Market Overview

The AI infrastructure market is valued at USD 45.49 billion in 2024, supported by a base of USD 35.42 billion in 2023, according to global industry analysis. This rapid revenue expansion reflects surging investments in compute hardware (GPUs, ASICs), high‑density data centers, and AI-optimised platforms, as enterprises move beyond pilot projects to production‑scale generative AI workloads.

Major metro hubs in India—like Navi Mumbai, Bengaluru, Hyderabad and Delhi‑NCR—lead adoption of AI infrastructure. This dominance stems from their concentration of hyperscale data center capacity (Mumbai and Bengaluru handle over 60% of new supply), strong corporate and startup ecosystems, supportive state policies, and superior network connectivity, which collectively attract cloud, hardware and hyperscaler investments.

Segmentation

By Component

The India AI infrastructure ecosystem is segmented into Compute, Storage, and Networking & Cooling. Compute leads the market due to the surge in demand for GPU clusters powering generative AI and deep learning. Enterprises, hyperscalers and national AI labs prioritize investment in GPUs, ASICs and FPGAs to handle training and inference workloads. While storage and networking infrastructure are critical, they remain secondary investments compared to high-performance compute capabilities required for AI deployments.

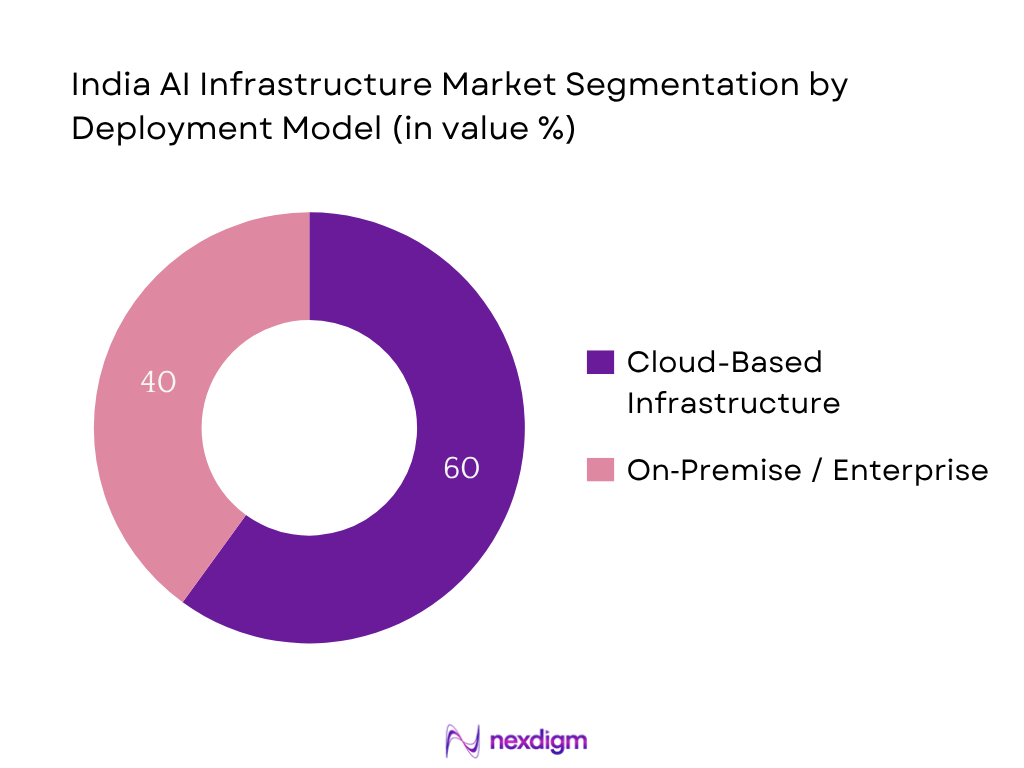

By Deployment Model

The India AI infrastructure market is divided between on‑premise enterprise data centers and cloud-based infrastructure. Cloud-based AI infrastructure dominates, reflecting enterprises’ preference for GPU-rich elastic compute provided by hyperscalers, which enables pay‑as‑you‑grow scalability and avoids large capex for in‑house deployments. On‑premise remains significant in regulated industries or R&D-driven labs, but cloud services command superior share thanks to India’s expanding public cloud ecosystem and hyperscaler investments.

Competitive Landscape

The competitive landscape reflects the dominance of hyperscale providers (AWS, Microsoft Azure) partnering with Indian data‑center operators like Yotta and CtrlS to deliver AI compute services. Meanwhile global vendors NVIDIA and Intel supply high‑performance compute hardware, working through partners to channel GPUs and processors into India’s AI ecosystem. Local data‑centre firms like Yotta Infrastructure enable scaling of AI‑optimised environments. This alignment of supply, deployment and infrastructure capabilities underscores a consolidated market structure.

| Company | Establish. | HQ Location | GPU Compute Capacity (India) | Data Center Ownership | Partnerships (OEM/cloud) | Cooling Tech Adoption | AI R&D Labs in India | IndiaFootprint |

| NVIDIA | 1993 | USA | – | – | – | – | – | – |

| Intel | 1968 | USA | – | – | – | – | – | – |

| AWS (Amazon Web Services) | 2006 | USA | – | – | – | – | – | – |

| Microsoft Azure India | ~2008 | USA | – | – | – | – | – | – |

| Yotta Infrastructure | 2016 | India | – | – | – | – | – | – |

India AI Infrastructure Market Analysis

Growth Drivers

National AI Policy and Mission AI Integration

India’s AI infrastructure momentum is underpinned by national policy alignment. In FY 2024–25, GDP reached USD 2,697.6 billion, up from USD 2,497.2 billion in FY 2023–24, reflecting strong economic capacity to support technology infrastructure. The national India AI Mission funds shared compute platforms and Centres of Excellence, aligned with state policies (e.g. Rajasthan’s allocated ₹1,000 crore for innovation hubs). Parallelly, India’s working-age population exceeded 1.45 billion in 2025, indicating a growing skilled talent pool for AI infrastructure deployment. These macroeconomic strengths – rising national income and policy‑led investment – enable significant expansion of AI-optimised compute infrastructure.

Data Center Growth and Hyperscaler Expansion

India’s data centre capacity grew from 854 MW in 2023 (up from 350 MW in 2019) to approximately 1,263 MW by April 2025, indicating rapid infrastructure scaling. Mumbai and Chennai contributed 44 percent of new supply, adding ~380 MW in utilities. Hyperscaler investments include Google’s USD 6 billion project for a 1 GW facility in Visakhapatnam, with USD 2 billion allocated for renewables. These figures reflect significant commitment toward AI-ready infrastructure in India. Public cloud revenue exceeded USD 2.8 billion in H1 2022, foreshadowing strong hyperscaler uptake in AI infrastructure

Market Challenges

High Cost of AI‑Optimized Compute and Storage

In India’s data centre industry, average per‑MW setup cost increased from ₹40–45 crore to ₹60–70 crore by early 2025, imposing high capital requirements for AI‑optimized compute facilities. GDP in 2024 stood at USD 2,697.6 billion, yet the disproportionate upfront infrastructure expense challenges enterprises and startups despite macroeconomic support. Despite 93 percent capacity absorption in 2023, smaller firms struggle to finance AI‑grade GPU clusters or liquid‑cooled systems given high energy and rack‑space investments. This cost barrier slows AI infrastructure adoption beyond major hyperscaler and enterprise players.

Energy Demand for AI Compute and Cooling

India’s energy demand growth reached 9 percent annually as of 2024, outpacing planned rates of 6.4 percent, due to expanding data centre loads. Data centres currently consume under 1 percent of national electricity, projected to exceed 3 percent by 2030. As of mid‑2025 data centre capacity stood at 1,263 MW, with 95 percent concentrated in metros, placing strain on local power grids not designed for sustained high loads. This energy requirement escalates the total cost of ownership for AI infrastructure and complicates deployment in non-metro areas.

Market Opportunities

Public Cloud Expansion for AI Workloads

India’s public cloud services market had revenue of USD 2.8 billion in H1 2022, reflecting strong uptake of cloud infrastructure. GDP of USD 2,697.6 billion supports enterprises’ shift to cloud‑based AI compute platforms. Hyperscaler investment includes Google’s USD 6 billion data centre in Andhra Pradesh and Airtel Nxtra’s USD 600 million to expand to 400 MW by 2027. These expansions increase access to GPU/TPU capacity for AI workloads without requiring upfront capex, enabling startups and mid‑sized enterprises to adopt AI infrastructure at scale through cloud.

Indigenous Development of AI Hardware and Accelerators

India’s working-age population reached 1.45 billion in 2025, with over 375,000 AI-skilled professionals, positioning India as a competitive engineering talent pool for AI hardware development. National initiatives, coupled with state policy support (Rajasthan’s ₹1,000 crore AI innovation fund), foster domestic design of accelerators. Projected national data centre capacity of 1,263 MW by April 2025 justifies co‑locating indigenous hardware fabrication and testing labs with infrastructure providers. This local development can reduce dependence on imports, shorten deployment cycles, and drive cost efficiencies across future AI infrastructure build-outs.

Future Outlook

Over the forecast horizon, India’s AI infrastructure market is poised for exponential growth, driven by expanding AI workloads, national compute missions, and acceleration of cloud and edge data centers. Public policy support via the IndiaAI Mission and increased capital expenditure on digital infrastructure will support large-scale deployment of GPU farms and sustainable data center models. With continuous demand growth from enterprise GenAI applications, government-backed shared compute infrastructure (e.g. AIRAWAT), and increasing hyperscaler investments in regional cloud data centers, the market is expected to maintain its strong momentum.

Major Players

- NVIDIA

- Intel

- AWS (Amazon Web Services India)

- Microsoft Azure India

- Yotta Infrastructure

- CtrlS Datacenters

- Netweb Technologies

- NTT GDC India

- STT GDC India

- Airtel Nxtra

- HCLTech

- IBM India

- Google Cloud India

- Tata Consultancy Services (TCS)

- Neysa Networks

Key Target Audience

- CTOs / Head of IT Infrastructure – large & mid‑size enterprises

- Chief Data Officers / Head of Data Science – enterprise users of AI compute

- CIOs of hyperscalers & data center operators

- Government and regulatory bodies (MeitY, Digital India Corporation, NASSCOM)

- Infrastructure investment firms and venture capitalists focused on AI hardware & data centres

- Enterprise procurement heads (BFSI, healthcare, telecom sectors)

- Technology investors in AI compute startups

- State government infrastructure planners in AI clusters

Research Methodology

Step 1: Identification of Key Variables

We mapped stakeholders across hyperscalers, data‑centre operators, hardware suppliers, and enterprise users. Desk research using secondary sources and proprietary market databases defined variables like GPU capacity, DC footprint, infrastructure spend.

Step 2: Market Analysis and Construction

Historical global and local data for infrastructure spending, compute unit deployment, data centre capacity and hardware revenues were analysed to project India‑specific metrics, cross‑verified using hardware/software splits.

Step 3: Hypothesis Validation and Expert Consultation

Key market assumptions were validated through CATI interviews with infrastructure leads at hyperscalers, AI labs, data‑centre executives, and hardware vendors to capture real‑world investment patterns and deployment insights.

Step 4: Research Synthesis and Final Output

Engagements with hyperscale cloud providers, local AI infrastructure startups (e.g. Neysa), data center firms and government officials allowed triangulation of bottom‑up capacity forecasts with top‑down projections for a validated and accurate market outlook.

- Executive Summary

- Research Methodology (Market Definitions and Assumptions, Abbreviations, Market Sizing Approach, Consolidated Research Approach, Expert Interviews, Primary Research Sources, Limitations and Future Assumptions)

- Definition and Scope

- India’s AI Infrastructure Evolution Timeline

- AI Value Chain: Chip to Cloud to Application

- Key Investment Phases in Infrastructure Expansion

- Integration with National Digital Economy Goals

- Cloud vs. On-Premise AI Infrastructure Penetration

- Growth Drivers

National AI Policy and Mission AI Integration

Data Center Growth and Hyperscaler Expansion

5G & Edge Computing Infrastructure Support

Rising Adoption of Generative AI Workloads

Academic and Research-Led Compute Infrastructure Demand - Market Challenges

High Cost of AI-Optimized Compute and Storage

Energy Demand for AI Compute and Cooling

Data Sovereignty and Cybersecurity Risks

Inadequate Domestic Chip Fabrication Ecosystem - Market Opportunities

Public Cloud Expansion for AI Workloads

Indigenous Development of AI Hardware and Accelerators

Private Cloud and Data Localization Solutions

Green AI Infrastructure and Sustainable Cooling Solutions - Trends

Liquid Cooling in AI Data Centers

AI-Powered Infrastructure Management

Convergence of HPC and AI Platforms - Government Policies and Regulations

IndiaAI Mission

MeitY Guidelines for Compute Infrastructure

National Data Governance Framework - SWOT Analysis

- Value Chain & Stakeholder Ecosystem

- Porter’s Five Forces Analysis

- Technology Stack Adoption Framework

- By Value, 2019-2024

- By Volume, 2019-2024

- By Compute Capacity (FLOPs and GPU Units), 2019-2024

- By Component (In Value)

Compute (CPU, GPU, ASIC, FPGA)

Storage (HDD, SSD, NVMe, SAN, NAS)

Networking (Ethernet, InfiniBand, Optical Interconnects)

Cooling Systems (Liquid Cooling, Air Cooling)

Software and AI Frameworks - By Deployment Type (In Value)

On-Premise AI Infrastructure

Cloud-Based AI Infrastructure

Hybrid Deployment - By End-User Industry (In Value)

BFSI

Healthcare and Life Sciences

Automotive and Transportation

Manufacturing

Telecom - By Organization Size (In Value)

Large Enterprises

Small & Medium Enterprises (SMEs)

Startups & R&D Labs - By Region (In Value)

North India

West India

South India

East India

- Market Share of Major Players (By Value & Compute Capacity)

- Cross Comparison Parameters (Company Overview, India Presence, AI Compute Capacity, Key Partnerships, Infrastructure Type – Cloud/On-Prem, Product Portfolio, Data Center Ownership, Green Cooling Initiatives, GPU Inventory, AI R&D Units, Software Stack Integration)

- SWOT Analysis of Key Players

- Infrastructure Pricing Trends by Player and Model

- Detailed Company Profiles

NVIDIA

AMD

Intel

Google Cloud (India Region)

Amazon Web Services India

Microsoft Azure India

Yotta Infrastructure

NTT India

HCLTech

Netweb Technologies

Hewlett Packard Enterprise India

Tata Communications

IBM India

Dell Technologies

CtrlS Data Centers

- Industry-Wise Infrastructure Investment Intent

- AI Workload Deployment Models

- Budget Allocation for Compute vs Storage

- Skill and Talent Availability in AI Ops

- Decision Making: CTO vs CIO vs Data Science Team

- By Value, 2025-2030

- By Volume, 2025-2030

- By Compute Capacity, 2025-2030