Market Overview

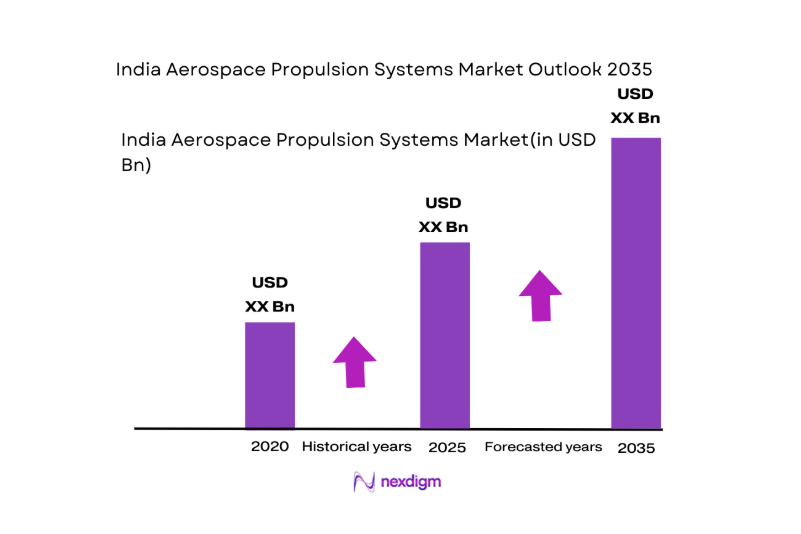

The Indian aerospace propulsion systems market is valued at USD ~, with significant contributions from both commercial and defense segments. The market is driven by the ongoing modernization of the defense forces, rapid advancements in space exploration technology, and an increase in the demand for fuel-efficient commercial aircraft engines. Furthermore, the growing importance of sustainability in the aerospace sector, particularly with the advent of electric propulsion, is expected to boost the market. The propulsion systems market is increasingly influenced by government policies aimed at self-reliance and innovation through initiatives such as “Make in India” and the privatization of the space sector.

India’s aerospace propulsion systems market is primarily driven by cities such as Bengaluru, Hyderabad, and Pune, which host a concentration of aerospace engineering firms and key manufacturers. Bengaluru is home to major aerospace R&D hubs like HAL, ISRO, and private companies like Bharat Forge. The government’s push to develop self-sufficiency in defense and space exploration has led to increased investments in these cities. Hyderabad, a growing aerospace and defense hub, also supports the sector with a growing number of aerospace companies and suppliers. Pune, with its proximity to major defense bases and aerospace development centers, further strengthens India’s position in the global aerospace propulsion market.

Market Segmentation

By Propulsion Type

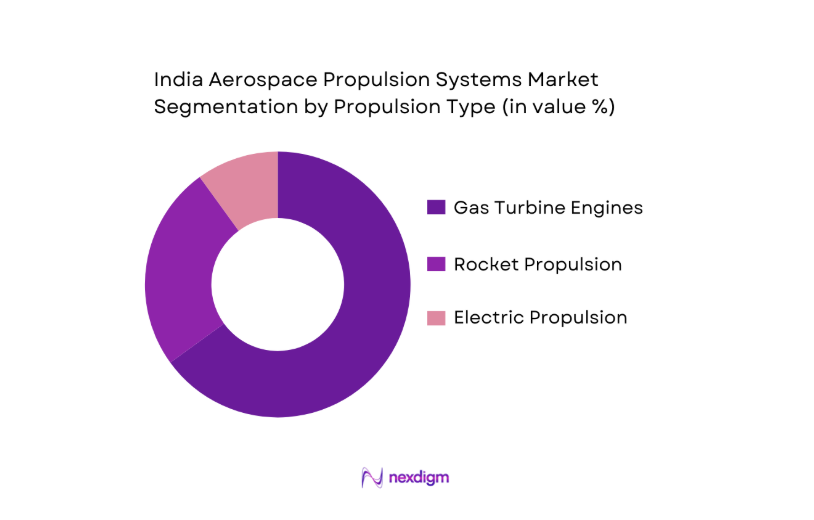

The India aerospace propulsion systems market is segmented by propulsion type into gas turbine engines, rocket propulsion systems, and electric propulsion systems. Gas turbine engines, which include turbojet and turbofan engines, dominate the market due to their application in both commercial and military aircraft. They are highly reliable, well-developed, and in high demand for modern aircraft, contributing significantly to the market’s growth. Rocket propulsion systems also hold a considerable share, primarily driven by ISRO’s growing space exploration missions and India’s expanding satellite launch program. Electric propulsion, although nascent, is gaining attention as part of India’s efforts to promote sustainable and energy-efficient aerospace technologies.

By Platform

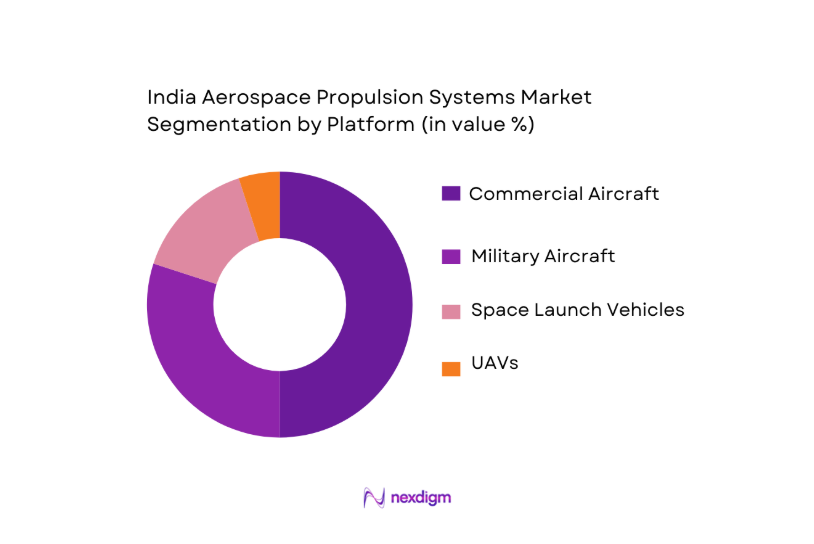

The market is further segmented by platform into commercial aircraft, military aircraft, space launch vehicles, and unmanned aerial vehicles (UAVs). The commercial aircraft segment leads the market share, driven by an increase in air travel and the expansion of domestic airline fleets. The military aircraft segment holds a considerable share due to the modernization of the Indian Air Force, with a focus on the development of indigenous fighter aircraft and unmanned aerial systems. Space launch vehicles and UAVs are also emerging segments due to increased investments in India’s space capabilities and defense modernization.

Competitive Landscape

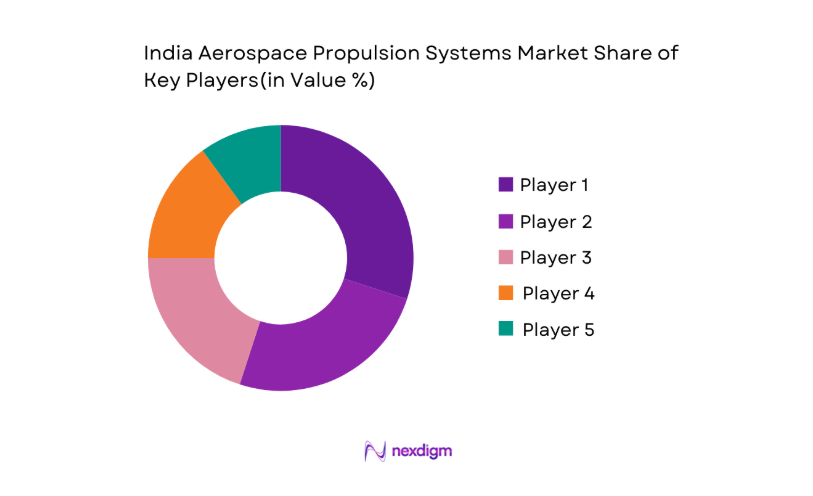

The India aerospace propulsion systems market is dominated by several established players, both local and international. These include Hindustan Aeronautics Limited (HAL), General Electric, Rolls-Royce, and Safran. The market is characterized by high competition between global players and increasing participation from domestic companies due to government support for self-reliance in defense and aerospace technologies. Local players like HAL are bolstering their position by entering joint ventures with international companies, such as the collaboration with Safran for the development of new propulsion technologies.

| Company | Establishment Year | Headquarters | R&D Investment (%) | Market Presence | Product Portfolio | Key Clients |

| Hindustan Aeronautics Ltd | 1940 | Bengaluru, India | ~ | ~ | ~ | ~ |

| General Electric (GE) | 1892 | Boston, USA | ~ | ~ | ~ | ~ |

| Rolls-Royce | 1906 | Derby, UK | ~ | ~ | ~ | ~ |

| Safran | 2005 | Paris, France | ~ | ~ | ~ | ~ |

| Pratt & Whitney | 1925 | East Hartford, USA | ~ | ~ | ~ | ~ |

India Aerospace Propulsion Systems Market Analysis

Growth Drivers

Fleet Expansion

The demand for fleet expansion in India is driven by the continuous growth in air travel and the modernization of the aviation infrastructure. The Indian aviation industry is expected to handle over ~ passengers annually by 2026, a substantial rise from the ~ in 2025. This growth is supported by increased air travel, as India is expected to become the third-largest aviation market in terms of passengers by 2026, according to the International Civil Aviation Organization (ICAO). The expansion of both domestic and international flight routes further supports the fleet expansion, with several airlines already placing large orders for new aircraft in the coming years. The Indian government’s infrastructure development programs, including the construction of new airports and upgrades to existing ones, also contribute to this growth. The government’s aim to increase the number of regional airports from 100 to 150 by 2025 will likely drive fleet expansion to meet the expected rise in passenger demand.

Defense Modernization

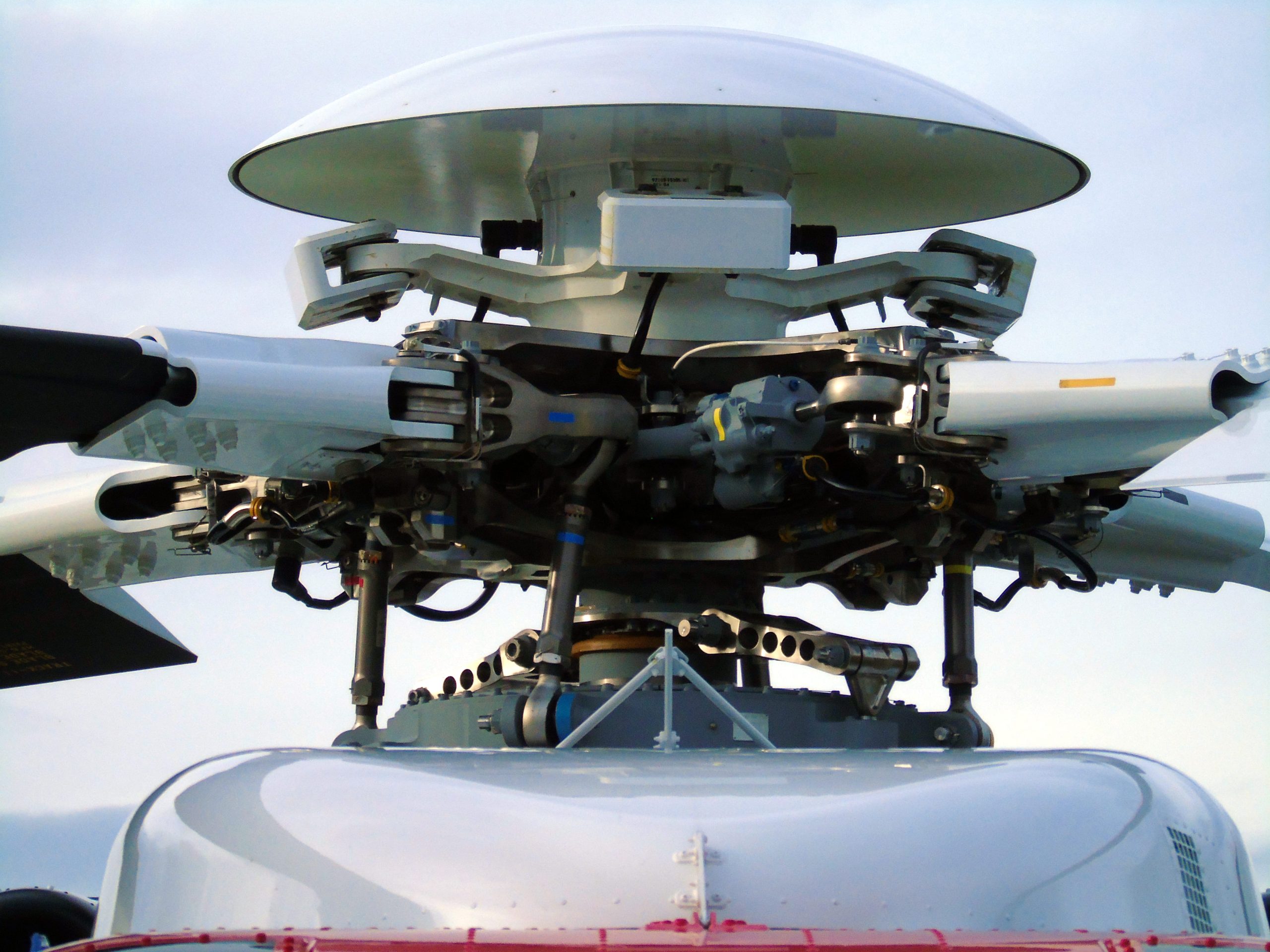

India’s defense modernization initiatives are integral to the growth of the aerospace propulsion systems market. With a defense budget of INR ~ for 2025, India is continuing to increase its focus on enhancing military capabilities. The Indian Air Force is prioritizing the induction of advanced fighter jets, such as the indigenous Light Combat Aircraft (LCA) Tejas, and is further expanding its fleet of transport and surveillance aircraft. Additionally, India’s defense procurement for aerospace systems has seen a significant boost, with orders for advanced missile defense systems and modern fighter jets expected to rise over the next few years. The country’s strategic shift towards strengthening indigenous defense production and reducing dependency on foreign imports also contributes to the growth of propulsion systems. The government’s focus on the Atmanirbhar Bharat (self-reliant India) campaign, which aims to promote indigenous defense manufacturing, further supports this modernization drive.

Market Challenges

Cost of R&D

Research and development (R&D) costs in the Indian aerospace propulsion systems market remain a significant challenge. In 2025, the total government expenditure on aerospace and defense R&D is estimated to be around INR ~, which is approximately ~ of the total defense budget. Despite this, the R&D spending remains insufficient to meet the demand for highly advanced propulsion technologies, especially in the defense and space sectors. This limitation is due to the high cost of developing new propulsion systems, including those that cater to electric and hybrid propulsion technologies, which require substantial investment in both material science and engineering. To stay competitive in the global market, India must further increase its R&D budget and promote greater collaboration between public and private entities. However, the high cost of cutting-edge technologies such as hypersonic propulsion systems continues to pose a financial barrier for domestic players.

Certification Barriers

The certification of new propulsion systems remains a major challenge in India, as the process for aircraft and aerospace propulsion system certification is lengthy and complex. According to the Directorate General of Civil Aviation (DGCA), the approval process for a new engine or propulsion system in India can take anywhere from 2 to 5 years, depending on the type and complexity of the system. This lengthy certification process not only delays the market entry of new technologies but also increases the development costs. The certification requirements for new defense and space propulsion systems also involve extensive testing for performance, durability, and safety, which can be resource-intensive. With the increasing demand for innovative propulsion systems, especially electric propulsion, the current certification process is a bottleneck for faster commercialization and integration of new technologies in the Indian aerospace sector.

Market Opportunities

Electric Propulsion Growth

Electric propulsion is gaining significant traction within India’s aerospace sector as part of a broader push for energy-efficient technologies. The Indian government has allocated over INR ~ for research into sustainable aviation technologies under its National Mission on Electric Mobility. As of 2025, there has been an increasing number of small and large-scale projects dedicated to the development of electric and hybrid-electric propulsion systems for aircraft. For example, companies like the Indian startup Agnikul Cosmos are already developing small satellite launch vehicles that integrate electric propulsion systems for low-cost, efficient launches. The rising global trend toward decarbonizing aviation, especially in the face of the UN’s sustainability goals, further strengthens India’s position in the global electric propulsion market. Despite the nascent stage of the industry, India’s increasing investments in infrastructure and technological research suggest that electric propulsion systems will play a key role in the country’s future aerospace industry.

Localized MRO

India is rapidly becoming a regional hub for maintenance, repair, and overhaul services, providing significant growth opportunities for the aerospace propulsion market. With the growth of both the commercial and military aviation sectors, the demand for MRO services has surged. In 2024, the Indian MRO market is expected to reach a value of INR ~. The Indian government’s focus on improving domestic capabilities has led to increased investments in MRO infrastructure, which includes the establishment of new repair centers, particularly in Bengaluru, Hyderabad, and Pune. The country’s large domestic fleet, along with its growing role as an aviation center for international airlines, positions India as a prime location for high-quality, cost-effective MRO services. As a result, this growing segment presents a major opportunity for the aerospace propulsion market, particularly in turbine engine maintenance and overhaul services.

Future Outlook

Over the next decade, the Indian aerospace propulsion systems market is poised for substantial growth, driven by continuous government support for the defense and space sectors. Technological advancements in propulsion, particularly the development of hybrid and electric engines, along with India’s increasing participation in global aerospace supply chains, will further fuel market expansion. The government’s “Make in India” initiative will be pivotal in increasing domestic production capabilities, reducing reliance on foreign suppliers, and increasing export potential for aerospace propulsion technologies.

Major Players

- Hindustan Aeronautics Ltd

- General Electric

- Rolls-Royce

- Safran

- Pratt & Whitney

- Honeywell Aerospace

- Aerojet Rocketdyne

- ISRO Propulsion Labs

- Skyroot Aerospace

- MTAR Technologies

- Bharat Dynamics Limited

- Mahindra Aerospace

- Agnikul Cosmos

- CFM International

- Bharat Forge

Key Target Audience

- Investments and Venture Capitalist Firms

- Defense Ministry

- Aerospace OEMs

- Indian Space Research Organization

- Indian Air Force

- Indian Navy

- Private Aerospace Startups

- Aviation Regulatory Bodies

Research Methodology

Step 1: Identification of Key Variables

The first phase involves constructing an ecosystem map of key stakeholders within the Indian aerospace propulsion systems market. This process utilizes a combination of secondary data from industry reports, databases, and government publications, complemented by primary data from interviews with market participants and experts. The primary goal is to identify and define the critical variables driving the market dynamics.

Step 2: Market Analysis and Construction

Historical data is compiled and analyzed to understand market penetration, product/service offerings, and consumer behavior. This includes evaluating the growth of the commercial and defense aerospace sectors, as well as the expansion of the space industry. Service quality assessments, specifically in terms of engine maintenance and reliability, will also be analyzed to ensure accurate and comprehensive data collection.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be validated through telephone and online surveys with industry experts from manufacturers, suppliers, and regulators. These consultations will yield valuable insights into technological developments, regulatory challenges, and future industry trends. The information obtained will be critical for refining market projections.

Step 4: Research Synthesis and Final Output

The final phase involves consolidating the findings, which include detailed insights into product segments, emerging market trends, competitive forces, and technological advancements. This stage ensures the report reflects accurate data, validated by multiple sources, and is aligned with the evolving market landscape.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In‑Depth Industry Interviews, Primary Research Framework, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Market Development

- Timeline

- Growth Drivers

Fleet expansion

defense modernization

space launch frequency - Market Challenges

Cost of R&D

certification barriers

talent and infrastructure gaps - Opportunities

Electric propulsion growth

localized MRO

JV tech transfers - Trends

Hybrid/electric propulsion

composite structural integration

AI in engine diagnostics - Government Regulations & Policies

Defence offset policies

space sector reforms IN‑SPACe - SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Volume, 2020-2025

- By Average Price, 2020-2025

- By Propulsion Type (In Value %)

Gas Turbine Engines

Rocket Propulsion Systems

Electric/Hybrid Propulsion

Auxiliary Power Units

- By Platform (In Value %)

Commercial Aircraft

Military Combat Aircraft, Trainers

Space Launch Vehicles & Satellites

Unmanned Aerial Vehicles / Drones

- By End‑User Industry (In Value %)

OEMs

Defense Forces/DRDO & ISRO Contracts

MRO

Aftermarket Components & Retrofit

- By Propulsion Technology (In Value %)

Conventional

Sustainable Fuels & Biofuel Compatible Engines

Electrified Propulsion

Additively Manufactured Engines

- By Supply Chain Tier (In Value %)

Tier‑1 Systems Integrators

Precision Component Suppliers

Materials

Testing & Certification Services

- Market Share of Major Players

- Cross Comparison Parameters (Thrust Class Performance, Fuel Efficiency, Life‑Cycle Cost, R&D Intensity)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players

- Detailed Profiles of Major Players

Hindustan Aeronautics Limited

Gas Turbine Research Establishment

General Electric

Pratt & Whitney

Rolls‑Royce

Safran Aircraft Engines

CFM International

Honeywell Aerospace

Aerojet Rocketdyne

ISRO Propulsion Labs

Skyroot Aerospace

Agnikul Cosmos

MTAR Technologies

Bharat Dynamics Limited

Mahindra Aerospace

- Cost to End‑User & Lifecycle Value

- Operational Requirements

- Technical Certification & Compliance Costs

- Aftermarket Support Needs

- By Market Value Forecast, 2026–2035

- By Volume Forecast, 2026–2035

- By Average Realized Price Trends, 2026–2035