Market Overview

Germany’s agrivoltaics market is best measured by operational Agri-PV capacity because most public sources track megawatt deployment more consistently than revenue. The country had ~ Agri-PV facilities totaling ~ MWp in the preceding period, while capacity was expected to rise sharply to about ~ MWp by the end of the latest period as more projects moved from pilots into utility-scale and tender-backed builds. This ramp-up is reinforced by Germany’s wider PV acceleration: newly installed PV capacity increased from ~ GWp to ~ GWp across consecutive reporting years.

Agri-PV development in Germany clusters where three conditions align: active state-level pilots, strong developer/EPC presence, and faster permitting/practice adoption for “special solar installations.” Baden-Württemberg stands out due to its applied research density and repeated agri-PV demonstrations; southern Germany also benefits from established PV supply chains and a high concentration of energy-transition actors. In parallel, large open-space project economics increasingly favor regions with suitable contiguous farmland parcels and grid connection feasibility, while corporate offtake appetite (PPAs) is strongest near industrial load centers that prioritize long-term renewable sourcing.

Market Segmentation

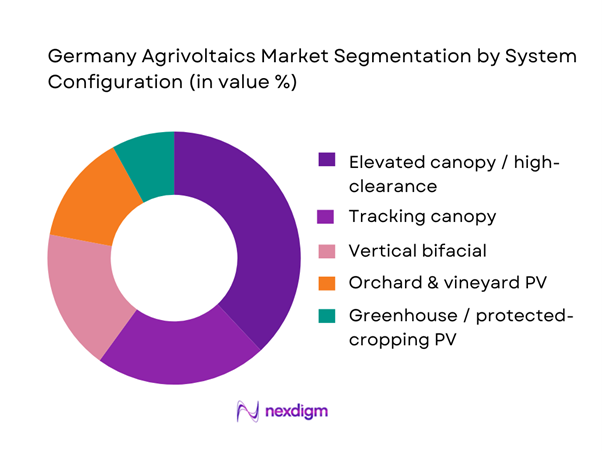

By System Configuration

Germany’s agrivoltaics market is segmented by system configuration into elevated canopy, tracking canopy, vertical bifacial “solar fence” systems, orchard & vineyard PV, and greenhouse PV. Recently, elevated canopy/high-clearance systems hold a dominant share because they best match German farm operations: they preserve primary agricultural use by enabling machinery access, reduce land-use conflict risk, and are easier to position within “special solar installations” logic when developers need bankable layouts. Their engineering is also more standardized for EPC delivery, lowering execution risk versus niche crop-specific structures, while still allowing agronomic co-activity (crop cultivation or grazing) that improves acceptance and permitting narratives.

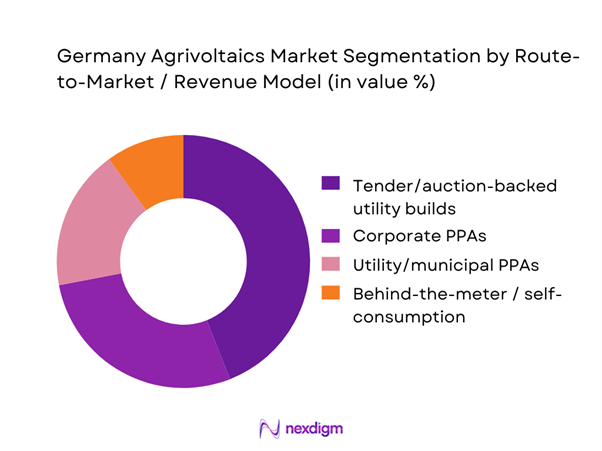

By Route-to-Market / Revenue Model

Germany’s agrivoltaics market is also segmented by route-to-market into auction/tender-backed utility builds, corporate PPA-backed projects, utility PPA/municipal offtake, and behind-the-meter/self-consumption (farm + adjacent loads). Tender/auction-backed utility builds dominate because German ground-mounted PV financing is still strongly shaped by regulated award mechanisms and clear grid-integration processes, which lenders prefer for early-stage categories like Agri-PV. Corporate PPAs are growing, but underwriting can be slower due to offtake credit screening, contract structuring, and curtailment/grid-risk allocation. Behind-the-meter models remain smaller because many farms lack sufficiently large, steady on-site load (or storage) to absorb generation economically at scale, pushing most growth toward utility-scale execution with standardized procurement and O&M structures.

Competitive Landscape

The Germany agrivoltaics market is moving from demonstration-heavy activity to a more bankable, utility-scale phase where a smaller set of developers, utilities, and specialized engineering players can repeatedly deliver permitting, grid connection, and offtake structures. This creates a landscape led by established renewable developers and utilities (strong balance sheets, grid/tender experience) alongside Agri-PV specialists (design IP, vertical-bifacial layouts, farm integration playbooks).

| Company | Est. Year | HQ | Core Agri-PV Play | System Bias | Typical Project Scale | Primary Offtake Route | Delivery Model | Key Differentiation (Germany Context) |

| EnBW Energie Baden-Württemberg | 1997 | Karlsruhe, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Vattenfall | 1909 | Solna, Sweden (Germany operations) | ~ | ~ | ~ | ~ | ~ | ~ |

| BayWa r.e. (BayWa Group lineage) | 1923 | Munich, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Next2Sun | 2015 | Dillingen, Germany | ~ | ~ | ~ | ~ | ~ | ~ |

| Utility-scale developers active in German PV pipelines | — | — | ~ | ~ | ~ | ~ | ~ | ~ |

Germany Agrivoltaics Market Analysis

Growth Drivers

Energy transition targets

Germany’s agrivoltaics adoption is structurally pulled by the scale and pace of the broader energy transition, because Agri-PV is increasingly used to unlock additional developable land without displacing agriculture. In the latest reporting year, Germany added ~ gigawatts of solar capacity, and Bavaria alone installed ~ gigawatts, indicating that permitting, EPC capacity, and grid-facing execution capability for PV are already operating at very large volumes—an enabling condition for Agri-PV standardization. In the same year, Germany’s GDP was USD ~ trillion and GDP per capita was USD ~, supporting continued capital availability for grid reinforcement, rural infrastructure upgrades, and project finance depth relative to many EU peers. Meanwhile, Germany’s wider energy-system restructuring shows up in physical energy data: primary energy consumption was ~ petajoules in the latest year, giving policymakers and utilities a strong incentive to prioritize scalable electrification and renewable generation pathways. Agrivoltaics benefits because it aligns with “special solar installations” policy categories and can be positioned as an implementation tool where land availability becomes the gating factor for incremental solar build-out.

Land-use conflict resolution

Agrivoltaics’ Germany-specific growth logic is grounded in land competition: Germany’s agricultural land base is large but highly utilized, and high-quality parcels are politically sensitive. Official agricultural statistics show ~ agricultural holdings in Germany, demonstrating how fragmented land control can be and why “dual-use” models that preserve agricultural activity are more socially and administratively feasible than pure land conversion. Crop systems with strong land-use constraints are especially relevant: Germany’s viticulture footprint alone is ~ hectares of vineyard area, and annual production is meaningful at ~ million hectoliters of wine and must, which underlines why regions with specialty crops can be protective of productive land and supportive of canopy-style Agri-PV when it provides crop protection co-benefits (hail, heat stress mitigation logic) without eliminating farming. On the macro side, Germany’s economic scale (GDP USD ~ trillion) and labor-market tightness (modeled unemployment ~) strengthen the case for land-use efficiency solutions that reduce planning conflicts and speed delivery of renewable assets without creating new distributional disputes between rural producers and energy developers. Agri-PV becomes a “conflict-minimizing” pathway: it can be designed to keep machinery access, sustain cultivation, and document agricultural primacy—key arguments in German municipal planning discussions around open-space PV siting.

Challenges

Prime farmland permitting barriers

Permitting for Agri-PV is hardest where land is both productive and politically protected, because authorities must ensure “agriculture remains primary” and that installations do not function as de-facto land conversion. Germany’s specialty agriculture underscores this sensitivity: vineyard area is ~ hectares, and wine/must output totals ~ million hectoliters, which strengthens regional incentives to guard high-value crop systems and restrict non-essential land take. Farm structure also matters: with ~ agricultural holdings, land governance is fragmented, and municipal bodies can face high procedural load evaluating whether a specific site is truly dual-use rather than PV-first. From a macroeconomic lens, Germany’s indicators—GDP USD ~ trillion and modeled unemployment ~—mean rural land policy is debated in a high-income economy where environmental, food-system, and local identity concerns carry weight and can translate into stricter planning scrutiny. Practically, Agri-PV developers must spend more effort on agronomic baselining, machinery access envelopes, soil protection measures, and legally robust proof of continued cultivation. That documentation load grows further in prime farmland contexts because “opportunity cost” arguments are strongest and because agricultural stakeholders can point to existing production volumes and land scarcity. The result is that permitting timelines can lengthen, site selection narrows, and developers increasingly prioritize regions where local authorities have clearer playbooks for “special solar installations” and where farmland protection rules are interpreted consistently.

Interconnection queue delays

Grid connection is a central bottleneck for Germany’s entire renewable pipeline, and Agri-PV inherits this constraint because dual-use does not automatically simplify interconnection. Germany’s solar expansion scale—~ gigawatts added in the latest reporting year—pushes DSOs and TSOs to process a very high volume of applications, studies, and reinforcement needs. The broader grid pressure is also visible in adjacent connection-demand categories: the regulator reports that network operators issued about ~ connection commitments for battery storage requests, totaling about ~ gigawatts of power and about ~ gigawatt-hours of capacity—an indicator that “grid reservation” and connection capacity are being contested across multiple asset types, not only PV. This environment creates queue risk for Agri-PV because projects often require multi-step coordination (grid study + permitting + tender/PPA readiness). At the macro level, Germany’s GDP per capita is USD ~ supports investment, but the practical constraint is procedural and engineering throughput, not national affordability. Therefore, the most bankable Agri-PV pipelines are increasingly those that are explicitly “grid-aligned”: near substations, compatible with local reinforcement plans, and supported by credible schedules for transformer capacity, switchgear availability, and metering compliance—reducing the probability that farms secure land permissions but wait extended periods for connection.

Opportunities

Solar grazing scale-up

Solar grazing is a near-term growth lever for Germany’s agrivoltaics market because it matches existing land-use patterns and livestock economics while simplifying vegetation management without removing agricultural activity. Germany’s permanent grassland base is large at ~ million hectares, and it is actively managed with ~ used as pasture and ~ cut as meadow, creating a broad operational footprint where grazing-compatible PV layouts can be deployed without fundamentally changing land identity. The livestock base is also material: ~ million sheep were recorded in the latest reporting year, and it is noted that about ~ farms held sheep in the preceding reporting year—important because sheep grazing is commonly used for PV vegetation control where fencing and safety protocols are managed well. The opportunity becomes more compelling when tied to macro stability: Germany’s GDP per capita is USD ~, which supports the development of specialized service ecosystems (grazing contractors, fencing suppliers, animal-safe electrical standards) needed to scale dual-use operations across multiple regions. As PV additions remain high (~ gigawatts in the latest reporting year), developers also have an incentive to differentiate projects with lower O&M friction and stronger local acceptance narratives; grazing-based Agri-PV can be presented as a land stewardship model that keeps farming visibly active while supporting renewable generation.

Orchard and vineyard canopy deployments

Orchard and vineyard canopies represent a strong Germany-specific opportunity because specialty crops have high sensitivity to weather volatility and land-use scrutiny, making “production-preserving” dual-use solutions more acceptable than standard open-space PV. Official statistics show Germany’s vineyard area is ~ hectares, with large concentrations in states such as Baden-Württemberg (~ hectares) and Bavaria (~ hectares), and annual output of ~ million hectoliters of wine and must—numbers that highlight both the economic relevance of viticulture regions and the political need to protect these landscapes. Canopy-style Agri-PV can be framed as “infrastructure that protects production” (e.g., hail and heat risk mitigation concepts) while generating electricity, which is a more convincing permitting narrative in specialty-crop corridors than ground-mounted conversion. The macro context supports investability: Germany’s GDP is USD ~ trillion and inflation is ~, which generally favors long-lived infrastructure where benefits are tied to risk reduction and stable output rather than short-cycle gains. In addition, Germany’s high solar build rate (~ gigawatts added in the latest reporting year) suggests that scaling will increasingly depend on unlocking more “socially and agriculturally compatible” sites—exactly where orchard/vineyard canopies can expand the addressable land pool without undermining agricultural primacy.

Future Outlook

Over the next five to six years, Germany’s agrivoltaics market is expected to expand as PV buildout remains structurally high, “special solar installations” and clearer definitions reduce classification ambiguity, and large projects prove repeatable economics through PPAs and auction-backed revenues. Standardization—especially around agricultural primary use and technical layout categories—should reduce permitting friction and improve lender comfort, pulling Agri-PV further into mainstream utility-scale solar development.

Major Players

- EnBW Energie Baden-Württemberg

- Vattenfall

- BayWa r.e. / BayWa Group

- Next2Sun

- RWE Renewables

- E.ON Energy Infrastructure / renewables entities

- Statkraft

- Lightsource bp

- ib vogt

- juwi

- Enerparc

- ABO Energy

- Goldbeck Solar

- Belectric

Key Target Audience

- Utility-scale solar developers & IPPs

- Agricultural landowners, cooperatives, and large farm operators

- Corporate renewable procurement teams

- Grid connection and infrastructure stakeholders

- EPC contractors and BoP integrators

- Module/structure OEMs

- Investments and venture capitalist firms

- Government and regulatory bodies

Research Methodology

Step 1: Identification of Key Variables

We map Germany’s Agri-PV ecosystem (developers, utilities, EPCs, agri stakeholders, permitting bodies, offtakers). Desk research combines peer-reviewed sources, standards references (e.g., DIN guidance), tender notes, and project disclosures to define variables like project typology, land-use constraints, and grid-connection pathways.

Step 2: Market Analysis and Construction

We compile historical deployment indicators (facility counts, MWp pipelines where disclosed, tender classification patterns) and triangulate them with Germany’s broader PV build-out context to ensure Agri-PV growth is consistent with national solar acceleration dynamics.

Step 3: Hypothesis Validation and Expert Consultation

We validate commercialization hypotheses through structured expert interviews (developers, EPCs, land aggregators, offtakers), focusing on bankability, permitting bottlenecks, agronomic compatibility, and operational performance under German climate conditions.

Step 4: Research Synthesis and Final Output

We synthesize bottom-up project intelligence with policy/tender signals and standardization trends to finalize segment shares, competition benchmarking, and future outlook—ensuring the report is actionable for investment, origination, and market-entry decisions.

- Executive Summary

- Research Methodology (Market definitions and inclusions/exclusions, DIN-based Agri-PV qualification logic, assumptions and conversion factors, primary interview framework farmers developers DSOs municipalities, secondary research sources, project database build approach, tender and auction tracking approach, triangulation and validation steps, limitations)

- Definition and Scope

- Market Evolution and Adoption Pathway

- Ecosystem Genesis policy-to-project pipeline

- Business Cycle development-to-operations timeline

- Growth Drivers

Energy transition targets

Land-use conflict resolution

Grid-aligned renewable buildout

Farm income resilience requirements

Community acceptance and shared value models - Challenges

Prime farmland permitting barriers

Interconnection queue delays

Operational complexity of dual land use

Winter performance and snow management

Bankability and documentation burden - Opportunities

Solar grazing scale-up

Orchard and vineyard canopy deployments

Standardized DIN-ready design templates

Retrofit conversion of existing solar assets - Trends

Hybridization with energy storage

Vertical bifacial system adoption

Biodiversity-linked agrivoltaic design

Municipal participation models

Data-backed agronomic verification - SWOT Analysis

- Stakeholder & Ecosystem Analysis

- Porter’s Five Forces Analysis

- Competitive Intensity & Ecosystem Mapping

- By Value, 2019–2024

- By Installed Capacity, 2019–2024

- By Project Count, 2019–2024

- By Revenue Stream Mix EEG support PPA merchant self-consumption, 2019–2024

- By Fleet Type (in Value %)

Overhead canopy systems

Inter-row agrivoltaics

Vertical bifacial systems

Greenhouse-integrated agrivoltaics

Orchard and vineyard protection structures - By Application (in Value %)

Arable crops

Specialty crops and horticulture

Orchards

Viticulture

Grazing and animal husbandry - By Technology Architecture (in Value %)

Fixed-tilt elevated structures

Single-axis tracker elevated systems

Vertical east–west bifacial layouts

Semi-transparent photovoltaic modules

Dynamic shading control systems - By Connectivity Type (in Value %)

DSO-connected projects

TSO-connected projects

EEG innovation tender linked projects

Corporate PPA linked projects

Behind-the-meter self-consumption projects - By End-Use Industry (in Value %)

Independent farmers and landowners

Agricultural cooperatives

Renewable energy developers and IPPs

Municipality-backed energy projects

Agri-food corporates and estate owners - By Region (in Value %)

Bavaria

Baden-Württemberg

Lower Saxony

North Rhine-Westphalia

Brandenburg

- Competition ecosystem developers EPCs racking specialists agronomy partners asset owners

- Cross Comparison Parameters (Agri-PV design archetype strength, DIN SPEC compliance playbook maturity, agronomic monitoring and verification stack, grid-connection execution track record, tender and PPA origination capability, farm-operations integration machinery grazing, hybridization capability storage coupling, O&M model for dual-use uptime and co-activity coordination)

- Company strategy benchmark route-to-market partnerships standardization regional focus

- Pricing and commercial models revenue share leases EPC contracts availability guarantees

- Detailed Profiles of Major Companies

BayWa r.e.

Sunfarming Cube Green Energy

EnBW

Next2Sun

GOLDBECK SOLAR

BELECTRIC

JUWI

ib vogt

ABO Energy

STEAG Solar Energy Solutions

IDEEMATEC

Schletter Group

ENERPARC

VSB Group

- Farmer segmentation by size crop tenancy risk appetite

- Developer and IPP segmentation tender PPA hybrid focused

- Utility and offtaker requirements firming traceability ESG

- Municipality and community decision framework acceptance and value capture

- Purchase and adoption journey site to operations

- By Value, 2025–2030

- By Installed Capacity, 2025–2030

- By Project Count, 2025–2030

- By Revenue Stream Mix EEG support PPA merchant self-consumption, 2025–2030