Market Overview

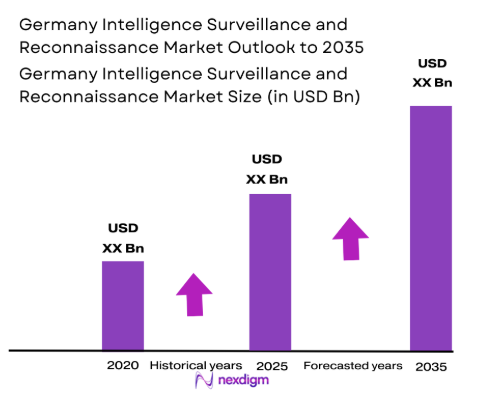

The Germany Intelligence Surveillance and Reconnaissance market is projected to reach approximately USD ~ billion, driven by increasing government investment in defense technologies and rising demand for advanced surveillance systems. A key factor driving market growth is the integration of artificial intelligence (AI) and machine learning technologies in surveillance platforms, which improves operational efficiency and data processing. The market is expected to benefit from continuous technological advancements in radar systems, unmanned aerial vehicles (UAVs), and sensor fusion technologies. Additionally, growing geopolitical tensions and security concerns are prompting governments to prioritize intelligence gathering systems, further fueling the market.

Germany is a dominant player in the global Intelligence Surveillance and Reconnaissance market due to its strategic position within the European Union and strong military and defense infrastructure. The country’s investments in modernizing its armed forces, coupled with strong partnerships with leading technology providers, have enabled Germany to become a hub for cutting-edge ISR systems. Major urban centers like Berlin and Munich house defense contractors and research facilities, while Germany’s central location in Europe allows for efficient collaboration across neighboring countries. The nation’s leadership in drone technology and AI further bolsters its dominance in this market.

Market Segmentation

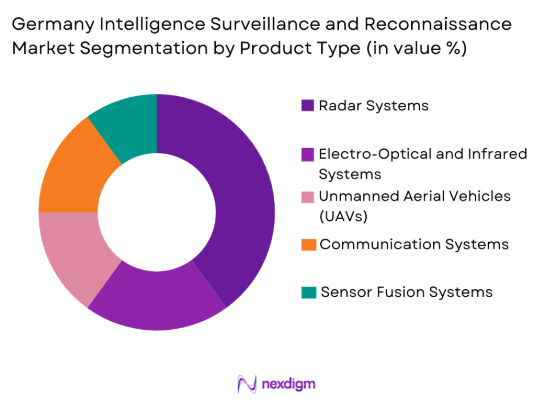

By Product Type

Germany Intelligence Surveillance and Reconnaissance market is segmented by product type into radar systems, electro-optical and infrared systems, unmanned aerial vehicles (UAVs), communication systems, and sensor fusion systems. Recently, radar systems have dominated the market due to their significant role in military surveillance and intelligence gathering. Their ability to provide real-time data on potential threats, regardless of visibility conditions, has made them indispensable for both defense and security applications. In addition, the growing demand for long-range, high-resolution radar systems in defense forces and security agencies has further solidified radar systems’ dominance in the market.

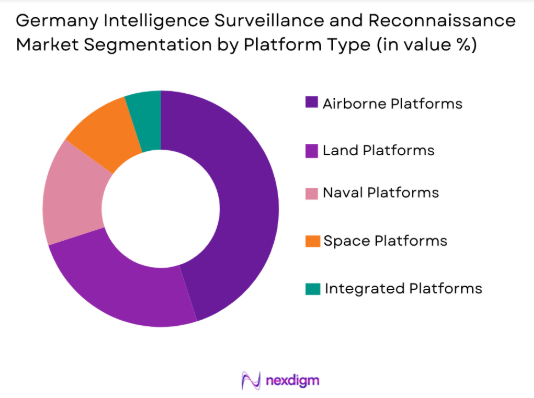

By Platform Type

Germany Intelligence Surveillance and Reconnaissance market is segmented by platform type into land platforms, airborne platforms, naval platforms, space platforms, and integrated platforms. Recently, airborne platforms have dominated the market due to their ability to cover large areas in real-time, providing critical data for military and security operations. These platforms are equipped with advanced sensors and imaging systems that can capture high-quality images and data over vast distances, making them ideal for intelligence-gathering missions. The increasing demand for aerial surveillance in both military and border control applications has driven a significant share of airborne platforms in the market.

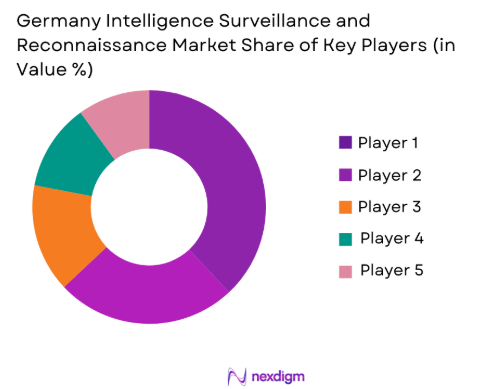

Competitive Landscape

The Germany Intelligence Surveillance and Reconnaissance market is highly competitive, with several leading players dominating the space. The consolidation of defense and technology companies, through mergers and acquisitions, is a common trend that continues to shape the market. The major players are investing heavily in advanced technologies like AI, machine learning, and autonomous systems to stay competitive. Additionally, strategic partnerships and collaborations with governments and other defense organizations have allowed these companies to expand their market reach.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Additional Parameters |

| Lockheed Martin | 1912 | Bethesda, Maryland | ~ | ~ | ~ | ~ | ~ |

| Thales Group | 2000 | Paris, France | ~ | ~ | ~ | ~ | ~ |

| BAE Systems | 1999 | London, UK | ~ | ~ | ~ | ~ | ~ |

| Northrop Grumman | 1939 | Falls Church, VA | ~ | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ | ~ |

Germany Intelligence Surveillance and Reconnaissance Market Analysis

Growth Drivers

Increasing Investment in National Defense Infrastructure

One of the primary drivers for the growth of Germany’s Intelligence Surveillance and Reconnaissance market is the rising investment in national defense infrastructure. The German government has continuously increased its defense budget to modernize its armed forces, ensuring its technological capabilities are on par with global standards. The focus has been on upgrading surveillance systems, incorporating cutting-edge technologies like AI, machine learning, and cyber solutions into ISR systems. The growing need for enhanced surveillance systems, due to evolving threats, has resulted in a significant rise in funding for defense contracts. These investments not only boost ISR capabilities but also drive the market for new and advanced platforms that provide real-time, actionable intelligence. As part of Germany’s commitment to NATO defense initiatives and international security, this expansion will continue to fuel the market’s growth. Additionally, Germany’s reliance on AI and automation in defense systems will further accelerate the adoption of ISR systems, making them a core component of modern military strategy.

Technological Advancements in Surveillance Systems

Another important growth driver for the market is the ongoing technological advancements in surveillance systems. As the need for precision in defense intelligence escalates, Germany is at the forefront of developing next-generation radar systems, electro-optical technologies, and UAVs. These innovations, driven by advances in AI and sensor fusion, provide more accurate and faster intelligence to decision-makers. Germany’s strong ties to tech companies and research institutions foster a culture of continuous innovation, enabling the rapid deployment of state-of-the-art ISR systems. With technologies such as autonomous systems, machine learning algorithms, and satellite imaging being integrated into ISR platforms, surveillance systems are becoming more sophisticated and capable of handling complex intelligence gathering tasks. These advancements also allow for faster data processing and more precise targeting, which is critical for both military and border security operations. With the continuous evolution of these technologies, the market is expected to see further growth in demand for highly advanced ISR solutions.

Market Challenges

High Capital Expenditure in ISR Systems

One of the significant challenges for the Germany Intelligence Surveillance and Reconnaissance market is the high capital expenditure required to develop and deploy advanced ISR systems. These systems require significant upfront investment, which can be a barrier for smaller entities or defense contractors looking to enter the market. The integration of new technologies, such as AI and machine learning, further increases development costs. Additionally, the need for continuous upgrades and maintenance of ISR platforms further adds to the financial burden. While larger defense companies can absorb these costs, smaller players and government entities may struggle to keep pace. This capital-intensive nature of the market may limit the overall market expansion, particularly for countries with more constrained budgets. Furthermore, the global competition for top-tier ISR technology places additional pressure on defense contractors to continuously innovate and improve, requiring even greater investments.

Technological Integration and Interoperability Issues

The integration of new technologies into existing defense infrastructure poses another challenge to the growth of the Germany Intelligence Surveillance and Reconnaissance market. Many ISR systems rely on a wide array of hardware and software components that must work seamlessly together to function effectively. However, ensuring interoperability between different systems, especially when integrating newer technologies such as AI and machine learning, remains a significant hurdle. This challenge is exacerbated by the complexities of defense procurement processes, where legacy systems and newly developed technologies must coexist. The need for systems that can efficiently communicate with each other, share data in real time, and operate across different platforms is a critical factor for ensuring the success of ISR systems. The lack of standardized protocols and potential compatibility issues between various systems and technologies may hinder the seamless adoption and deployment of new ISR solutions.

Opportunities

Integration of Artificial Intelligence (AI) and Autonomous Systems

A major opportunity for the Germany Intelligence Surveillance and Reconnaissance market lies in the integration of artificial intelligence (AI) and autonomous systems. These technologies allow ISR systems to analyze vast amounts of data in real time, identifying potential threats and providing actionable insights faster than ever before. As AI capabilities continue to advance, ISR systems can process complex data more efficiently, improving decision-making and operational effectiveness. Autonomous systems, particularly unmanned aerial vehicles (UAVs), play a crucial role in surveillance by providing intelligence gathering capabilities without putting human lives at risk. Germany, with its technological prowess and strong defense industry, is well-positioned to capitalize on this trend, with numerous defense contractors already exploring AI and automation in ISR platforms. The continued development and deployment of AI and autonomous systems in ISR applications will likely drive significant growth in the market.

Expansion of Cybersecurity Solutions for ISR Platforms

Another key opportunity for the Germany Intelligence Surveillance and Reconnaissance market is the expansion of cybersecurity solutions for ISR platforms. As surveillance systems become more interconnected, the risk of cyber threats increases, making robust cybersecurity measures a top priority for both military and defense contractors. The growing reliance on digital platforms for intelligence gathering, communications, and operations has made ISR systems vulnerable to cyberattacks that could compromise national security. This has led to an increasing demand for cybersecurity solutions designed specifically for ISR platforms. Germany’s strong position in the cybersecurity domain, along with its focus on defense technology innovation, provides an ideal environment for the development of advanced cybersecurity solutions. By integrating cutting-edge security technologies into ISR systems, Germany can ensure the integrity and confidentiality of intelligence data, thus driving market growth in this area.

Future Outlook

The future outlook of the Germany Intelligence Surveillance and Reconnaissance market over the next five years looks promising, with continued growth driven by technological advancements and increased government spending on defense. Expected growth trends point to further integration of AI and machine learning technologies, which will enhance the efficiency and accuracy of ISR systems. Additionally, the demand for autonomous platforms, including UAVs and drones, is expected to rise, providing significant growth opportunities for the market. Regulatory support from both the German government and international defense alliances will play a key role in accelerating innovation and deployment of new ISR technologies. Demand-side factors, such as rising security concerns and geopolitical instability, will further drive the need for advanced surveillance solutions. The combination of these trends is expected to lead to a highly dynamic market with numerous opportunities for companies involved in the development and deployment of ISR systems.

Major Players

- Lockheed Martin

- Thales Group

- BAE Systems

- Northrop Grumman

- Airbus

- Leonardo

- Raytheon Technologies

- L3 Technologies

- General Dynamics

- Saab Group

- Harris Corporation

- Rheinmetall AG

- Elbit Systems

- Boeing

- Sikorsky Aircraft

Key Target Audience

- Investments and venture capitalist firms

- Government and regulatory bodies

- Defense contractors

- Military forces

- Aerospace and defense companies

- Cybersecurity firms

- Security services

- Technology firms

Research Methodology

Step 1: Identification of Key Variables

Key variables such as market size, trends, and growth drivers are identified through secondary research and expert consultations to ensure a comprehensive understanding of the market.

Step 2: Market Analysis and Construction

The market structure is analyzed by reviewing key drivers, challenges, and regional trends that impact the overall market, supported by statistical modeling and forecasting.

Step 3: Hypothesis Validation and Expert Consultation

Findings are validated through discussions with industry experts, ensuring accuracy and relevance by gathering insights from major players and industry reports.

Step 4: Research Synthesis and Final Output

The research results are compiled into a final report, including market sizing, segmentation, and future outlook, ensuring actionable insights for decision-makers.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increased Government Investment in National Security

Technological Advancements in AI and Cybersecurity

Rising Geopolitical Tensions

Growing Military Modernization Programs

Integration of Commercial Technologies into Defense Systems - Market Challenges

High Capital Expenditure in Defense Projects

Cybersecurity Threats and Vulnerabilities

Regulatory and Compliance Barriers

Technological Integration and Interoperability Issues

Political and Social Resistance to Military Expansion - Market Opportunities

Expansion in Artificial Intelligence-Driven Defense Solutions

Partnerships with Private Tech Firms for Enhanced Cybersecurity

Emerging Demand for Autonomous Systems and Robotics - Trends

Increase in Use of Autonomous and Unmanned Systems

Integration of AI and Machine Learning in Battlefield Operations

Surge in Cybersecurity Investments for Defense Systems - Government Regulations & Defense Policy

Data Protection and Privacy Regulations

Export Control and Compliance Policies

Government Funding and Grants for Defense Technologies

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Radar Systems

Electro-Optical and Infrared Systems

Unmanned Aerial Vehicles (UAVs)

Communication Systems

Sensor Fusion Systems - By Platform Type (In Value%)

Land Platforms

Airborne Platforms

Naval Platforms

Space Platforms

Integrated Platforms - By Fitment Type (In Value%)

On-premise Solutions

Cloud-based Solutions

Hybrid Solutions

Modular Solutions

Integrated Solutions - By End User Segment (In Value%)

Military Forces

Defense Contractors

Government Agencies

Security Services

Private Sector / Technology Firms - By Procurement Channel (In Value%)

Direct Procurement

Government Tenders

Private Sector Procurement

Online Bidding Platforms

Third-party Distributors - By Material / Technology (In Value%)

AI and Machine Learning Technologies

Radar and Communications Technologies

Thermal Imaging & Electro-optical Sensors

Autonomous Systems & Robotics

Cybersecurity Solutions

- Market structure and competitive positioning

- Market share snapshot of major players

- Cross Comparison Parameters (System Type, Platform Type, Procurement Channel, End User Segment, Fitment Type)

- SWOT Analysis of Key Players

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Key Players

Lockheed Martin

Thales Group

BAE Systems

General Dynamics

Northrop Grumman

Raytheon Technologies

L3 Technologies

Leonardo

Harris Corporation

Saab Group

Rheinmetall AG

Elbit Systems

Hewlett Packard Enterprise

Boeing

Sikorsky Aircraft

- Military Forces’ Increasing Demand for Digital Systems

- Government Agencies’ Role in Regulating and Procuring Defense Systems

- Defense Contractors’ Shift Towards Innovation and Integration

- Private Sector’s Growing Interest in Cybersecurity Solutions

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035