Market Overview

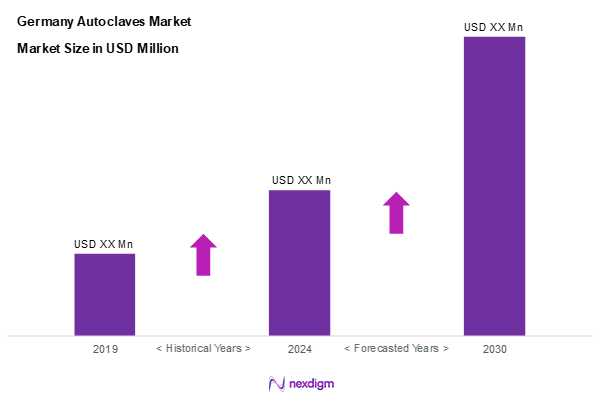

As of 2024, the Germany autoclaves market is valued at USD 14.2 million, with a growing CAGR of 12.4% from 2024 to 2030, reflecting robust demand across various industries such as healthcare and pharmaceuticals. This market growth is driven by increasing healthcare expenditure and advancements in sterilization technologies that enhance efficiency and effectiveness in sterilization processes. With an emphasis on safety and hygiene, the demand for autoclaves has surged significantly, facilitating the expansion of the market.

Key regions that dominate the Germany autoclaves market include Bavaria and North Rhine-Westphalia, primarily due to their extensive healthcare infrastructure and strong industrial bases. These regions host numerous hospitals, research facilities, and pharmaceutical companies that require reliable sterilization equipment, thereby establishing themselves as critical hubs within the market landscape. The presence of major manufacturers in these areas further contributes to their dominance.

Market Segmentation

By Product Type

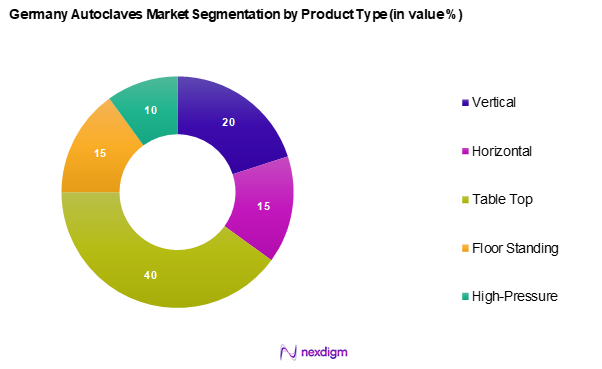

The Germany autoclaves market is segmented into vertical, horizontal, table top, floor standing, and high-pressure autoclaves. Table top autoclaves hold a dominant position in the market due to their compact size and increasing popularity in smaller clinics and laboratories. Their ease of use and efficient sterilization capabilities make them a preferred choice for various end-users, contributing to their significant market share.

By Technology

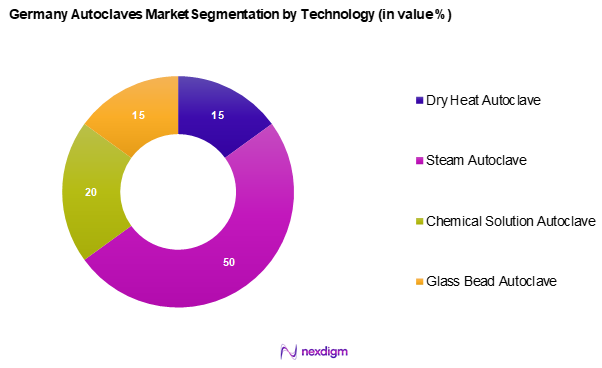

The Germany autoclaves market is segmented into dry heat autoclave, steam autoclave, chemical solution autoclave, and glass bead autoclave. Steam autoclaves segment dominant due to their established effectiveness in efficiently sterilizing a wide range of materials and instruments. This technology is favored in healthcare settings because of its ability to eliminate a broad spectrum of pathogens quickly and reliably, accounting for a substantial portion of the market.

Competitive Landscape

The Germany autoclaves market is characterized by the presence of prominent players, including CEM GmbH, HiTec Zang GmbH, and MELAG Medizintechnik GmbH & Co. KG. These companies have established themselves through innovative technologies and strong market presence. The competition highlights the market’s dynamic nature, with these key players continuously advancing their product offerings and market strategies to maintain their leadership.

| Company Name | Establishment Year | Headquarters | Revenue (USD Mn) | Market Segment Focus | Technology Type | Market

Share |

| CEM GmbH | 1978 | Nordrhein-Westfalen, Germany | – | – | – | – |

| HiTec Zang GmbH | 1979 | Herzogenrat, Germany | – | – | – | – |

| MELAG Medizintechnik GmbH | 1951 | Berlin, Germany | – | – | – | – |

| SHP Steriltechnik AG | 2006 | Sachsen-Anhalt, Germany | – | – | – | – |

| Systec GmbH & Co. KG | 1994 | Hessen, Germany | – | – | – | – |

Germany Autoclaves Market Analysis

Growth Drivers

Rising Healthcare Expenditure

Germany’s commitment to improving its healthcare system is evident through substantial investments in healthcare expenditure. This financial dedication enhances healthcare infrastructure and ensures advanced service delivery. As the population ages, the need for improved sterilization processes becomes more critical, which in turn drives the demand for autoclaves. The significant financial allocations toward healthcare reflect a solid commitment to maintaining high standards in medical facilities and prompt the ongoing procurement of advanced sterilization equipment, facilitating needs specific to hospitals and clinics.

Technological Advancements

Innovations in autoclave technology play a crucial role in the market’s expansion. Enhanced steam sterilization methods and increased automation within autoclaves are becoming increasingly popular among healthcare providers, promoting streamlined operations. The integration of smart technologies into medical equipment aids in improving efficiency and reducing operational expenses. Furthermore, the government’s focus on research and development fosters an environment conducive to technological progress within the medical device sector, encouraging manufacturers to produce cutting-edge autoclave systems that meet contemporary healthcare needs.

Market Challenges

High Initial Investments

The financial barrier posed by the initial investments required for high-quality autoclaves can be considerable. Many healthcare facilities, particularly smaller clinics, often face challenges in budgeting for innovative sterilization systems. The potential long-term efficiencies and compliance benefits starkly contrast with these upfront costs, which can lead to reluctance among organizations to upgrade existing equipment. This financial constraint hinders the modernization of sterilization practices, ultimately impacting operational efficiency and safety standards in healthcare settings.

Compliance and Regulatory Challenges

Navigating Germany’s rigorous regulatory framework for medical devices poses a significant challenge for autoclave manufacturers and users. Compliance with the Medical Device Regulation requires thorough assessments and continuous monitoring, often leading to delays in product approvals. These regulations also demand that healthcare personnel receive ongoing training and updates, which can contribute to higher operational costs for facilities. Balancing such compliance requirements with the need for efficient processes adds complexity to the market dynamics, compelling healthcare providers to invest time and resources to maintain adherence.

Opportunities

Expansion in Emerging Markets

The opportunities for growth in the autoclave market are significantly bolstered by the expansion into emerging markets, particularly in regions like Eastern Europe and Southeast Asia. As healthcare infrastructures in these areas continue to modernize, the demand for dependable sterilization solutions is expected to rise. German autoclave manufacturers can leverage this growth by exporting technology and products tailored to the specific needs of these developing healthcare markets. The shift toward improved healthcare quality opens doors for strategic partnerships and investments focused on elevating sterilization practices.

Growth of Personalized Medicine

The evolution of personalized medicine is transforming the healthcare landscape and creating unique opportunities for the use of advanced autoclaves. As healthcare facilities adopt specialized approaches tailored to individual patient needs, the demand for advanced sterilization methods to support these practices increases. The continued investment in personalized medicine fosters a greater necessity for autoclave systems that can accommodate small-scale and precise sterilization requirements. This trend suggests an upward trajectory in the adoption of sophisticated autoclave technologies, particularly within facilities dedicated to personalized healthcare services.

Future Outlook

Over the next five years, the Germany autoclaves market is expected to experience significant growth driven by increasing investments in healthcare infrastructure, the ongoing demand for sterilization in medical applications, and advancements in autoclave technologies. Innovations aimed at improving efficiency and reducing environmental impact will further catalyze market expansion, positioning the sector for a robust future.

Major Players

- CEM GmbH

- HiTec Zang GmbH

- JUCHHEIM Laborgeräte GmbH

- Systec GmbH & Co. KG

- Adolf Wolf SANOclav

- Haage Anagramm Technologien GmbH

- HMC Europe GmbH

- IBK Industriebedarf GmbH

- Parr Instrument (Deutschland) GmbH

- SHP Steriltechnik AG

- UniEquip Laborgerätebau & Vertriebs GmbH

- Witeg Labortechnik GmbH

- ZIRBUS technology GmbH

- MELAG Medizintechnik GmbH & Co. KG

Key Target Audience

- Pharmaceutical and Healthcare Providers

- Aerospace Manufacturers

- Research and Development Laboratories

- Government and Regulatory Bodies (e.g., Federal Institute for Drugs and Medical Devices)

- Investments and Venture Capitalist Firms

- Medical Device Manufacturers

- Hospital Supply Chains

- Laboratories in Academic Research Institutions

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Germany autoclaves market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Germany autoclaves market. This includes assessing market penetration, the ratio of manufacturers to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through Computer-Assisted Telephone Interviews (CATI) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple autoclave manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Germany Autoclaves Market.

- Executive Summary

- Research Methodology

(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Overview Genesis

- Timeline of Major Players

- Business Cycle

- Supply Chain and Value Chain Analysis

- Growth Drivers

Rising Healthcare Expenditure

Technological Advancements - Market Challenges

High Initial Investments

Compliance and Regulatory Challenges - Opportunities

Expansion in Emerging Markets

Growth of Personalized Medicine - Trends

Shift Towards Green Technologies

Increasing Demand for Sterile Products - Government Regulation

Sterilization Standards

Health and Safety Regulations - SWOT Analysis

- Stakeholder Ecosystem

- Porter’s Five Forces

- By Value, 2019-2024

- By Volume, 2019-2024

- By Average Price, 2019-2024

- By Product Type (In Value %)

Vertical

Horizontal

Table Top

Floor Standing

High pressure - By Capacity (In Value %)

50-200 Liters

200-500 Liters

500-1000 Liters

1000-2000 Liters

>2000 Liters - By Technology (In Value %)

Dry Heat Autoclave

Steam Autoclave

Chemical Solution Autoclave

Glass Bead Autoclave - By Application (In Value %)

Medical

Pharmaceutical

Dental

Aerospace

Laboratory

Others - By End User (In Value %)

Pharmaceutical and Healthcare

Aerospace

Others - By Region (In Value %)

North Rhine-Westphalia

Bavaria

Baden-Württemberg

Hesse

Others

- Market Share of Major Players on the Basis of Value/Volume, 2024

Market Share of Major Players by Type of Product Segment, 2024 - Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenues, Distribution Channels, Market Penetration, Innovation and Technology)

- SWOT Analysis of Major Players

- Pricing Analysis Basis SKUs for Major Players

- Detailed Profiles of Major Companies

CEM GmbH

HiTec Zang GmbH

JUCHHEIM Laborgeräte GmbH

Systec GmbH & Co. KG

Adolf Wolf SANOclav

Haage Anagramm Technologien GmbH

HMC Europe GmbH

IBK Industriebedarf GmbH

Parr Instrument (Deutschland) GmbH

SHP Steriltechnik AG

UniEquip Laborgerätebau & Vertriebs GmbH

Witeg Labortechnik GmbH

ZIRBUS technology GmbH

MELAG Medizintechnik GmbH & Co. KG

- Market Demand and Utilization Patterns

- Budget Allocations by End Users

- Compliance Requirements

- Needs, Desires, and Pain Point Analysis

- Decision Making Process

- By Value, 2025-2030

- By Volume, 2025-2030

- By Average Price, 2025-2030