Market Overview

The India aerospace valves market, valued at USD ~, is primarily driven by the increasing demand for advanced aircraft systems, modernization of defense infrastructure, and the growth of domestic commercial aviation. Aerospace valves play a critical role in hydraulic systems, fuel systems, and environmental control systems of both commercial and military aircraft. This market is witnessing strong growth due to the rising air traffic, fleet expansion by domestic airlines, and significant investments in India’s defense sector. Furthermore, a push towards domestic manufacturing in line with the “Make in India” initiative is contributing to local production and growth in the aerospace sector.

India’s aerospace valve market is predominantly driven by cities like Bangalore, Hyderabad, and Pune, which are key aerospace manufacturing hubs. Bangalore hosts major defense and aerospace giants, including HAL (Hindustan Aeronautics Limited) and other key suppliers to Boeing and Airbus. Hyderabad, with its robust aerospace ecosystem, serves as a major center for R&D and component manufacturing. Pune’s aerospace sector benefits from its proximity to global OEMs and its established supply chain for valve components. The dominance of these cities is fueled by their strong infrastructure, skilled labor, and significant investment from both government and private entities in aerospace technologies.

Market Segmentation

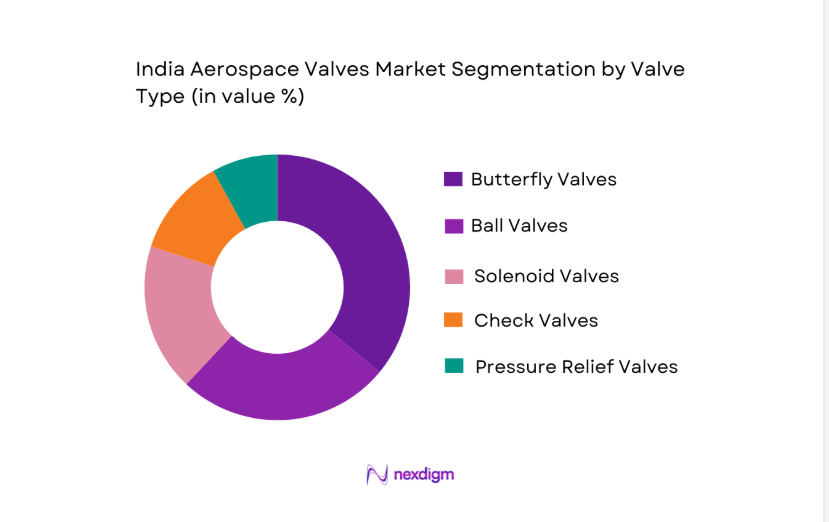

By Valve Type

The India aerospace valves market is segmented into several valve types, including solenoid valves, butterfly valves, ball valves, check valves, and pressure relief valves. The butterfly valve segment holds a dominant share in India due to its widespread use in airframe systems, where they are preferred for their lightweight design and efficient flow control properties. These valves are essential for controlling fuel flow and pressurization in hydraulic systems. With increasing demand for efficient fuel management in both commercial and defense aircraft, butterfly valves have a larger share of the market due to their performance, reliability, and ease of installation in critical systems.

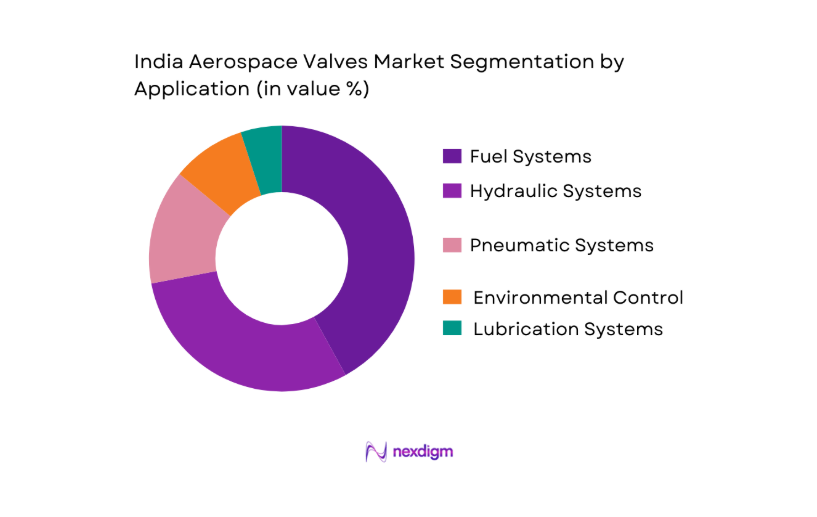

By Application

The market is also segmented by application, with fuel systems, hydraulic systems, pneumatic systems, and environmental control systems being the key sectors. Fuel system valves, which ensure safe and efficient management of fuel in commercial and military aircraft, dominate the market. These valves are integral for controlling the flow of fuel, preventing overpressure situations, and ensuring reliability during flight. With the continued growth in both domestic and international air travel, as well as ongoing upgrades to defense aircraft, fuel system valves hold the largest share in the aerospace valves market.

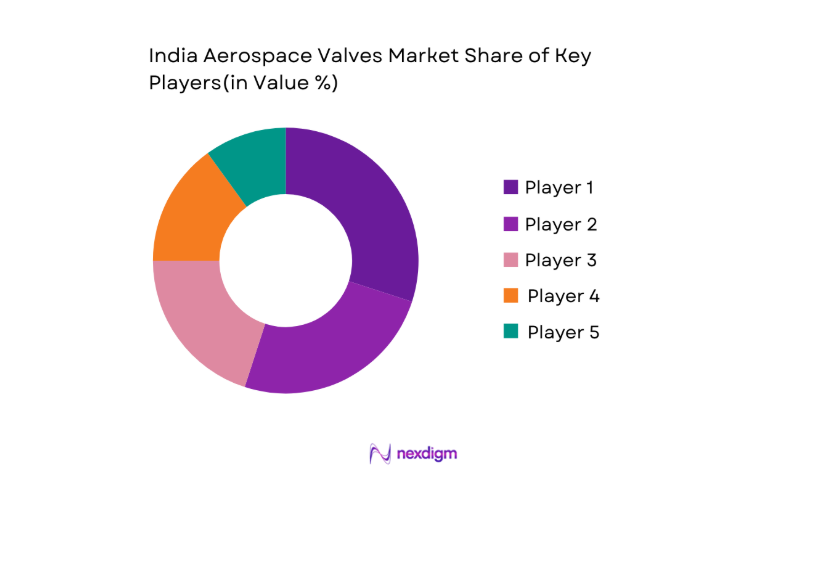

Competitive Landscape

The Indian aerospace valves market is highly competitive, with both global giants and local manufacturers vying for market share. Key players in the market include Eaton Corporation, Honeywell, Moog Inc., Parker Hannifin, and Safran, all of which provide a broad range of valve solutions for various aerospace applications. The market is characterized by a consolidation of these large players, which leverage advanced technologies, robust R&D capabilities, and established relationships with aerospace OEMs and MRO service providers. The competition in this space is intense, with companies focusing on innovations in lightweight materials, higher pressure tolerance, and integrated systems that enhance aircraft efficiency.

| Company | Establishment Year | Headquarters | Valve Types | Application Areas | Market Strategy | Key Products |

| Eaton Corporation | 1911 | Dublin, Ireland | ~ | ~ | ~ | ~ |

| Honeywell International | 1885 | Morris Plains, USA | ~ | ~ | ~ | ~ |

| Moog Inc. | 1951 | East Aurora, USA | ~ | ~ | ~ | ~ |

| Parker Hannifin | 1917 | Cleveland, USA | ~ | ~ | ~ | ~ |

| Safran | 2005 | Paris, France | ~ | ~ | ~ | ~ |

India Aerospace Valves Market Analysis

Growth Drivers

Air Passenger Traffic

The rise in air passenger traffic is a significant growth driver for the aerospace valves market. India’s aviation industry is poised for continued growth, with an expected ~ increase in passenger traffic by 2026, supported by a strong domestic and international air travel market. In 2024, the number of air passengers in India is expected to surpass ~. With more passengers, the demand for aircraft components, including aerospace valves for fuel, hydraulic, and pneumatic systems, will surge. According to the International Civil Aviation Organization (ICAO), global air passenger traffic has seen consistent growth, which mirrors India’s expanding air travel demand.

Fleet Expansion

Fleet expansion is a key factor driving the aerospace valves market in India. The Indian aviation industry continues to experience fleet expansion, with airlines such as IndiGo, Air India, and SpiceJet expanding their fleets to accommodate the increasing demand for air travel. By the end of 2024, it is projected that India will add over 200 aircraft to its existing fleet of approximately 700 aircraft. This growing fleet directly drives the demand for aerospace valves to support fuel, hydraulic, and flight control systems in new aircraft. This expansion is further fueled by the Indian government’s National Civil Aviation Policy, which aims to increase air connectivity across the country.

Market Challenges

Certification Costs

Certification costs remain a significant challenge in the aerospace valves market, especially in India, where the regulatory process for aerospace components is rigorous. The Directorate General of Civil Aviation (DGCA), which oversees the certification of aircraft components, requires stringent tests and approvals for each component used in aircraft systems. These processes can take up to 12 months, involving substantial costs for manufacturers. For instance, to receive certification for aerospace valves, manufacturers must ensure compliance with both national and international standards, which leads to higher development and testing costs. Additionally, the cost of meeting AS9100 certification standards for aerospace parts adds to the overall expense.

Supply Chain Fragmentation

Supply chain fragmentation in India’s aerospace sector presents a challenge for manufacturers of aerospace valves. The aerospace manufacturing ecosystem is still developing, with a reliance on imports for high-quality raw materials and precision components. In 2024, approximately ~ of raw materials for aerospace production, including valves, are still imported from countries like the U.S., Germany, and France. India’s local supply chain for these components remains fragmented, which leads to inefficiencies, delays, and higher costs. With increasing local demand, supply chain challenges need to be addressed to streamline production and distribution, improving reliability and reducing lead times for aerospace valve components.

Market Opportunities

Localization of Supply

Localization of supply presents a significant opportunity for the growth of the aerospace valves market in India. As part of the “Make in India” initiative, the government has been focusing on boosting domestic manufacturing in the aerospace sector. With the increasing demand for high-quality aerospace components, local production of aerospace valves is expected to rise, reducing dependency on imports and creating growth opportunities for domestic suppliers. The government’s emphasis on self-reliance is encouraging both international and Indian manufacturers to set up production facilities in India. In 2024, the government has already sanctioned INR 10,000 crore for the development of aerospace manufacturing infrastructure in India.

MRO Expansion

The expanding Maintenance, Repair, and Overhaul (MRO) market in India is another promising opportunity for the aerospace valves market. India’s MRO industry is expected to grow to USD ~ by 2026, driven by an expanding fleet of commercial and military aircraft. As airlines and defense forces increase their reliance on domestic MRO services, there is a rising demand for aerospace valve replacements, repairs, and upgrades. With airlines focusing on reducing operational costs and downtime, the MRO sector’s growth directly translates into increased demand for aerospace valves, contributing to a stable and growing market for valve manufacturers.

Future Outlook

Over the next decade, the Indian aerospace valves market is expected to see steady growth driven by continuous advancements in aerospace technologies and increasing demand for efficient, high-performance components. The domestic air travel industry is set to expand with a growing middle class, and defense modernization plans will further spur demand for aerospace valves. Additionally, innovations in smart valves, lightweight materials, and IoT integration will propel future growth in the sector.

Major Players

- Eaton Corporation

- Honeywell International

- Moog Inc.

- Parker Hannifin

- Safran

- Circor International

- Crane Aerospace & Electronics

- Woodward Inc.

- Liebherr Aerospace

- Precision Fluid Controls, Inc.

- Aequs Aerospace

- TASE Global

- Emerson Electric Co.

- Rolls-Royce Holdings

- Zodiac Aerospace

Key Target Audience

- Aerospace OEMs

- MRO

- Providers

- Government Defense Agencies

- Investments and Venture Capitalist Firms

- Aircraft Manufacturers

- Aviation Regulatory Bodies

- Airline Operators

- Valve Component Suppliers

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the India Aerospace Valves Market. This step is underpinned by extensive desk research, utilizing secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the India Aerospace Valves Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple aerospace valve manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the India Aerospace Valves Market.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Market Dynamics

- Historical Overview

- Timeline

- Growth Drivers

Air Passenger Traffic

Fleet Expansion

Defense Modernization

- Market Challenges

Certification Costs

Supply Chain Fragmentation

Price Sensitivity

- Market Opportunities

Localization of Supply

MRO Expansion

Smart Valves with IoT

- Market Trends

Lightweight Materials

Additive Manufacturing Adoption)

- Government Regulations & Standards

- SWOT Analysis

- Porter’s Five Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Selling Price, 2020-2025

- By Valve Type, 2020-2025

- By Valve Type (In Value %)

Butterfly Valves

Ball Valves

Solenoid Valves

Check / Relief Valves

Poppet & Rotary Valves - By Application (In Value %)

Fuel System

Hydraulic System

Pneumatic System

Environmental Control System

Lubrication & Backup Systems - By End‑Use (In Value %)

OEM

Aftermarket - By Aircraft Type (In Value %)

Commercial

Defence & Military Platforms

Regional & Business Jets

Helicopter / VTOL / UAVs - By Material (In Value %)

Stainless Steel

Titanium

Aluminum

- Market Share of Major Players

- Cross‑Comparison Parameters (Valve Type Coverage , ASP / Price Band Premium, Certification Portfolio, Supply Chain Integration, Quality & Failure Rates, Regional Footprint & Export Intensity)

- SWOT Analysis of Key Players

- Pricing Analysis of Major Players (MSRP, OEM Contract Pricing, Volume Discounts)

- Detailed Profile of Major Players

Eaton Corporation plc

Safran SA

Triumph Group, Inc.

Sitec Aerospace Gmbh

Woodward, Inc.

Circor International, Inc.

Crane Aerospace & Electronics

Honeywell International Inc.

Moog Inc.

Parker Hannifin Corporation

Liebherr‑International Deutschland GmbH

Precision Fluid Controls, Inc.

Porvair plc

TASE Global

Aequs

- Performance Requirements

- Total Cost of Ownership

- OEM Procurement Criteria

- MRO Demand Drivers

- By Value, 2026 to 2035

- By Volume, 2026 to 2035

- By Average Selling Price, 2026 to 2035

- By Valve Type, 2026 to 2035