Market Overview

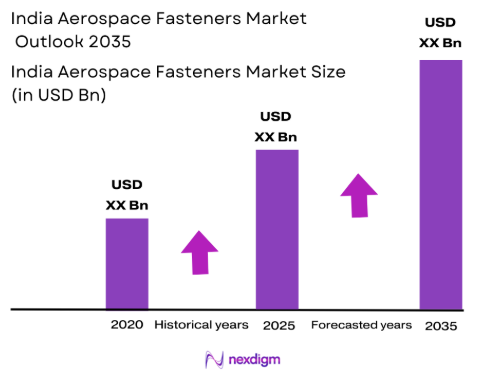

The India aerospace fasteners market is valued at approximately USD ~billion, as of the most recent data. The market has been significantly driven by the expansion of the Indian aerospace sector, encompassing both civil and defense aviation. Increased demand for commercial aircraft, government initiatives aimed at boosting defense manufacturing, and the growing focus on indigenization have been key contributors. Additionally, advancements in materials such as titanium and high-strength alloys have bolstered the demand for specialized fasteners. India’s burgeoning aerospace manufacturing capabilities, particularly in regions like Bengaluru and Hyderabad, are also fueling the market’s growth trajectory.

India’s aerospace fastener market is predominantly driven by cities with robust aerospace manufacturing hubs, such as Bengaluru, Hyderabad, Pune, and New Delhi. Bengaluru, being the “Aerospace Hub of India,” is home to several major players, including Boeing and HAL, which manufacture components for both commercial and defense sectors. The dominance of these cities can be attributed to the availability of skilled labor, proximity to aerospace OEMs, and government incentives. Additionally, major defense contractors are located in cities like New Delhi, contributing to the defense sector’s demand for aerospace fasteners.

Market Segmentation

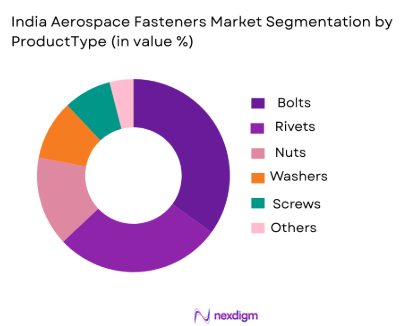

By Product Type

India’s aerospace fasteners market is segmented by product type into bolts, screws, rivets, nuts, washers, and other fasteners. Among these, bolts and rivets dominate the product type segmentation due to their essential role in the assembly of aircraft structures. Bolts are crucial in ensuring structural integrity, while rivets are extensively used in aircraft fuselage and wing assemblies. The dominance of these segments can be attributed to the complexity of modern aircraft, where a large number of fasteners are required for load-bearing and safety-critical applications.

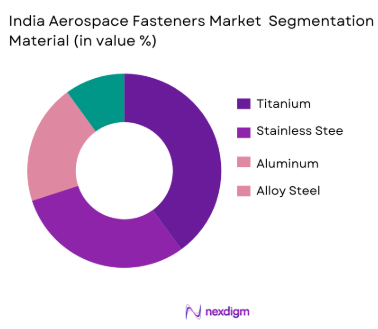

By Material

The aerospace fasteners market in India is also segmented by material, including titanium, stainless steel, aluminum, and alloy steel. Titanium-based fasteners dominate this segment due to their lightweight, high-strength, and corrosion-resistant properties, making them ideal for aerospace applications. Titanium fasteners are particularly preferred in critical components such as engine assemblies and airframes. The preference for titanium is driven by the increasing focus on weight reduction in aircraft design and the growing use of high-performance materials in the aerospace sector.

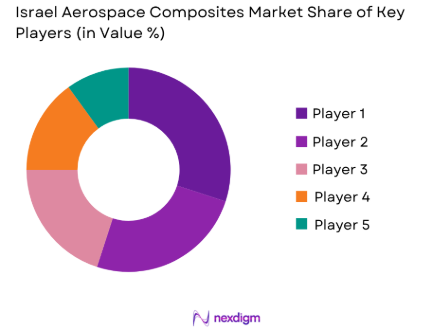

Competitive Landscape

The India aerospace fasteners market is characterized by the presence of both local and international players who supply fasteners to aerospace OEMs, Tier-1 suppliers, and MRO providers. The market is dominated by a few key players that have established a strong presence due to their advanced manufacturing capabilities, certifications, and strategic partnerships with aerospace companies. Notable players include Avdel India, Sanket Fasteners, and Aerospace Fastener Solutions, with a heavy focus on innovation, quality assurance, and timely delivery.

| Company Name | Establishment Year | Headquarters | Certification Status | Product Range | Market Presence | Revenue in 2023 (USD) |

| Avdel India | 1985 | Bengaluru | ~ | ~ | ~ | ~ |

| Sanket Fasteners | 1995 | Pune | ~ | ~ | ~ | ~ |

| Aerospace Fastener Solutions | 2000 | Hyderabad | ~ | ~ | ~ | ~ |

| Jayant Impex | 1992 | New Delhi | ~ | ~ | ~ | ~ |

| Randhir Metal & Alloys | 2003 | Mumbai | ~ | ~ | ~ | ~ |

India Aerospace Fasteners Market Analysis

Growth Drivers

Commercial Fleet Growth & Aircraft Deliveries

India’s commercial fleet is undergoing a significant expansion, driven by increasing passenger air traffic and the rise in disposable income. As of 2025, India is projected to be the world’s third-largest aviation market by passenger traffic, with the fleet expected to reach over 1,000 aircraft in the next few years. In addition, India has seen an order of 500 new aircraft from airlines like IndiGo, Air India, and SpiceJet. This growth directly impacts the demand for aerospace fasteners as airlines require them for new aircraft assembly and maintenance. The robust demand for air travel, with India’s passenger traffic estimated to grow at a rate of 11% annually, fuels the need for fasteners in aircraft production and MRO operations.

Defense Modernisation & Indigenous Production

India’s defense sector is undergoing modernization, with a focus on indigenization under the “Atmanirbhar Bharat” initiative. The Indian Air Force (IAF) is slated to add over 300 fighter jets and modernize its fleets by 2026. The Make-in-India campaign encourages local manufacturing, creating demand for aerospace components, including fasteners. India’s indigenous aircraft programs, such as the HAL Tejas, further boost demand for locally produced aerospace fasteners. The Indian government’s defense spending, expected to exceed USD 70 billion in 2024, will directly influence the procurement of high-grade aerospace fasteners to meet defense aviation requirements.

Challenges

Stringent QA/QC & Certification Barriers

Aerospace fasteners are subject to strict quality assurance (QA) and quality control (QC) regulations, including compliance with international standards like AS9100 and NADCAP. For instance, a delay in certification approval from regulatory authorities such as the Directorate General of Civil Aviation (DGCA) can delay production timelines. In 2024, India saw a rise in audits and inspections due to heightened security measures post-pandemic, which significantly impacted the certification of aerospace components. This stringent certification process is causing delays in the supply chain, affecting fastener manufacturers, especially local SMEs, which face challenges in maintaining consistent production and meeting the regulatory requirements for aerospace-grade components.

Import Dependency on High‑Grade Titanium & Alloy Inputs

India is heavily reliant on imports for high-grade materials used in aerospace fasteners, such as titanium and high-strength alloys. As of 2025, over 65% of titanium used in India’s aerospace manufacturing is imported from countries like the USA and Russia. Despite local manufacturing efforts, India’s titanium production capacity remains limited, and the high cost of these imported materials increases the overall production cost of aerospace fasteners. The dependency on foreign supply chains makes the market vulnerable to geopolitical disruptions and changes in export policies. This import dependency is a key challenge for the growth of the market, especially as the demand for high-performance materials continues to rise.

Opportunities

Localization of Tier‑1 Supply Chains

India’s aerospace sector is shifting towards local production to reduce dependency on imports. The localization of Tier-1 supply chains is being supported by government initiatives, including the “Make in India” program, which aims to boost domestic production of aerospace components. In 2025, the Indian government announced new incentives for companies investing in aerospace manufacturing, including tax breaks and subsidies. These efforts have resulted in the establishment of several new aerospace fastener manufacturing facilities across India, especially in industrial hubs such as Bengaluru and Hyderabad, which will drive the growth of local fastener suppliers, meeting both domestic and export demand.

Advanced Material Innovation

Advancements in materials science are creating new opportunities for the aerospace fastener market in India. The growing trend toward lightweight and high-strength materials such as composite fasteners and titanium alloys presents opportunities for manufacturers to meet evolving aerospace industry requirements. India’s aerospace manufacturers are increasingly focusing on developing fasteners using advanced materials that improve fuel efficiency and reduce weight, which is crucial for commercial and military aircraft. As of 2024, new alloys and composite fasteners are being explored to enhance the performance of aerospace structures, and local manufacturers are expected to benefit from these innovations.

Future Outlook

The India aerospace fasteners market is expected to see substantial growth over the next decade, driven by increased demand from both the civil aviation and defense sectors. The Indian government’s push towards self-reliance in defense manufacturing under initiatives like “Atmanirbhar Bharat” is likely to enhance the demand for indigenously manufactured fasteners. Additionally, the growing presence of international aerospace manufacturers in India and increasing aircraft deliveries will continue to fuel the market. Over the next five years, the market is set to benefit from advancements in materials, manufacturing technologies, and an expanding MRO market.

Major Players

- Avdel India

- Sanket Fasteners

- Aerospace Fastener Solutions

- Jayant Impex

- Randhir Metal & Alloys

- Dwarka Metal Corporation

- Aryan Aerospace Fasteners

- Niko Steel & Engineering LLP

- Excel Metal & Engineering Industries

- AAA Industries

- Rimco Overseas

- Hical Technologies

- Roll-Fast Supplies

- Special Metals (Mumbai)

- Indo Aerospace Fasteners

Key Target Audience

- OEM Manufacturers

- Aerospace Component Distributors

- Aerospace Maintenance, Repair & Overhaul (MRO) Providers

- Defense Contractors (Boeing India, Hindustan Aeronautics Limited)

- Airline Operators

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace Engineering Firms

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying and categorizing the major players, end-users, and supply chain participants. Secondary research, including a review of government publications, industry reports, and proprietary databases, is used to gather comprehensive insights.

Step 2: Market Analysis and Construction

In this phase, historical data is analyzed to understand the trends influencing the India aerospace fasteners market. Data on raw materials, demand-supply gaps, pricing, and regional trends are assessed to build a detailed market model.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are validated through direct interviews and consultations with industry experts, key stakeholders, and executives from major companies to enhance the accuracy and reliability of the market projections.

Step 4: Research Synthesis and Final Output

The final research involves synthesizing data from both primary and secondary sources and consolidating information obtained through expert interviews. The result is a comprehensive market report with actionable insights for decision-makers in the aerospace fasteners sector.

- Executive Summary

- Research Methodology (Market Definitions & Aerospace Standards (AS, NAS, MS), Primary & Secondary Data Sources, Material Classification Matrix (Titanium, Alloy Steel, Composite Fasteners), Aerospace Quality & Certification Benchmarking (AS9100, ISO9001), Market Sizing & Forecasting Logic, Data Normalization & Validation, Limitations & Assumptions)

- Market Definition & Scope

- Aerospace Fasteners Value Chain

- Strategic Importance in India’s Aerospace Ecosystem

- Aviation Demand Drivers

- Regulatory & Civil Aviation Requirements

- Growth Drivers

Commercial Fleet Growth & Aircraft Deliveries

Defense Modernisation & Indigenous Production

Government Initiatives - Challenges

Stringent QA/QC & Certification Barriers

Import Dependency on High‑Grade Titanium & Alloy Inputs

Counterfeit & Non‑Compliant Parts Risk - Emerging Opportunities

Localization of Tier‑1 Supply Chains

Advanced Material Innovation

MRO Market Expansion - Key Market Trends

Lightweight Fastener Adoption

Digital Thread Traceability & Smart QA

Additive Manufacturing Integration

- India Aerospace Fasteners Market Value, 2020-2025

- Volume Shipment, 2020-2025

- Average Realisation, 2020-2025

- Historical Growth & CAGR Trends, 2020-2025

- Forecast Scenarios, 2020-2025

- By Product Type (In Value%)

Bolts & Screws

Nuts & Washers

Rivets & Blind Fasteners

Pins & Retainers

Specialised Inserts & Threaded Components - By Material (In Value%)

Titanium Alloys

High‑Strength Alloy Steel

Aluminium Alloys

Composite/Hybrid Fasteners - By End‑Use Application (In Value%)

Commercial Aircraft

Military & Defense Aviation

Space & Launch Vehicle Components

MRO

General Aviation & Rotorcraft - By Certification Level (In Value%)

AS9100 Certified

NADCAP Accredited

ISO/TS Compliant - By Supply Channel (In Value%)

OEM Supply Contracts

Tier‑1 / Tier‑2 Subcontracts

Aftermarket / MRO Distribution

- Market Share Landscape (Value & Volume)

- Cross‑Comparison Parameters (Company Positioning, AS9100 / NADCAP Accreditations, Supply Chain Tier Level, Revenue Mix, Product Portfolio Depth (NAS / MS Code Coverage), Material Expertise, OEM Contract Footprint, Aftermarket Share, QA & Testing Infrastructure, Production Capacity , Geographic Footprint, Strategic Partnerships / JVs, R&D Intensity)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Forces

- Company Profiles

Avdel (India) Pvt. Ltd.

UPS Lakshmi Industries

Aryan Aerospace Fasteners

Dwarka Metal Corporation

Randhir Metal and Alloys Pvt Ltd.

Special Metals (Mumbai)

NIKO Steel & Engineering LLP

Jayant Impex

AAA Industries

Rimco Overseas

Excel Metal & Engineering Industries

Sanket Fastners

Hical Technologies

JJG Aero Components |

Roll‑Fast Supplies

- OEM Demand Pattern

- MRO Usage & Replacement Cycles

- Tier‑1 / Tier‑2 Purchasing Behaviour

- Material & Specification Preferences

- Pain Points & Quality Expectations

- Market Size Forecast (Value & Volume), 2026-2035

- Technology Innovation Roadmap, 2026-2035

- Strategic Investment Themes, 2026-2035

- Market Entry & Scaling Recommendations, 2026-2035