Market Overview

The India Aerospace Industry in Mexico market is valued at USD ~billion in 2024 . It is experiencing significant growth, driven by an increase in bilateral aerospace collaborations between India and Mexico, as well as growing investment in research and development. The market has seen a surge in demand for both commercial and military aircraft, as well as unmanned aerial vehicles (UAVs), owing to advancements in technology and cross-border partnerships. In recent years, Mexico has become a strategic hub for aerospace manufacturing due to its proximity to the United States and competitive labor costs, which have attracted major aerospace players. In 2024, the market is expected to reach USD ~billion, reflecting the growing significance of this industry.Dominant cities such as Mexico City and Querétaro continue to lead in the aerospace market due to their well-established infrastructure and concentration of aerospace manufacturers. Mexico City, as the capital, remains a central business hub, offering access to global supply chains. Querétaro, known for its aerospace cluster, hosts multiple international aerospace companies and is gaining traction as a competitive manufacturing center. These regions benefit from strong government support and investment in aerospace technology, positioning them as key players in Mexico’s aerospace landscape.

Market Segmentation

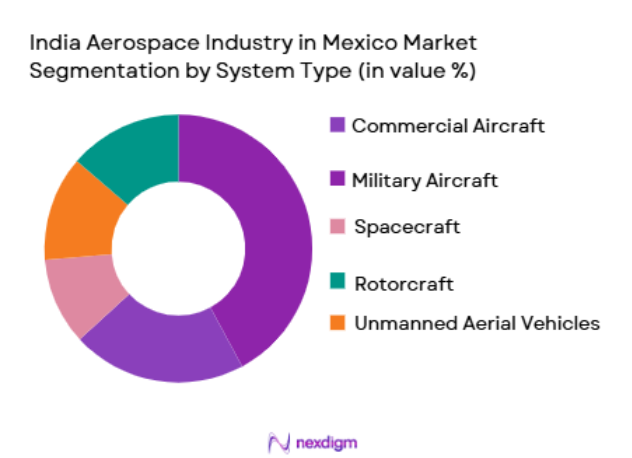

By System Type

The India Aerospace Industry in Mexico is segmented by system type, including commercial aircraft, military aircraft, spacecraft, rotorcraft, and unmanned aerial vehicles (UAVs). Commercial aircraft dominate the market due to the increasing air travel demand across Mexico and international markets. India and Mexico’s aerospace collaboration has further driven the manufacturing of commercial aircraft, meeting the needs of both local airlines and international customers. The rising demand for eco-friendly aircraft has also contributed to the growing market share of commercial aircraft, as both countries focus on developing more efficient models. In 2024, the market share of commercial aircraft is expected to reach ~%

By Platform Type

In the aerospace sector, the platform type segmentation is crucial for defining the technological requirements of various aerial systems. Fixed-wing platforms have a dominant market share, driven by their widespread use in commercial and military aviation. These platforms are preferred for their efficiency, long-range capability, and ability to carry heavier payloads. The demand for fixed-wing platforms continues to rise, particularly in commercial aviation. In addition, rotorcraft platforms hold a significant portion of the market, especially in military and emergency services applications. As of 2024, fixed-wing platforms hold ~% of the market share.

Competitive Landscape

The India Aerospace Industry in Mexico is dominated by a few key global and local players. The market landscape features well-established international aerospace giants like Boeing and Airbus, which have significant operations in Mexico. Additionally, companies such as Hindustan Aeronautics and ISRO (Indian Space Research Organisation) are contributing to the market through joint ventures and partnerships with local manufacturers. This consolidation of major aerospace players enhances the development of aerospace systems and technologies. The presence of multinational players in Mexico allows for enhanced access to advanced technology and expertise, positioning the country as an aerospace manufacturing hub.

| Company Name | Establishment Year | Headquarters | Revenue (2024) | Product Portfolio | Key Market Segment | Market Influence |

| Boeing | 1916 | Chicago, USA | ~ | ~ | ~ | ~ |

| Airbus | 1970 | Toulouse, France | ~ | ~ | ~ | ~ |

| Hindustan Aeronautics | 1940 | Bangalore, India | ~ | ~ | ~ | ~ |

| ISRO | 1969 | Bangalore, India | ~ | ~ | ~ | ~ |

| Bell Helicopter | 1935 | Fort Worth, USA | ~ | ~ | ~ | ~ |

Market Analysis

Market Analysis

Growth Drivers

Urbanization

Urbanization plays a crucial role in the growth of the aerospace industry in Mexico, particularly as cities like Mexico City, Monterrey, and Querétaro expand. Mexico’s urban population was estimated at ~million in 2024, making up nearly ~% of the country’s total population. As urban areas grow, the demand for advanced aerospace technologies and services, including transportation systems, drones, and satellite-based systems, increases. Urban centers also host the majority of aerospace manufacturing hubs and research institutions, contributing to the market’s expansion by fostering innovation and international collaboration.

Industrialization

Mexico’s industrialization, particularly its automotive, manufacturing, and aerospace sectors, significantly drives the demand for aerospace products and services. The country’s industrial production, which contributed nearly ~% to the GDP in 2024, includes a burgeoning aerospace manufacturing industry that caters to both local and international markets. As Mexico continues to develop its aerospace industry, with growth observed in regions like Querétaro, it supports the global supply chain for aircraft manufacturers like Boeing and Airbus. The demand for commercial aircraft and defense systems is set to grow, supported by industrialization trends.

Restraints

High Initial Costs

High initial costs associated with aerospace technology and infrastructure pose a significant restraint for the industry. In 2024, the cost of setting up aerospace manufacturing facilities in Mexico is substantial, with an average investment of USD ~million required for a mid-sized facility. These costs make it challenging for smaller companies and local governments to establish and maintain aerospace-related infrastructure, particularly in rural areas. Additionally, the high cost of advanced aerospace technologies and regulatory compliance further limits the scope of industry expansion in certain regions.

Technical Challenges

The aerospace industry in Mexico faces technical challenges, particularly in terms of adopting and integrating advanced technologies. In 2024, only ~% of Mexico’s aerospace firms possess the technical capabilities to design and manufacture advanced aerospace systems like unmanned aerial vehicles (UAVs) and satellite systems. This technical gap is compounded by challenges in adhering to international quality standards and maintaining high levels of production efficiency. Furthermore, Mexico’s reliance on foreign technology for components and expertise further adds complexity to the industry’s growth trajectory.

Opportunities

Technological Advancements

Technological advancements are poised to drive significant growth in the aerospace industry in Mexico. Innovations such as the development of electric and hybrid aircraft, as well as advancements in aerospace materials and automation, present substantial opportunities. In 2024, Mexico’s aerospace sector is witnessing increased collaboration with companies like Bombardier and Embraer to develop more energy-efficient aircraft. Mexico is also a key player in the development of advanced materials used in aerospace manufacturing, positioning the country to lead in next-generation aerospace technologies.

International Collaborations

International collaborations continue to play a pivotal role in Mexico’s aerospace sector growth. Mexico has established strong partnerships with global aerospace giants like Boeing, Airbus, and Lockheed Martin, positioning it as an important hub for aerospace manufacturing and innovation. In 2024, Mexico saw a ~% increase in international investments in the aerospace sector, driven by favorable policies and its strategic location near the U.S. market. These collaborations foster technology transfer, enhance local manufacturing capabilities, and provide Mexico with access to global aerospace supply chains.

Trends

Adoption of IoT

The adoption of IoT (Internet of Things) technology in Mexico’s aerospace industry is growing rapidly. In 2024, Mexican aerospace manufacturers have begun implementing IoT solutions to improve monitoring and maintenance of aircraft and aerospace components. By integrating sensors and data analytics, these technologies enable real-time data collection and predictive maintenance, reducing downtime and improving operational efficiency. IoT is also being leveraged in the development of UAVs and satellite systems, making it a key trend in Mexico’s aerospace sector.

Integration with Smart City Projects

Integration with smart city projects is a key trend that is driving innovation in Mexico’s aerospace industry. In 2024, Mexico City and Monterrey are incorporating aerospace technologies into their smart city infrastructure, including the use of drones for traffic monitoring and surveillance. These cities are also adopting satellite-based communication systems to improve urban management and emergency response. As Mexico continues to develop its smart city initiatives, the aerospace industry is expected to see increased demand for advanced aerospace technologies to support these projects.

Future Outlook

Over the next 5 years, the India Aerospace Industry in Mexico is expected to witness substantial growth, driven by advancements in aerospace technologies and increased cross-border collaborations between Indian and Mexican companies. The growing demand for commercial aircraft, particularly for the Latin American and North American regions, will further fuel market expansion. Additionally, military aerospace projects and the continued development of UAVs and spacecraft will contribute significantly to the market’s growth. As both countries invest in infrastructure and regulatory enhancements, the industry is poised for continued development, with a forecasted compound annual growth rate (CAGR) of ~% from 2026 to 2035.

Major Players in the Market

- Boeing

- Airbus

- Hindustan Aeronautics

- ISRO (Indian Space Research Organisation)

- Bell Helicopter

- Lockheed Martin

- Textron

- Sikorsky

- General Electric

- Northrop Grumman

- Raytheon

- Dassault Aviation

- Saab Group

- L3 Technologies

- Honeywell

Key Target Audience

- Aerospace Manufacturers

- Government Agencies (Mexican Ministry of National Defense, Indian Ministry of Defence)

- Aviation Industry Stakeholders (Airlines, Aviation Service Providers)

- Military and Aerospace Research Institutions

- Aircraft Parts Suppliers

- Investments and Venture Capitalist Firms

- Aerospace Regulators (Federal Aviation Administration – FAA, European Union Aviation Safety Agency – EASA)

- Aerospace Technology Developers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves gathering a comprehensive understanding of the major variables influencing the India Aerospace Industry in Mexico. Desk research and secondary data collection will be conducted using global aerospace databases and industry reports to identify the core market dynamics.

Step 2: Market Analysis and Construction

This phase focuses on compiling historical data, assessing trends in manufacturing, trade, and government initiatives, and examining the demand for specific aerospace products. An in-depth study of service providers and the market value chain will also be conducted.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, industry experts, including key stakeholders from aerospace manufacturing companies, will validate the initial hypotheses. CATI (Computer-Assisted Telephone Interviews) will be conducted with senior executives, engineers, and aerospace policymakers to gain deeper insights into emerging trends.

Step 4: Research Synthesis and Final Output

The final step integrates data from experts and companies to validate market sizing and projections. This phase will also involve consultations with key players to verify the accuracy and comprehensiveness of the findings.

- Executive Summary

- Research Methodology(Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increase in aerospace collaborations between India and Mexico

Government initiatives and funding for aerospace growth

Expansion of space exploration and satellite manufacturing - Market Challenges

Limited local aerospace manufacturing capacity

Dependence on foreign technology and expertise

Regulatory hurdles in cross-border aerospace trade

- Trends

Increased automation and AI integration in aerospace systems

Shifting focus to sustainable aerospace solutions

Technological advancements in drone and UAV applications - Market Opportunities

Establishment of joint ventures between Indian and Mexican aerospace companies

Growing demand for unmanned aerial systems

Investment opportunities in space technology and satellite communication

- Government Regulation

National and International Defense and Security Regulations

Export and Import Restrictions for Airborne Systems - SWOT Analysis

- Porter’s Five Forces

- By Market Value 2020-2025

- By Installed Units 2020-2025

- By Average System Price 2020-2025

- By System Complexity Tier 2020-2025

- By System Type (In Value%)

Commercial Aircraft

Military Aircraft

Spacecraft

Rotorcraft

Unmanned Aerial Vehicles - By Platform Type (In Value%)

Fixed Wing

Rotary Wing

Space Launch Platforms

Unmanned Platforms

Hybrid Platforms - By Fitment Type (In Value%)

Original Equipment Manufacturer

Aftermarket Parts

Customization Services

Upgrade Kits

System Integration Services

- By EndUser Segment (In Value%)

Commercial Airlines

Military Organizations

Government Agencies

Private Aerospace Companies

Research and Development Institutions - By Procurement Channel (In Value%)

Direct Purchase

Government Contracts

Third-Party Suppliers

OEM Partnerships

Online Platforms

- Market Share Analysis

- CrossComparison Parameters(Market Growth Rate, Technological Advancements, Regulatory Support, Investment Activity, Market Fragmentation)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Boeing

Airbus

Textron

Lockheed Martin

Honeywell

General Electric

Sikorsky

Bell Helicopter

Raytheon

Northrop Grumman

Hindustan Aeronautics

ISRO

L3 Technologies

Dassault Aviation

Saab Group

- Commercial airlines seeking cost-effective aircraft

- Military agencies focusing on modernizing fleets

- Private aerospace startups investing in advanced aerospace technology

- Research institutions pursuing aerospace innovation for space exploration

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035