Market Overview

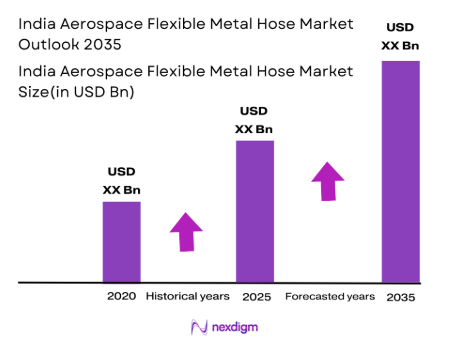

The India aerospace flexible metal hose market has witnessed steady growth, fuelled by the increasing demand for lightweight and durable hose solutions across various aerospace applications. As of 2025, the market is valued at approximately USD ~million, driven by expanding air travel, military aerospace requirements, and the growing aerospace manufacturing sector in the country. The major factors propelling market growth include increasing aircraft production, modernization of aging aircraft fleets, and the development of new-generation commercial and military platforms. Furthermore, the advancement of aerospace technologies, such as cryogenic fuel systems and more efficient hydraulic and pneumatic systems, is fostering demand for high-performance aerospace flexible metal hoses, which are critical in maintaining system integrity and reliability.

The market in India is primarily driven by aerospace hubs like Bengaluru, Hyderabad, and Pune. Bengaluru is regarded as the aerospace capital of India, with significant investments from both domestic and international aerospace companies. Hyderabad is home to major defense contractors, and Pune serves as a manufacturing hub for global aerospace players. These cities dominate due to their proximity to major OEMs and Tier 1 suppliers, as well as the presence of highly skilled labor, government support through initiatives like “Make in India,” and a robust supply chain. These factors make these cities key players in driving the growth of the aerospace flexible metal hose market in India.

Market Segmentation

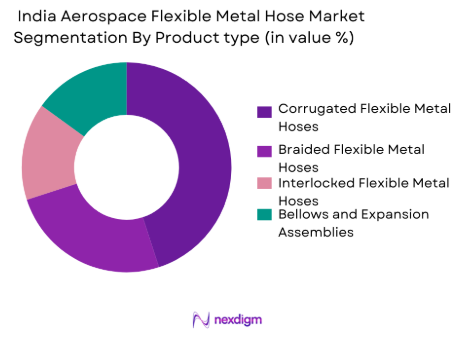

By Product Type

India’s aerospace flexible metal hose market is segmented into various product types, including corrugated hoses, interlocked hoses, braided hoses, and bellows. Among these, corrugated flexible metal hoses hold the dominant market share due to their versatility and widespread application in hydraulic and fuel systems. These hoses offer superior flexibility and resistance to vibration, making them ideal for aerospace environments where system performance and reliability are critical. Their ability to handle high temperatures, pressures, and aggressive media contributes to their market dominance in both commercial and defense sectors.

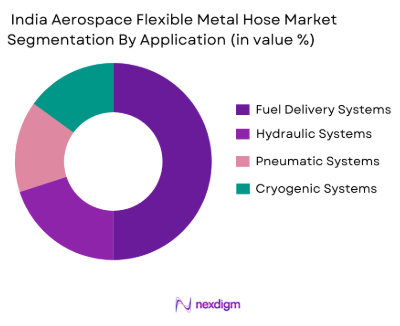

By Application

The market is also segmented by application, including fuel delivery systems, hydraulic systems, pneumatic systems, and cryogenic systems. Fuel delivery systems account for the largest share of the market, largely driven by the growth in commercial air travel and the modernization of military aircraft. The need for reliable fuel transfer lines, which are resistant to wear, pressure, and vibration, makes flexible metal hoses indispensable in these systems. As air traffic and defense spending increase, particularly in the Asia-Pacific region, fuel delivery systems continue to drive significant demand for aerospace flexible metal hoses.

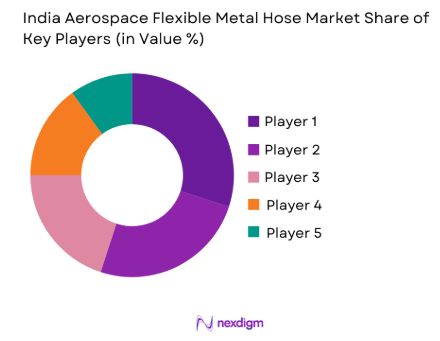

Competitive Landscape

The India aerospace flexible metal hose market is highly competitive, dominated by both international giants and domestic players. Major global players like Parker Hannifin, Eaton, and Witteman GmbH have established strong footholds in the Indian market through their advanced technologies and local manufacturing capabilities. Domestic players like Aeroflex Industries and Senior Flexonics are capitalizing on cost-effectiveness and understanding of local market needs, including regulatory requirements and raw material sourcing.

| Company | Establishment Year | Headquarters | Product Types | Certification Status | Market Presence | Key OEM Partnerships |

| Parker Hannifin | 1917 | USA | ~ | ~ | ~ | ~ |

| Eaton Corporation | 1911 | USA | ~ | ~ | ~ | ~ |

| Witzenmann GmbH | 1854 | Germany | ~ | ~ | ~ | ~ |

| Aeroflex Industries | 1985 | India | ~ | ~ | ~ | ~ |

| Senior Flexonics | 1947 | USA | ~ | ~ | ~ | ~ |

India Aerospace Flexible Metal Hose Market Dynamics

Growth Drivers

Engine Weight Reduction Imperatives & Fuel Efficiency Mandates

Robust economic growth, with India’s Real GDP estimated at~ lakh crore and manufacturing output growing strongly, underscores pressure on aerospace OEMs to optimise aircraft performance and fuel efficiency. Reducing aircraft weight is a proven method to reduce operating costs and emissions, a priority for both commercial and defense operators in a market where aviation investments continue to grow. Flexible metal hoses, manufactured from lightweight yet durable alloys like stainless steel and titanium, facilitate weight savings in critical fuel delivery and thermal management systems. These components, therefore, are pivotal in meeting stringent efficiency and performance norms within high‑growth aerospace activities.

Demand for Cryogenic Hoses for Hydrogen & Advanced Propulsion

The aerospace sector’s expansion into greener propulsion technologies increases interest in cryogenic systems, which rely on advanced hose solutions to transfer liquid hydrogen and other cryogenic fuels. Globally, the cryogenic hoses market was estimated at USD ~ billion in 2025, reflecting broader industrial enthusiasm for cryogenic technology deployment. Although this figure is global, it illustrates structural demand for high‑performance metal hoses as aerospace players explore hydrogen propulsion, satellite launch systems, and advanced propulsion architectures, necessitating components that withstand extreme temperatures and pressures in aerospace applications.

Restraints

Stringent Qualification / Certification Lead Times

Aerospace safety standards demand rigorous testing and certification, especially for fluid transfer components like flexible metal hoses that operate in flight‑critical systems. Certification processes such as compliance with AS9100 and detailed material traceability often require extensive lead times, which can delay market entry. This challenge comes amid India’s broader push to integrate domestic suppliers into the global aerospace supply chain while maintaining international safety norms. Extended qualification cycles increase time‑to‑market and capital tied up in validation, constraining the ability of emerging suppliers to respond rapidly to procurement cycles without compromising compliance requirements.

Superalloy Price Volatility & Import Dependencies

Flexible metal hoses in aerospace commonly require high‑performance alloys to meet demanding operational contexts. These materials’ prices are linked to broader commodities markets, where volatility can strain manufacturers’ input costs. Since India’s manufacturing ecosystem still relies heavily on imports of specialised aerospace alloys, fluctuations in global metal prices and exchange rates can significantly affect production cost structures. This external dependency on imported feedstock exposes the sector to international market swings, which hampers cost planning and competitiveness, especially for domestic manufacturers aiming to serve both commercial and defense aerospace customers.

Opportunities

Test Lab Establishment for FAA/EASA Traceability

The lack of domestic testing facilities accredited to international standards is a significant bottleneck, as Indian suppliers currently depend on overseas labs for certification traceability recognized by FAA and EASA. Establishing test laboratories with capabilities for high‑pressure, cryogenic, and fatigue testing will reduce lead times, cut certification costs, and attract component manufacturers to scale operations locally. This development would align with India’s industrial upgrade efforts and bolster global competitiveness, enabling faster qualification for aerospace flexible metal hoses and related systems, leveraging localized approval pathways and improving export potential.

Expansion of Additively Manufactured Bellows

Additive manufacturing (AM) presents a transformative opportunity by enabling complex bellows and hose components with optimized geometries and material use, reducing waste and lead time. As India’s advanced manufacturing investments grow, the adoption of AM for metal aerospace components offers a future‑oriented route to enhance design flexibility and performance. By incorporating AM, manufacturers can address niche applications requiring custom configurations, which are particularly valuable in aerospace contexts where space, weight, and performance constraints are paramount. This positions India to develop competitive advantages in bespoke aerospace component production.

Future Outlook

Over the next decade, the India aerospace flexible metal hose market is poised for strong growth, driven by the country’s expanding aerospace manufacturing sector and the increasing need for high-performance components in aircraft systems. As India continues to boost its defense capabilities and invest in air travel infrastructure, the demand for flexible metal hoses will rise substantially. The growth of new-generation aircraft, such as fuel-efficient commercial airliners and next-gen military fighter jets, will further drive the need for specialized flexible hoses that meet stringent industry standards. This trend is expected to accelerate with government initiatives such as “Atmanirbhar Bharat” and “Make in India,” promoting local manufacturing of aerospace components.

Major Players

- Parker Hannifin

- Eaton Corporation

- Witzenmann GmbH

- Aeroflex Industries

- Senior Flexonics

- Titeflex Aerospace

- Amphenol Corporation

- Swagelok

- Texcel Industries

- Flextech Industries

- Metal Hose & Assemblies

- Hyspan Precision Products

- Cryogenic Industries

- Saint-Gobain

- Microflex Inc.

Key Target Audience

- Aerospace OEMs

- Tier 1 Aerospace Suppliers

- Defense and Military Agencies

- Aerospace Component Manufacturers

- Airline Operators

- Aerospace MROs

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Aerospace Certification Authorities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a market ecosystem map encompassing all major stakeholders within the India aerospace flexible metal hose market. This step is underpinned by extensive desk research, utilizing secondary sources and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling historical data and performing a detailed analysis of market penetration and the ratio of component manufacturers to aerospace service providers. Additionally, an assessment of service quality metrics ensures the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through telephone interviews (CATIs) with industry experts, covering a wide range of companies. These consultations provide operational and financial insights directly from key market players, aiding in refining and confirming the market data.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with manufacturers, which helps acquire detailed insights into product segments, sales performance, and consumer preferences. This interaction ensures the comprehensive, accurate, and validated analysis of the India aerospace flexible metal hose market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions; Primary & Secondary Data Sources, India Supply Chain Mapping Approach, Quantitative Modelling, Forecasting Technique, Interview Panels with OEMs, Tier‑1s, Test Labs & Defense Buyers)

- Market Definition & Scope

- Market Genesis & Evolution in India

- Value Chain & Supply Chain Ecosystem

- Certification & Qualification Framework

- Role of Aero‑Engine & Airframe OEMs in Hose Specification Adoption

- Growth Drivers

Localization Push by Make in India & Defense Aero Procurement

Engine Weight Reduction Imperatives & Fuel Efficiency Mandates

Demand for Cryogenic Hoses for Hydrogen & Advanced Propulsion - Restraints

Stringent Qualification / Certification Lead Times

Superalloy Price Volatility & Import Dependencies - Opportunities

Tier‑1 Integration with Indian OEMs

Test Lab Establishment for FAA/EASA Traceability

Expansion of Additively Manufactured Bellows

- Industry Trends

Supply Chain Verticalization Among Tier‑1s

Digital Twin & IoT‑Embedded Hose Monitoring

Materials Innovation

- By Value, 2020-2025

- By Volume, 2020-2025

- Price Benchmarks & Average Selling Price, 2020-2025

- By Product Type (Value %)

Corrugated Flexible Metal Hoses

Interlocked / Stripwound Hoses

Bellows & Expansion Assemblies

Braided Hoses

Custom or Additively Manufactured Hoses

- By Material (Value %)

Stainless Steel

Titanium Alloys

Inconel & Superalloy Hoses

Hybrid / Composite + Metal Solutions

- By Operating Pressure Class (Value %)

Low Pressure

Medium Pressure

High Pressure

- By Application (Value %)

Fuel Delivery Lines

Hydraulic & Pneumatic Circuits

CryogenicCoolant / Hydrogen Transfer

Thermal Management & Bleed Air Systems

Actuation / Landing Gear Fluid Routing - By End‑Use Sector (Value %)

Commercial Aircraft

Military Aircraft

Helicopters & UAV Platforms

Space & Launch Components

Emerging eVTOL/Urban Air Mobility

- India Market Share: Domestic vs Global Supplier Participation

- Cross‑Comparison Parameters (Company Profile, Product Portfolio Breadth Material Expertise, Certification Status, Average Order Value & Lead Times, OEM Approvals & Qualified Lists, Manufacturing Footprint, R&D & Additive Manufacturing Capabilities)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Force

- Competitors Profile

Parker‑Hannifin Corporation

Eaton Corporation plc

Safran SA

AMETEK, Inc.

Smiths Group plc

Aeroflex Industries

Senior Flexonics

FMH Aerospace

Shine Aero

Titeflex Aerospace

Microflex Inc.

Witteman GmbH

Trelleborg Aerospace

AeroDyne Industries

Eaton Aerospace

- Procurement Patterns

- Decision Driver

- Adoption Barriers and Quality Expectations

- Lifecycle & Maintenance Cost Profiles

- By Value, 2026-20235

- By Volume, 2026-20235

- Price & Content Per Aircraft Trend, 2026-20235