aviation infrastructure and economic diversification strategies. These nations have been focusing on expanding their airports and creating favorable regulatory environments, which enhances their attractiveness for both private aviation companies and consumers. The UAE has seen significant investments in aviation hubs, which positions it as a key player in the GCC’s aviation sector.

Market Segmentation

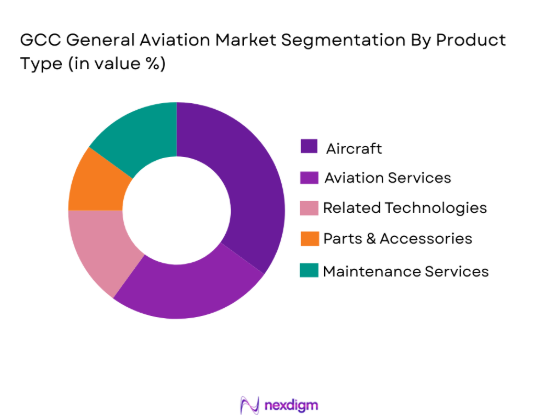

By Product Type

The GCC general aviation market is segmented by product type into aircraft, aviation services, related technologies, parts & accessories, and maintenance services. Recently, the aircraft sub-segment has a dominant market share due to factors such as demand for business jets, helicopters, and light aircraft used for personal, commercial, and government operations. The increasing need for connectivity in the region and the rising popularity of private air travel among high-net-worth individuals have driven demand for aircraft across the GCC. Additionally, strategic partnerships between aviation companies and government bodies have resulted in expanded fleets and availability of aircraft in the region, further enhancing their market dominance.

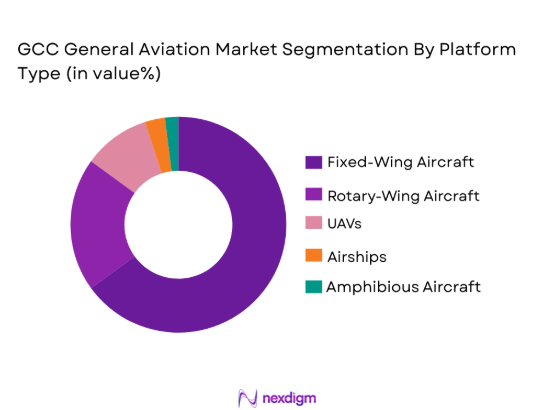

By Platform Type

The market is segmented by platform type into fixed-wing aircraft, rotary-wing aircraft, UAVs (Unmanned Aerial Vehicles), airships, and amphibious aircraft. The fixed-wing aircraft sub-segment holds the largest share of the market due to their established presence in business aviation and air transportation in the GCC. Fixed-wing aircraft are often preferred for longer trips and their ability to carry more passengers or cargo. Moreover, the increasing demand for executive jets and air taxis in urban areas has bolstered the market position of fixed-wing aircraft, making it a leading platform type in the region.

Competitive Landscape

The competitive landscape of the GCC general aviation market is shaped by a few key players who dominate the space, including international aviation giants and local players. These companies are engaged in strategic alliances, mergers, and investments to consolidate their position and expand their market reach. The influence of these major players, coupled with the supportive regulatory environment in the GCC, ensures a dynamic and competitive market where both private and commercial aviation players strive for dominance.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Gulfstream Aerospace | 1958 | USA | ~ | ~ | ~ | ~ | ~ |

| Bombardier | 1942 | Canada | ~ | ~ | ~ | ~ | ~ |

| Embraer | 1969 | Brazil | ~ | ~ | ~ | ~ | ~ |

| Saudi Arabian Airlines | 1945 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| Dubai Aerospace | 2004 | UAE | ~ | ~ | ~ | ~ | ~ |

GCC General Aviation Market Analysis

Growth Drivers

Increasing Affluence and Tourism

The GCC region has seen a substantial rise in disposable income, particularly among business elites, high-net-worth individuals, and professionals across industries. This increase in affluence has directly contributed to the growing demand for private jets, executive aviation services, and luxury travel experiences. Business owners and corporate executives are increasingly opting for private flights to enhance their productivity, efficiency, and flexibility in travel schedules. Additionally, the rise in tourism, particularly luxury tourism, plays a crucial role in boosting general aviation. Leisure travelers, particularly those seeking high-end experiences, are increasingly choosing private flights for both convenience and comfort, avoiding the hassle and delays associated with commercial airlines. The rapid expansion of tourism infrastructure, alongside growing interest in regional tourism and high-profile events, further fuels this demand. The establishment of world-class resorts, cultural festivals, sporting events, and international exhibitions in cities such as Dubai, Abu Dhabi, and Doha, has made luxury travel an essential component of the region’s broader economic strategy. Furthermore, the shift towards tourism-based diversification in several GCC countries has been instrumental in creating a high demand for private and business aviation, with many travelers preferring to travel on private jets or chartered aircraft for personalized experiences. As a result, the general aviation market in the region is seeing substantial growth, with affluence and tourism as key contributors to the sector’s expansion.

Government Investment in Aviation Infrastructure

The governments of the GCC countries have made substantial investments in aviation infrastructure, with the vision to position the region as a global aviation hub. The development of state-of-the-art airports, modern air traffic control systems, and seamless connectivity is central to this ambition. Countries such as the UAE and Saudi Arabia are continuously expanding their aviation networks, including the building of new terminals, aviation parks, and specialized infrastructure catering to private jets, business aviation, and cargo services. These investments are designed to facilitate a smooth and efficient air travel experience for both commercial and general aviation users. As a result, there has been significant growth in regional connectivity, facilitating both short and long-haul private flights. Additionally, the introduction of policies that favor the growth of general aviation, such as tax exemptions for private jets, reduced regulatory barriers, and more streamlined licensing processes, have created a conducive environment for the sector’s growth. These infrastructural developments not only support the rise in demand for aircraft and aviation services but also stimulate the need for advanced technologies and systems that can manage increasing air traffic. The region’s dedication to aviation as a pillar of economic diversification, coupled with substantial government spending, ensures the continued rise of general aviation demand and opportunities for further market expansion.

Market Challenges

High Operational Costs

Operating costs in the GCC general aviation market remain a significant challenge for both private operators and aviation companies. The specialized nature of aircraft, coupled with the region’s harsh environmental conditions, makes it expensive to maintain and operate aircraft. For instance, frequent maintenance is required to ensure the durability of the aircraft in hot and sandy environments, increasing operational expenses. Additionally, fuel costs, which are a key component of operational expenses, fluctuate significantly. The cost of aviation fuel can represent a substantial part of a flight’s overall operational budget. Moreover, the high cost of aircraft insurance, especially for luxury jets and large fleets, can deter some smaller aviation firms from expanding their operations. Stringent regulations concerning aircraft safety and environmental standards require operators to continuously upgrade their fleets and invest in new technologies, which further increases the cost burden. Furthermore, costs associated with airport services, ground handling, and air traffic management are typically higher for general aviation users compared to commercial airlines. The high operational expenses, coupled with intense competition, create challenges for profit margins, particularly for smaller aviation companies that may struggle to expand their fleets or maintain long-term profitability. This environment presents a major obstacle to growth and sustainability within the sector.

Regulatory Hurdles and Bureaucracy

Despite a favorable regulatory environment in many parts of the GCC, navigating the complex landscape of aviation regulations and government bureaucracy remains a challenge. The aviation regulatory frameworks across GCC countries, although increasingly aligned with international standards, still present challenges for operators, particularly new entrants. New companies or foreign entities seeking to establish a presence in the region often face considerable delays in obtaining licenses, permits, and approvals required to operate. The need to comply with a broad range of standards—ranging from aircraft safety to environmental regulations—can result in time-consuming paperwork and operational delays. Furthermore, the differences in regulations and policies between the various GCC countries can create inefficiencies and administrative hurdles. While the UAE and Saudi Arabia have relatively streamlined processes for aviation businesses, other GCC countries may have more bureaucratic systems, which can slow down operations and increase costs. The challenge is compounded by the need to comply with international aviation safety and environmental standards, which often means meeting higher operational standards than those imposed locally. For aviation companies operating across multiple GCC nations, the lack of harmonization in aviation regulations is an ongoing challenge. This regulatory complexity and the bureaucratic hurdles that come with it often add a layer of uncertainty and risk for general aviation operators, limiting their ability to expand and reach full market potential.

Opportunities

Expansion of Air Taxi Services

As urban mobility becomes increasingly important, the expansion of air taxi services presents a significant opportunity for the GCC general aviation market. The region’s rapid urbanization, coupled with congestion in major cities like Dubai and Riyadh, has created a growing demand for alternative modes of transport. Air taxis, which offer faster, more efficient travel within cities, are expected to revolutionize urban transportation in the region. Unlike traditional helicopters, air taxis, particularly those utilizing vertical take-off and landing (VTOL) technology, are more cost-effective and efficient, making them suitable for urban air mobility. The ongoing development of infrastructure designed to accommodate VTOL aircraft, such as dedicated take-off and landing zones in busy urban centers, further supports the feasibility of air taxis. The region’s strong commitment to technological innovation, coupled with an already existing aviation infrastructure, provides an ideal environment for air taxi services to thrive. Investors are pouring resources into the development of these air mobility solutions, which can provide convenient and fast travel for passengers avoiding road traffic congestion. As demand for eco-friendly transportation solutions grows, air taxis powered by electric engines are expected to be a game-changer, contributing to the reduction of carbon emissions in urban environments. These air mobility solutions are seen as a major growth opportunity, and the regulatory landscape is expected to evolve in favor of this technology, creating an avenue for expansion in the GCC general aviation market.

Growth of Helicopter Services

Helicopter services in the GCC region have witnessed a rise in demand, particularly for oil and gas operations, emergency medical services, and luxury tourism. As oil exploration activities continue to expand, helicopters play a critical role in providing access to remote areas, including offshore drilling platforms and other hard-to-reach locations. In addition to their utility in the oil and gas sector, helicopters are increasingly being used for emergency medical services, where they can quickly transport patients to hospitals or accident sites, often in less time than traditional ground transportation. The demand for helicopter services in luxury tourism is also growing, with tourists opting for scenic flights over deserts, mountains, and other iconic landmarks. The UAE, for example, has seen a rise in demand for helicopter tours of Dubai’s famous skyline and surrounding desert landscapes. This niche market is expected to continue growing, driven by an increase in tourism and a growing preference for exclusive, personalized experiences. The development of more efficient, cost-effective helicopters and the increasing demand for air transport in hard-to-reach locations create a wealth of opportunities in this sub-sector of general aviation. Furthermore, the rise of VIP helicopter services, particularly among the region’s high-net-worth individuals, is expected to drive significant growth in the helicopter segment, providing a substantial market opportunity for operators in this space.

Future Outlook

The future outlook for the GCC general aviation market remains positive, driven by a combination of infrastructural growth, technological advancements, and increasing demand for private air travel. Regulatory support is expected to continue, with governments in the region prioritizing aviation as a key economic driver. The market is anticipated to benefit from technological developments such as electric aircraft and air taxis, which promise to revolutionize the aviation landscape. Additionally, continued economic diversification in countries like Saudi Arabia and the UAE will create new avenues for investment in general aviation, further boosting market expansion.

Major Players

- Gulfstream Aerospace

- Bombardier

- Embraer

- Saudi Arabian Airlines

- Dubai Aerospace

- Airbus

- Boeing

- Textron Aviation

- Dassault Aviation

- Cessna Aircraft

- Honeywell International

- Lockheed Martin

- Leonardo Helicopters

- Raytheon Technologies

- Gulf Air

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Private jet operators

- Aviation infrastructure developers

- Aviation service providers

- Aircraft manufacturers

- Tourism companies

- Corporate fleets

Research Methodology

Step 1: Identification of Key Variables

Identification of key market variables such as demand drivers, technological advancements, and regulatory factors impacting the GCC general aviation sector.

Step 2: Market Analysis and Construction

Analysis of market trends, segmentation, and consumer behavior, alongside an assessment of key players and competition in the GCC general aviation market.

Step 3: Hypothesis Validation and Expert Consultation

Expert consultations and validation of findings through interviews with aviation industry professionals, policymakers, and other stakeholders.

Step 4: Research Synthesis and Final Output

Synthesis of data collected from primary and secondary sources to create a comprehensive market report on the GCC general aviation sector, focusing on historical and forecasted trends.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing Affluence and Tourism

Government Investment in Aviation Infrastructure

Technological Advancements in Aircraft Design

Increased Demand for Private Air Travel

Rising Adoption of UAVs in Commercial and Civil Applications - Market Challenges

High Operational Costs

Regulatory Hurdles and Bureaucracy

Limited Availability of Skilled Workforce

High Fuel Prices

Infrastructure Limitations in Remote Areas - Market Opportunities

Expansion of Air Taxi Services

Growth of Helicopter Services in Oil and Gas

Technological Developments in Autonomous Aircraft - Trends

Increasing Adoption of Electric Aircraft

Integration of AI in Air Traffic Management

Rise in Urban Air Mobility Solutions

Demand for Eco-friendly Aircraft Technologies

Government Support for Aviation Industry Growth - Government Regulations & Defense Policy

Supportive Government Regulations in the GCC

International Aviation Safety Standards

Regional Defense Policies and Their Impact on Aviation

- SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Aircraft

Aviation Services

Related Technologies

Parts & Accessories

Maintenance Services - By Platform Type (In Value%)

Fixed-Wing Aircraft

Rotary-Wing Aircraft

UAVs (Unmanned Aerial Vehicles)

Airships

Amphibious Aircraft - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Upgrade Kits

Retrofit

Custom Fitments - By End User Segment (In Value%)

Private Operators

Commercial Operators

Government & Defense

Aviation Service Providers

Tourism & Leisure - By Procurement Channel (In Value%)

Direct Sales

Distributors

Online Channels

Retail

Leasing Companies - By Material / Technology (in Value%)

Advanced Composites

Lightweight Materials

Avionics Technology

Fuel-efficient Engines

Autonomous Technologies

- Market share snapshot of major players

- Cross Comparison Parameter (Market Share, Technological Innovation, Service Quality, Customer Loyalty, Pricing Strategy, Geographic Reach, Product Portfolio, Brand Recognition, Customer Support)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Gulfstream Aerospace

Bombardier

Embraer

Saudi Arabian Airlines

Dubai Aerospace

Airbus

Boeing

Textron Aviation

Dassault Aviation

Cessna Aircraft

Honeywell International

Lockheed Martin

Leonardo Helicopters

Raytheon Technologies

Gulf Air

- Private Operators Increasing Fleet Size

- Commercial Operators Expanding Service Offerings

- Government Demand for Military and Civil Aircraft

- Tourism Sector’s Growing Dependence on Air Travel

- Forecast Market Value, 2026-2030

- Forecast Installed Units, 2026-2030

- Price Forecast by System Tier, 2026-2030

- Future Demand by Platform, 2026-2030