Market Overview

The India Aerospace Fluoropolymers Market is valued at approximately USD ~ million in 2025, with a strong demand for high-performance polymers such as PTFE, PVDF, and PFA, essential for aerospace applications. The market is primarily driven by the increasing adoption of lightweight, durable materials in aircraft and spacecraft manufacturing, particularly in fuel systems, seals, and thermal management components. The expanding aerospace sector in India, driven by defense modernization and the rise in civil aviation, continues to fuel this market’s growth.

The Indian cities of Bengaluru, Hyderabad, and Pune dominate the aerospace fluoropolymers market. Bengaluru is a major hub for aerospace and defense manufacturing with the presence of industry giants like HAL and ISRO. Hyderabad is a key center for aerospace research, while Pune houses several aerospace component manufacturers. These cities benefit from strong government initiatives such as the “Make in India” program, creating a conducive environment for aerospace innovations and the demand for advanced materials like fluoropolymers.

Market Segmentation

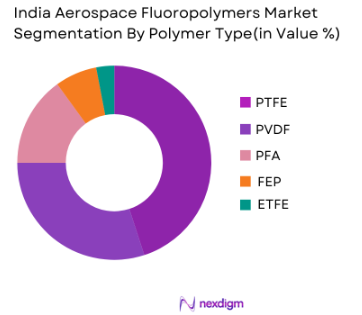

By Polymer Type

India’s Aerospace Fluoropolymers market is segmented by polymer type into PTFE, PVDF, PFA, FEP, and ETFE. Among these, PTFE dominates the market due to its unparalleled properties of high thermal stability, low friction, and chemical resistance, making it the preferred choice for components like fuel systems, gaskets, and seals. The high durability and versatility of PTFE ensure its widespread use in demanding aerospace applications, further solidifying its dominant position in the market.

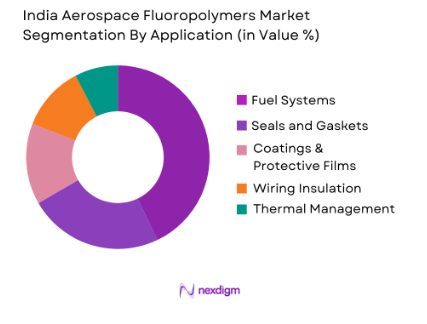

By Application

The market is also segmented by application into fuel systems, seals and gaskets, coatings and protective films, wiring insulation, and thermal management components. Fuel systems command the largest share of the market due to the increasing demand for high-performance materials that can withstand extreme pressures and temperatures. PTFE and PFA polymers are widely used in fuel lines, seals, and valves due to their exceptional chemical and thermal resistance, which is essential for ensuring safety and durability in aerospace systems.

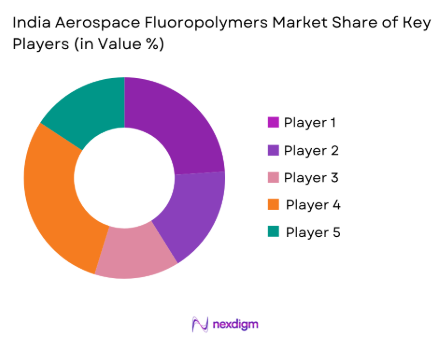

Competitive Landscape

The India Aerospace Fluoropolymers market is dominated by a few major players that lead the sector with their strong technological capabilities, comprehensive product portfolios, and strategic alliances. Leading players like DuPont, Solvay, and 3M have established themselves as key suppliers to the aerospace sector through innovation in fluoropolymer materials that meet the stringent requirements of aerospace applications. These companies focus on high-quality, durable materials that can withstand extreme temperatures and harsh chemical environments.

| Company Name | Establishment Year | Headquarters | Polymer Portfolio | R&D Investment | Production Capacity | Key Certifications |

| DuPont India | 1802 | Hyderabad | ~ | ~ | ~ | ~ |

| Solvay Specialty Polymers | 1863 | Mumbai | ~ | ~ | ~ | ~ |

| 3M India | 1902 | Bangalore | ~ | ~ | ~ | ~ |

| Arkema India | 2004 | Pune | ~ | ~ | ~ | ~ |

| Hindustan Fluorocarbons | 1980 | Delhi | ~ | ~ | ~ | ~ |

India Aerospace Fluoropolymers Market Dynamics

Growth Drivers

Demand for Lightweight, High Durability Materials

The growing demand for lightweight, durable materials in the aerospace industry is driven by the aviation sector’s ongoing efforts to improve fuel efficiency and reduce operational costs. India’s aviation sector is projected to see a steady increase in both domestic and international flights, especially as passenger traffic in India is expected to grow to over 450 million by 2035, as per the International Civil Aviation Organization (ICAO). The Indian government has recognized the need for lightweight materials in the aerospace sector, with a focus on reducing fuel consumption. Fluoropolymers, known for their strength-to-weight ratio and chemical resistance, are ideal for fuel lines, wiring insulation, and seals. The importance of these materials is underscored by the global push toward sustainable aviation, as India continues to modernize its fleet and expand its aerospace capabilities. The increasing use of such materials is, therefore, crucial to meeting these needs.

Expansion of MRO and Aftermarket Services

India is witnessing robust growth in the Maintenance, Repair, and Overhaul (MRO) sector, which is expected to expand significantly in the coming years. As the Indian fleet of aircraft grows, the need for MRO services and replacement parts such as seals, gaskets, and thermal management components will increase. The Indian MRO market is valued at over INR 20,000 crores and is anticipated to witness continuous growth, fueled by the increasing number of domestic aircraft and the expansion of airlines operating in India. Additionally, the growing demand for faster and more efficient aftermarket services in both civil and defense aerospace sectors further increases the demand for high-performance materials like fluoropolymers, which are ideal for harsh environments in aerospace systems. The increased reliance on domestic MRO services will directly benefit the fluoropolymer market as aircraft maintenance increasingly focuses on utilizing durable, high-performance materials.

Restraints

High Raw Material Costs

The production of fluoropolymers requires specialized raw materials like tetrafluoroethylene (TFE) and other fluorinated monomers, which are expensive to procure and process. In India, these raw materials are often imported from international suppliers, contributing to the rising costs of aerospace fluoropolymers. Moreover, the inflation in global commodity prices has impacted the overall manufacturing costs. The global price volatility of fluorinated compounds has been reflected in India, with the cost of TFE alone having risen by 15% over the past year, according to recent reports by the Indian Ministry of Chemicals and Fertilizers. These high material costs can significantly strain the profitability of manufacturers, especially small and mid-sized suppliers, limiting their capacity to compete. The inflationary pressure from global supply chains, coupled with currency fluctuations, continues to affect the economic feasibility of producing affordable fluoropolymers domestically.

Complex Qualification & Certification Processes

Aerospace materials, particularly those used in critical applications like fuel systems, must meet stringent regulatory requirements. The certification and qualification processes for fluoropolymers are particularly rigorous, with companies needing to adhere to international standards such as AS9100, ISO 9001, and others specified by regulatory bodies like the Directorate General of Civil Aviation (DGCA) in India. These certification processes often take years to complete and require extensive testing to ensure the materials meet performance specifications. The complex and lengthy qualification process for aerospace-grade materials can delay product development and increase time-to-market, which acts as a major restraint on market growth. Manufacturers also face challenges in ensuring compliance with evolving aerospace standards, which require constant adaptation of their materials and processes.

Opportunities

Growth in Defense & Space Programs

India’s defense and space programs represent a key growth opportunity for the aerospace fluoropolymers market. The Indian government has ramped up its defense budget allocation, with INR ~lakh crore earmarked for defense spending, which includes considerable investments in the aerospace and space sectors. The expansion of ISRO’s space missions, including satellite launches and deep space exploration, presents a substantial opportunity for fluoropolymers. These materials are essential for various components in both spacecraft and satellite systems due to their high chemical resistance, heat tolerance, and electrical insulation properties. Additionally, the Indian government’s push to achieve self-reliance in defense production under the “Atmanirbhar Bharat” initiative is expected to stimulate the demand for locally produced aerospace materials, further bolstering the demand for specialized materials like fluoropolymers in the defense and space sectors.

Local Polymer Formulation & Value Addition

India is increasingly focusing on local production of fluoropolymer materials to reduce its dependence on imports and enhance the value addition in the aerospace sector. The government has been promoting the “Make in India” initiative, which encourages domestic production of high-performance materials, including polymers. Several local manufacturers are investing in the development of new formulations of fluoropolymers that meet the stringent requirements of the aerospace industry. As of 2024, the Indian government is providing support in terms of grants, research, and tax incentives for companies involved in material science and aerospace manufacturing. This shift towards local polymer formulation is expected to reduce costs and improve supply chain efficiencies, making fluoropolymers more affordable and accessible for aerospace applications. Additionally, the growth of the Indian aerospace sector is creating demand for tailored, high-performance materials that can be locally sourced and custom-formulated to meet specific aerospace needs.

Future Outlook

Over the next decade, the India Aerospace Fluoropolymers market is expected to show robust growth driven by continuous advancements in aerospace manufacturing technologies and government support for defense and civil aviation. As India strengthens its position in the global aerospace supply chain, the demand for specialized high-performance materials like fluoropolymers will continue to grow. Additionally, the trend towards lightweight and high-durability components in both commercial and defense aircraft is likely to push the adoption of advanced polymers in aerospace systems.

Major Players

- DuPont India

- Solvay Specialty Polymers

- 3M India

- Arkema India

- Hindustan Fluorocarbons

- Gujarat Fluorochemicals Ltd.

- SRF Limited

- Daikin Industries

- Chemours India

- Polyfluoro Ltd.

- Polymet Corporation

- Flowserve Corporation

- AFT Fluorotec Ltd.

- Fluorocarbon Ltd.

- Chemplex Industries Inc.

Key Target Audience

- Aerospace OEMs

- Tier-1 Aerospace Suppliers

- Government and Regulatory Bodies

- Investments and Venture Capitalist Firms

- Aerospace Materials Distributors

- Aerospace Component Manufacturers

- MRO Service Providers

- Aerospace R&D Institutions and Laboratories

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, an ecosystem map will be constructed to identify all relevant stakeholders, including material suppliers, OEMs, and regulatory bodies. This will be based on desk research, using secondary industry reports and proprietary databases to define the key variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase involves gathering and analysing historical market data related to the aerospace fluoropolymers market. We will assess market penetration, product types used across applications, and the value chain from manufacturing to end-user. Segment analysis will provide insights into the demand trends across polymer types and applications.

Step 3: Hypothesis Validation and Expert Consultation

We will test market hypotheses through consultations with industry experts representing major aerospace companies, manufacturers, and government officials. Their input will help refine the research model and validate the market data.

Step 4: Research Synthesis and Final Output

The final stage involves compiling all research findings, including insights from primary interviews and secondary data sources, to provide a comprehensive market analysis. This will include segmentation, competitive landscape insights, and actionable recommendations for stakeholders.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Fluoropolymer Material Grade Codes, Aerospace Supply Chain Coverage, Primary & Secondary Research Framework, Data Triangulation and Forecasting Models, Limitations and Risk Calibration)

- India Aerospace Market Context

- Fluoropolymer Material Landscape

- Market Value Chain

- Technology & Material Trends

- Regulatory & Certification Norms

- Drivers

Increasing Domestic Aerospace Manufacturing

Demand for Lightweight, High Durability Materials

Expansion of MRO and Aftermarket Services - Restraints

High Raw Material Costs

Complex Qualification & Certification Processes - Opportunities

Growth in Defense & Space Programs

Local Polymer Formulation & Value Addition - Trends

Shift to High‑Purity, Low Outgassing Polymers

Adoption in Additive Manufacturing & Composite Integration

- Current Market Size, 2020-2025

- Demand by Polymer Type, 2020-2025

- By Application End‑Use, 2020-2025

- By Channel, 2020-2025

- By Polymer Type (In Value%)

PTFE (Polytetrafluoroethylene)

PVDF (Polyvinylidene Fluoride)

PFA (Perfluoroalkoxy)

FEP (Fluorinated Ethylene Propylene)

ETFE (Ethylene Tetrafluoroethylene)

- By Functional Application (In Value%)

Fuel & Hydraulic Systems

Seals & Gaskets

Coatings & Protective Films

Wiring Insulation & Cable Sheathing

Thermal Management Components

- By Aircraft Platform (In Value%)

Commercial Aircraft

Military & Defense Aircraft

Space Launch & Satellites

Business Jets & Regional Aircraft

- By Supply Chain Tier (In Value%)

Tier‑1 Material Suppliers

Tier‑2 Fabricators & Compounders

OEM Integration End‑Users

- Market Share by Value & Volume

- Cross Comparison Parameters (Company Overview, Polymer Portfolio Coverage, Tier Position, Certifications Held, Production Footprint, Material Grade Approvals, Aerospace Approvals, R&D Investment, Supply Chain Depth, Global vs Local Sourcing, Strategic Partnerships, Aftermarket Support Capabilities)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Porter’s Five Force

- Company Profiles

SRF Limited

Gujarat Fluorochemicals Limited

Hindustan Fluorocarbons Limited

DuPont India

3M India Limited

Solvay Specialities India

AGC Chemicals India Pvt. Ltd.

Daikin Industries (India)

Arkema India

The Chemours Company

Saint‑Gobain Fluoropolymers

Shin‑Etsu Chemical India

Dongyue Group (China)

Halopolymer & Specialty Resins

Polyfluoro Ltd

- OEM Procurement Criteria

- Tier‑1 Supplier Material Specifications

- Aftermarket Demand Patterns

- Market Forecast by Value, 2026-2035

- Forecast by Polymer Type, 2026-2035

- Forecast by Application Segment, 2026-2035

- Price Forecast & Margin Projections, 2026-2035