Market Overview

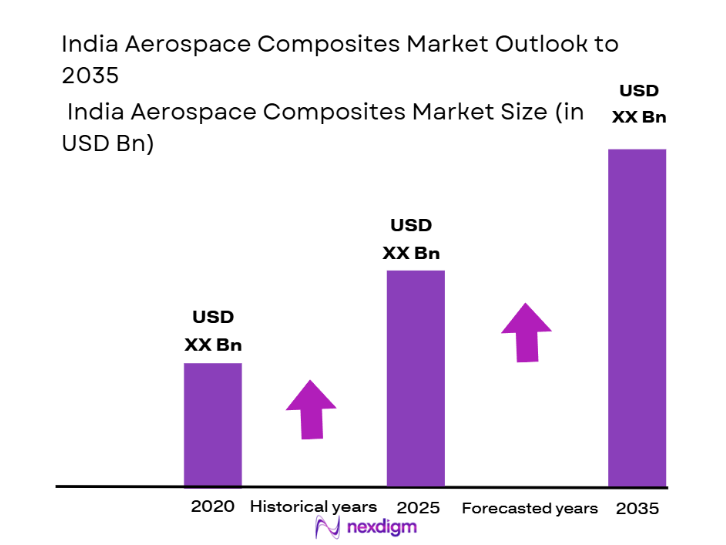

The India Aerospace Composites Market is valued at USD ~ billion, based on a five-year historical analysis. This market is driven by increasing government initiatives such as the “Make in India” program, the growing domestic defense and aerospace industry, and the expansion of civil aviation. Additionally, advancements in composite materials like carbon fiber and resin systems, along with the rising demand for lightweight and fuel-efficient aircraft, are key factors propelling the growth of this sector. In 2023, the market experienced a significant boost due to the government’s focus on aerospace modernization and self-reliance.

India’s aerospace composites market is dominated by key regions like Bangalore, Hyderabad, and Pune, which serve as the primary aerospace hubs. These cities house major aerospace manufacturing facilities and R&D centers, bolstered by a robust supply chain infrastructure. Bangalore, in particular, is a leader due to its high concentration of aerospace companies like HAL (Hindustan Aeronautics Limited) and a large talent pool in the composite material space. Furthermore, the government’s increasing investments in defense projects, including indigenous aircraft manufacturing, further fuel the market growth in these regions.

Market Segmentation

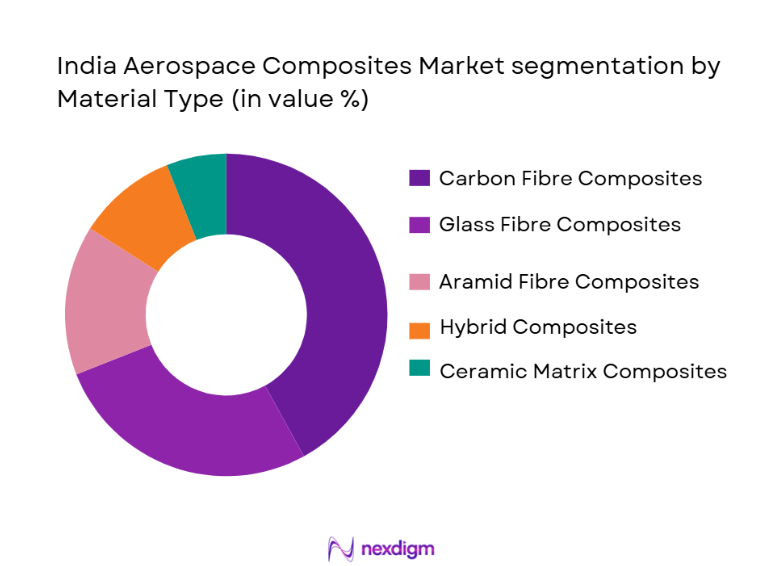

By Material Type

India’s aerospace composites market is segmented by material type into carbon fiber composites, glass fiber composites, aramid fiber composites, hybrid composites, and ceramic matrix composites. Carbon fiber composites have the largest market share due to their superior strength-to-weight ratio, which makes them ideal for use in primary aircraft structures. The demand for carbon fiber composites is bolstered by their role in reducing aircraft weight, improving fuel efficiency, and enhancing overall performance. As global aerospace manufacturers and Indian suppliers focus on high-performance materials, carbon fiber continues to dominate, especially in the manufacturing of fuselage, wings, and structural components of aircraft.

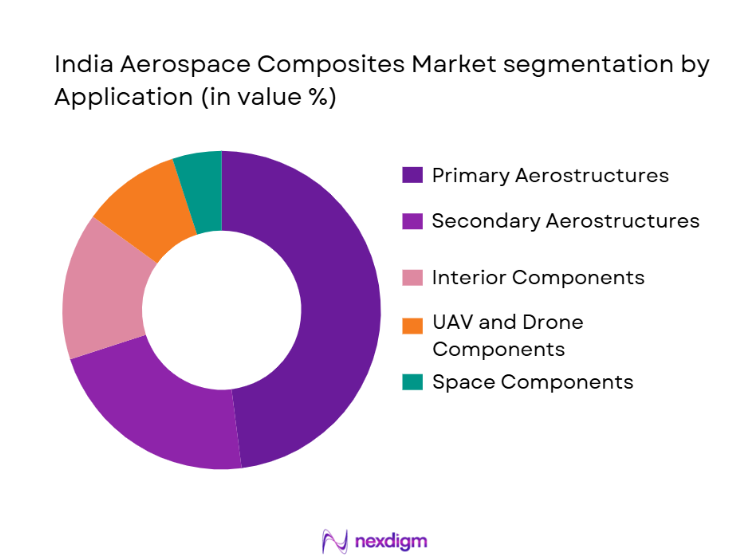

By Application

The aerospace composites market in India is segmented by application into primary aerostructures, secondary aerostructures, interior components, UAV and drone components, and space components. Among these, the primary aerostructures segment holds the dominant market share. This is due to the increasing use of composites in critical structures such as wings, fuselage, and tail sections of aircraft, driven by the demand for lightweight, fuel-efficient, and high-strength materials. Moreover, the expansion of the commercial aerospace sector and military aircraft programs significantly contributes to the dominance of this segment in the Indian aerospace composites market.

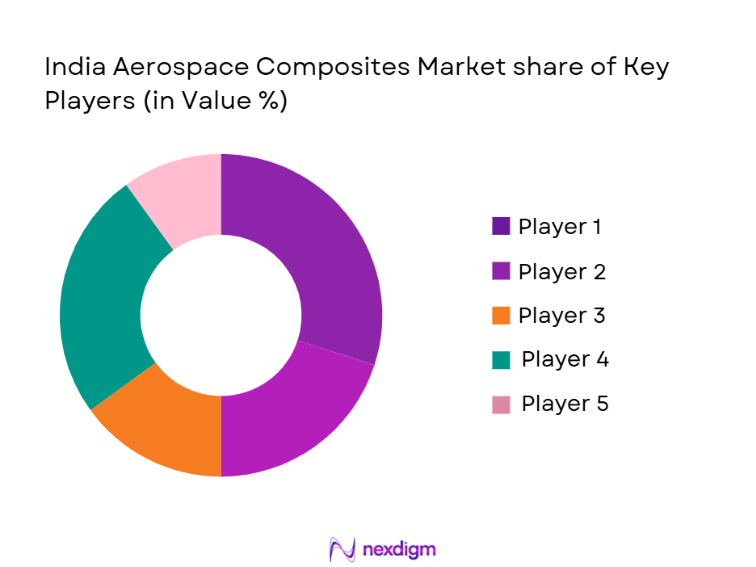

Competitive Landscape

The India Aerospace Composites Market is dominated by both global players and domestic manufacturers. Key players like Tata Advanced Systems, Rockman Advanced Composites, and Kineco Aerospace lead the market by offering high-quality composite materials used in both civil and military aircraft. Additionally, HAL (Hindustan Aeronautics Limited) and Mahindra Aerospace play a pivotal role in advancing aerospace technology and meeting the growing demand for composite components in the Indian defense sector.

| Company | Establishment Year | Headquarters | Key Product Lines | Material Types | Manufacturing Process | Key Markets |

| Tata Advanced Systems | 2007 | Bangalore | ~ | ~ | ~ | ~ |

| Rockman Advanced Composites | 2005 | Delhi | ~ | ~ | ~ | ~ |

| Kineco Aerospace Pvt. Ltd. | 1993 | Goa | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics Limited (HAL) | 1940 | Bangalore | ~ | ~ | ~ | ~ |

| Mahindra Aerospace Pvt. Ltd. | 2008 | Mumbai | ~ | ~ | ~ | ~ |

Market Analysis

Growth Drivers

Government Support and Defense Modernization

The Indian government’s push towards self-reliance in defense manufacturing through initiatives like “Make in India” significantly drives the aerospace composites market. Investments in modernizing defense infrastructure, including indigenous fighter jets and military helicopters, create substantial demand for advanced composite materials, particularly carbon and glass fiber composites for lightweight and durable aerospace structures.

Increase in Civil Aviation Demand

India’s rapidly growing civil aviation sector, fueled by rising air passenger traffic and the expansion of budget carriers, contributes significantly to the demand for lightweight, fuel-efficient aircraft. The need for composite materials in aircraft fuselages, wings, and other components is increasing as airlines seek to improve fuel efficiency, reduce operational costs, and comply with environmental regulations.

Market Challenges

High Raw Material Costs

The rising prices of raw materials, especially carbon fiber, are a major challenge in the aerospace composites market. These materials are essential for manufacturing lightweight and durable aerospace components, but their high costs create financial pressures for manufacturers. This affects the overall affordability of composite solutions, particularly in the Indian market where cost-sensitive procurement is crucial.

Complex Certification and Regulatory Standards

The aerospace industry is subject to strict regulatory and certification requirements, such as those set by the Directorate General of Civil Aviation (DGCA) and international standards like AS9100. The lengthy certification process for new materials and components increases the time and cost involved in bringing new composite products to market, posing a barrier to faster innovation and production scale-up.

Opportunities

Expansion of UAV and Drone Market

The growing demand for unmanned aerial vehicles (UAVs) and drones for military, defense, and commercial applications presents a significant opportunity for the aerospace composites market. UAVs require lightweight, high-strength composite materials to enhance their performance and efficiency, creating a favorable environment for manufacturers of aerospace composites to supply specialized parts.

Technological Advancements in Composite Materials

Ongoing innovations in composite materials, such as the development of hybrid composites and high-performance thermoset resins, offer opportunities for manufacturers to create even lighter, more durable, and cost-effective components. This technological progress can provide a competitive edge for Indian aerospace manufacturers, making them more attractive to global OEMs and defense contractors.

Future Outlook

Over the next 5 years, the India Aerospace Composites Market is expected to witness steady growth. This growth is driven by continued government support for defense modernization, the rise of indigenous aircraft manufacturing, and the demand for more fuel-efficient commercial aircraft. Moreover, advancements in aerospace composite materials, such as the integration of hybrid composites and the use of advanced automated manufacturing processes, will further strengthen the market’s expansion. The push for self-reliance and the increasing adoption of UAV technology will also contribute to the positive market trajectory.

Major Players

- Tata Advanced Systems

- Rockman Advanced Composites

- Kineco Aerospace Pvt. Ltd.

- Hindustan Aeronautics Limited (HAL)

- Mahindra Aerospace Pvt. Ltd.

- Lohia Aerospace Systems

- Aequs Aerospace

- Boeing India Pvt. Ltd.

- Airbus India Pvt. Ltd.

- Safran India Composites

- Bharat Forge Limited

- JMB Aerospace

- Godrej Aerospace

- Reliance Defence & Aerospace

- MARS Aerospace

Key Target Audience

- Aerospace Original Equipment Manufacturers (OEMs)

- Tier-1 & Tier-2 Aerospace Component Suppliers

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies (Ministry of Defence, Directorate General of Civil Aviation – DGCA)

- Aerospace and Defence Contractors

- Aerospace Aftermarket and MRO Service Providers

- Defense Contractors and Subcontractors

- Export Agencies and Trade Associations

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves gathering extensive secondary data and consulting industry databases to map out all key stakeholders in the India Aerospace Composites Market. The objective is to identify and understand the critical variables driving market growth, including material types, manufacturing processes, and end-user demands.

Step 2: Market Analysis and Construction

This step entails collecting and analyzing historical data regarding market penetration, the growth of composites in aerospace, and the share of different aerospace sub-segments. The information collected will also cover production, revenue, and technological adoption rates across the market.

Step 3: Hypothesis Validation and Expert Consultation

We will develop hypotheses around the drivers and barriers of the India Aerospace Composites Market and validate them through expert consultations. These will include interviews with key players in the aerospace composites value chain, ranging from raw material suppliers to aerospace OEMs, to gather first-hand insights.

Step 4: Research Synthesis and Final Output

The final research phase involves synthesizing the insights derived from primary research and expert consultations. The data will be validated by engaging with aerospace manufacturers and suppliers, confirming the forecast, market growth drivers, and competitive landscape, ensuring an accurate market analysis.

- Executive Summary

- Research Methodology (Market Definitions & Industry Terminology; Composite Material Classification Protocols; Data Triangulation; Primary vs Secondary Research Weightage; Forecasting Models; Geographic Market Partitioning; Limitations and Assumptions)

- India Aerospace Composites Scope

- Value Chain Architecture

- Material Hierarchy

- Application Value Stacks

- Regulatory & Certification Landscape

- Growth Drivers

Lightweighting and Fuel Efficiency

Growth of Commercial Aerospace Industry

Expanding Space Programs and Satellite Industry

Increasing Government Initiatives

Technological Advancements in Composite Manufacturing Processes

Demand for Sustainable and Eco-Friendly Materials - Market Challenges

High Initial Investment and Capital Expenditure

Complex Certification and Regulatory Requirements

Lack of Skilled Workforce in Composite Manufacturing

Supply Chain Disruptions

Price Volatility of Raw Materials

Competition from Alternative Lightweight Materials - Opportunities

Defense Modernization and Strategic Procurement

Growth in UAV and Drone Manufacturing

Expansion of Domestic Composite Production

Increasing Adoption of Carbon Fiber in Commercial Aircraft

Growing Space Exploration and Satellite Launches

Potential in Aftermarket MRO Services for Composite Parts - Market Trends

Rising Demand for Hybrid Composite Materials

Shift Towards Resin Transfer Molding (RTM) and Automated Processes

Integration of Smart and Multifunctional Composites

Focus on Sustainability

Increasing Use of Composites in Cabin Interiors and Secondary Structures

- Market Value 2020-2025

- Volume Consumption Across Subsegments 2020-2025

- Composite Adoption Intensity 2020-2025

- By Material Type (In Value%)

Carbon Fiber Reinforced Polymer

Glass Fiber Reinforced Polymer

Aramid Fiber Composites

Hybrid Composite Systems

Ceramic Matrix Composites - By Manufacturing Process (In Value%)

Automated Fiber Placement (AFP)

Resin Transfer Molding (RTM)

Prepreg Layup & Autoclave

Filament Winding

Pultrusion & Other Processes - By Application Domain (In Value%)

Primary Aerostructures

Secondary Aerostructures

Interiors & Cabin Components

UAV & Remotely Piloted Aircraft Composites

Satellite & Spacecraft Composites - By EndUser Channel (In Value%)

OEM

Tier1 & Tier2 Suppliers

Aftermarket & MRO

Exports - By Geography (In Value%)

Western India (Gujarat, MH)

Southern India (KA, TN)

Northern India (DL/NCR)

Eastern India

- Market Share Analysis by Value/Volume

- Cost Curve Benchmarking

- CrossComparison Parameters (Company Revenue, Composite Types, Certification Levels, Production Capacity, Quality Accreditation, Number of OEM Contracts, Export Footprint, R&D Intensity)

- Major Players

Tata Advanced Systems Ltd

Rockman Advanced Composites Ltd

Kineco Aerospace Pvt Ltd

Gopalan Aerospace

International Aerospace Manufacturing Pvt Ltd

Chakradhara Aerospace & Cargo Pvt Ltd

Aequs Aerospace

Lohia Aerospace Systems

HAL Composite Units

BEL Composite Systems

Mahindra Aerospace Pvt Ltd

Adani Defence & Aerospace

Safran India Composites

TASE Global

Other Key Consortiums & JVs

- Aerospace OEM Procurement Trends

- Tier1/2 Supplier Sourcing Patterns

- Aftermarket Demand for Composite Repairs/Upgrades

- Buyer Decision Levers

- Customer PainPoints & Technical Requirements

- Forecast by Value & Growth Scenarios 2026-2035

- Forecast by Volume & Composite Penetration 2026-2035

- Future Demand by Aircraft Segment 2026-2035