Market Overview

The India aerospace bearing market is experiencing significant growth, driven by increasing investments in the aerospace industry, both from the government and private players. In 2025, the market was valued at USD ~ million, with projections indicating a steady increase in 2026. This growth is largely attributed to the rise in domestic aircraft production, increasing fleet sizes, and a substantial uptick in defense procurements, especially under the government’s “Make in India” initiative. Additionally, advancements in bearing technologies and the rising demand for high-performance bearings for critical aerospace applications are further fuelling the market’s expansion.

India’s aerospace bearing market is predominantly influenced by major aerospace hubs such as Bengaluru, Hyderabad, and Pune. These cities are home to key players in aerospace manufacturing and research, including public sector giants like Hindustan Aeronautics Limited (HAL) and private sector entities like Tata Aerospace and Defence. The dominance of these cities is due to their robust aerospace infrastructure, availability of skilled labor, and strong government backing through initiatives like aerospace parks and defense manufacturing policies. Additionally, the presence of international aerospace manufacturers and service providers in these cities boosts market activities and innovation.

Market Segmentation

By Product Type

The India aerospace bearing market is segmented by product type into ball bearings, roller bearings, tapered bearings, and needle bearings. Ball bearings have the dominant market share in the Indian aerospace bearing market. This is due to their widespread usage in various aerospace applications, including propulsion systems, landing gears, and control systems. The inherent advantages of ball bearings, such as their ability to handle both radial and axial loads, make them indispensable in high-speed and high-load operations common in aerospace applications. The constant advancements in bearing technologies, along with a growing demand for lightweight and high-performance components, also contribute to the growing dominance of ball bearings in the market.

By Application

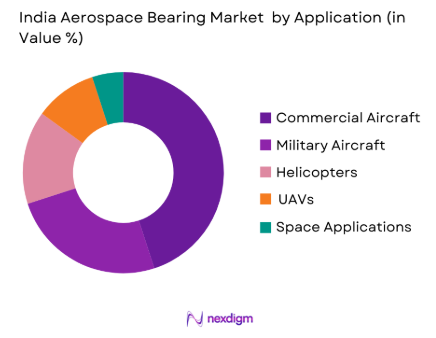

The India aerospace bearing market is also segmented by application into commercial aircraft, military aircraft, helicopters, UAVs, and space applications. The commercial aircraft segment holds the largest share due to the increase in air travel demand and the growth of the airline industry in India. As India emerges as a hub for aircraft manufacturing and assembly, especially with companies like Boeing and Airbus establishing a footprint in the country, commercial aircraft demand continues to soar. Bearings are integral to the efficient operation of various systems in commercial jets, such as engine components, landing gear, and actuation systems. This high demand for commercial aircraft is driving the growth of aerospace bearings in this segment.

Competitive Landscape

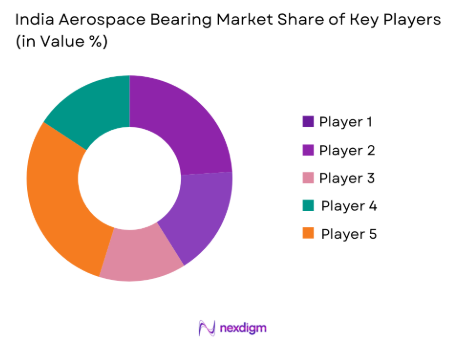

The India aerospace bearing market is dominated by several key players, both local and international, offering a wide range of bearings for various aerospace applications. Major players in the market include SKF India, Timken India, and NRB Bearings, along with international giants like Schaeffler and NSK. These companies hold substantial market shares due to their established reputation, strong supply chain networks, and ongoing R&D investments to develop innovative products suited to the stringent requirements of the aerospace industry.

| Company | Established Year | Headquarters | Key Market Parameters |

| SKF India | 1961 | Pune, Maharashtra | ~ |

| Timken India | 1999 | Jamshedpur, Jharkhand | ~ |

| NRB Bearings | 1965 | Mumbai, Maharashtra | ~ |

| Schaeffler India | 1962 | Bangalore, Karnataka | ~ |

| NSK Bearings | 1964 | Chennai, Tamil Nadu | ~ |

India Aerospace Bearing Market Analysis

Growth Drivers

Demand from Expanding Civil Aircraft Fleet

India’s civil aircraft fleet continues to grow as the country’s aviation sector experiences rapid expansion. The Indian government projects an increase in passenger traffic, with the aviation sector expected to handle~ million passengers by 2035. This growth in air travel directly correlates with the demand for new aircraft, increasing the need for aerospace bearings. The Directorate General of Civil Aviation (DGCA) reported that India is expected to receive more than 2,000 aircraft by 2035, which will necessitate high-quality bearings in commercial aircraft systems such as landing gears, engines, and control systems.

Defense Modernization & Indigenous Procurement

India’s defense sector is undergoing significant modernization, with a substantial push toward indigenous procurement under the “Atmanirbhar Bharat” (Self-reliant India) initiative. The government has earmarked USD ~billion for defense modernization in the 2024 defense budget, which includes the procurement of advanced military aircraft, fighter jets, and unmanned aerial vehicles (UAVs). This emphasis on domestic defense production will drive demand for aerospace bearings used in critical military systems, including propulsion, landing gear, and airframe structures.

Source: Indian Ministry of Defence

Market Restraints

High Capital & Certification Costs

The aerospace bearing market in India is constrained by high capital costs associated with manufacturing and the lengthy certification process for aerospace-grade components. The cost to establish and maintain manufacturing facilities that meet international standards is substantial, with investments reaching USD ~ million for state-of-the-art plants. Additionally, obtaining certifications from bodies such as the Directorate General of Civil Aviation (DGCA) and the Federal Aviation Administration (FAA) adds to the cost burden for manufacturers. These barriers may deter small and mid-sized companies from entering the market.

Raw Material Import Dependency

India remains heavily dependent on the import of raw materials such as high-strength steel, titanium, and special alloys used in the production of aerospace bearings. In 2022, India imported raw materials worth USD ~billion for the aerospace and defense sector, highlighting the country’s reliance on foreign suppliers. This dependency makes the aerospace bearing market vulnerable to supply chain disruptions and fluctuations in material prices, particularly from major producers like the U.S. and Russia. Such vulnerabilities could increase production costs and impact the market’s growth trajectory.

Market Opportunities

Make in India / Aero PLI & Policy Push

India’s “Make in India” initiative is a major opportunity for the aerospace bearing market. Under this program, the government has allocated INR ~ crore for the aerospace and defense sector over the next five years. The introduction of the Aerospace and Defense Industry Policy (Aero PLI) aims to bolster domestic manufacturing by offering financial incentives to local players. As a result, this will drive the production of critical components, including aerospace bearings, reducing dependency on imports and positioning India as a global manufacturing hub for aerospace components.

Shared MRO Capex & Engine Overhaul Facilities Growth

The Indian MRO industry is experiencing a paradigm shift, with shared investments in MRO capital expenditure and engine overhaul facilities expanding at a rapid pace. In 2025, India’s commercial MRO market saw substantial investments in shared engine overhaul facilities, where multiple airlines and defense entities can consolidate operations. This growth directly benefits the aerospace bearing market as the need for specialized high-performance bearings increases with the demand for more efficient MRO services.

Future Outlook

The India aerospace bearing market is set to experience significant growth in the coming years, driven by the expanding aerospace sector and growing demand for high-performance components. As the country continues to develop its aerospace capabilities, both for commercial and military applications, the demand for advanced bearings will surge. Government policies such as “Atmanirbhar Bharat” and “Make in India” will further boost domestic production, minimizing reliance on imports. Additionally, technological advancements in bearing materials and designs will open new avenues for growth in high-tech applications, including space exploration and UAVs. The future of aerospace bearings in India looks promising, with steady investments in infrastructure, research, and development.

Major Players

- SKF India

- Timken India

- NRB Bearings

- Schaeffler India

- NSK Bearings

- RBC Bearings

- Kaman Aerospace

- The Timken Company

- JTEKT Corporation

- NTN Corporation

- FAG Bearings India

- Aequs Aerospace

- Hical Technologies

- Avtec Limited

- Bharat Forge Aerospace

Key Target Audience

- Aerospace Manufacturers

- Defense and Military Agencies

- Aircraft MRO Service Providers

- Investments and Venture Capitalist Firms

- Regulatory Bodies

- Aircraft Suppliers and Component Manufacturers

- Private Airlines and Commercial Aircraft Operators

- Government and Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of the aerospace bearing market in India. This includes identifying the critical factors influencing the market, such as technological advancements, regulatory changes, and key stakeholders. A combination of secondary research and proprietary databases will be used to gather comprehensive data.

Step 2: Market Analysis and Construction

In this phase, historical data regarding the aerospace bearing market will be compiled, focusing on market penetration, key aircraft platforms, and supplier dynamics. Additionally, this step involves evaluating the competitive landscape to identify growth trends and market shifts.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses developed from the desk research will be validated through consultations with industry experts. These consultations will involve phone interviews and roundtables with key stakeholders from aerospace companies, bearing manufacturers, and regulatory bodies.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the insights gathered from primary and secondary research. This will culminate in a comprehensive analysis of market trends, growth drivers, challenges, and opportunities. Insights will be validated with key industry players to ensure accuracy and relevance.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Aerospace Component Taxonomy, Market Sizing Framework, Targeted Primary Interviews, supply‑chain Mapping Approach, Forecasting and Validation Techniques, Limitations & Future Scenarios)

- Market Definition & Coverage

- India Aerospace Industry Genesis & Structural Evolution

- Civil Aviation vs Defense Aerospace Bearings Demand Profile

- Aircraft Platforms & System‑Level Bearing Requirements

- Global Value Chain Positioning of India

- Aerospace Quality & Certification Standards

- Growth Drivers

Demand from Expanding Civil Aircraft Fleet

Defense Modernization & Indigenous Procurement

MRO Market Growth & Turn‑Time Optimization

Supply Chain Diversification

Lightweight/High‑Temp Material Adoption - Market Restraints

High Capital & Certification Costs

Raw Material Import Dependency

Regulatory & Quality Barriers

Long Qualification Lead Times - Market Opportunities

Make in India / Aero PLI & Policy Push

Shared MRO Capex & Engine Overhaul Facilities Growth

Local Complex Component Manufacturing Initiatives

UAV & Space Platform Bearings Demand Surge - Market Trends

Industry 4.0 & Smart Bearing Diagnostics

Composites, Ceramic Hybrids, Nano‑coatings

Aftermarket Digital Platforms

- Market Size, 2020-2025

- Market Consumption, 2020-2025

- Average Unit Price Trends, 2020-2025

- Historical Demand Drivers & Cycles, 2020-2025

- By Bearing Type (Value %)

Ball Bearings

Roller Bearings

Tapered & Spherical Bearings

Needle Bearings

Ceramic/Hybrid Aerospace Bearings - By End‑Use Platform (Value %)

Commercial Aircraft

Military Aircraft

Helicopters & VTOL

Unmanned Aerial Vehicles (UAVs)

Space Launch Vehicles & Satellites - By Supply Source (Value %)

Qualified Domestic Manufacture

Import from OEM Tier‑1

Reconditioned/MRO Components - By Distribution Channel (Value %)

OEM Direct

Tier‑1/Tier‑2 Contracts

After‑Market / MRO

Defense & Government Procurement - By Material & Technology (Value %)

High‑Strength Steel

Ceramic / Hybrid

Coated & Surface‑Treated Bearings

Additive Manufactured Bearings

- Market Share – By Revenue & Volume

- Cross‑Company Comparison Parameters (Certified Bearing Inventory, Product Portfolio Breadth, R&D Intensity, Production Footprint & Capacity Utilization, Global Supply Chain Participation, Quality & Failure Rate Benchmarks, Tier‑Certification Levels, Aftermarket & MRO Service Penetration)

- SWOT Analysis of Key Players

- Detailed Company Profiles

SKF India

Timken India

NRB Bearings Ltd.

Schaeffler

NSK Bearings India

NTN Corporation

RBC Bearings

JTEKT/Toyo Bearing

GGB Bearing Technology

Kaman Aerospace Bearings

NBC Bearings

Bharat Forge

Precision Castparts / PCC Aerospace

Hical Technologies

Aequs Aerospace Components

- Inbound Supply Dynamics

- Manufacturing & Assembly Footprint

- Global Tier‑1/Tier‑2 Supplier Dependencies

- MRO & Recertification Lifecycle Model

- Risk & Resilience Analysis

- Growth Scenarios, 2026-2035

- Segment Forecasts, 2026-2035

- Technology Adoption & CAGR Levers, 2026-2035