Market Overview

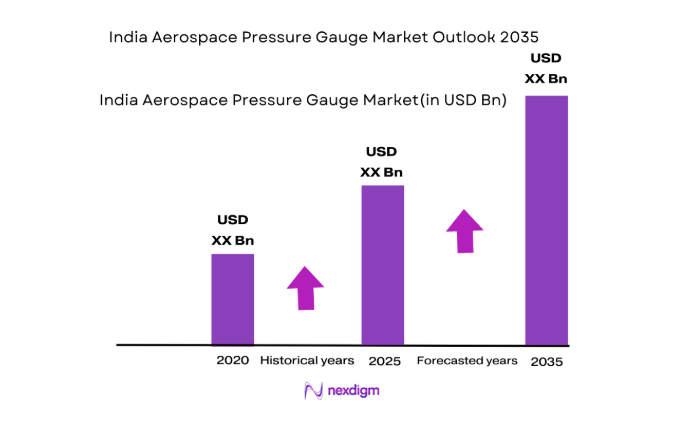

The India aerospace pressure gauge market is valued at USD ~. This market is driven by the growing demand for high-precision instruments in the aerospace and defense sectors, particularly due to the increasing aerospace manufacturing activities in the country. Furthermore, the rise in space exploration programs by the Indian government, such as those led by ISRO, significantly contributes to market growth. These factors, coupled with advancements in sensor technology and growing defense budgets, are fostering the market’s expansion.

India’s aerospace pressure gauge market is primarily driven by aerospace hubs in cities such as Bengaluru, Hyderabad, and New Delhi. Bengaluru, known as the “Silicon Valley of India,” is home to numerous aerospace and defense companies like HAL (Hindustan Aeronautics Limited) and ISRO. Hyderabad is another significant hub, housing major players like Defence Research and Development Organisation (DRDO) and Bharat Dynamics. The dominance of these cities stems from their strong infrastructure, availability of skilled workforce, and proximity to key aerospace manufacturers and research facilities.

Market Segmentation

By Product Type

India’s aerospace pressure gauge market is segmented by product type into mechanical, digital, differential, and absolute pressure gauges. Mechanical pressure gauges hold the dominant market share in India due to their longstanding presence and wide usage across various aerospace applications. These gauges offer high durability and reliability in critical environments, making them the preferred choice for commercial and military aircraft. They have become standard in the industry due to their robustness and low maintenance costs, which are vital in the aviation sector.

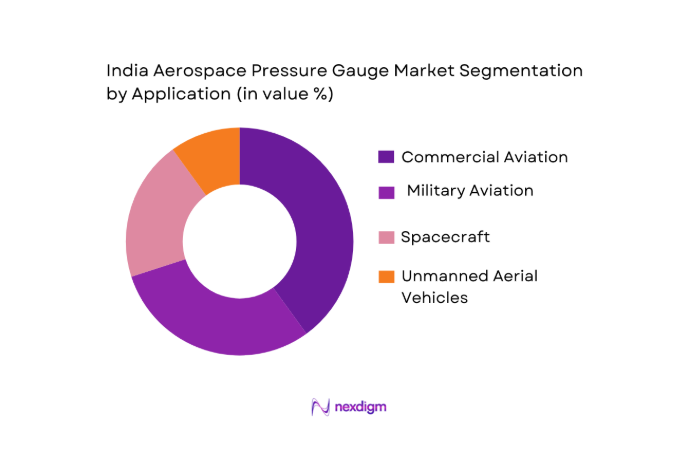

By Application

The market is also segmented by application, including commercial aviation, military aviation, spacecraft, and unmanned aerial vehicles (UAVs). Commercial aviation dominates this segment due to the massive growth of the airline industry in India. As the number of flights continues to rise, airlines prioritize precision instruments like aerospace pressure gauges for maintaining the safety and reliability of aircraft systems. The increased demand for passenger and cargo aircraft has resulted in a substantial need for pressure gauges in both aircraft maintenance and new aircraft production.

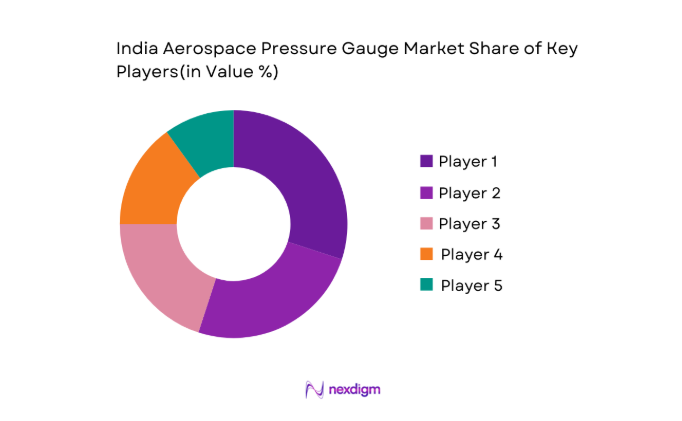

Competitive Landscape

The India aerospace pressure gauge market is highly competitive, dominated by both local and international players. Major companies like Honeywell Aerospace, Parker Hannifin, and Safran Pressure Systems hold substantial market shares. These players benefit from strong relationships with OEMs (Original Equipment Manufacturers) and a long history of manufacturing precision instruments for aerospace applications. Their advanced technologies, robust product portfolios, and large-scale manufacturing capabilities enable them to maintain a competitive edge.

| Company Name | Establishment Year | Headquarters | Key Market Parameters | Revenue (2023) | Production Capacity | Product Portfolio | Distribution Channels |

| Honeywell Aerospace | 1906 | United States | ~ | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1917 | United States | ~ | ~ | ~ | ~ | ~ |

| Safran Pressure Systems | 2005 | France | ~ | ~ | ~ | ~ | ~ |

| Ashcroft Inc. | 1852 | United States | ~ | ~ | ~ | ~ | ~ |

| Omega Engineering | 1962 | United States | ~ | ~ | ~ | ~ | ~ |

India Aerospace Pressure Gauge Market End-User Analysis

Growth Drivers

Increasing Demand for Accurate Pressure Measurement Systems

The demand for accurate pressure measurement systems in the aerospace sector is being driven by a rise in the adoption of sophisticated technologies to ensure safety and operational efficiency. As of 2024, the global aerospace industry continues to invest heavily in technology upgrades, with over USD 8 billion allocated annually for enhancing aviation safety and performance systems, including pressure gauges. Additionally, the Indian government’s push to modernize the aviation industry through the UDAN (Ude Desh ka Aam Naagrik) scheme has increased the need for high-quality pressure measurement solutions in regional aircraft. This program aims to increase domestic air traffic by ~ by 2026, further driving demand for precision instruments. According to the Ministry of Civil Aviation, India’s domestic passenger traffic grew by ~ in 2024, contributing to the heightened requirement for these systems in commercial and military aviation.

Expansion of the Aerospace and Defense Sector in India

The aerospace and defense sector in India is undergoing rapid expansion, supported by increased government defense spending and strategic partnerships. In 2025, India’s defense budget was increased to INR ~, a significant rise from previous years, reflecting the country’s focus on bolstering defense capabilities, including indigenous aircraft and spacecraft production. Additionally, the Indian government’s “Make in India” initiative has incentivized domestic manufacturers to upgrade their capabilities, encouraging the establishment of more aerospace manufacturing plants. According to the Indian Ministry of Defense, India’s defense sector imports have been decreasing as local production of aerospace components like pressure gauges is steadily rising. This creates a need for precise and reliable pressure measurement systems that align with defense and aerospace manufacturing standards.

Market Challenges

High Production Costs and Maintenance

The production of aerospace pressure gauges in India remains expensive due to the high costs associated with raw materials and complex manufacturing processes. According to the World Bank’s 2025 data, India’s manufacturing sector is experiencing an inflationary increase in input costs, including steel and precision-grade components necessary for the production of aerospace instruments. With high labor costs in the skilled manufacturing sector, companies in India face challenges in maintaining cost-effective production lines. These factors have resulted in an average increase of ~ in production costs for aerospace components, including pressure gauges, as manufacturers are forced to adopt newer, more expensive technologies to meet international standards.

Stringent Regulatory and Compliance Requirements

The Indian aerospace industry faces stringent regulatory and compliance requirements, which significantly impact the market for aerospace pressure gauges. The Directorate General of Civil Aviation (DGCA) mandates rigorous certification processes for all aerospace components, including pressure measurement systems. For example, DGCA’s certification process requires compliance with global standards, such as those set by the International Civil Aviation Organization (ICAO) and the Federal Aviation Administration (FAA). The detailed and often lengthy certification processes can delay the production timelines and increase costs. Moreover, as of 2025, the implementation of stricter environmental and safety standards across both domestic and international flights has added further pressure on manufacturers to ensure that pressure gauges meet high performance and safety standards.

Market Opportunities

Increased Investment in Indian Aerospace Industry

The Indian aerospace industry is attracting significant investment, which presents opportunities for the expansion of pressure gauge demand. In 2025, the Indian government committed over INR ~ (approximately USD ~) to modernize and expand the defense and aerospace sectors. This includes the establishment of new aerospace manufacturing facilities, such as the Aeronautical Development Agency’s new research centers. Additionally, the Ministry of Defence has partnered with private aerospace companies to boost local manufacturing capabilities, further supporting the demand for advanced aerospace instruments like pressure gauges. The rise in investments has also led to increased procurement of high-precision pressure measurement systems, which are integral to ensuring the safety and efficiency of modern aerospace equipment.

Rising Space Exploration Programs

India’s growing commitment to space exploration offers significant opportunities for aerospace pressure gauges. With the recent launch of the Gaganyaan mission and other planned space exploration initiatives, India is rapidly advancing its space capabilities. As of 2025, ISRO’s budget allocation for space programs has increased to INR ~, with a portion earmarked for high-tech instrumentation such as aerospace pressure gauges. These gauges are essential in ensuring the safety of spacecraft during launch, orbit, and re-entry phases. The Indian government’s focus on self-reliance in space exploration, along with increasing partnerships with private companies, is expected to significantly drive demand for precision aerospace instruments over the next few years.

Future Outlook

The India aerospace pressure gauge market is expected to witness steady growth over the next decade. This growth is driven by the ongoing expansion of India’s aerospace manufacturing sector, supported by both government initiatives and rising demand for military and civilian aircraft. Additionally, technological advancements in sensor technologies, along with India’s continued focus on space exploration through ISRO, will further fuel market development. With rising defense budgets and increased aerospace research and development activities, the market is poised to show substantial growth.

Major Players

- Honeywell Aerospace

- Safran Pressure Systems

- Parker Hannifin

- Ashcroft Inc.

- Omega Engineering

- General Electric Aviation

- KROHNE India

- Endress+Hauser

- Bourdon-Haenni India

- Meggitt PLC

- Vishay Precision Group

- Siemens AG

- Rosemount

- ABB Ltd.

- Micro-Epsilon

Key Target Audience

- Aerospace Manufacturers

- Defense Contractors

- Investments and Venture Capitalist Firms

- Aerospace Research Institutes

- Government and Regulatory Bodies

- Aerospace Component Suppliers

- Airline Operators and Maintenance Organizations

- Aerospace Equipment Distributors

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India aerospace pressure gauge market. This phase will be supported by secondary data collection from credible sources, including industry reports and databases, to identify the critical market variables affecting the sector.

Step 2: Market Analysis and Construction

In this phase, historical data on the aerospace pressure gauge market will be compiled and analyzed. This includes understanding the market penetration of pressure gauges, evaluating existing service providers, and reviewing their market performance across different segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be tested through expert consultations and structured interviews with industry leaders, including manufacturers, suppliers, and technology providers. This will help validate the findings and enhance the overall understanding of market trends and future projections.

Step 4: Research Synthesis and Final Output

The final phase will involve comprehensive data analysis, supplemented by feedback from stakeholders, including product manufacturers and distributors. The synthesis will lead to a detailed market report with validated data and actionable insights into market opportunities and challenges.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Overview

- Timeline of Major Developments

- Growth Drivers

Increasing Demand for Accurate Pressure Measurement Systems

Expansion of the Aerospace and Defense Sector in India

Technological Advancements in Pressure Sensing Technologies - Market Challenges

High Production Costs and Maintenance

Stringent Regulatory and Compliance Requirements

Limited Availability of Skilled Labor - Trends

Growing Adoption of Smart Pressure Gauges

Integration of Sensors with IoT - Opportunities

Increased Investment in Indian Aerospace Industry

Rising Space Exploration Programs

Innovations in Miniaturized Pressure Gauges for UAVs - Government Regulations

Aerospace Standards and Certifications

Import Tariffs and Customs Duties on Aerospace Equipment - SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Product Type (In value %)

Mechanical Pressure Gauges

Digital Pressure Gauges

Differential Pressure Gauges

Absolute Pressure Gauges - By Application (In value %)

Aircraft

Spacecraft

Satellites

UAVs - By End-Use Industry (In value %)

Commercial Aviation

Military Aviation

Space Exploration

Defense Industry - By Distribution Channel (In value %)

Direct Sales

Online Platforms

Third-Party Distributors

- Market Share of Major Players

- Cross Comparison Parameters (Company Overview, Business Strategies, Recent Developments, Strengths, Weaknesses, Revenues, Revenue by Product Type, Number of Distributors, Number of Manufacturing Plants, Distribution Channels, Production Capacity, Unique Value Proposition)

- SWOT Analysis of Key Players

Pricing Analysis - Detailed Profiles of Major Companies

Honeywell Aerospace

Safran Pressure Systems

Parker Hannifin

General Electric Aviation

UTC Aerospace Systems

Siemens AG

Bourdon-Haenni India

Omega Engineering

Ashcroft Inc.

Meggitt PLC

KROHNE India

Endress+Hauser

Vishay Precision Group

Rosemount

ABB Ltd.

- Market Demand and Utilization

- Purchasing Power and Budget Allocations

- Regulatory and Compliance Requirements

- Needs and Pain Point Analysis

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035