Market Overview

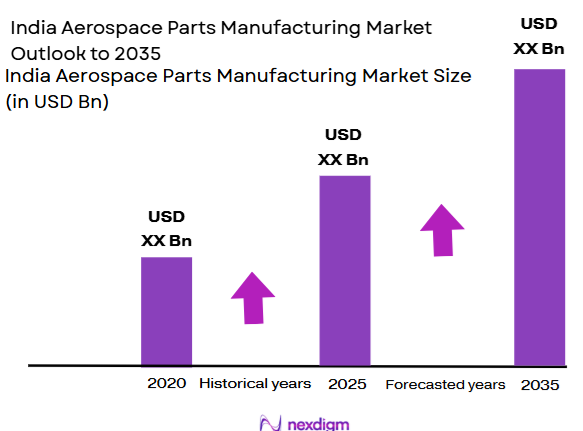

The Indian Aerospace Parts Manufacturing market is valued at USD ~ billion, based on a comprehensive analysis of historical trends. The market is driven by the rising demand for both military and civilian aircraft parts, bolstered by government initiatives to strengthen the defense sector. The country’s growing aviation industry, increasing aircraft fleet, and robust defense programs are pivotal in shaping this market. Furthermore, advancements in technologies such as additive manufacturing and the government’s push for “Make in India” have encouraged foreign investment and domestic manufacturing, contributing to the market’s growth trajectory.

The Indian Aerospace Parts Manufacturing market is predominantly driven by key regions like Bengaluru, Hyderabad, and Pune. Bengaluru, often referred to as the “Aerospace Hub” of India, hosts numerous aerospace and defense companies such as HAL and Boeing. Pune and Hyderabad also emerge as critical contributors, with growing manufacturing facilities and R&D centers for aerospace parts. The dominance of these cities is attributed to their strategic location, availability of skilled labor, and strong infrastructure, supported by a conducive business environment for aerospace firms. Additionally, these cities have become focal points for aerospace research, development, and training.

Market Segmentation

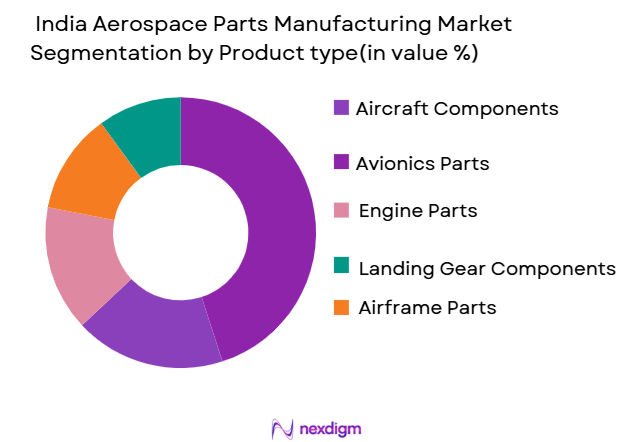

By Product Type:

The India Aerospace Parts Manufacturing market is segmented by product type into aircraft components, avionics parts, engine parts, landing gear components, and airframe parts. The aircraft components segment holds a dominant market share due to the consistently high demand for structural and non-structural parts used in both commercial and military aircraft manufacturing. This segment’s dominance is driven by the extensive supply chain infrastructure and the long-standing presence of key players like Hindustan Aeronautics Limited (HAL) and Boeing India. These companies have well-established relationships with both domestic and international airlines, contributing to sustained demand for aircraft components across various sectors.

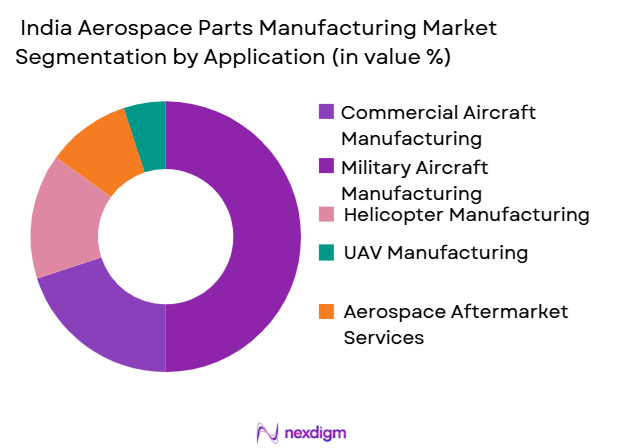

By Application:

The market is segmented by application into commercial aircraft manufacturing, military aircraft manufacturing, helicopter manufacturing, UAV manufacturing, and aerospace aftermarket services. The commercial aircraft manufacturing segment leads the market share, driven by the rapid expansion of the aviation industry in India. With increasing air traffic, both domestic and international, the need for new commercial aircraft and their parts has surged. Major airlines in India, such as Indigo and Air India, are expanding their fleets, creating a high demand for aircraft parts. Additionally, government initiatives promoting air travel connectivity, like UDAN (Ude Desh ka Aam Naagrik), further fuel the growth in this segment.

Competitive Landscape

The Indian Aerospace Parts Manufacturing market is characterized by a competitive landscape dominated by both global players and key domestic manufacturers. Major companies such as Hindustan Aeronautics Limited (HAL), Tata Advanced Systems, and Godrej Aerospace are prominent in the sector. These companies benefit from a strong foothold in both the defense and commercial aerospace segments. Furthermore, foreign companies like Boeing and Airbus are establishing their manufacturing bases in India, strengthening the market dynamics. The presence of these key players, along with government support, ensures continued innovation, production scale-up, and market share consolidation.

| Company | Establishment Year | Headquarters | Key Market Parameter 1 | Key Market Parameter 2 | Key Market Parameter 3 | Key Market Parameter 4 | Key Market Parameter 5 | Key Market Parameter 6 |

| Hindustan Aeronautics Limited | 1940 | Bengaluru, India | Product Portfolio | ~ | ~ | ~ | ~ | ~ |

| Tata Advanced Systems | 2007 | Hyderabad, India | ~ | ~ | ~ | ~ | ~ | ~ |

| Godrej Aerospace | 1958 | Mumbai, India | ~ | ~ | ~ | ~ | ~ | ~ |

| Boeing India | 1996 | Bengaluru, India | ~ | ~ | ~ | ~ | ~ | ~ |

| Airbus India | 2008 | New Delhi, India | ~ | ~ | ~ | ~ | ~ | ~ |

India Aerospace Parts Manufacturing Market Analysis

Growth Drivers

Urbanization

Urbanization is a key driver for the growth of the aerospace parts manufacturing market. As per World Bank data, India’s urban population has been growing steadily, reaching approximately ~% of the total population in 2024, up from ~% in 2010. This growing urbanization leads to increased demand for transportation and aviation services, thus driving the demand for aircraft parts. With cities like Bengaluru and Hyderabad seeing increased investment in aerospace manufacturing and related infrastructure, urbanization has contributed to a rise in demand for air travel, necessitating more commercial and defense aircraft, and, in turn, aerospace parts. The concentration of industries in urban areas has also attracted investments in the sector, further propelling growth.

Restraints

High Initial Costs

The high initial costs associated with manufacturing aerospace parts are a significant restraint for the market. Manufacturing precision parts such as avionics, landing gear, and engine components require significant investments in high-tech equipment and specialized facilities. In India, where most aerospace parts manufacturers rely on imports for advanced machinery, the capital expenditure (CapEx) for setting up production units is substantial. The cost of R&D for new materials and technologies in aerospace manufacturing adds further strain. Although government subsidies and incentives are available, these remain limited, making it difficult for smaller players to enter the market.

Technical Challenges

The aerospace industry faces numerous technical challenges, particularly in manufacturing complex and high-precision parts. India’s aerospace manufacturers often struggle with adopting cutting-edge technologies like additive manufacturing and precision casting due to lack of specialized skill sets. The country still lags behind in advanced manufacturing capabilities when compared to global leaders like the United States and European countries. In 2024, India’s aerospace sector continues to address these challenges with various foreign collaborations and technical partnerships, but the skills gap in the workforce remains a barrier to scaling up production.

Opportunities

Technological Advancements

Technological advancements are a significant opportunity for the Indian aerospace parts manufacturing market. Innovations in additive manufacturing, such as 3D printing of titanium and aluminum alloys, are revolutionizing the production of aerospace components. The adoption of Industry 4.0 technologies, including automation and artificial intelligence, is enhancing efficiency and precision in production. In 2024, the Indian aerospace industry is leveraging these technological advancements to boost the production of lighter, more fuel-efficient aircraft components. These technological innovations are expected to reduce manufacturing costs and improve overall production quality, driving market growth.

International Collaborations

International collaborations between Indian aerospace manufacturers and global industry leaders offer significant growth opportunities. In recent years, several partnerships have been formed between Indian aerospace firms and global giants like Boeing, Airbus, and Rolls-Royce. These collaborations provide access to advanced technologies and best practices, boosting the quality of Indian-made aerospace parts. Additionally, these partnerships enable Indian manufacturers to tap into global supply chains, helping them expand their market reach. With government policies encouraging foreign direct investment (FDI) and the easing of regulations, the Indian aerospace market is well-positioned to benefit from these collaborations.

Future Outlook

Over the next decade, the India Aerospace Parts Manufacturing market is poised for substantial growth, driven by the government’s commitment to defense and aviation sector expansion. Continuous advancements in aerospace technologies such as additive manufacturing, coupled with a growing demand for both military and commercial aircraft, will fuel the market’s growth. Additionally, India’s push for self-reliance in aerospace manufacturing, under the “Make in India” initiative, along with increasing foreign investment, positions the country as a key player in the global aerospace supply chain. The evolution of emerging technologies like electric aviation and UAVs will further drive market dynamics and attract investments.

Major Players in the India Aerospace Parts Manufacturing Market

- Hindustan Aeronautics Limited

- Tata Advanced Systems

- Godrej Aerospace

- Boeing India

- Airbus India

- Mahindra Aerospace

- Lockheed Martin India

- Rolls-Royce India

- Safran India

- Raytheon Technologies India

- UTC Aerospace Systems India

- L&T Aerospace

- Nexter Systems

- Dassault Aviation India

- Bell Helicopter India

Key Target Audience

- Aerospace Manufacturers and Suppliers

- Airlines and Aviation Operators

- Military and Defense Agencies

- Aerospace Component Distributors and Dealers

- Government and Regulatory Bodies

- Aviation Infrastructure Developers

- Investors and Venture Capitalist Firms

- Technology Providers and Aerospace R&D Institutions

Research Methodology

Step 1: Identification of Key Variables

This step focuses on identifying the critical variables that influence the Indian Aerospace Parts Manufacturing market. This is achieved by reviewing secondary data sources such as industry reports, government publications, and financial disclosures. A clear mapping of stakeholders, from manufacturers to distributors, is developed to set the groundwork for deeper analysis.

Step 2: Market Analysis and Construction

In this phase, we analyze historical market data to understand growth trends, technological advancements, and economic factors that impact the industry. Data is gathered from trusted industry sources, including reports from the Ministry of Civil Aviation and private aerospace companies, and is used to estimate the market size for 2024.

Step 3: Hypothesis Validation and Expert Consultation

Our hypotheses on market dynamics, growth drivers, and challenges are validated by consulting industry experts. These consultations are conducted through interviews with key personnel in aerospace companies, defense agencies, and academic experts specializing in aerospace technologies. Insights from these experts help refine assumptions and ensure the reliability of the data.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all collected data and expert inputs to construct a comprehensive market report. This includes validating statistical data through direct interactions with major aerospace parts manufacturers and suppliers, ensuring that the findings align with the reality of market conditions and customer needs.

- Executive Summary

- Research Methodology(Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Genesis and Historical Development

- Key Milestones in Market Evolution

- Business Cycle and Market Dynamics

- Supply Chain and Value Chain Analysis

- Growth Drivers

Increasing Demand for Aircraft

Government Initiatives for Domestic Manufacturing

Rising Military Aircraft Demand

- Market Challenges

Raw Material Sourcing and Pricing Volatility

Regulatory and Compliance Barriers

Technological Advancements and Adoption

- Opportunities

Growth in UAV and Drones Market

Expansion of Aerospace Aftermarket Services

Rise in Civil Aviation Demand

- Market Trends

Adoption of Sustainable Manufacturing Practices

Shift Towards Lightweight and Composite Materials

- Government Regulations

Aerospace Standards and Certifications

Import Tariffs and Export Regulations

Government Funding and Incentives for Local Manufacturers

- SWOT Analysis

- Porter’s Five Forces

- By Value, Market Size (2020 2025)

- By Volume, Market Size (2020-2025)

- By Average Price, Market Size (2020-2025)

- By Product Type (In Value and Volume %)

Aircraft Components

Avionics Parts

Engine Parts

Landing Gear Components

Airframe Parts - By Application (In Value and Volume %)

Commercial Aircraft Manufacturing

Military Aircraft Manufacturing

Helicopter Manufacturing

UAV Manufacturing

Aerospace Aftermarket Services - By Distribution Channel (In Value %)

Direct Sales to Aircraft Manufacturers

Sales through Distributors

Online Sales and E-Commerce - By End-Use Industry (In Value %)

Civil Aviation

Military Aviation

Aerospace Defense - By Region (In Value %)

North India

West India

South India

East India - By Technology (In Value and Volume %)

Additive Manufacturing

CNC Machining

Casting and Forging

Composite Manufacturing

Welding and Fabrication

- Market Share Analysis

- Cross Comparison Parameters(Company Overview, Business Strategies, Recent Developments, Financial Performance and Revenue Breakdown, Market Share by Region and Technology, Strengths, Weaknesses, Opportunities, and Threats, Distribution Channels and Dealer Network, Production Capacity and Manufacturing Capabilities)

- SWOT Analysis of Major Competitors

- Major Players

Boeing India

HAL

Tata Advanced Systems

Bharat Electronics Limited

Samtel Avionics

L&T Aerospace

Mahindra Aerospace

Godrej Aerospace

Nexter Systems

Airbus India

Safran India

Rolls-Royce India

Lockheed Martin India

United Technologies Aerospace Systems

GE Aviation India

- Market Demand and Utilization Trends

- Industry-Specific Budget Allocations and Purchasing Power

- Regulatory and Compliance Requirements for End-Users

- Procurement Process and Decision Making

- Impact of Government Regulations on End-Users

- By Market Value,2025-2030

- By Adoption Rate,2025-2030

- By Use‑Case Growth Curves,2025-2030