Market Size and Growth Drivers

The India Aerostat Systems market has witnessed a significant expansion in recent years, with the market valued at approximately USD ~million in 2024. This growth is primarily driven by the increasing need for surveillance, defense applications, and border security, with aerostat systems playing a crucial role in offering real-time, high-altitude intelligence. As defense agencies continue to invest in modern surveillance and communication infrastructure, aerostat systems are being increasingly adopted due to their cost-effectiveness compared to traditional satellite systems. This demand is anticipated to rise as more sectors recognize the utility of these systems for monitoring remote areas and critical infrastructure.

India stands as the leading market for aerostat systems, primarily due to the country’s large geographical area, high demand for border surveillance, and the ongoing modernization of defense infrastructure. Several regions in India, including Jammu & Kashmir, Rajasthan, and the North-East regions, are witnessing the deployment of aerostat systems for enhancing security and surveillance capabilities. Furthermore, the country’s government initiatives, such as the Defense Production Policy, have fostered the development and procurement of aerostat systems. The dominance of India in this market is further supported by increasing defense expenditure and technological advancements, which have created a conducive environment for market growth.

Market Segmentation

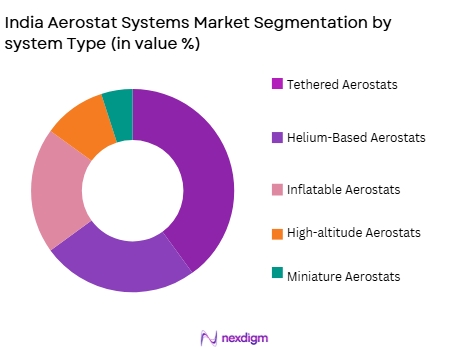

By System Type

India Aerostat Systems market is segmented by system type into tethered aerostats, helium-based aerostats, inflatable aerostats, high-altitude aerostats, and miniature aerostats. Among these, tethered aerostats hold a dominant position in the market due to their widespread application in surveillance and reconnaissance missions. Tethered systems are known for their stability, longer operational time, and relatively lower cost compared to other types of aerostats. These systems are especially favored for border patrol and security operations, where consistent monitoring is essential. The ability to remain airborne for extended periods without the need for continuous refueling is a key reason behind the growing adoption of tethered aerostats.

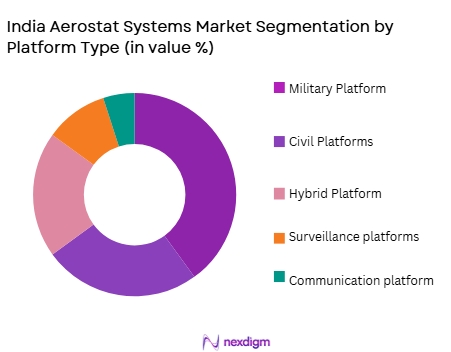

By Platform Type

The market is also segmented by platform type into military platforms, civil platforms, hybrid platforms, surveillance platforms, and communication platforms. Among these, military platforms dominate the market share, largely due to the heavy reliance on aerostat systems for defense and border security applications. The increasing adoption of hybrid platforms, which combine aerostats with drones or other UAVs for enhanced operational capability, is also gaining traction. Military platforms account for a significant portion of the market due to their ability to provide extended surveillance capabilities in remote and hostile environments, offering real-time intelligence for defense operations.

Competitive Landscape

The India Aerostat Systems market is dominated by both domestic and international players. Local companies are increasingly gaining ground due to the government’s push for indigenization in defense equipment, with firms like TCOM LPS and Lockheed Martin playing crucial roles. The market is also witnessing significant contributions from global manufacturers such as Raytheon and Saab, who are recognized for their expertise in advanced aerostat technologies and their integration with defense systems. The consolidation of these key players highlights their influence and growing presence in the Indian defense market.

Competitive Landscape Table

| Company Name | Establishment Year | Headquarters | Key Technology Focus | Market Focus | Product Innovation | Strategic Initiatives |

| Lockheed Martin | 1912 | USA | ~ | ~ | ~ | ~ |

| Raytheon Technologies | 1922 | USA | ~ | ~ | ~ | ~ |

| TCOM LPS | 1985 | USA | ~ | ~ | ~ | ~ |

| General Electric | 1892 | USA | ~ | ~ | ~ | ~ |

| Saab Group | 1989 | Sweden | ~ | ~ | ~ | ~ |

India Aerostat Systems Market Analysis

Growth Drivers

Urbanization

Indonesia’s urbanization trend has been a significant growth driver for the air quality monitoring system market. The urban population in Indonesia is expected to reach nearly ~of the total population in 2024, with cities like Jakarta, Surabaya, and Bandung experiencing rapid population growth. As urban areas expand, air pollution from industrial, vehicular, and construction activities intensifies. With a growing need to manage pollution levels, urban centers are increasingly investing in air quality monitoring systems to ensure better environmental management.

Industrialization

Indonesia’s industrial sector, contributing to ~ of its GDP, is a major factor driving the air quality monitoring system market. The continued growth in manufacturing, mining, and energy sectors has led to increased emissions, particularly in areas with heavy industrial activity like East Java and Jakarta. To combat pollution and comply with environmental regulations, industries are adopting advanced air quality monitoring systems to monitor and reduce harmful emissions. The increased industrialization presents an ongoing opportunity for air quality management solutions.

Government Regulations

The Indonesian government has implemented strict environmental regulations that support the growth of air quality monitoring systems. The Ministry of Environment and Forestry’s National Air Quality Monitoring Program, launched in 2024, emphasizes continuous monitoring of air pollution in urban centers. In addition, the government set a target to reduce greenhouse gas emissions by ~ by 2030, which is expected to increase demand for air quality monitoring systems to ensure compliance. These regulations are boosting the market for air quality management technologies.

Public Awareness

Public awareness about the dangers of air pollution in Indonesia has risen dramatically. In 2024, surveys from the Ministry of Health showed that air pollution was considered one of the leading environmental health concerns affecting millions. With more citizens recognizing the negative effects of poor air quality, there has been a surge in demand for real-time monitoring systems. Cities like Jakarta are increasingly using these systems to inform the public about pollution levels, creating an urgent need for air quality monitoring solutions.

Restraints

High Initial Costs

A significant restraint in the adoption of air quality monitoring systems in Indonesia is the high initial cost. The price of advanced monitoring systems, especially those capable of providing real-time data across vast areas, is substantial. For industries and government bodies, the installation and operational costs pose a barrier to implementation. Despite government subsidies, the upfront investment remains high, limiting widespread adoption. The cost factor is particularly concerning for small and medium-sized businesses and public agencies.

Technical Challenges

Indonesia faces several technical challenges related to the deployment of air quality monitoring systems. The country’s diverse climate, including tropical conditions and varied geographical features, affects the performance of monitoring equipment. Furthermore, maintaining consistent data accuracy in rural and remote areas remains a challenge. The lack of local infrastructure to support advanced air quality monitoring solutions, such as electricity and internet connectivity in remote areas, complicates the situation.

Opportunities

Technological Advancements

Technological advancements in air quality monitoring systems present a significant opportunity for market growth. Innovations such as IoT-based sensors, real-time data analytics, and cloud computing are making air quality monitoring systems more affordable, efficient, and accurate. As of 2024, the Indonesian government has been investing in the development of smart air quality monitoring solutions, which will improve data collection capabilities and allow for faster decision-making. These advancements are expected to lower costs and increase market penetration. [Source: Ministry of Industry, Indonesia]

International Collaboration

International collaborations provide significant opportunities for Indonesia to enhance its air quality monitoring infrastructure. In 2024, Indonesia signed an agreement with the United Nations Environment Programme (UNEP) to collaborate on improving air quality monitoring and pollution control. These partnerships bring access to advanced technologies, funding, and international expertise, all of which contribute to the development of more efficient monitoring systems. As such collaborations increase, so will the adoption of better air quality monitoring systems across the country.

Future Outlook

Over the next decade, the India Aerostat Systems market is expected to show continued growth. This is driven by the increasing demand for advanced surveillance technologies in border security and defense, as well as the government’s continued focus on strengthening defense capabilities. The integration of artificial intelligence (AI) and automation in aerostat systems is expected to enhance their operational efficiency, making them even more attractive for various applications. Additionally, the growing need for cost-effective solutions in remote monitoring is likely to propel further market expansion.

Major Players

- Lockheed Martin

- Raytheon Technologies

- TCOM LPS

- General Electric

- Saab Group

- Northrop Grumman

- AeroVironment

- IAI – Israel Aerospace Industries

- L-3 Communications

- Chinese Aerospace Corporation

- Boeing

- Harris Corporation

- Orbital ATK

- Thales Group

- BAE Systems

Key Target Audience

- Investments and Venture Capitalist Firms

- Government and Regulatory Bodies

- Military and Defense Agencies

- Aerospace and Defense Manufacturers

- Border Security and Surveillance Organizations

- Telecom Companies

- Environmental and Research Organizations

- Infrastructure Development Companies

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the stakeholders within the India Aerostat Systems market. This step utilizes a combination of secondary and primary research to gather industry-level insights, with a focus on identifying key variables influencing market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling historical data related to aerostat system usage in India, with an emphasis on military and border security applications. A detailed market construction process is carried out to assess penetration rates, revenue generation, and service quality.

Step 3: Hypothesis Validation and Expert Consultation

The hypotheses formed during the analysis phase are validated through direct interviews with industry experts and stakeholders. This includes experts from defense agencies and aerostat manufacturers, ensuring that the market data is grounded in real-world applications.

Step 4: Research Synthesis and Final Output

The final phase engages with manufacturers to refine insights into product segments, sales performance, and consumer behavior. This comprehensive approach ensures that the analysis is robust, accurate, and validated against real-time industry data.

- Executive Summary

- Research Methodology (Definitions, Scope, Industry Assumptions, Market Sizing Approach, Primary & Secondary Research Framework, Data Collection & Verification Protocol, Analytic Models & Forecast Methodology, Limitations & Research Validity Checks)

- Market Definition and Scope

- Value Chain & Stakeholder Ecosystem

- Regulatory / Certification Landscape

- Sector Dynamics Affecting Demand

- Strategic Initiatives & Infrastructure Growth

- Growth Drivers

Increasing demand for surveillance and monitoring systems in defense

Rising adoption of aerostat systems for border security and surveillance

Government investments in defense infrastructure and surveillance technology - Market Challenges

High operational and maintenance costs

Technical limitations related to altitude and environmental conditions

Regulatory challenges in deployment and operations - Market Opportunities

Growth in telecommunication sector requiring aerial communication solutions

Increasing demand for environmental monitoring systems

Technological advancements in aerostat materials and systems - Trends

Integration of IoT with aerostat systems

Adoption of hybrid platforms combining aerostats and drones

Shift towards sustainable and low-maintenance aerostat solutions - Government Regulation & Policy Impact

- SWOT Analysis

- Porter’s Five Forces

- By Market Value, 2020-2025

- By Installed Units ,2020-2025

- By Average System Price, 2020-2025

- By System Complexity Tier, 2020-2025

- By System Type (In Value%)

Tethered Aerostats

Helium-based Aerostats

Inflatable Aerostats

High-Altitude Aerostats

Miniature Aerostats - By Platform Type (In Value%)

Military Platforms

Civil Platforms

Hybrid Platforms

Surveillance Platforms

Communication Platforms - By Fitment Type (In Value%)

Portable Aerostat Systems

Vehicle-mounted Aerostat Systems

Stationary Aerostat Systems

Balloon-mounted Aerostat Systems

Mobile Ground-based Aerostat Systems - By EndUser Segment (In Value%)

Defense & Security

Telecommunications

Environmental Monitoring

Surveillance & Monitoring

Research & Development - By Procurement Channel (In Value%)

Direct Purchase from Manufacturers

Government Contracts

Third-party Distributors

Online Platforms

Wholesale Procurement

- Market Share Analysis

- Cross-Comparison Parameters (System Type, Platform Type, Procurement Channel, Geographic Presence, Market Share)

- SWOT Analysis of Key Competitors

- Key Players

Lockheed Martin

Raytheon Technologies

Tcom LPS

General Electric

L-3 Communications

SAAB Group

Aerostats International

Vallentune Aerostats

Raytheon Anschütz

Rivada Networks

Harris Corporation

Orbital ATK

Boeing

Northrop Grumman

China Aerospace Corporation

- Defense sector’s reliance on aerial surveillance

- Telecommunication industry expanding with aerial systems for better coverage

- Use of aerostat systems in environmental monitoring and research

- Increased use of aerostat systems in large-scale infrastructure projects

- Forecast Market Value 2026-2035

- Forecast Installed Units 2026-2035

- Price Forecast by System Tier 2026-2035

- Future Demand by Platform 2026-2035