Market Overview

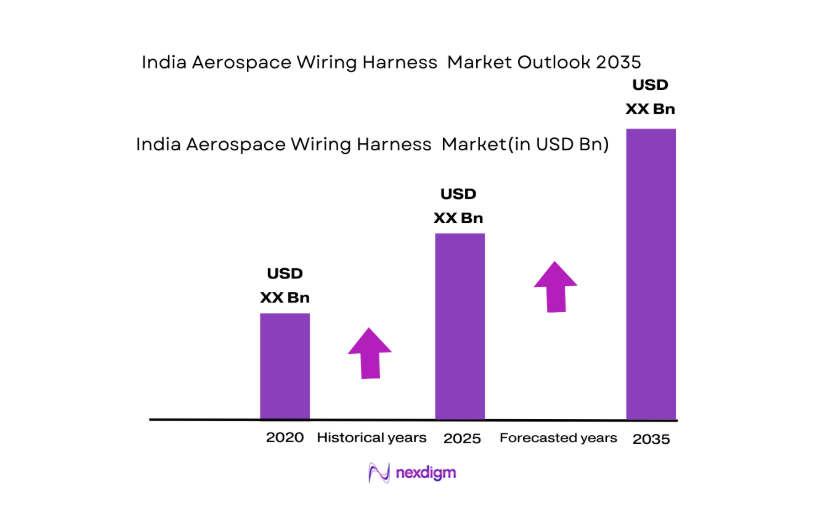

The India aerospace wiring harness market is valued at USD ~, primarily driven by increasing defense contracts and the growth of the domestic aerospace sector. The market is shaped by the rising demand for advanced, lightweight wiring solutions, especially for military and commercial aircraft. A significant push comes from government initiatives like Make in India, promoting local manufacturing of aerospace components. The need for high-performance, reliable wiring systems, along with the growth of regional aviation, further accelerates market expansion. Increasing investments in aerospace infrastructure and MRO facilities further support market growth.

India’s aerospace wiring harness market is predominantly driven by key cities such as Bengaluru, Hyderabad, and Pune. Bengaluru, often regarded as the aerospace hub of India, is home to several OEMs, MRO facilities, and Tier-1 suppliers such as HAL and GE Aviation. Hyderabad is another critical player, with large defense contracts and strong aerospace manufacturing capabilities. Pune, with its proximity to key manufacturers and growing defense presence, also plays a significant role. These cities dominate the market due to their established infrastructure, skilled workforce, and close ties with government and defense bodies.

India Aerospace Wiring Harness Market Segmentation

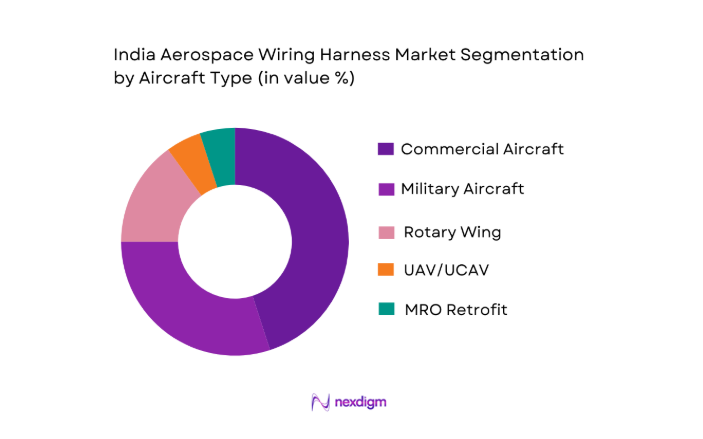

By Aircraft Type

The India aerospace wiring harness market is segmented by aircraft type into commercial, military, rotary wing, UAV/UCAV, and MRO retrofit systems. The commercial aircraft segment dominates the market, driven by the increasing number of passenger flights and aircraft deliveries. India has seen significant growth in its aviation sector, with major players such as Air India and IndiGo increasing their fleets, requiring new wiring harness systems. These systems are crucial for avionics, control systems, and power distribution, all of which are essential for the safe operation of modern aircraft. The growing demand for air travel, along with regional aircraft operations, fuels the dominance of the commercial aircraft segment in India’s aerospace wiring harness market.

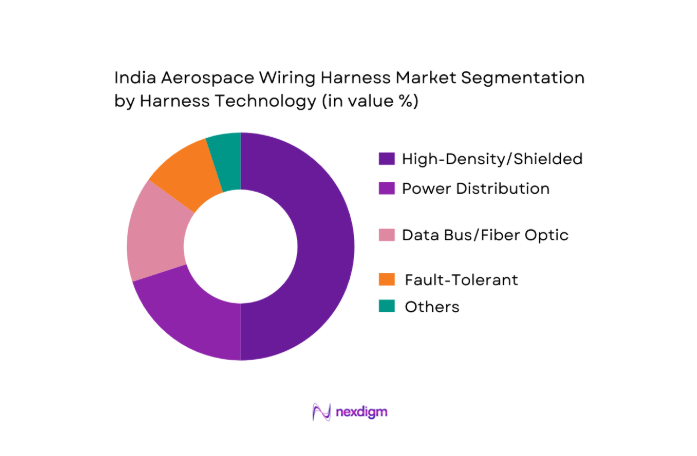

By Harness Technology

India’s aerospace wiring harness market is also segmented by technology into high-density, shielded, power distribution, data bus, fiber optic, and fault-tolerant harnesses. The high-density/EMI shielded harness technology has the largest market share due to the growing need for lightweight yet high-performance solutions in avionics and aircraft control systems. As avionics systems become more complex and integrated, the demand for these advanced technologies increases. Furthermore, the shift towards electric and hybrid-electric aircraft is driving demand for high-density harnesses, which offer better space utilization while maintaining robust electromagnetic interference (EMI) shielding properties.

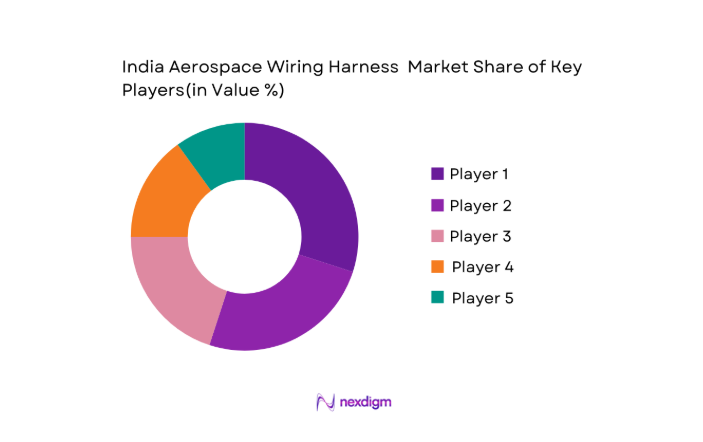

Competitive Landscape

The India aerospace wiring harness market is dominated by a few key players, both global and domestic. Key international players like TE Connectivity, Amphenol Aerospace, and Collins Aerospace hold a significant share, while local companies such as Hical Technologies and Kaynes Technology are gaining ground. These companies benefit from their established presence in the defense and aerospace sectors, extensive research and development investments, and long-term relationships with major OEMs and MRO service providers. The competition is characterized by rapid technological advancements, with firms focusing on enhancing the performance, reliability, and weight reduction of their wiring harness solutions.

| Company Name | Year Established | Headquarters | Certifications | Annual Revenue | Market Segments Served | Key Clients |

| TE Connectivity | 1941 | Switzerland | ~ | ~ | ~ | ~ |

| Amphenol Aerospace | 1932 | USA | ~ | ~ | ~ | ~ |

| Collins Aerospace | 2018 | USA | ~ | ~ | ~ | ~ |

| Hical Technologies | 1988 | India | ~ | ~ | ~ | ~ |

| Kaynes Technology | 1985 | India | ~ | ~ | ~ | ~ |

India Aerospace Wiring Harness Market Analysis

Growth Drivers

Indigenous Defense Platforms

India’s push for self-reliance in defense production has resulted in several indigenous defense platforms driving the aerospace wiring harness market. The Indian Air Force (IAF) continues to prioritize domestic manufacturing, which is evident from their commitment to acquiring indigenous platforms such as the HAL Tejas fighter aircraft and the Tejas Mark 2. The Indian government allocated INR ~ in defense spending for 2025 to boost domestic defense production. These initiatives are expected to spur demand for locally produced aerospace wiring harnesses as they are integral to avionics, power systems, and control systems. The Defence Acquisition Procedure 2020 aims to push 75% of the defense procurement budget toward domestic production, further accelerating local demand for critical aerospace components like wiring harnesses. The government’s strategic shift toward indigenous platforms highlights a solid growth trajectory for this market.

Passenger Air Traffic Growth

India’s civil aviation sector has seen substantial growth in the past decade, a trend expected to continue, thereby driving the aerospace wiring harness market. The country recorded more than ~ domestic passengers in 2025, and this figure is projected to reach ~ by 2026, according to the Directorate General of Civil Aviation (DGCA). The increase in air traffic leads to higher demand for new aircraft, as well as for retrofitting older ones. This results in a robust market for aerospace wiring harnesses, which are critical to the integration of avionics, in-flight entertainment systems, and communication technologies. Domestic carriers like IndiGo, Air India, and Vistara are increasing their fleet sizes, with IndiGo ordering 500 aircraft in 2024, which directly affects the demand for wiring solutions. Additionally, India’s expansion as a key hub for international air travel, with airports like Delhi and Mumbai becoming major transit points, further boosts the need for modern wiring harnesses.

Market Challenges

Certification Cycle Bottlenecks

One of the key challenges in the aerospace wiring harness market is the lengthy certification cycle. New wiring solutions must comply with rigorous standards set by global aviation authorities like the Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA). Certification often takes several years due to the complexity of testing electrical systems for aircraft. As of 2025, the Directorate General of Civil Aviation (DGCA) has set guidelines that require a minimum of two years for the certification of new aerospace wiring harness systems in India. This delay in certification results in slow integration of innovative technologies, limiting the market’s potential to capitalize on newer materials and designs. In the broader context, certification bottlenecks also affect India’s ability to compete in the international aerospace market, particularly when up against countries that have more streamlined processes for new technology approvals.

Raw Material Imports

India’s dependence on imported raw materials for aerospace manufacturing presents a significant challenge. The country imports approximately 80% of the high-quality copper, aluminum, and specialized polymer composites required for wiring harness production. This reliance is attributed to the limited domestic production capacity for such materials, which is compounded by the lack of advanced raw material suppliers capable of meeting stringent aerospace standards. In 2025, the import value of these critical raw materials was pegged at USD ~, according to Ministry of Commerce and Industry data. The fluctuation in global commodity prices, trade policies, and foreign exchange rates often results in price volatility, impacting the cost structure of Indian aerospace manufacturers. Additionally, delays in imports due to customs procedures further affect supply chain efficiency, leading to delayed deliveries and increased production costs for aerospace wiring harnesses.

Opportunities

Supply Chain Localization

India is actively pursuing supply chain localization to reduce its dependency on foreign imports, creating significant opportunities for the aerospace wiring harness market. In 2024, the government announced the Atmanirbhar Bharat Abhiyaan, which encourages the domestic production of critical aerospace components. As part of the Make in India initiative, the government has provided incentives to local manufacturers of wiring harnesses, aiming to replace imported components. The domestic manufacturing push is supported by substantial policy support, such as the Production Linked Incentive (PLI) scheme for defense manufacturing, which is expected to see an investment of INR 5,000 crore (USD 625 million) by 2026. This initiative has already attracted several foreign and domestic players to set up manufacturing units in India, with Boeing and Airbus increasing their local sourcing of aerospace components, including wiring harnesses. As a result, supply chain localization will drive greater production of high-quality aerospace wiring harnesses domestically.

Electrified Aircraft Systems

The demand for electrified aircraft systems, including hybrid-electric and fully electric aircraft, is expected to grow significantly, offering new avenues for aerospace wiring harness manufacturers. The Indian government has committed to reducing carbon emissions from aviation, setting ambitious targets for the adoption of electric and hybrid-electric aircraft. In 2025, the Civil Aviation Ministry outlined plans to accelerate the development of electric aviation technology, with a projected goal of launching electric passenger planes in India by the late 2020s. This shift toward electrification demands advanced wiring solutions that can handle high voltages, data transmission, and complex power distribution. As part of this initiative, India has already partnered with global leaders in electric propulsion systems, increasing the need for specialized aerospace wiring harnesses. This market opportunity is amplified by a growing global trend toward sustainable aviation, with countries worldwide investing in electric aircraft technologies.

Future Outlook

The India aerospace wiring harness market is expected to experience significant growth over the next decade, driven by ongoing advancements in aerospace technology, a surge in both military and commercial aircraft production, and the rapid development of the UAV and electric aviation sectors. Government initiatives such as Make in India and defense modernization programs are likely to further boost local production, reducing dependence on foreign suppliers. Innovations in lightweight, high-performance materials and smart wiring technologies will provide new opportunities for harness manufacturers. As the domestic aerospace sector matures, India is poised to become a global player in aerospace wiring harness manufacturing, catering to both domestic and international markets.

Major Players

- TE Connectivity

- Amphenol Aerospace

- Collins Aerospace

- Hical Technologies

- Kaynes Technology

- Carlisle Interconnect Technologies

- Nexans SA

- Honeywell Aerospace

- Miracle Electronics Devices Pvt Ltd

- Sumitomo Electric Industries

- GE Aviation

- TASE Global

- Apar Industries Ltd.

- Savi Aerospace

- Jabil Inc.

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Original Equipment Manufacturers

- Defense Contractors

- Aerospace Component Suppliers

- Aerospace MRO Providers

- Aerospace System Integrators

- Aircraft Operators and Airlines

Research Methodology

Step 1: Identification of Key Variables

This phase involves constructing an ecosystem map that includes all stakeholders within the India aerospace wiring harness market. Secondary research from proprietary databases and industry reports helps to identify the key players, technologies, and market drivers that shape the market dynamics.

Step 2: Market Analysis and Construction

Historical data regarding the aerospace wiring harness market is compiled, focusing on demand trends, technological advancements, and consumer behavior. By analyzing these data points, a comprehensive picture of the market’s evolution is created to predict future trends.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are tested through in-depth consultations with industry experts, including engineers, manufacturers, and policymakers. This phase employs computer-assisted telephone interviews (CATIs) to gather insights on operational challenges, technological adoption, and future demand.

Step 4: Research Synthesis and Final Output

After gathering insights from primary and secondary sources, the findings are validated and synthesized into a coherent market report. The final analysis combines quantitative data with qualitative insights from industry experts to provide actionable conclusions for decision-makers.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-Depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and scope

- Market dynamics

- Historical overview

- Timeline

- Growth drivers

Indigenous defense platforms

passenger air traffic growth - Market challenges

Certification cycle bottlenecks

raw material imports - Opportunities

Supply chain localization

electrified aircraft systems - Market trends

High‑speed data bus harness

fiber optics integration - Government regulations

- SWOT analysis

- Porter’s 5 Forces

- By Value, 2020-2025

- By Volume, 2020-2025

- By Average Realized Price, 2020-2025

- By Aircraft Type (In Value %)

Commercial fixed wing

Military aircraft

Rotary wing

UAV/UCAV platforms - By Harness Technology (In Value %)

High‑density/Shielded

High‑voltage power distribution harness

Data bus & fiber optic harness - By End‑Use OEM Tier (In Value %)

OEM

Tier‑1 integrators

Authorized MRO & retrofit - By Certification Standard (In Value %)

AS9100/ISO 9001 certified

MIL‑STD compliant

DO‑160 environmental tested harness - By Supply Chain Source (In Value %)

Domestic manufactured

Imported sub‑assemblies

- Market share of major players

- Cross‑Comparison Parameters (Certification Standards Achieved, High‑Voltage Harness Capability, EMI/EMC Shielding Efficiency Metrics, Domestic Localization % , Supply Chain Tier Capability, Production Capacity , On‑board Data Bus Integration Capability, Aftermarket & MRO Support Network )

- SWOT Analysis of Key Players

- Pricing analysis of major players

- Detailed Profile of Major Players

Safran S.A.

TE Connectivity plc

Amphenol Aerospace

Collins Aerospace

Carlisle Interconnect Technologies

Hical Technologies

JJG Aero

Nexans SA

Miracle Electronics Devices Pvt Ltd

Apar Industries Ltd.

Sumitomo Electric Industries

Thermo Cables Limited

Kaynes Technology

TASE Global

Honeywell Aerospace

- OEM specification compliance

- Certification and quality standards

- Lifecycle cost considerations

- Supplier qualification lead time

- By Value, 2026-2035

- By Volume, 2026-2035

- By Average Price, 2026-2035