Market Overview

According to a credible analysis by Nexdigm, the Germany BNPL market is valued at USD 15.40 billion, based on a five‑year historical and current outlook. This expansion is substantially driven by rising e‑commerce adoption, evolving consumer preferences toward installment‑based payments, and fintech innovation across digital retail ecosystems.

Major cities like Berlin, Munich, and Hamburg lead BNPL adoption, hosting dense populations, thriving online retail sectors, and concentrated tech innovation. Their high digital infrastructure, strong fintech ecosystems, and progressive consumer lifestyles underpin why they dominate BNPL usage in Germany.

Market Segmentation

By Channel

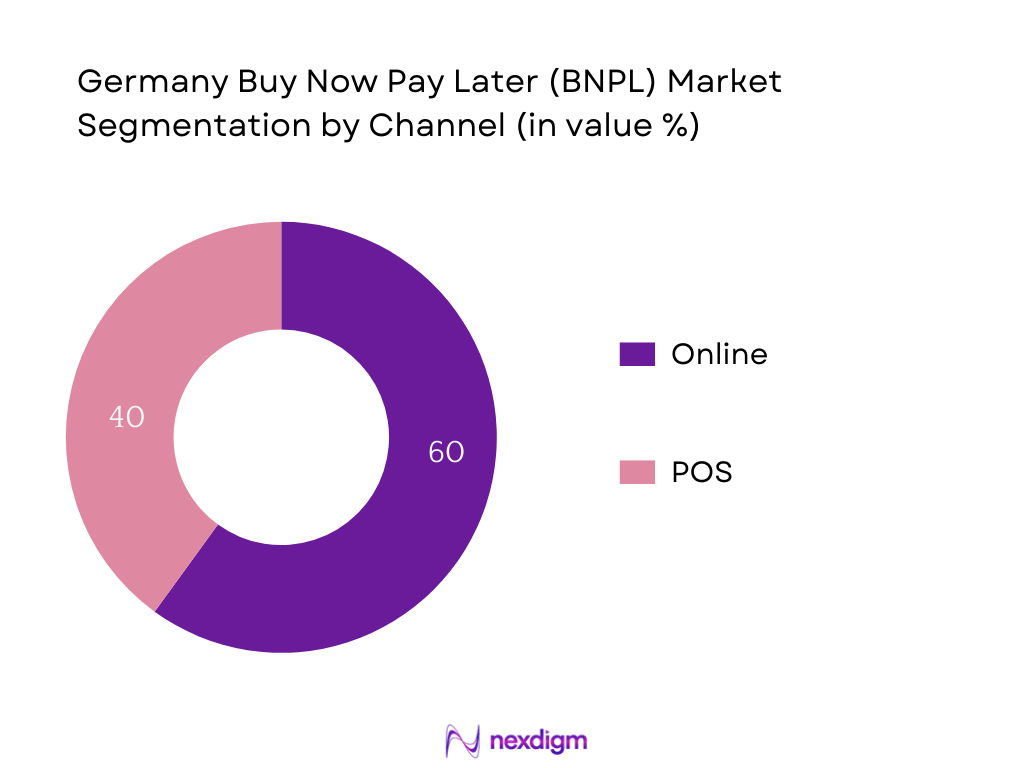

Germany BNPL market divides into online and POS segments, with online BNPL holding a dominant share of 60%. This supremacy stems from the strong penetration of e‑commerce, smoother integration at checkout, and elevated convenience for digital shoppers. Providers such as Klarna and PayPal Pay Later thrive in this segment due to consumer familiarity with digital payment flows and rapid checkout benefits, giving online BNPL a clear edge.

By Provider Type

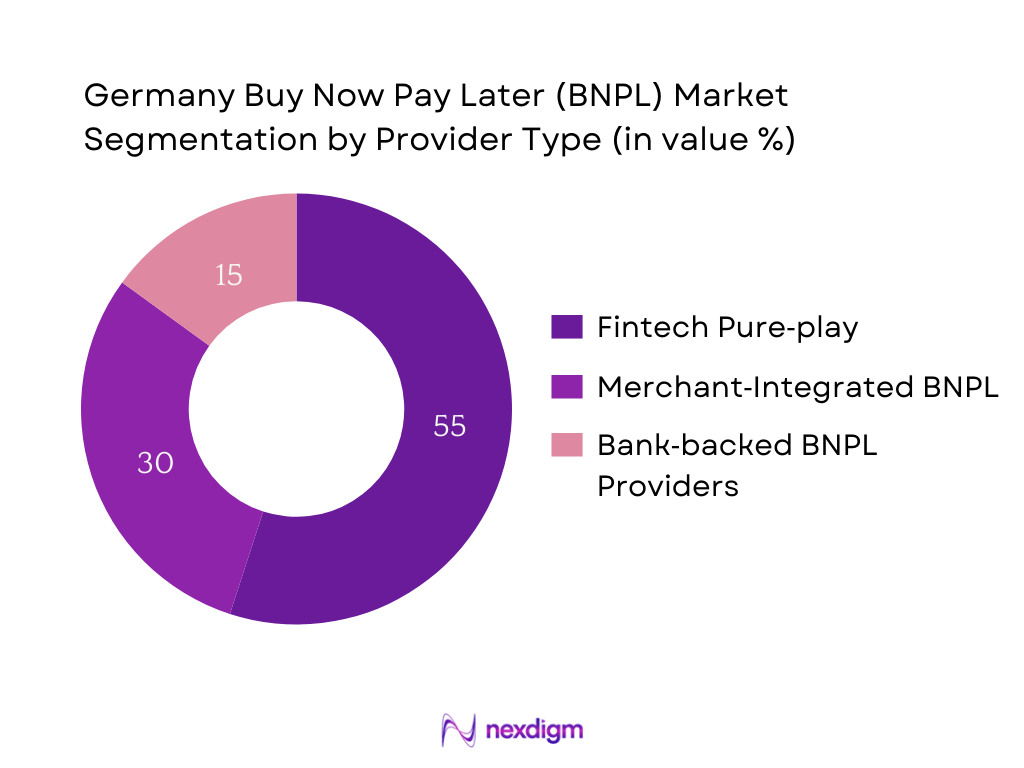

The Germany BNPL market is segmented into fintech pure‑play providers, merchant‑integrated solutions, and traditional bank-backed BNPL offerings. Fintech pure‑play providers lead with 55% share due to agile technology stacks, appealing user experiences, and deep integration with digital platforms. Merchant-integrated BNPL follows at 30%, driven by in‑checkout embedding and promotion partnerships. Bank-backed providers, though more trusted, trail at 15% due to slower innovation and higher regulatory licensing overheads.

Competitive Landscape

The Germany BNPL market is shaped by key players like Klarna, Ratepay, Billie, PayPal Pay Later, and Banxware. This concentration underscores how market innovators and established platforms exert strong influence, driving product evolution and consumer reach.

| Company | Establishment Year | Headquarters | Tech Integration & APIs | Schufa Credit Integration | Merchant Network Depth | Product Differentiation | Risk/Default Management | Regulatory Readiness |

| Klarna | 2005 | Stockholm, Sweden | – | – | – | – | – | – |

| Ratepay | 2011 | Berlin, Germany | – | – | – | – | – | – |

| Billie | 2016 | Berlin, Germany | – | – | – | – | – | – |

| PayPal Pay Later | 1998 (PayPal), BNPL later | San Jose, USA | – | – | – | – | – | – |

| Banxware | 2019 | Berlin, Germany | – | – | – | – | – | – |

Germany BNPL Market Analysis

Key Growth Drivers

Rising e‑Commerce Penetration

Germany’s e-commerce sector recorded €79.7 billion in gross revenue from online goods last year, representing a major factor in supporting BNPL adoption among digital consumers; this figure illustrates robust online retail behavior. In the first half of this year alone, consumers spent €39.84 billion on products online—demonstrating sustained momentum in e‑commerce purchasing. Concurrently, Germany’s total e‑commerce sales in 2024 rose to €80.6 billion, signaling returning confidence and spending power in digital channels. High smartphone-enabled shopping complements this trend: 47 million adults were engaged in e‑commerce as of mid‑2025. These robust online retail figures provide a fertile environment for BNPL services, which thrive at digital checkouts and embedded payment flows, as consumers increasingly prefer flexible payment options that align with the scale and frequency of online spending.

Shift Towards Alternative Credit Tools

While Germany typically exhibits prudent consumer borrowing habits, macro indicators offer insight into demand for non‑traditional credit. Retail turnover, although recovering, is still slightly below pre‑pandemic baseline—real retail turnover in March 2023 remained down by 1.3 percent compared to March 2019—driving interest in flexible payment methods such as BNPL among cost-conscious consumers. Meanwhile, Germany’s online retail revenue growth of 1.1 percent in 2024 (in real terms) confirms cautious spending behavior with controlled exposure to extended credit. This economic conservatism fosters acceptance of low‑commitment installment tools, especially during promotional periods like Black Friday where €87.1 billion is anticipated in e‑commerce sales—indicating that consumers seek soft‑credit solutions to smooth large digital purchases. Thus, the data underscores the emergence of BNPL as a favorable alternative to outright credit or loans, aligning with consumers’ desire to manage budgets while maintaining spending.

Key Market Challenges

Regulatory Pressure & Consumer Credit Directive

Germany operates under stringent consumer credit regulations derived from EU law, including the Consumer Credit Directive and national implementations. The complex regulatory environment, combined with oversight from BaFin and rigorous credit transparency requirements, adds layers of compliance pressure for BNPL providers. While exact numerical data is not applicable due to legal frameworks, the competitive landscape is significantly shaped by regulatory friction—providers must navigate licensing, credit assessment protocols, and disclosure mandates before launching BNPL products. Delayed regulatory clarity can slow market entry and expansion, creating uncertainty for fintech firms and merchant‑integrated lenders alike.

Default Risk Among First‑Time Credit Users

German consumers’ traditionally risk‑averse credit approach aligns with low delinquency environments. While exact default figures for BNPL-specific cohorts are not publicly available, Germany’s broader retail lending exhibits low non-performing loan ratios—under 2 percent—which establishes a high benchmark for BNPL risk management. However, first‑time or younger borrowers using BNPL for impulse purchases may challenge underwriting paradigms, as BNPL growth risks inflating small-balance defaults among under‑scored segments. This emerging risk dimension could constrain provider growth until more granular consumer behavior data is secured.

Emerging Market Opportunities

BNPL in Healthcare & Education Services

Digital spending in Germany demonstrates that consumers are migrating online for diverse product categories. In 2024, two‑thirds of Germans ordered clothing and shoes online, electronics followed closely, and personal care product purchases doubled from 18 percent to 35 percent over four years. Additionally, online grocery and pharmaceuticals have increased significantly. This indicates rising comfort with online spending in personal wellbeing and services, creating a fertile ground for BNPL solutions in healthcare and education services sectors. Embedding BNPL into telemedicine, online tutoring, or supplementary vocational education platforms could align with consumers’ established digital purchasing behavior and broaden BNPL utility across non‑retail verticals.

Green & Sustainability‑Linked BNPL Products

Germany’s “Next Generation”, comprising individuals aged 18‑30, exhibits strong environmental awareness and a preference for sustainability. While specific numbers on green spending are not provided, studies show this cohort is particularly engaged with ecological causes and expects businesses to reflect climate-conscious values. Given their significant population share, sustainability-linked BNPL products—such as green financing for eco-friendly goods or carbon-offset installments—can resonate strongly. Only by aligning BNPL offerings with ESG values can providers appeal to this conscientious demographic’s purchasing motivations, positioning BNPL not just as a payment tool but also as a reflection of personal ethics.

Future Outlook

Over the forecast horizon, Germany’s BNPL market is poised for strong expansion, propelled by deepening digital retail penetration, fintech innovation, and evolving consumer behaviors. Continued growth across key verticals such as electronics, fashion, and healthcare, combined with further regulatory clarity, will propel adoption—especially through online channels and embedded merchant integrations.

Major Players

- Klarna

- Ratepay

- Billie

- PayPal Pay Later

- Banxware

- Afterpay / Clearpay

- Twisto

- Zilch

- Alma

- Scalapay

- Payla

- GetPaid

- Finiata

- Novalnet

- Consors Finanz

Key Target Audiences

- Large Retail and Marketplace CFOs

- E‑commerce Platform CEOs

- Digital Payment Infrastructure VPs

- Investments and Venture Capitalist Firms

- Banking & Financial Institution Product Heads

- Fintech Strategic Partnership Leaders

- Government and Regulatory Bodies (e.g., BaFin – Federal Financial Supervisory Authority, Bundesbank)

- Consumer Finance Association Representatives

Research Methodology

Step 1: Identification of Key Variables

Initial analysis involved mapping Germany’s BNPL ecosystem—including providers, merchants, regulatory factors, and consumer behaviors—using a blend of secondary intelligence sources, proprietary databases, and fintech industry publications to pinpoint pivotal variables.

Step 2: Market Analysis and Construction

Historical data on transaction volumes, user adoption, and revenue were compiled and analyzed, with focus on channel-specific performance (online vs POS) and provider-type contributions to derive accurate 2024 market sizing.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding growth drivers, segmentation trends, and competitive dynamics were validated through structured interviews with industry executives from fintechs, merchant acquirers, and regulatory bodies to ensure real-world alignment.

Step 4: Research Synthesis and Final Output

Conversations with BNPL providers, industry analysts, and regulatory experts were conducted to refine segmentation rationales, competitive analysis, and outlook, ensuring a validated and comprehensive market report.

- Executive Summary

- Research Methodology (Market Definition & Assumptions, Abbreviations, Market Sizing Approach, Primary & Secondary Data Collection, Expert Interviews, Forecasting Models, Limitations & Future Considerations)

- Definition and Scope

- Evolution of BNPL in Germany

- Regulatory Environment and the EU Consumer Credit Directive (Market-Specific Parameter: Regulatory Framework)

- Key Stakeholders and Value Chain (Market-Specific Parameter: Value Chain Actors)

- BNPL Ecosystem in Germany – Banks, Fintechs, Merchants, Consumers (Market-Specific Parameter: Ecosystem Structure)

- Key Growth Drivers

Rising eCommerce Penetration

Shift Towards Alternative Credit Tools

Smartphone-Enabled Payment Adoption

Younger Consumer Demographic Demand - Key Market Challenges

Regulatory Pressure & Consumer Credit Directive

Default Risk Among First-Time Credit Users

Schufa Credit Integration Limitations

Consumer Awareness Gaps Outside Urban Areas - Emerging Market Opportunities

BNPL in Healthcare & Education Services

Green & Sustainability-Linked BNPL Products

BNPL-as-a-Service for SMEs

Cross-border BNPL Opportunities - Industry Trends

Merchant API Integrations

AI-based Risk Profiling

Embedded BNPL Solutions

Subscription Financing Models - Government and Regulatory Analysis

EU and German BNPL Directives

Consumer Credit Regulations

Licensing Requirements and Penalties - SWOT Analysis (Market-Specific Parameter: Strategic Positioning of BNPL)

- Stakeholder Ecosystem (Market-Specific Parameter: Fintech-Merchant-Bank-Consumer Framework)

- Porter’s Five Forces Analysis

- By Value of BNPL Transactions, 2019-2024

- By Volume of BNPL Transactions, 2019-2024

- By Active User Base, 2019-2024

- By Payment Channel (In Value %)

Online BNPL

POS BNPL

Mobile App BNPL - By Provider Type (In Value %)

Pure-Play BNPL Fintechs

Merchant-Integrated BNPL

Traditional Banks Offering BNPL - By Industry Vertical / Use-Case (In Value %)

Fashion and Apparel

Consumer Electronics

Healthcare Services

Furniture & Home Improvement

Travel & Mobility - By Merchant Size (In Value %)

SMEs

Large Enterprise Retailers

Digital Marketplaces - By Repayment Structure (In Value %)

0% Interest Short-Term

Interest-Bearing Installments

Subscription-Style Rolling Credit

- Market Share of Top 15 Players (Value-Based, Volume-Based)

Cross Comparison Parameters (Company Overview, Strategic Positioning, BNPL Volume Processed, API / Tech Stack Strength, Regulatory Alignment & Schufa Integration, Merchant Partnerships, Unique Value Proposition, Revenue by BNPL Model) - SWOT Analysis of Leading Players

- Pricing & Fee Structure Analysis (Based on Product SKUs and Use-Cases)

- Detailed Profiles of Major Companies

Klarna

Ratepay

Billie

PayPal (Pay Later)

Payla

Afterpay

Twisto

Zilch

Alma

Banxware

GetPaid

Novalnet

Scalapay

Consors Finanz

Finiata

- User Persona Mapping

- Credit Risk Appetite Across User Segments

- Product Preferences by Channel

- Purchase Motivation & Payment Behavior

- Urban vs Rural BNPL Adoption Gap

- By Value of BNPL Transactions, 2025-2030

- By Volume of BNPL Transactions, 2025-2030

- By Active BNPL Users, 2025-2030