Market Overview

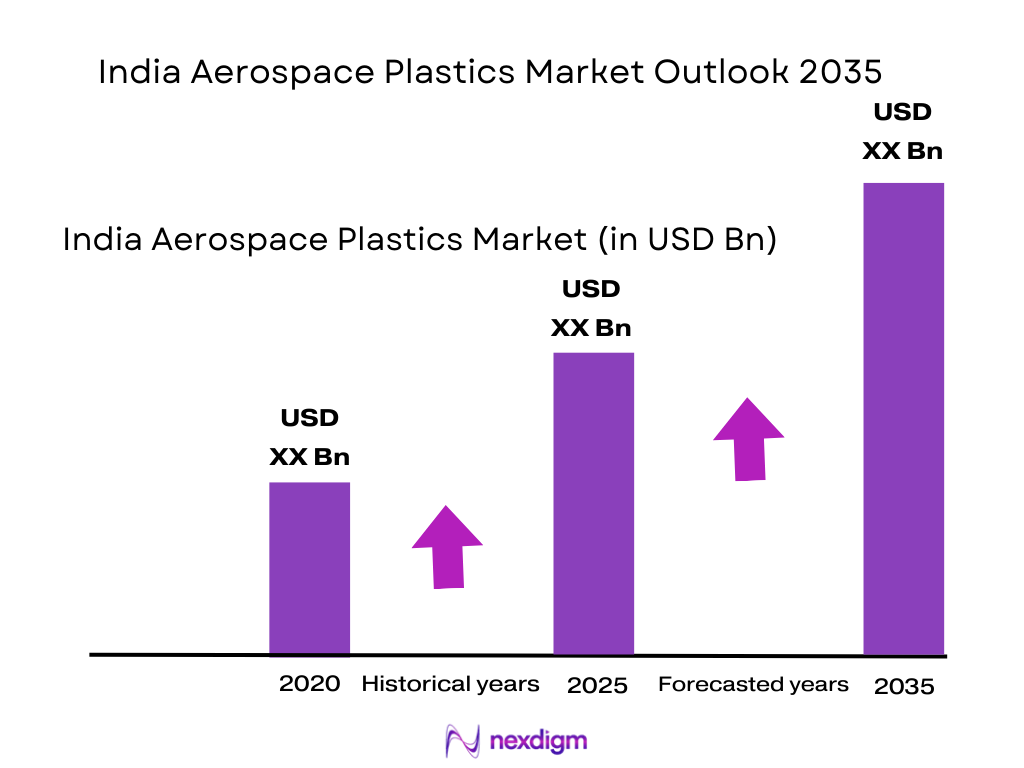

The India aerospace plastics market is anchored to the broader global aerospace plastics industry, which recorded a value of ~ based on a recent historical assessment, driven by rising aircraft production, increasing replacement of metal components with lightweight polymers, and sustained demand from both commercial and defense aviation sectors. Within this global context, India generated an aerospace plastics market value of ~, supported by growing aircraft assembly activities, expanding maintenance, repair and overhaul facilities, and increasing use of high-performance polymers such as PEEK, PEI, and PPS in interiors, electrical systems, and structural components to enhance fuel efficiency and lifecycle performance.

India’s aerospace plastics demand is concentrated in established aerospace manufacturing and MRO hubs such as Bengaluru, Hyderabad, Pune, Chennai, and Nagpur, which benefit from proximity to aircraft OEMs, Tier-1 suppliers, and defense research organizations. These cities dominate due to strong industrial ecosystems, skilled labor availability, and government-backed aerospace parks that attract domestic and foreign investment. International collaborations, licensed manufacturing of aircraft, and localized defense production programs further reinforce India’s position as a growing consumption and processing base for aerospace-grade plastics.

Market Segmentation

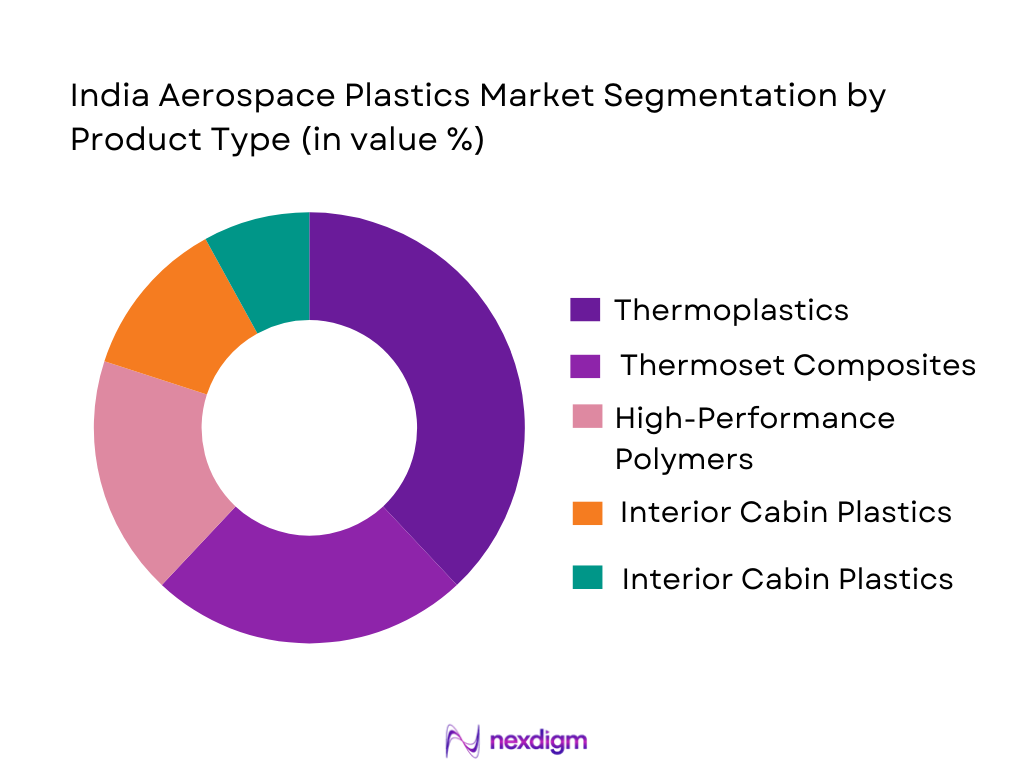

By Product Type

India aerospace plastics market is segmented by product type into thermoplastics, thermoset composites, high-performance polymers, interior cabin plastics, and reinforced plastic assemblies. Recently, thermoplastics have a dominant market share due to their superior strength-to-weight ratio, recyclability, and growing acceptance in structural and semi-structural aircraft components. Indian OEMs and Tier-1 suppliers increasingly favor thermoplastics such as PEEK and PEKK because they support faster manufacturing cycles, automated processing, and reduced lifecycle costs compared to traditional thermosets. Additionally, thermoplastics meet stringent fire, smoke, and toxicity standards required for aerospace applications while enabling lightweighting objectives crucial for fuel efficiency.

By Platform Type

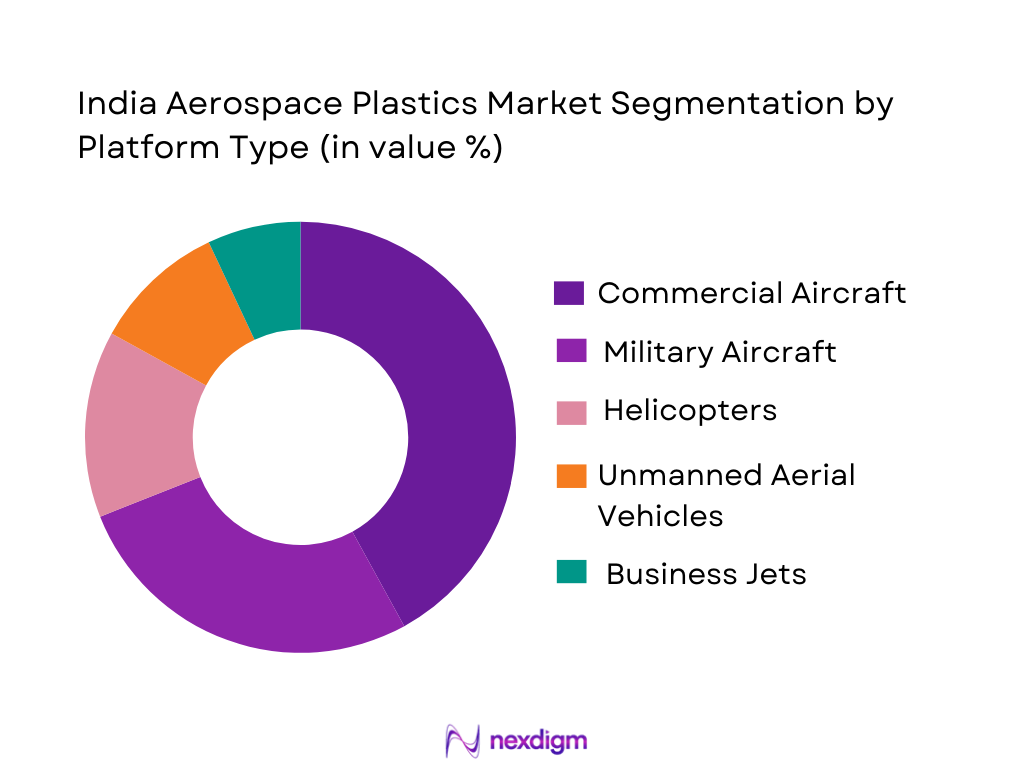

India aerospace plastics market is segmented by platform type into commercial aircraft, military aircraft, helicopters, unmanned aerial vehicles, and business jets. Recently, commercial aircraft platforms dominate market share due to sustained growth in domestic air passenger traffic, fleet expansion by Indian airlines, and increased procurement of narrow-body aircraft requiring lightweight interior and system components. Commercial platforms consume large volumes of aerospace plastics for seating structures, overhead bins, ducting, insulation, and electrical housings, making them a primary demand driver. The expansion of airport infrastructure and the rise of low-cost carriers further accelerate aircraft deliveries and refurbishment cycles, boosting plastic component consumption.

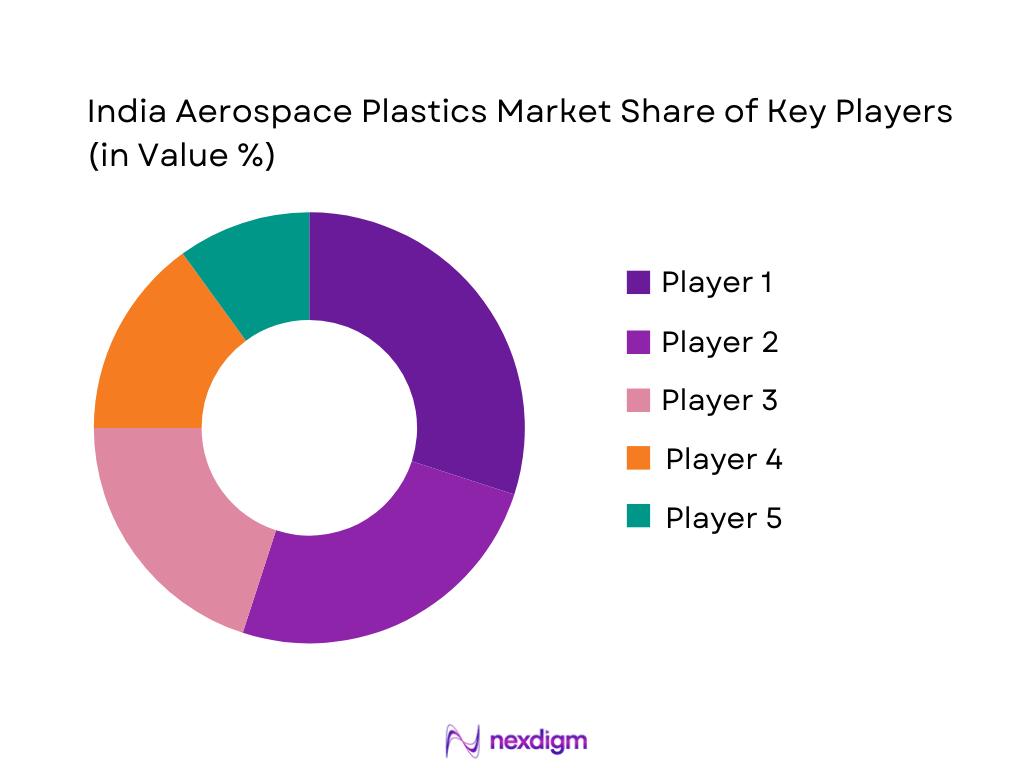

Competitive Landscape

The India aerospace plastics market exhibits moderate consolidation, with a mix of domestic material processors, global polymer manufacturers, and composite specialists supplying aerospace-grade solutions. Major players leverage advanced material science capabilities, long-term supply contracts with OEMs, and compliance with international aviation certification standards to strengthen their market presence.

| Company Name | Establishment Year | Headquarters | Technology Focus | Market Reach | Key Products | Revenue | Aerospace Certification Portfolio |

| Tata Advanced Materials Ltd | 2007 | India | ~ | ~ | ~ | ~ | ~ |

| Solvay Specialty Polymers | 1863 | Belgium | ~ | ~ | ~ | ~ | ~ |

| SABIC Innovative Plastics | 1976 | Saudi Arabia | ~ | ~ | ~ | ~ | ~ |

| BASF India Ltd | 1943 | India | ~ | ~ | ~ | ~ | ~ |

| Hexcel Composites | 1948 | USA | ~ | ~ | ~ | ~ | ~ |

India Aerospace Plastics Market Analysis

Growth Drivers

Rising Aircraft Manufacturing and Assembly in India

This is a primary growth driver for the aerospace plastics market as domestic production capabilities continue to expand under national aviation and defense programs. Increasing localization of aircraft components encourages OEMs and suppliers to source lightweight plastic materials domestically, improving cost efficiency and supply security. Aerospace plastics are increasingly specified for structural brackets, interior fittings, and electrical components to meet fuel efficiency and performance targets. Government-backed aerospace parks and production-linked incentive schemes attract investments into polymer processing and composite manufacturing. These initiatives reduce dependence on imported components while accelerating adoption of certified aerospace plastics. Expanding final assembly lines and licensed production of aircraft platforms create consistent demand volumes. Growth in aircraft refurbishment cycles further amplifies material consumption.

Expansion of Maintenance, Repair, and Overhaul Infrastructure

Expansion of maintenance, repair, and overhaul infrastructure significantly drives demand for aerospace plastics as India positions itself as a regional MRO hub. MRO facilities consume plastics for replacement of worn interior components, ducting, insulation, and system housings. Compared to metal parts, plastic components reduce downtime and maintenance costs, making them preferred in routine servicing operations. Growth in domestic airline fleets increases aircraft utilization rates, accelerating replacement cycles for plastic parts. International airlines outsourcing MRO services to India further elevate material demand. Availability of skilled technicians and competitive operating costs strengthen India’s MRO attractiveness. Regulatory acceptance of locally sourced certified materials also supports usage.

Market Challenges

Stringent Certification and Qualification Requirements

Stringent certification and qualification requirements pose a significant challenge for the India aerospace plastics market due to the complex and time-intensive approval processes involved. Aerospace plastics must comply with rigorous fire, smoke, toxicity, and mechanical performance standards set by global aviation authorities. Achieving these certifications requires extensive testing, documentation, and audits, increasing development timelines and costs. Smaller domestic manufacturers often face resource constraints in meeting international compliance benchmarks. Delays in certification can limit supplier participation in OEM programs. Continuous updates to regulatory standards further complicate long-term planning. High compliance costs discourage rapid material innovation. As a result, certification barriers restrict market entry and slow adoption of new plastic formulations.

Dependence on Imported Raw Materials

Dependence on imported raw materials remains a structural challenge for the India aerospace plastics market, affecting cost stability and supply continuity. Many high-performance polymers used in aerospace applications are sourced from global suppliers. Currency fluctuations and international trade policies impact procurement costs. Supply chain disruptions can delay manufacturing schedules for aerospace components. Limited domestic production capacity for specialty polymers constrains localization efforts. Import dependency also affects lead times for MRO and OEM programs. Efforts to develop indigenous material capabilities are ongoing but require long-term investment. Until local production scales up, reliance on imports will continue to challenge market resilience.

Opportunities

Indigenization of Aerospace Materials and Components

Indigenization of aerospace materials and components presents a major opportunity for the India aerospace plastics market as national policies emphasize self-reliance. Domestic development of certified plastic materials reduces import dependence and enhances supply security. Collaboration between research institutions, OEMs, and polymer manufacturers accelerates material innovation. Local sourcing improves cost competitiveness for aircraft programs. Government incentives encourage investment in polymer processing and testing infrastructure. Successful indigenization supports export opportunities for Indian suppliers. Increased confidence in domestic materials strengthens OEM adoption. Over time, localized production can position India as a regional supplier of aerospace plastics.

Growth of Unmanned Aerial Vehicle and Space Programs

Growth of unmanned aerial vehicle and space programs offers significant opportunities for aerospace plastics manufacturers due to high material intensity and design flexibility requirements. UAV platforms extensively use lightweight plastics to enhance endurance and payload efficiency. Space applications demand advanced polymers with thermal and radiation resistance. India’s expanding space missions and private sector participation increase demand for specialized plastic components. These programs allow faster qualification cycles compared to commercial aviation. Innovation in additive manufacturing with aerospace polymers further supports opportunity creation. As UAV and space activities scale, demand for high-performance plastics will rise steadily. This segment enables diversification beyond traditional aircraft markets.

Future Outlook

The India aerospace plastics market is expected to witness steady growth over the next five years, supported by expanding aircraft fleets, rising MRO activities, and increased localization of aerospace manufacturing. Advancements in high-performance polymers and thermoplastic composites will drive material substitution across aircraft platforms. Regulatory support for domestic production and defense indigenization will further stimulate demand. Growing participation of private players and international collaborations is likely to enhance technology transfer and market maturity.

Major Players

- Tata Advanced Materials Limited

- Hindustan Aeronautics Limited Composites Division

- Kemrock Industries and Exports Limited

- Solvay Specialty Polymers India

- SABIC Innovative Plastics India

- BASF India Limited

- Victrex India

- Ensinger India Engineering Plastics

- Röchling Industrial India

- Toray Advanced Composites India

- Hexcel Composites India

- Mitsubishi Chemical India

- DuPont India

- Evonik India

- TPI Composites India

Key Target Audience

- Aircraft OEMs

- Aerospace component manufacturers

- Maintenance, Repair and Overhaul providers

- Defense procurement agencies

- Civil aviation authorities

- Investments and venture capitalist firms

- Government and regulatory bodies

- Aerospace material distributors

Research Methodology

Step 1: Identification of Key Variables

Key variables such as material types, application areas, platform demand, and procurement channels were identified through industry databases and regulatory publications. Emphasis was placed on certified aerospace plastic materials and India-specific aviation activity. Macroeconomic and industrial indicators were also reviewed.

Step 2: Market Analysis and Construction

Market size construction involved analysis of global aerospace plastics data and derivation of India-specific demand using aircraft production, MRO activity, and material consumption benchmarks. Cross-validation was conducted using multiple secondary sources.

Step 3: Hypothesis Validation and Expert Consultation

Assumptions and preliminary findings were validated through consultations with industry experts, suppliers, and aerospace engineers. Feedback was used to refine segmentation and demand drivers.

Step 4: Research Synthesis and Final Output

All validated data points were synthesized into a structured market model. Insights were reviewed for consistency, accuracy, and relevance before final presentation.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Rising aircraft manufacturing and assembly activities in India

Increasing demand for lightweight and fuel-efficient aircraft materials

Expansion of domestic defense aviation programs - Market Challenges

High certification and compliance costs for aerospace-grade plastics

Dependence on imported high-performance polymer raw materials

Limited local manufacturing scale for advanced composites - Market Opportunities

Growing indigenization initiatives under national aerospace programs

Increasing adoption of thermoplastics in next-generation aircraft

Expansion of MRO facilities driving aftermarket demand - Trends

Shift toward recyclable and sustainable aerospace plastics

Increased use of additive manufacturing with aerospace polymers - Government Regulations

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units, 2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Thermoplastics for structural components

Thermoset composites

High-performance polymer resins

Interior cabin plastic systems - By Platform Type (In Value%)

Commercial fixed-wing aircraft

Military aircraft

Rotary-wing helicopters

Unmanned aerial vehicles

Regional and business jets - By Fitment Type (In Value%)

Line-fit installations

Retrofit and replacement fitment

OEM-supplied assemblies - By End User Segment (In Value%)

Aircraft OEMs

Defense aviation agencies

Commercial airlines - By Procurement Channel (In Value%)

Direct OEM contracts

Tier-1 supplier sourcing

Government defense procurement

Long-term supply agreements

- Market Share Analysis

- Cross Comparison Parameters (Material performance rating, Certification compliance level, Cost competitiveness, Local manufacturing capability, Supply chain integration)

- SWOT Analysis of Key Competitors

- Pricing & Procurement Analysis

- Key Players

Tata Advanced Materials Limited

Hindustan Aeronautics Limited Composites Division

Kemrock Industries and Exports Limited

Solvay Specialty Polymers India

SABIC Innovative Plastics India

BASF India Limited

Victrex India

Ensinger India Engineering Plastics

Röchling Industrial India

Toray Advanced Composites India

Hexcel Composites India

Mitsubishi Chemical India

DuPont India

Evonik India

TPI Composites India

- Material demand patterns across commercial aviation operators

- Procurement behavior of defense aerospace agencies

- OEM preferences for certified plastic suppliers

- Role of MRO providers in aftermarket plastics consumption

- Forecast Market Value, 2026-2035

- Forecast Installed Units, 2026-2035

- Price Forecast by System Tier, 2026-2035

- Future Demand by Platform, 2026-2035