Market Overview

The aerospace and defense market in Germany is a substantial sector with a market size driven by both domestic demand and global exports. In recent historical assessments, the market value stands at USD ~ billion, supported by the country’s strong industrial base, technological advancements, and increasing defense expenditures. Germany’s aerospace industry benefits from a robust manufacturing ecosystem, with significant contributions from sectors such as military aircraft, space systems, and defense electronics. Growth is propelled by the government’s continuous investments in technological innovation and defense modernization, making it a key player in European and global defense markets.

Germany’s aerospace and defense industry is primarily concentrated in cities like Munich, Hamburg, and Berlin, which serve as key hubs due to their historical importance, proximity to major aerospace and defense manufacturers, and strategic geopolitical positioning. Munich is home to aerospace giants like Airbus, while Hamburg houses a significant part of the European aerospace supply chain. Berlin has seen rising investments in defense tech startups, contributing to the growth of the defense sector. These cities are pivotal to Germany’s dominance due to their advanced infrastructure, access to highly skilled labor, and government support for innovation in defense technologies.

Market Segmentation

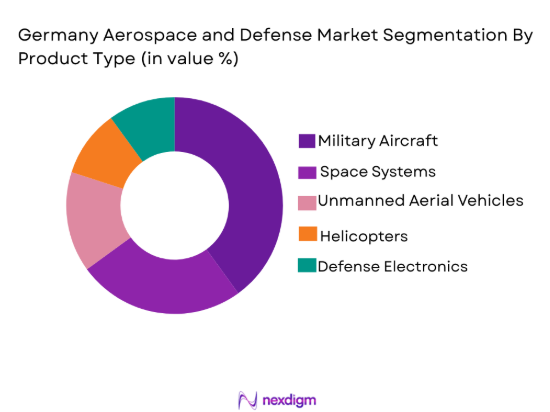

By Product Type

The aerospace and defense market in Germany is segmented by product type into military aircraft, space systems, unmanned aerial vehicles (UAVs), helicopters, and defense electronics. Recently, military aircraft has dominated the market share due to factors such as an increase in defense spending by the government, the growing need for modernized fleets, and the integration of advanced technology. Germany’s strategic location and membership in NATO have led to high demand for defense-ready military aircraft to maintain security and military preparedness. The focus on improving fleet capabilities and expanding defense exports has cemented the military aircraft segment as the dominant player.

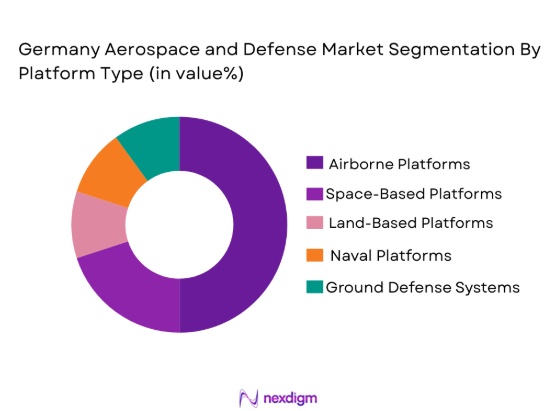

By Platform Type

The aerospace and defense market in Germany is segmented by platform type into airborne platforms, space-based platforms, land-based platforms, naval platforms, and ground defense systems. Recently, airborne platforms have taken the lead in market share due to Germany’s focus on enhancing its air defense systems and upgrading its military aircraft fleet. Airborne platforms benefit from the rising demand for advanced fighter jets, surveillance systems, and unmanned aerial vehicles, contributing to their dominant position in the market. Additionally, the government’s defense initiatives and collaborations with NATO further boost the demand for these platforms.

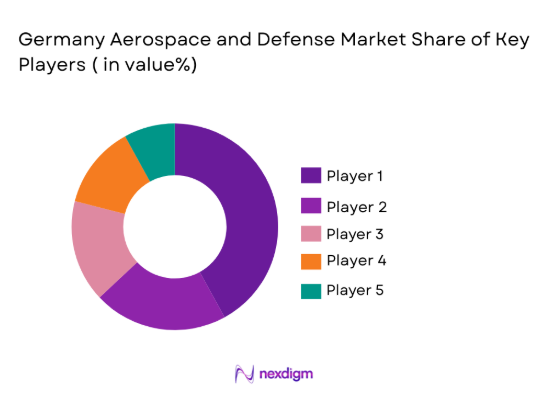

Competitive Landscape

Germany’s aerospace and defense sector is characterized by a competitive landscape with several major players involved in defense manufacturing, technology development, and supply chain management. The market sees consolidation with significant players like Airbus, Rheinmetall, and MTU Aero Engines leading the industry. These companies possess strong technological capabilities, diverse portfolios, and extensive market reach, which enable them to dominate both domestic and international markets. Their influence on policy, infrastructure, and technological advancements shapes the direction of the market, fostering a competitive and dynamic environment.

|

Company Name |

Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue (USD) | Additional Parameter |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

| Rheinmetall | 1889 | Düsseldorf, Germany | ~ | ~ | ~ | ~ | ~ |

| MTU Aero Engines | 1934 | Munich, Germany | ~ | ~ | ~ | ~ | ~ |

| Hensoldt | 2017 | Taufkirchen, Germany | ~ | ~ | ~ | ~ | ~ |

| Krauss-Maffei Wegmann | 1931 | Munich, Germany | ~ | ~ | ~ | ~ | ~ |

Germany Aerospace and Defense Market Analysis

Growth Drivers

Government Investment in Defense Modernization

The German government has been increasing its investments in defense modernization, a critical growth driver for the aerospace and defense market. Germany’s commitment to enhancing its military capabilities, driven by its membership in NATO and the European Union, has resulted in substantial defense budgets. These investments focus on upgrading the country’s fleet of military aircraft, space systems, and defense electronics, fueling demand in the sector. The German Ministry of Defense continues to allocate significant resources toward expanding and modernizing military infrastructure to maintain national security and respond to evolving geopolitical challenges. The country’s political landscape is also pushing for advanced technologies in defense, such as drones and unmanned aerial vehicles, further accelerating the demand for sophisticated aerospace and defense systems.

Technological Advancements in Aerospace

Another key growth driver in Germany’s aerospace and defense market is the rapid pace of technological advancements in aerospace systems. The German aerospace industry has a strong track record of research and development, particularly in the areas of military aviation, space exploration, and defense electronics. The advancement of cutting-edge technologies, including AI, automation, and satellite systems, is making German aerospace companies leaders in the global market. Additionally, technological breakthroughs in materials science, such as the development of lighter and stronger composites, are driving the production of more efficient and cost-effective aircraft. These innovations are not only improving the performance of defense systems but also enhancing their sustainability, contributing to the long-term growth of the sector.

Market Challenges

Supply Chain Disruptions and Component Shortages

One of the major challenges facing the aerospace and defense market in Germany is the ongoing disruption in global supply chains, which has led to a shortage of essential components for defense manufacturing. These disruptions are impacting the timely production and delivery of critical aerospace systems, including military aircraft and defense electronics. The reliance on international suppliers for raw materials and key components makes the German aerospace industry vulnerable to delays, price fluctuations, and geopolitical instability. These supply chain issues have forced companies to rethink their procurement strategies and invest in more resilient and localized supply chains to avoid further delays. As global tensions rise, the aerospace sector faces increasing challenges in securing the materials needed for advanced defense systems, which is expected to impact market growth in the near term.

Stringent Regulatory Compliance and Certification Processes

Another challenge affecting the aerospace and defense market in Germany is the stringent regulatory compliance and certification processes that companies must adhere to in order to market their products. The aerospace industry is subject to a complex web of regulations at the national, European, and global levels, which makes the development and deployment of new defense technologies a lengthy and costly process. Compliance with standards for safety, environmental impact, and export controls can delay product launches, restrict market access, and increase operational costs. Furthermore, the evolving nature of these regulations, particularly those focused on environmental sustainability, places additional pressure on companies to innovate and ensure their products meet the required standards.

Opportunities

Advancement of Space Exploration Programs

Germany’s commitment to space exploration presents significant opportunities for growth in its aerospace and defense sector. The country is an active member of the European Space Agency (ESA), and its involvement in space exploration programs offers opportunities to develop advanced space systems, including satellites, launch vehicles, and scientific missions. The growing demand for satellite-based services, such as communication, Earth observation, and GPS, is driving the expansion of the German space industry. Germany’s advanced technology capabilities and strong industrial base in aerospace manufacturing position it as a key player in the global space market. As space exploration evolves, there is a substantial opportunity for the German aerospace sector to expand its offerings in space-based systems and technology, contributing to long-term growth.

Rise of Unmanned Aerial Vehicles (UAVs) and Drones

The increasing adoption of unmanned aerial vehicles (UAVs) and drones presents another lucrative opportunity for Germany’s aerospace and defense market. UAVs have applications in both military and civilian sectors, including surveillance, reconnaissance, logistics, and infrastructure inspection. Germany has a strong presence in the UAV market, with companies developing cutting-edge drone technologies for defense and commercial purposes. The German government’s support for the integration of UAVs into military operations, coupled with advancements in autonomous systems and AI, is driving the demand for drones in both defense and commercial applications. The market for UAVs is expected to grow rapidly in the coming years, presenting a significant opportunity for German aerospace companies to expand their product portfolios and capitalize on the increasing demand for drone technology.

Future Outlook

The aerospace and defense market in Germany is expected to see continued growth in the next five years, driven by rising demand for advanced defense technologies, increased government spending on modernization efforts, and expanding commercial aerospace capabilities. Technological advancements, particularly in UAVs and space systems, will further fuel the sector’s development, while regulatory support and strategic initiatives will provide a conducive environment for growth. As geopolitical dynamics evolve, Germany’s role in the global defense landscape will be critical in shaping future market trends and demand-side factors.

Major Players

- Airbus Group

- Rheinmetall

- MTU Aero Engines

- Hensoldt

- Krauss-Maffei Wegmann

- Thales Deutschland

- Boeing Germany

- Lockheed Martin Deutschland

- Safran

- Northrop Grumman Germany

- Rolls-Royce Deutschland

- General Electric Aviation

- RUAG Aerospace

- Leonardo

- BAE Systems

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace and defense manufacturers

- Technology developers and suppliers

- Defense contractors

- Military agencies

- Space exploration agencies

- Commercial aerospace companies

Research Methodology

Step 1: Identification of Key Variables

This step involves identifying the critical factors affecting the market, including economic trends, technological advancements, and regulatory changes.

Step 2: Market Analysis and Construction

Data is gathered from a variety of sources to analyze the current state of the market, including primary research, historical data, and expert opinions.

Step 3: Hypothesis Validation and Expert Consultation

The identified hypotheses are validated through consultations with industry experts, stakeholders, and market leaders to ensure the robustness of the findings.

Step 4: Research Synthesis and Final Output

All collected data is synthesized into a comprehensive report, ensuring it is accurate, actionable, and tailored to meet client needs.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Military Budgets and Defense Spending

Technological Advancements in Aerospace and Defense Technologies

Rising Geopolitical Tensions and Security Concerns

Growth in the Civil Aviation Sector

Government Support for Innovation and R&D - Market Challenges

Rising Operational and Maintenance Costs

Supply Chain Disruptions and Component Shortages

Regulatory Compliance and Certification Complexities

Defense Budget Constraints Amid Economic Pressures

Growing Environmental and Sustainability Regulations - Market Opportunities

Expansion in Emerging Markets for Aerospace Exports

Development of Advanced Space Exploration Technologies

Growth in Demand for Unmanned Systems and Drones - Trends

Adoption of Artificial Intelligence and Automation in Defense Systems

Increased Investment in Electric and Hybrid Aerospace Technologies

Rise in Strategic Partnerships Between Private and Government Sectors

Shift Towards Modular and Flexible Aerospace Solutions

Growing Demand for Advanced Materials and Lightweight Structures - Government Regulations & Defense Policy

Tightening of Military Export Controls

Increased Focus on Cybersecurity in Aerospace Systems

New Defense Spending Initiatives Under the European Union Framework - SWOT Analysis

- Stakeholder and Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competition Intensity and Ecosystem Mapping

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Military Aircraft

Space Systems

Unmanned Aerial Vehicles (UAVs)

Helicopters

Defense Electronics - By Platform Type (In Value%)

Airborne Platforms

Space-Based Platforms

Land-Based Platforms

Naval Platforms

Ground Defense Systems - By Fitment Type (In Value%)

OEM (Original Equipment Manufacturer)

Aftermarket

Maintenance, Repair, and Overhaul (MRO)

Retrofit

Upgrades - By End User Segment (In Value%)

Government Defense Agencies

Private Aerospace Companies

Research and Development Institutes

Military Contractors

Commercial Aviation Operators - By Procurement Channel (In Value%)

Direct Procurement

Third-Party Procurement

Public-Private Partnerships

Private Procurement

Government Contracts - By Material / Technology (in Value%)

Composite Materials

Advanced Electronic Systems

Propulsion Systems

Radar and Communication Systems

Structural Components

- Market structure and competitive positioning

- Cross Comparison Parameters (Market Share, Technological Capabilities, R&D Investment, Product Diversification, Customer Base, Geographic Reach, Regulatory Compliance, Supply Chain Efficiency, Partnerships)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Airbus Group

Luftwaffe

MTU Aero Engines

Rheinmetall

Diehl Defence

Hensoldt

Krauss-Maffei Wegmann

Thales Deutschland

Boeing Germany

Lockheed Martin Deutschland

Safran

Northrop Grumman Germany

Rolls-Royce Deutschland

General Electric Aviation

RUAG Aerospace

- Government Defense Agencies Increasing Focus on Technological Upgrades

- Private Aerospace Companies Increasing Investment in Commercialization

- Military Contractors Expanding Partnerships with Government Entities

- Research Institutes Driving Innovation in Aerospace and Defense Technologies

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035