Market Overview

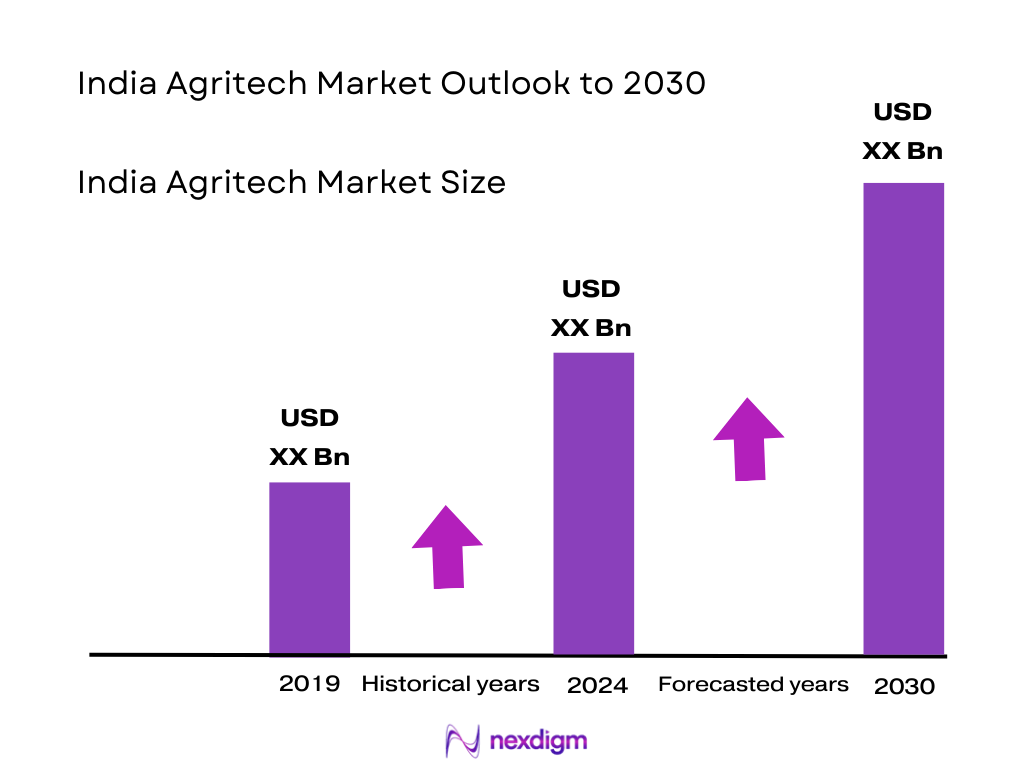

The India Agritech Market is valued at USD 878.1 million, based on a comprehensive industry analysis, reflecting current adoption across precision farming, supply-chain platforms, IoT devices, and analytics in agricultural operations. This valuation stems from robust secondary research by a leading research firm, ensuring accuracy and credibility.

India’s agritech momentum is driven by the growing penetration of smartphones and internet in rural areas, coupled with supportive government initiatives such as digital agriculture missions, eNAM, and data-centric platforms like AgriStack. These factors enhance real-time decision-making and productivity enhancements for farmers.

Geographically, South Indian states along with the Delhi NCR and Maharashtra are dominant hubs in the agritech ecosystem. Their strength lies in a strong digital infrastructure, high startup density, established tech ecosystems, and supportive state policies that foster rapid agritech innovation and deployment.

Market Segmentation

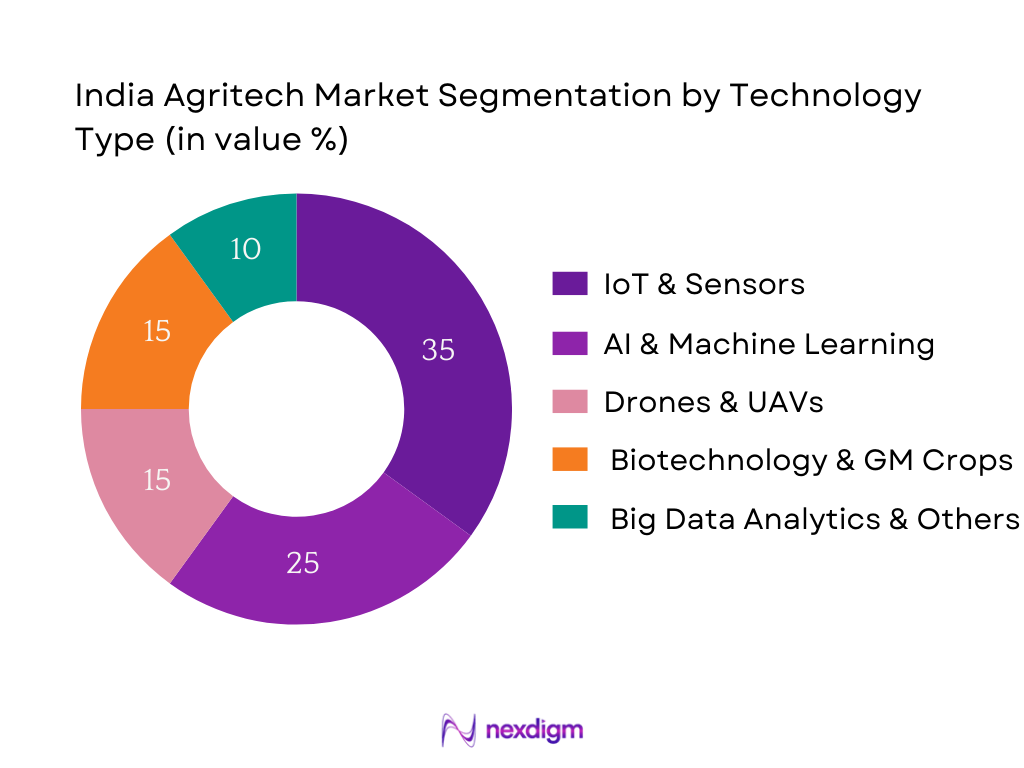

By Technology Type

IoT & Sensors dominate the India Agritech market due to their immense value in real-time monitoring of soil health, moisture, temperature, and crop conditions. The affordability and practicality of sensor technologies allow even smallholder farmers to make data-rich decisions. This segment has witnessed widespread adoption in both precision irrigation and crop advisory systems, offering tangible yield and cost benefits.

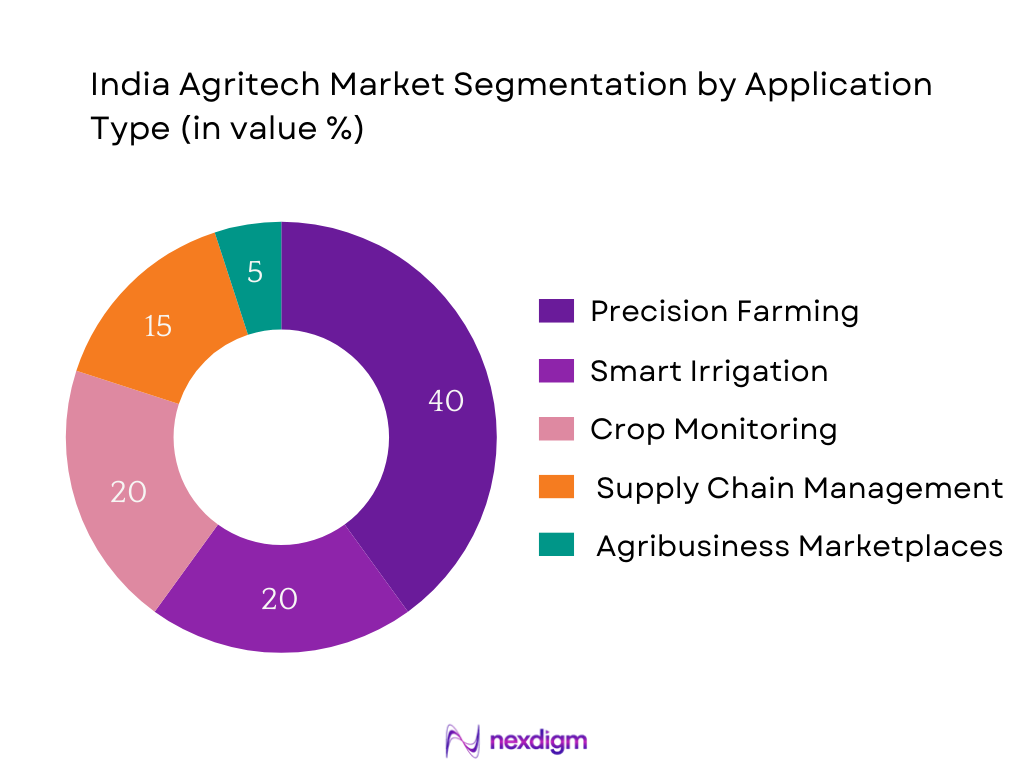

By Application Area

Precision Farming leads in application share as it empowers farmers to optimize input use via real-time analytics and prescriptive actions. Applications like variable-rate seeding/fertilization, soil mapping, and satellite-based yield forecasting are widely used across larger and small farms alike—driven by cost efficiency imperatives and technology effectiveness.

Competitive Landscape

The India Agritech market exhibits a concentrated competitive landscape led by both homegrown startups and tech‑enabled businesses. Their strategic partnerships, platform innovation, and rural penetration underscore their commanding positions.

| Company | Established | Headquarters | Business Model | Tech Focus | Farmer Coverage | Government Collaboration | Unique Strength |

| Cropin | 2010 | Bengaluru | – | – | – | – | – |

| DeHaat | 2012 | Gurugram | – | – | – | – | – |

| Ninjacart | 2015 | Bengaluru | – | – | – | – | – |

| AgroStar | 2013 | Ahmedabad | – | – | – | – | – |

| Fasal | 2016 | Gurgaon | – | – | – | – | – |

India Agritech Market Analysis

Growth Drivers

Government Agri‑Tech Subsidies

India’s government continues to deploy significant financial support across agriculture. In the current fiscal projections, combined allocations for food, fertilizer, and rural employment subsidies stand at ₹4.57 trillion (approx. USD 52.81 billion), nearly unchanged from the previous year’s ₹4.54 trillion. This level of subsidy ensures liquidity for rural households and increases their capacity to invest in agritech solutions such as precision irrigation tools or digital advisory services. For example, fertilizer subsidy alone represents ₹1.67 trillion in outlay, supporting affordability of key inputs that can interface with tech-driven nutrient management systems. By relieving cost burdens on farmers, these subsidies indirectly amplify adoption of agritech applications—allowing investments in sensors, advisory apps, and mechanized platforms—thus serving as a foundational driver for the sector.

FPO Expansion (Farmer Producer Organisations)

As smallholder farming dominates India—where 94.3% of operational holdings are classified as small (below 4 hectares) and account for 65.2% of farmland, while holdings under 2 hectares constitute 78% of farmers, generating 41% of food grain production—aggregated institutional forms like FPOs are critical. Expansion of FPOs provides collective access to technology, bulk buying, and logistics services, effectively bridging small fragmented landholdings with agritech platforms. Given the average holding is under 2 ha, individual investment in IoT tools or drone services is not viable; FPOs streamline cost-sharing and enable scale deployment. Therefore, FPO proliferation significantly accelerates agritech adoption among marginal farmers by leveraging aggregated demand and shared infrastructure without needing macro‑level stats.

Market Challenges

Farmer Digital Literacy

Despite rapid rural digitization, digital literacy remains a key barrier. While specific literacy rates for farmers are not directly published, the rural internet penetration was reported at roughly 52% in 2023 by TRAI (Telecom Regulatory Authority of India), compared to over 85% in urban areas, indicating a significant gap in reaching farmers. Low digital fluency impedes uptake of sophisticated agritech solutions such as mobile advisory apps or precision monitoring tools. The disparity in digital preparedness limits farmers’ ability to navigate platforms, interpret data-driven recommendations, or transact via e-marketplaces. Overcoming this challenge requires robust digital education outreach, which is currently not widespread, thereby constraining the agritech market’s expansion among the core rural user base.

Fragmented Land Holdings

India’s agriculture is characterized by acute fragmentations: 78% of farmers hold less than 2 ha, but these account for only 33% of total farmland, while contributing 41% to food grain output, highlighting productivity inefficiencies. Additionally, mechanization efficacy is significantly depressed because productivity improvements require holdings exceeding 10 hectares, per government analysis. This fragmentation means that deploying agritech hardware like sensors, drones, or automated irrigation across discontinuous small plots becomes logistically complex and cost-inefficient. Technology diffusion in such environments is sluggish, as it lacks economies of scale. Fragmentation remains a structural challenge for scaling agritech solutions broadly—hampering unified tech application, data aggregation, and cost-effective deployment.

Opportunities

Carbon Credit Monitoring

While data infrastructure for carbon credit programs is nascent in India, the double mandate of climate action and farmer income opens a clear opportunity. The global total for annual producer support in agriculture is estimated at around USD 456 billion—though not India-specific, it underscores global traction for sustainable practices. As domestic schemes begin to link carbon sequestration outcomes (through agroforestry, regenerative practices) with monetary rewards, there is a need for accurate monitoring—ideally through agritech tools such as soil sensors, satellite analytics, and blockchain tracking. Agritech platforms that can quantify carbon capture in absolute numbers (e.g., tons of CO₂ equivalent per hectare) will become invaluable. With increasing global emphasis on verifiable carbon credits, Indian agritech stands to play a critical role by offering precise, scalable measurement technologies tailored to fragmented lands—positioning as an enabler for carbon finance flows.

Agrivoltaics

India has around 60% of its land used for agriculture, significantly above the global average of 37%. This land pressure is especially acute as solar and green energy ambitions compete for the same space. Agrivoltaic solutions—combining solar panels with crops—offer dual utilization, but require complex coordination and monitoring. Agritech platforms capable of managing light modulation, soil moisture underneath panels, and plant growth data can optimize both energy and crop yield. Given average land parcels are small, expectation of dual-use efficiencies on every plot incentivizes agritech involvement. Thus, agritech tools for agrivoltaics—tracking microclimatic variation and crop response under panel shade—emerge as a promising opportunity in high land competition environments like India’s.

Future Outlook

Over the coming six years, the India Agritech market is projected to exhibit robust expansion driven by sustained rural digitization, growing investor interest in agri‑fintech, deployment of AI‑enabled decision tools, and stronger public-sector tech infrastructure. Agritech will become central to doubling farmer incomes, enhancing climate resilience, and integrating supply-chains.

Major Players

- Cropin Technology Solutions

- DeHaat (Green Agrevolution Pvt. Ltd.)

- Ninjacart Pvt. Ltd.

- AgroStar

- Fasal (Wolkus Technology Solutions Pvt. Ltd.)

- AgNext Technologies Pvt. Ltd.

- BharatAgri

- AVPL International

- FarmERP (Shivrai Technologies Pvt. Ltd.)

- EM3 Agriservices

- Stellapps

- Bijak

- Intello Labs

- ag

- Gramophone

Key Target Audience

- Chief Investment Officers, Agritech Venture Capital Firms

- Private Equity Investment Directors in Agri‑Technology

- Agricultural Technology Program Heads, NITI Aayog

- Project Leads, Ministry of Agriculture & Farmers’ Welfare

- Policy Analysts, Ministry of Electronics & Information Technology

- Strategy Heads, National Bank for Agriculture and Rural Development (NABARD)

- Business Heads of Agritech Corporate Investors

- Innovation Mission Leads, Atal Innovation Mission

Research Methodology

Step 1: Identification of Key Variables

We map the India Agritech ecosystem—including stakeholders like farmers, FPOs, startups, input providers, and agribusiness—through exhaustive desk research leveraging both secondary data sources and proprietary databases. This lays the foundation for defining key impact variables.

Step 2: Market Analysis and Construction

Historical data from credible database sources on market size, adoption rates, technology spread, and revenue generation are compiled and analyzed. We cross-validate through marketplace penetration and service provider ratios to ensure reliability of estimates.

Step 3: Hypothesis Validation and Expert Consultation

Constructed market assumptions are validated through CATI-powered interviews with agritech leaders across startups, government institutions, and input suppliers. Their operational and financial insights refine our projections and validate ground realities.

Step 4: Research Synthesis and Final Output

We reconcile insights via direct engagement with major agritech firms—gathering details about product segments, farmer touchpoints, revenue, and adoption drivers. A bottom-up triangulation aligns firm data with the macro market picture to produce an accurate, validated industry analysis.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Understanding Market Potential Through In-depth Industry Interviews, Primary Research Approach, Limitations and Future Conclusions)

- Definition and Scope

- Evolution and Historical Landscape

- Agriculture Sector Share in GDP and Employment

- Technology Integration Timeline in Indian Agriculture

- Agritech Value Chain Analysis (Input Procurement to Post-Harvest

- Growth Drivers (Government Agri-Tech Subsidies, FPO Expansion, Smartphone Penetration in Rural India, Digital Agri Credit Penetration, Agri Start-up Funding, Satellite Connectivity, Kisan Drones, eNAM Adoption)

- Market Challenges (Farmer Digital Literacy, Fragmented Land Holdings, Connectivity Gaps, Trust Deficit, Credit Access)

- Opportunities (Carbon Credit Monitoring, Agrivoltaics, Insurance Tech, Micro Weather Stations, AI-based Predictive Yield Systems)

- Trends (IoT-Enabled Smart Irrigation, Blockchain-based Produce Traceability, Agri Embedded Lending, D2F Models)

- Government Policy and Initiatives (PM-Kisan, Agri Stack, Smart Farming Missions, Drone Policy, Agri Infra Fund, FPO Schemes)

- Stakeholder Ecosystem (Startups, Agri-input Companies, Drone OEMs, Financial Institutions, FPOs, Regulators)

- Porter’s Five Forces Analysis

- SWOT Analysis

- Innovation and Patent Landscape in Indian Agritech

- By Value, 2019-2024

- By Volume, 2019-2024

- By Number of Agritech Startups, 2019-2024

- By Farmer Adoption Rate, 2019-2024

- By Technology Spend per Hectare, 2019-2024

- By Technology Type (In Value %)

Precision Agriculture

Farm Management Software

Remote Sensing & Drones

IoT & Automation

Blockchain in Agriculture - By Application Area (In Value %)

Crop Monitoring

Soil & Water Monitoring

Weather Forecasting

Livestock Monitoring

Financial Inclusion & Insurance - By Business Model (In Value %)

B2B Input Platforms

B2C Output Marketplaces

Farm Advisory Platforms

Embedded Finance Providers

Supply Chain Optimization - By End User (In Value %)

Smallholder Farmers

Large Farm Enterprises

Agri-Cooperatives

Agribusinesses

Government Bodies & NGOs - By Region (In Value %)

Northern Region

Southern Region

Western Region

Eastern Region

Central Region

- Market Share of Major Players (Basis Revenue & Farmer Touchpoints)

By Business Model

By Technology Focus - Cross Comparison Parameters: (Company Overview, Business Model & Tech Stack, Revenue & Farmer Coverage, Funding Stage and Investors, Distribution Model (Online/Offline Hybrid, Rural Agents, etc.), FPO/Co-op Partnerships, Government Tender Participation, Integration with Financial Services, Customization Capabilities, Field Agent Network Strength)

- SWOT Analysis of Major Players

- Pricing Analysis (Subscription, Hardware Bundles, Advisory Fees, Embedded Commissions)

- Detailed Company Profiles

DeHaat

AgroStar

Ninjacart

CropIn

Stellapps

Fasal

Bijak

Arya.ag

Gramophone

BharatAgri

BigHaat

EM3 Agri Services

Intello Labs

Krishify

Reshamandi

- Usage Behavior and Challenges

- Tech Awareness by Farm Size

- Digital Literacy Index

- Financing Preferences and Access

- Technology Retention Rate

- By Value, 2025-2030

- By Volume, 2025-2030

- By Agri Startups Count, 2025-2030

- By Digitally Connected Farms, 2025-2030

- By Rural Internet Penetration, 2025-2030