Market Overview

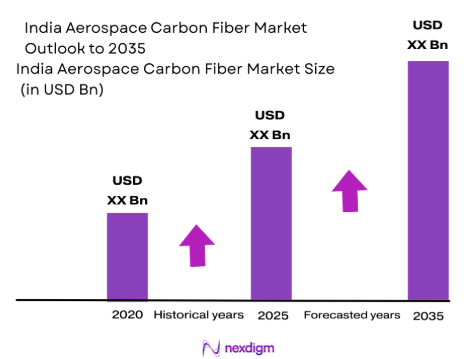

The India aerospace carbon fiber market is experiencing robust growth, with a notable rise in demand for lightweight, high-strength materials in the aerospace sector. Valued at USD ~ billion in 2025, the market continues to expand due to increased adoption of carbon fiber composites in airframe and engine components. The demand is being driven by a growing focus on fuel efficiency, cost reduction, and environmental sustainability within the aerospace industry. Carbon fiber composites offer exceptional weight-saving advantages, translating into reduced fuel consumption and extended aircraft longevity. With the Indian government’s push towards self-reliance in defense manufacturing and growing commercial aerospace manufacturing, this market is set to grow significantly in the upcoming years.

India’s aerospace carbon fiber market is concentrated in major aerospace hubs such as Bengaluru, Hyderabad, and Pune. Bengaluru, often referred to as the “Aerospace Capital of India,” houses a significant number of aerospace manufacturers, including public-sector undertakings like HAL (Hindustan Aeronautics Limited) and private players such as Boeing and Airbus, which are increasingly integrating carbon fiber composites into their aircraft designs. Hyderabad is emerging as another important location, with a focus on defense manufacturing, particularly for UAVs (unmanned aerial vehicles), which utilize carbon composites extensively. Pune is also growing as a key centre for aerospace part manufacturing and research in the domain of composites.

Market Segmentation

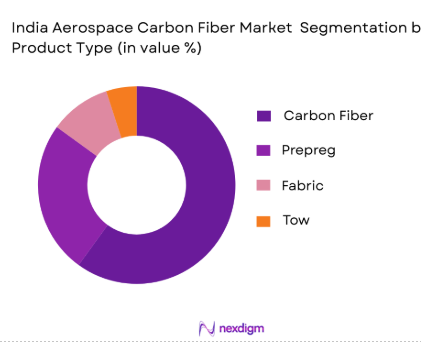

By Product Type

India’s aerospace carbon fiber market is segmented by product type into carbon fiber, prepreg, fabric, and tow. Among these, the carbon fiber segment dominates the market share. The dominance of carbon fiber is attributed to its unmatched strength-to-weight ratio, which makes it the material of choice for critical aerospace applications, including airframes and engine components. The demand for carbon fiber is also amplified by its superior durability and fatigue resistance, making it indispensable for aircraft manufacturing. As OEMs and tier suppliers focus on reducing weight to improve fuel efficiency and enhance performance, carbon fiber’s role in the aerospace sector remains central.By Component Type

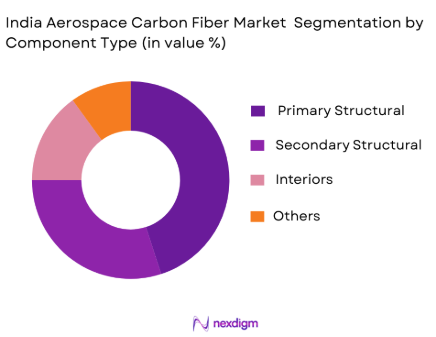

By Component Type

The primary structural components segment holds the largest share within the component type segmentation. These components, such as fuselage and wing structures, require the strength and lightweight properties offered by carbon fiber composites. Carbon fiber’s high resistance to stress, fatigue, and corrosion makes it ideal for primary structures that are crucial for the safety and integrity of the aircraft. Additionally, advancements in manufacturing techniques like automated fiber placement (AFP) have enabled efficient production of primary aerospace components, further driving the growth of this segment.

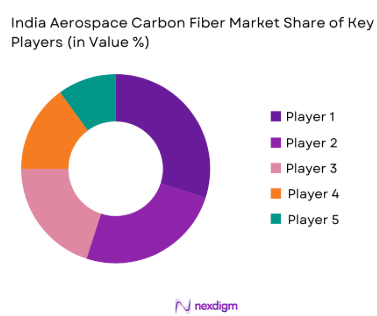

Competitive Landscape

The Indian aerospace carbon fiber market is led by a mix of global and regional players, each vying for market share through innovation and strategic collaborations. The market is characterized by a strong competitive presence from companies such as Toray Industries, Hexcel Corporation, and local firms like Reliance Industries, which are leveraging India’s emerging aerospace manufacturing ecosystem. These players dominate through technological superiority, strong supply chains, and extensive certifications.

| Company Name | Establishment Year | Headquarters | Product Portfolio | Certifications & Approvals | Manufacturing Capacity | Market Strategy | Financial Performance |

| Toray Industries | 1926 | Japan | ~ | ~ | ~ | ~ | ~ |

| Hexcel Corporation | 1948 | USA | ~ | ~ | ~ | ~ | ~ |

| Reliance Industries | 1966 | India | ~ | ~ | ~ | ~ | ~ |

| SGL Carbon | 1992 | Germany | ~ | ~ | ~ | ~ | ~ |

| Teijin Limited | 1918 | Japan | ~ | ~ | ~ | ~ | ~ |

India aerospace carbon fiber market Analysis

Growth Catalysts

Weight Reduction Mandates & Fuel Efficiency Drives

The aerospace industry continues to emphasize weight reduction to enhance fuel efficiency, which is a key growth catalyst for the aerospace carbon fiber market. With airlines under increasing pressure to reduce operational costs, weight-saving technologies, such as carbon fiber composites, play a crucial role in optimizing fuel consumption. The Indian aviation sector is expected to contribute to a 6.5% annual growth in passenger air traffic from 2024 to 2026, leading to a rise in aircraft manufacturing. Aircraft manufacturers like Boeing and Airbus are incorporating composite materials into their designs, such as the Boeing 787, which is 50% composite by weight, reducing fuel consumption by up to 20%. This transition aligns with global carbon reduction goals, supported by governmental aviation regulations.

Aerospace Modernization & Airframe Composite Integration

Aerospace modernization in India is a driving force behind the adoption of carbon fiber composites in airframe applications. India has committed to expanding its fleet and modernizing the defense sector, leading to increased demand for advanced materials like carbon fiber. For instance, the Indian Air Force’s modernization program includes replacing older aircraft with newer, lightweight designs such as the HAL Tejas, which integrates composite materials to enhance performance. The global aerospace composites market is expected to see a notable shift toward airframe composite integration, with composites now making up about 50% of modern aircraft structures. This shift supports the demand for carbon fiber, pushing manufacturers to invest heavily in R&D to produce better-performing composites.

Restraints & Challenges

High Cost of Carbon Fiber & Precursor Imports

The cost of carbon fiber remains a significant barrier to widespread adoption within the aerospace industry. India relies heavily on imported precursors for manufacturing carbon fiber, which adds to the production cost. In 2024, India’s imports of advanced materials, including carbon fiber precursors, are valued at around INR~crore (USD ~million), highlighting the country’s dependency on global suppliers. The high cost of raw materials is a significant challenge for manufacturers who must balance cost-effectiveness with performance. This issue also affects smaller aerospace manufacturers and defense contractors, limiting their ability to scale production efficiently.

Certification & Airworthiness Barriers

The rigorous certification process for aerospace components presents a challenge to the growth of the carbon fiber market. In India, aerospace materials, including carbon fiber composites, must meet stringent airworthiness standards set by regulatory bodies such as the DGCA. The certification process can take several years, delaying the deployment of new aircraft and technologies. In 2024, approximately 30% of new aircraft programs face delays due to the time-consuming certification of materials and parts, which includes compliance with global airworthiness standards. These delays not only impact the market’s growth but also increase costs for manufacturers.

Opportunities

Defense Offset Mandates

The Indian government’s defense offset policy presents a significant opportunity for the aerospace carbon fiber market. Under the Offset Policy, foreign defense contractors are required to invest in the Indian defense sector, particularly in technology transfer and manufacturing. In 2025, the Indian government is actively encouraging foreign players like Lockheed Martin and Boeing to establish local manufacturing units for carbon fiber and other aerospace components. The offsets provide the Indian aerospace industry with the opportunity to boost its capability in carbon fiber production while reducing reliance on imports. This policy has already led to successful collaborations with local players such as HAL, which are driving carbon fiber adoption in India’s defense aerospace sector. Source: Ministry of Defence, Government of India

Space Composites Acceleration

India’s rapidly growing space sector presents a promising opportunity for the carbon fiber market. With the Indian Space Research Organisation (ISRO) planning to expand its satellite launch capacity and build new space stations, the demand for advanced composites like carbon fiber will increase. In 2024, ISRO is aiming to launch over 30 missions, including both commercial and government satellites, many of which rely on lightweight carbon composites for their structural integrity. The acceleration of India’s space endeavors opens new markets for carbon fiber suppliers, especially in the development of reusable launch vehicles and advanced satellite components.

Future Outlook

Over the next decade, the India aerospace carbon fiber market is expected to experience considerable growth, driven by technological advancements in carbon fiber composites, increasing demand from the aerospace and defense sectors, and the government’s push towards self-reliance in aerospace manufacturing. As India’s aerospace industry continues to grow, both commercial and defense sectors will increasingly rely on carbon fiber composites to meet performance and sustainability goals. The rise in domestic manufacturing, along with technological partnerships with international players, will further fuel market expansion. Furthermore, the ongoing trend of incorporating advanced materials in UAVs and smaller commercial aircraft will continue to support the demand for high-performance composites like carbon fiber.

Major Players

- Toray Industries

- Hexcel Corporation

- Reliance Industries

- SGL Carbon

- Teijin Limited

- Mitsubishi Chemical Corporation

- Solvay S.A.

- Evonik Industries AG

- Kureha Corporation

- Cytec Solvay Group

- 3M Company

- Zoltek Companies, Inc.

- Hyosung Corporation

- Jiangsu Hengshen Co., Ltd.

- Saertex GmbH & Co. KG

Key Target Audience

- Aerospace OEMs

- Defense Contractors

- Carbon Fiber Raw Material Suppliers

- Aerospace Tier-1 and Tier-2 Suppliers

- Aerospace Component Manufacturers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Private and Public Aerospace Research Labs

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves gathering data on the key drivers of the India aerospace carbon fiber market, such as government policies, manufacturing trends, and technological innovations. This is done through secondary research, followed by primary consultations with industry experts.

Step 2: Market Analysis and Construction

Historical data on market size, production volumes, and technological advancements are analysed to construct an accurate base for the current market landscape. We use both desk research and field data from key stakeholders to evaluate the existing competitive environment.

Step 3: Hypothesis Validation and Expert Consultation

Key hypotheses regarding growth drivers, such as defense spending and commercial aircraft expansion, are tested by conducting interviews with subject-matter experts from aerospace manufacturers, OEMs, and industry analysts. This process ensures the accuracy of our findings.

Step 4: Research Synthesis and Final Output

We conduct final engagements with OEMs and suppliers to obtain granular insights into specific challenges and opportunities within the aerospace carbon fiber market. This ensures a comprehensive understanding of the market dynamics, allowing us to present a refined and validated forecast.

- Executive Summary

- Research Methodology (Definitions and Market Scope, Market Sizing Approaches

Data Sources and Validation Protocols, Assumptions and Forecast Confidence Intervals, Value Chain Cost Structure Benchmarking, Limitations & Risk Adjustments in Forecasting)

- India Aerospace Carbon Fiber Market Landscape

- Industry Genesis & Adoption Milestones

- Evolution of Aircraft Composite Structures

- Carbon Fiber Role in Airframe & Engine Components

- Supply Chain Structure

- Growth Driver

Weight reduction mandates & fuel efficiency drives

Aerospace modernization & Airframe composite integration

Government propulsion for local manufacturing - Restraints & Challenges

High cost of carbon fiber & precursor imports

Certification & airworthiness barriers

Limited domestic PAN precursor capacity - Opportunities

Defense offset mandates

Space composites acceleration

Prepreg & automated layup innovation

- Trends

Automated Fiber Placement (AFP) adoption

Hybrid composites (metal + carbon) for UAVs

- Market Revenue, 2020-2025

- Volume Consumption, 2020-2025

- Average Realized Price, 2020-2025

- By Product Form (In Value %)

Fiber

Prepreg

Fabric

Tow

Laminates

- By Precursor Type (In Value %)

PAN‑based

Pitch‑based

Others

- By Component Type (In Value %)

Primary Structural

Secondary Structural

Interiors - By End‑Use (In Value %)

Commercial Aircraft

Defense Aircraft

Space Systems

UAVs

- By End Customer (In Value %)

OEM

Tier‑1

Tier‑2

Aftermarket Repair & MRO

- Market Share Analysis

- Cross‑Comparison Parameter (Company Overview & India Operations Focus, Technology & Product Portfolio Breadth, Prepreg & Fabric Manufacturing Capabilities, Certification & Airworthiness Ratings, Supply Chain Integration Level, Manufacturing Footprint, Revenue Breakdown by Aerospace Tier Segment, Strategic Partnerships & OEM Approvals)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Competitive Profiles

Toray Industries

Hexcel Corporation

Solvay S.A.

Teijin Limited

Mitsubishi Chemical

SGL Carbon

Carbon Light Pvt. Ltd.

CREEDX Composites

Fabheads Automation

Lakshmi Carbons

Funique Composites

Reliance Industries

Tata Advanced Materials

Aequs Aerospace Components

Gurit / Kineco Exel Composites India

- Demand – Commercial Aviation OEMs

- Defense & Space Segment Demand

- UAV & Emerging Segment Dynamics

- MRO, Repair & Aftermarket Carbon Composite Consumption

- India Aerospace Carbon Fiber Market, 2026-2035

- Volume Demand & Import Substitution Forecasts, 2026-2035

- Carbon Fiber Composite Domestic Value Capture Goals, 2026-2035